Asia Pacific Machine Tools Market Size, Share, Trends and Forecast by Tool Type, Technology Type, End Use Industry, and Country, 2025-2033

Market Overview:

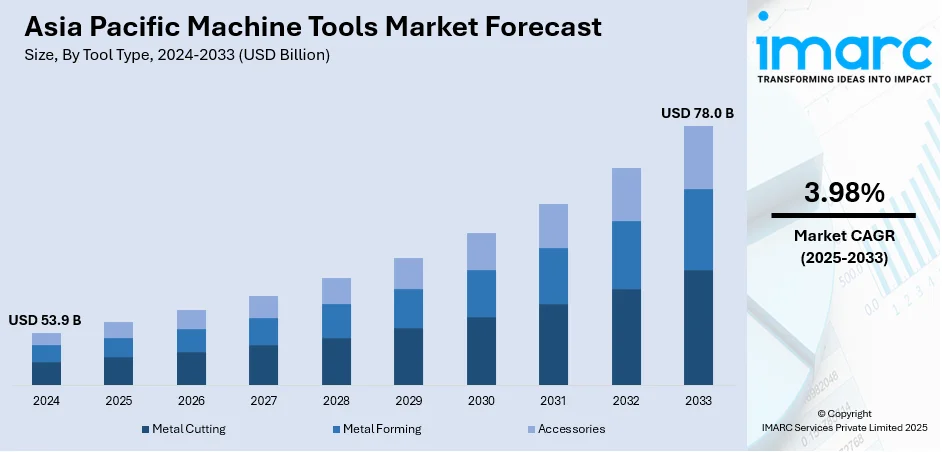

The Asia Pacific machine tools market size reached USD 53.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 78.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.98% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 53.9 Billion |

|

Market Forecast in 2033

|

USD 78.0 Billion |

| Market Growth Rate 2025-2033 | 3.98% |

Machine tools are operated using numerical control that helps in cutting hard materials into identical shapes and sizes. These tools minimize the manual efforts required to perform a range of operations, such as cutting, forming, drilling, grinding, abrading and nibbling. They also aid in eliminating unwanted variations and achieving product uniformity. As they form a basis for precision engineering, they find extensive applications in the automotive, aerospace and electronics sectors across the Asia Pacific region.

To get more information on this market, Request Sample

The increasing trend of industrial automation, along with the escalating demand for precision manufacturing, represents one of the key factors spurring the market growth in the Asia Pacific region. Apart from this, the advantages of machine tools, such as minimal vibrations, reduced scrap generation, and faster, automatic repeatable cutting operations, are expanding their applications in different industry verticals. Furthermore, several foreign companies are setting up their manufacturing facilities in the region due to cheap labor, low raw material costs and reduced tax rates, which, in turn, is propelling the market growth. Moreover, manufacturers are utilizing modern design and simulation engineering software, which is anticipated to create a positive outlook for the markets.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific machine tools market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on tool type, technology type and end use industry.

Breakup by Tool Type:

- Metal Cutting

- Metal Forming

- Accessories

Breakup by Technology Type:

- Conventional

- CNC (Computerized Numerical Control)

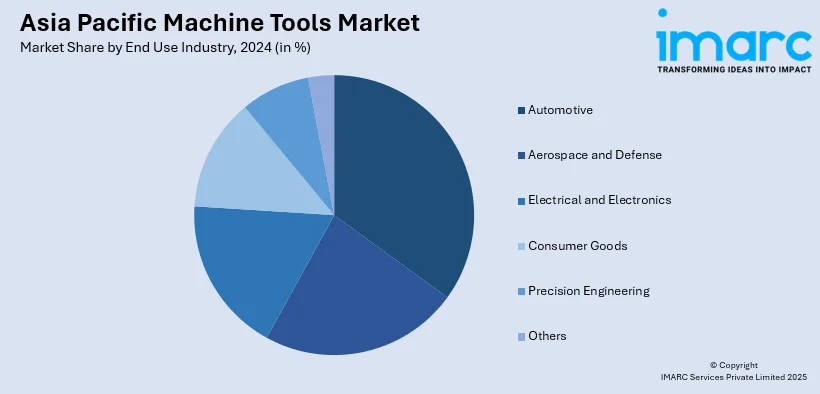

Breakup by End Use Industry:

- Automotive

- Aerospace and Defense

- Electrical and Electronics

- Consumer Goods

- Precision Engineering

- Others

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report

|

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Tool Types Covered | Metal Cutting, Metal Forming, Accessories |

| Technology Types Covered | Conventional, CNC (Computerized Numerical Control) |

| End Use Industries Covered | Automotive, Aerospace and Defense, Electrical and Electronics, Consumer Goods, Precision Engineering, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Asia Pacific machine tools market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Asia Pacific machine tools market?

- What are the key regional markets?

- What is the breakup of the market based on the tool type?

- What is the breakup of the market based on the technology type?

- What is the breakup of the market based on the end use industry?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the Asia Pacific machine tools market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)