Asia Pacific Metal Casting Market Size, Share, Trends and Forecast by Process, Material Type, End Use, Component, Vehicle Type, Electric and Hybrid Type, Application, and Country, 2026-2034

Market Overview:

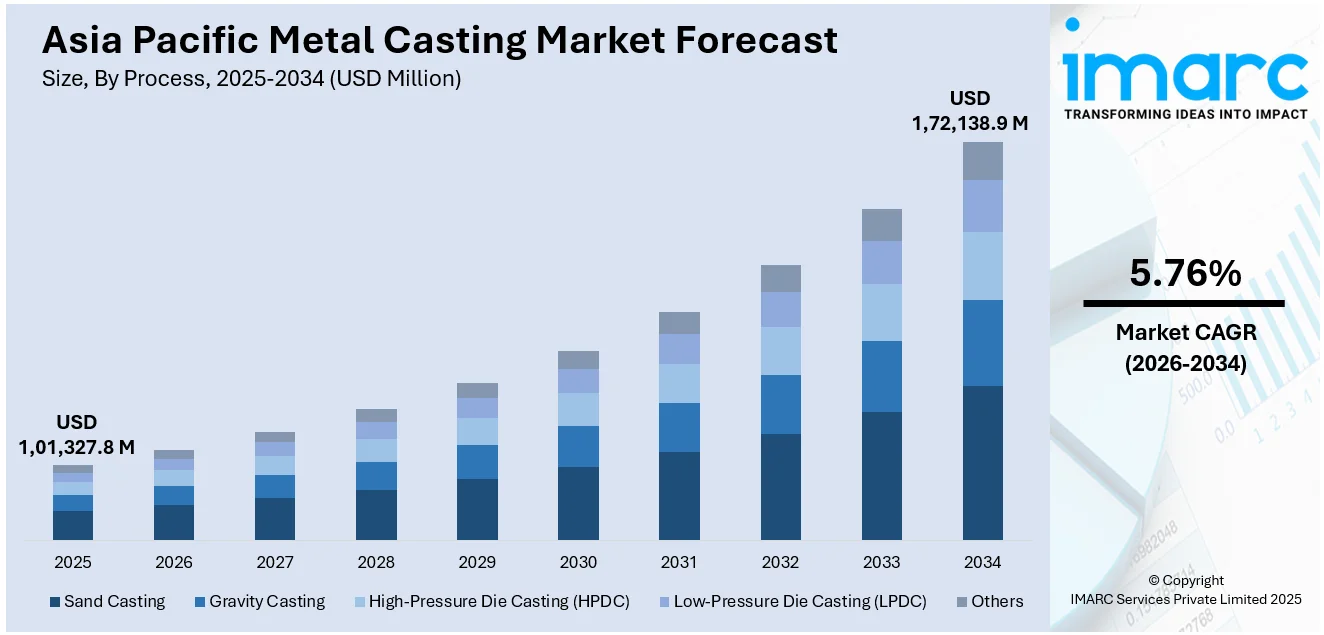

The Asia Pacific metal casting market size reached USD 1,01,327.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,72,138.9 Million by 2034, exhibiting a growth rate (CAGR) of 5.76% during 2026-2034.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,01,327.8 Million |

|

Market Forecast in 2034

|

USD 1,72,138.9 Million |

| Market Growth Rate 2026-2034 | 5.76% |

Metal casting is the process of pouring hot liquid metal into a mold containing a hollow cutout, which then solidifies into the desired finished shape. The process is used for mass production of components that utilize permanent metal mold to produce large and complex parts with low wall thickness. Metal casting is mostly made of non-ferrous materials, like zinc, copper, aluminum, magnesium, lead, pewter, and tin-based alloys. In the Asia Pacific region, the demand for metal casting has escalated as it aids in improving energy efficiency and lowering the environmental impact.

To get more information on this market Request Sample

The Asia Pacific metal casting market is primarily driven by the growing automotive industry, especially in countries like India, China, and Japan. Besides this, there has been an increasing demand for lightweight and electric vehicles due to the rising per capita incomes and growing environmental awareness among consumers. This has provided a positive impact on the metal casting market across the region. Apart from this, as China represents one of the largest automotive hubs in the world, with a strong presence of local and international OEMs, it plays an essential role in the growth of the market. Moreover, metal casting manufacturers have adopted simulation-based castings to create perfect defect-free products, which help in decreasing the wastage and reducing the costs of operations.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Asia Pacific metal casting market report, along with forecasts at the regional and country level from 2026-2034. Our report has categorized the market based on process, material type, end use, component, vehicle type, electric and hybrid type, and application.

Breakup by Process:

- Sand Casting

- Gravity Casting

- High-Pressure Die Casting (HPDC)

- Low-Pressure Die Casting (LPDC)

- Others

Breakup by Material Type:

- Cast Iron

- Aluminum

- Steel

- Zinc

- Magnesium

- Others

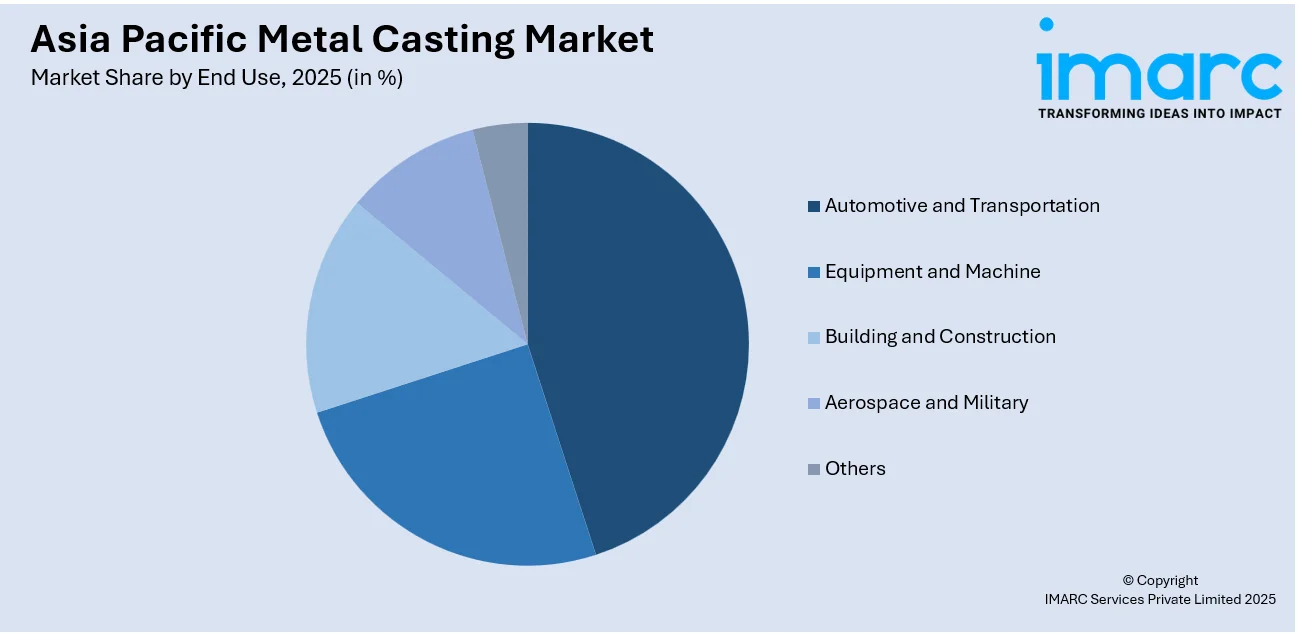

Breakup by End Use:

Access the comprehensive market breakdown Request Sample

- Automotive and Transportation

- Equipment and Machine

- Building and Construction

- Aerospace and Military

- Others

Automotive and Transportation Market: Breakup by Component:

- Alloy Wheel

- Clutch Casing

- Cylinder Head

- Cross Car Beam

- Crank Case

- Battery Housing

- Others

Automotive and Transportation Market: Breakup by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Automotive and Transportation Market: Breakup by Electric and Hybrid Type:

- Hybrid Electric Vehicles (HEV)

- Battery Electric Vehicles (BEV)

- Plug-In Hybrid Electric Vehicles (PHEV)

Automotive and Transportation Market: Breakup by Application:

- Body Assemblies

- Engine Parts

- Transmission Parts

- Others

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Segment Coverage | Process, Material Type, End Use, Component, Vehicle Type, Electric and Hybrid Type, Application, Country |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Asia Pacific metal casting market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Asia Pacific metal casting market?

- What are the key regional markets?

- What is the breakup of the market based on the process?

- What is the breakup of the market based on the material type?

- What is the breakup of the market based on the end use?

- What is the breakup of the market based on the component?

- What is the breakup of the market based on the vehicle type?

- What is the breakup of the market based on the electric and hybrid type?

- What is the breakup of the market based on the application?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the Asia Pacific metal casting market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)