Asia Pacific Green Cement Market Size, Share, Trends and Forecast by Product Type, End Use Industry, and Country, 2026-2034

Market Overview:

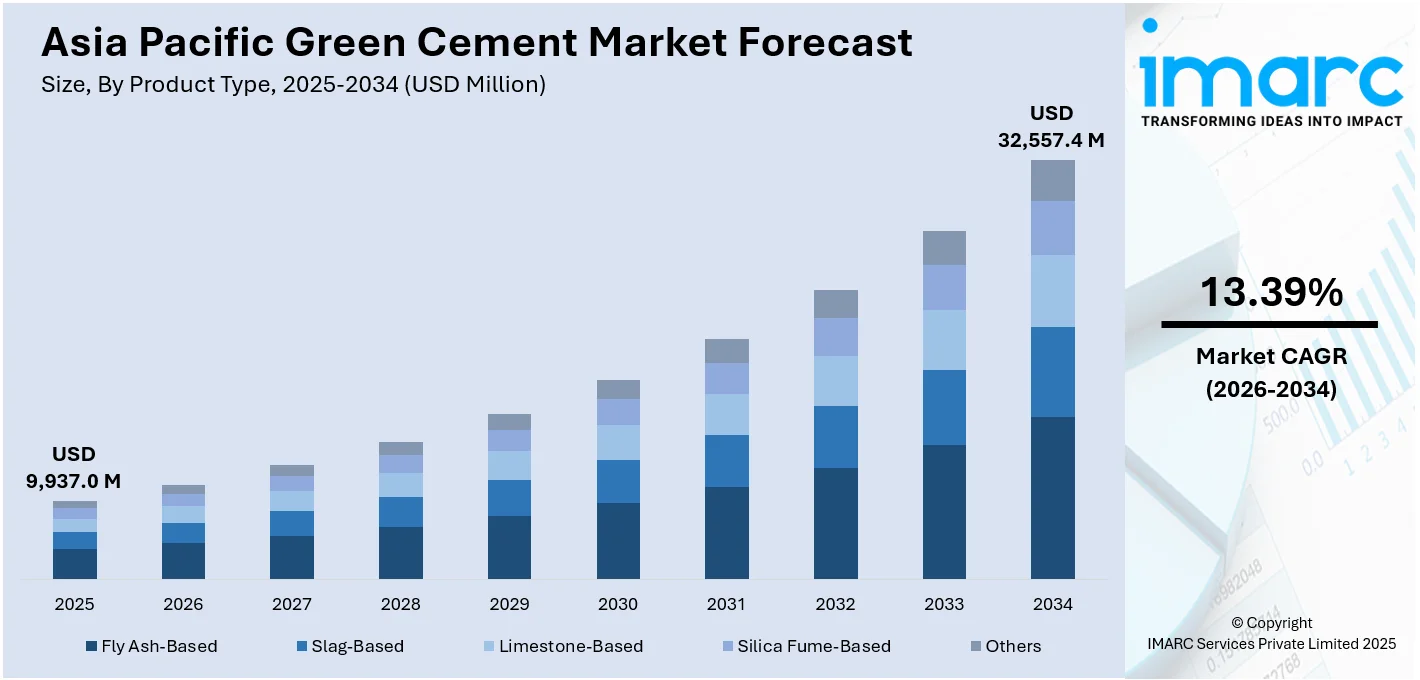

The Asia Pacific green cement market size reached USD 9,937.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 32,557.4 Million by 2034, exhibiting a growth rate (CAGR) of 13.39% during 2026-2034.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 9,937.0 Million |

|

Market Forecast in 2034

|

USD 32,557.4 Million |

| Market Growth Rate 2026-2034 | 13.39% |

Green cement is an essential raw material used in the construction industry. It utilizes industrial waste materials, such as blast furnace slag, micro silica and fly ash, to minimize the negative ecological impact by employing novel carbon-negative processes. In the Asia Pacific region, the growing concerns about climate change, environmental pollution, depletion of raw materials, and the rise in fuel prices have led to the development of sustainable green cement varieties.

To get more information on this market Request Sample

The Asia Pacific represents one of the largest green cement markets. The primary factor driving the growth of the market include rapid urbanization and increasing focus on ecological concerns. This has shifted preferences toward an eco-friendly and efficient construction material, such as green cement. Moreover, the cost-effectiveness and the easy availability of green cement across the region are also catalyzing the market growth. Furthermore, with the flourishing construction industry and the on-going infrastructural projects, various stringent regulations and policies have been introduced by governments in the region supporting the adoption of green cement.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Asia Pacific green cement market report, along with forecasts at the regional and country level from 2026-2034. Our report has categorized the market based on product type and end use industry.

Breakup by Product Type:

- Fly Ash-Based

- Slag-Based

- Limestone-Based

- Silica Fume-Based

- Others

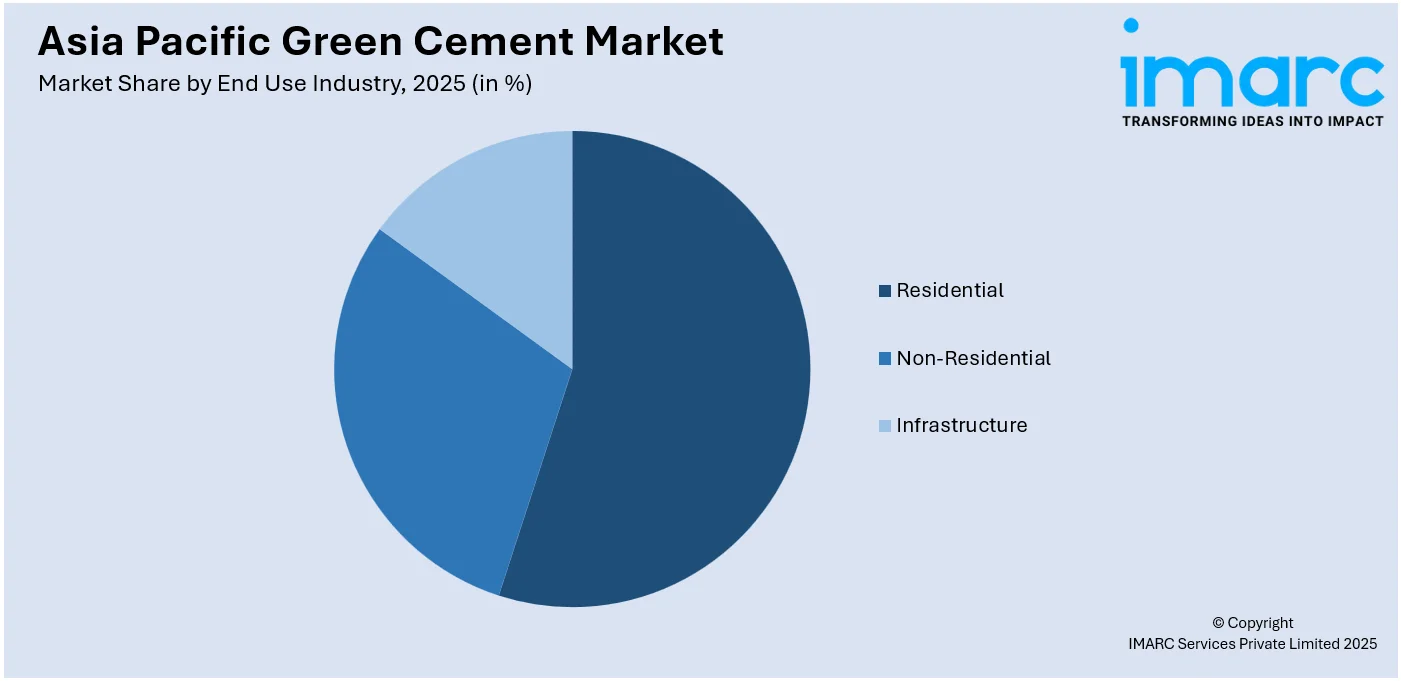

Breakup by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Residential

- Non-Residential

- Infrastructure

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Segment Coverage | Product Type, End Use Industry, Country |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Asia Pacific green cement market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Asia Pacific green cement market?

- What are the key regional markets?

- What is the breakup of the market based on the product type?

- What is the breakup of the market based on the end use industry?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the Asia Pacific green cement market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)