Metal Casting Market Size, Share, Trends and Forecast by Process, Material Type, End Use, Components, Vehicle Type, Electric and Hybrid Type, Application, and Region, 2026-2034

Metal Casting Market Size, Share, Growth & Outlook:

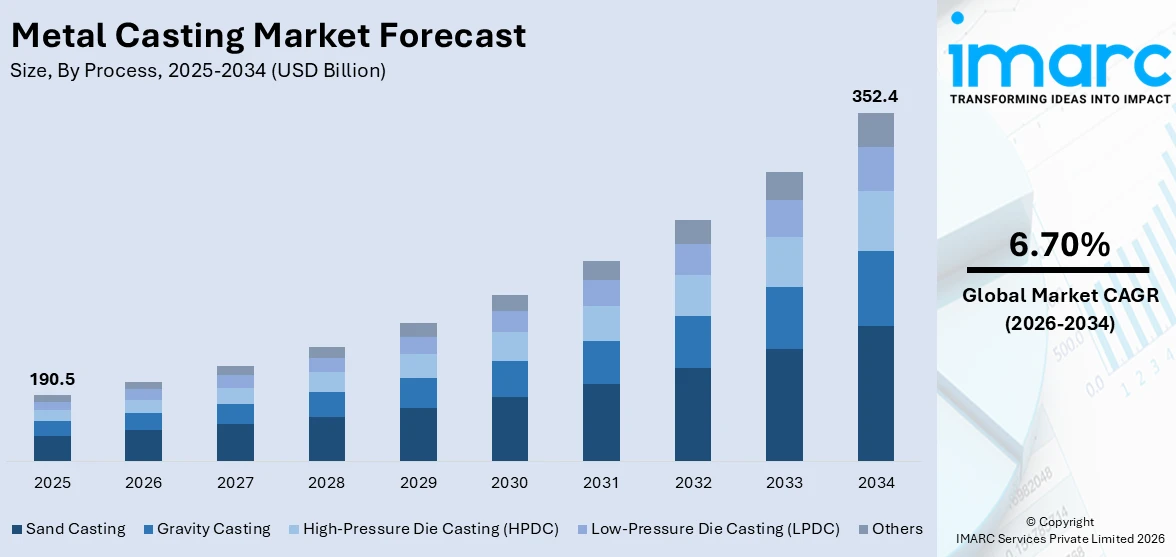

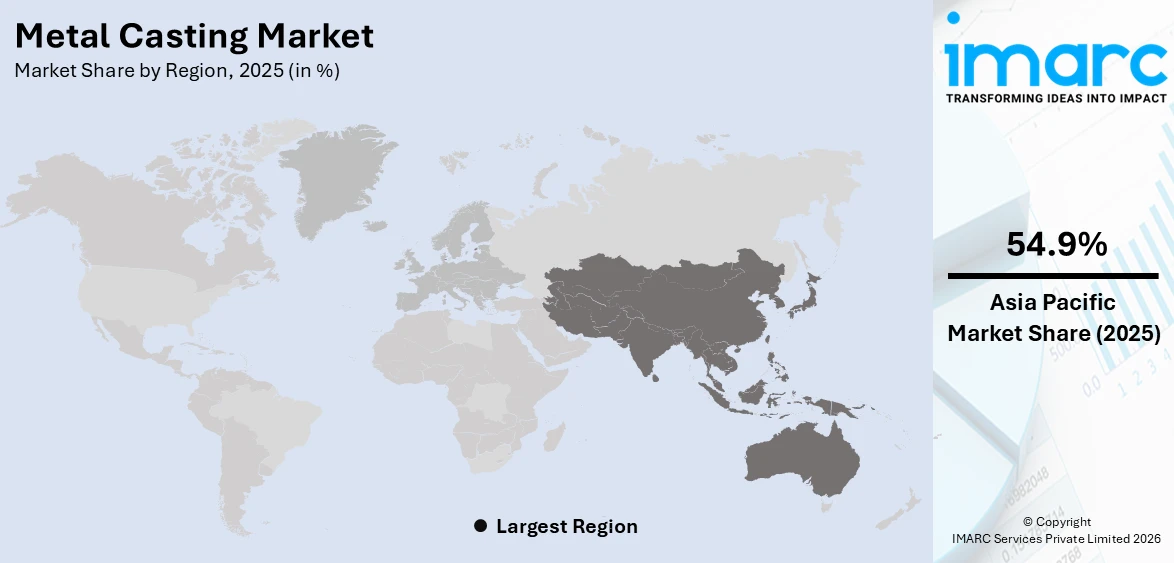

The global metal casting market size was valued at USD 190.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 352.4 Billion by 2034, exhibiting a CAGR of 6.70% from 2026-2034. Asia Pacific currently dominates the industry, holding metal casting market share of over 54.9% in 2025. The growth of the market is fueled by accelerated industrialization, growing demand in automotive manufacturing, and expanding infrastructure projects within the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 190.5 Billion |

|

Market Forecast in 2034

|

USD 352.4 Billion |

| Market Growth Rate (2026-2034) | 6.70% |

A key factor driving the global metal casting market is the swift industrialization, which boosts the need for metal parts across different industries. In addition, the growth in the automotive industry, especially for lightweight and fuel-efficient vehicles, boosts the need for advanced casting techniques, supporting the market demand. Moreover, the expansion of infrastructure projects worldwide also fuels the demand for durable metal products, providing an impetus to the market. Besides this, ongoing technological advancements in casting processes, such as three-dimensional (3D) printing and automation, enhance efficiency and product quality, impelling the market growth. Additionally, the increasing need for sustainable and recyclable materials in production is driving innovations in environmentally friendly casting techniques, further accelerating the growth of the market.

To get more information on this market Request Sample

The United States holds a share of 84.50% in the metal casting market. The demand in the region is driven by robust demand from key industries such as automotive, aerospace, and defense, which require high-quality, precision-cast components. In line with this, the increasing emphasis on electric vehicles (EVs) and hybrid technologies fosters demand for advanced casting materials, significantly contributing to the market expansion. Additionally, continuous advancements in automation and robotics promote higher efficiency in casting processes, fueling the market demand. Concurrently, the revival of the manufacturing sector and the reshoring of production also boost domestic demand for metal castings. Moreover, strong regulatory frameworks focusing on safety and quality standards drive innovation in the casting industry, impelling the market growth. Apart from this, rising investments in renewable energy (RE) infrastructure demand for industrial equipment, thereby propelling the market forward.

Metal Casting Market Trends:

Increasing Demand in Automotive and Aerospace Industries

The rising demand for metal castings in automotive applications, aerospace, and other sectors is another significant aspect that fuels the growth of the global metal castings market. In line with this, the increasing need for lightweight, high-strength, and impact-resistant components to enhance safety and fuel efficiency standards is fueling the market growth. Also, metal casting enables the making of complicated shapes and sizes that are useful in the manufacture of different parts of vehicles and aircraft, aiding the market demand. According to the International Energy Agency (IEA), electric car sales were 25% higher in 2024 than in 2023 first quarter, which is more than 3 million units. The increasing use of EVs is driving the need for light metal castings like battery cases, motors, and structural parts. Besides this, the growing emphasis on the improvement of innovation and efficient solutions that called for the requirement of improved metal casting technologies and materials is fostering the market growth. Furthermore, the rising focus on green and energy-efficient transportation modes, promotes the utilization of metal castings for creating EVs, driving the market expansion.

Rapid Technological Advancements

The rising technological improvements in casting methods, such as investment, die, and sand casting, enhancing the quality and efficiency of the end products is providing an impetus to the market. Moreover, the growing advancements in computer-aided design (CAD) and computer-aided manufacturing (CAM), which increase precision and reduce waste are boosting the market growth. The American Foundry Society (AFS) is leading the new program, called "AM for Metal Casting", aimed at adopting additive manufacturing to advance metal casting in July 2023. It will focus on supporting the dissemination of more sophisticated forms of additive manufacturing technologies through which products and processes could be enhanced by innovations in that sector. In addition to this, the growth of the 3D printing technology that enables the formation of shapes that are hard to accomplish by the casting processes is projected to foster the market growth. Apart from this, ongoing advancement in material science, and bringing in new alloys and treatments that improve the capabilities of cast products are also considered a growth-inducing factor.

Growing Use of Recycled Metals

The growing environmental awareness and the high cost of raw materials are promoting the casting industry to adopt the use of recycled metals, driving the market forward. In addition to this, the increased awareness about the potential benefits of recycling metals to save natural resources and decrease the carbon footprint of manufacturing is supporting the market growth. The International Aluminum Institute states that using recycled aluminum is five times more energy efficient than using virgin material, meaning that carbon emissions are cut by about 95 percent. Also, the growing awareness among customers about the use of recycled products encouraging manufacturers to use recycled metals and aluminum fuels the market expansion. Moreover, the growing usage of recycled materials which enables the manufacturers to avoid the changing raw material price is another factor driving the market growth.

Widespread Expansion in Construction and Infrastructure Projects

The increasing utilization of metal casting in the construction and infrastructure sector is fueling the market growth. In line with this, the development of residential, commercial, and industrial infrastructure, driving the demand for metal-cast components is fostering the market growth. Construction spending breached USD 2 Trillion and remained a balanced trend through the first half of 2024, an industry report cited. Along with this, the increasing product utilization in the creation of structural components, fixtures, and fittings that require durability and strength is favoring the market growth. Additionally, the growing integration of metal castings in renovation projects and maintenance of existing structures is strengthening the market share. In addition to this, the heightened investment by governments and private sectors in infrastructure projects like bridges, tunnels, and public transportation systems, prompting the need for specialized metal casting solutions is fueling the market growth.

Rising Investment in the Defense and Military Sector

The rising incorporation of metal castings in defense and military applications due to high quality, durability, and reliability is a key factor driving the market. In addition to this, the continuous raising of defense and military spending in terms of vehicles, aircraft, weapons, and protective gears, which requires the application of superior metal casting processes is fostering the market expansion. For example, the global spending on the military rose for a ninth consecutive year in 2023 to USD 2,443 Billion. This was an increase of 6.8% on the previous year, the fastest year-on-year growth since 2009, and took spending to its highest level ever globally, as SIPRI pointed out in its report. For this reason, defense expenditure has also gone up significantly, which has boosted the need for high-performance casting material still higher. Apart from this, the escalating political tensions across the world, leading to the need for effective and long-lasting military equipment is driving the market demand. Furthermore, the growing capability of the defense sector to develop massive, intricate, and durable parts to fulfill the requirements of military uses is the driver that is contributing to the market growth. In addition, constant research and development to manufacture enhanced and effective military equipment is creating new pathways to the growth of the market.

Metal Casting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global metal casting market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on process, material type, end use, components, vehicle type, electric and hybrid type, and application.

Analysis by Process:

- Sand Casting

- Gravity Casting

- High-Pressure Die Casting (HPDC)

- Low-Pressure Die Casting (LPDC)

- Others

Sand casting leads the market with around 45.6% of the market share in 2025. This segment is growing due to its flexibility, affordability, and capacity to produce large components. It entails forming molds from sand to pour molten metal into various shapes. Sand casting is known for its adaptability to various metals and simplicity, making it a popular method for custom and low-volume productions. It also can handle high melting temperature metals and alter mold designs easily. Moreover, the sand used in the casting process can be recycled, making it an environmentally friendly and cost-efficient option.

Analysis by Material Type:

- Cast Iron

- Aluminum

- Steel

- Zinc

- Magnesium

- Others

Cast iron leads the market with around 55.2% of the market share in 2025. This segment is growing due to its excellent durability, castability, and cost-effectiveness. It is widely used in industries, such as automotive, machinery, and construction owing to its high strength, wear resistance, and ability to absorb vibration. Cast iron is available in various forms, including gray, ductile, and malleable iron, each offering unique properties for different applications. Additionally, the development of advanced cast iron types like compacted graphite iron (CGI), which offers a desirable blend of strength, durability, and machinability, is opening new avenues in high-performance applications.

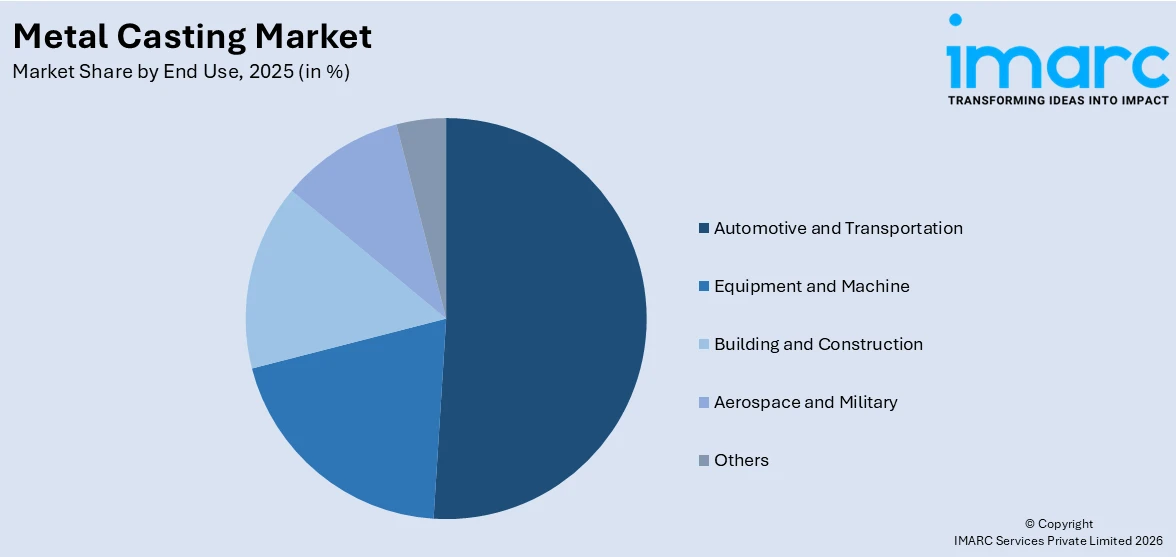

Analysis by End Use:

Access the comprehensive market breakdown Request Sample

- Automotive and Transportation

- Equipment and Machine

- Building and Construction

- Aerospace and Military

- Others

Automotive and transportation lead the market with around 51.5% of the market share in 2025. This segment is primarily driven by the extensive utilization of cast metal parts in vehicles, such as engine components, transmission parts, suspension systems, and various types of housings and supports. Moreover, due to the global changes towards vehicles with better fuel economy and vehicle weight reduction, the automotive industry has fueled the demand for improved metal casting technology, especially for aluminum and magnesium alloys. Furthermore, the growth in EV production, prompting the shift towards different component requirements compared to traditional combustion engines, is also favoring the market growth.

Analysis by Automotive and Transportation Market: Components:

- Alloy Wheels

- Clutch Casing

- Cylinder Head

- Cross Car Beam

- Crank Case

- Battery Housing

- Others

Alloy wheels represent the largest segment in the market with 12.12% of the total market share, owing to their combination of aesthetic appeal, durability, and performance enhancement. These components are crafted from aluminum or magnesium alloys, which improve fuel efficiency and enhance handling performance. The metal casting has the ability to produce complexity and strength, making it suitable for the production of alloy wheels particularly for high-performance and luxury automobiles. Besides this, they show better thermal conductivity than steel wheels, thus enhancing the braking efficiency and minimizing the threats of brake failure mainly in periods of high usage.

Analysis by Automotive and Transportation Market: Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Passenger cars dominate the market with 53.1% of the market share. The demand for passenger cars is fueled by the diverse range of components in passenger cars, such as engine parts, transmission housings, and chassis elements, which require lightweight structural components for improved fuel efficiency. Additionally, the growing trend of electrification of vehicles most especially electric and hybrid vehicles which has led to the casting of new components such as battery housings and special motors is also driving the market demand. In addition to this, the flexibility in the metal casting processes particularly in developing relative shapes and designs is boosting the market growth.

Analysis by Automotive and Transportation Market: Electric and Hybrid Type:

- Hybrid Electric Vehicles (HEV)

- Battery Electric Vehicles (BEV)

- Plug-In Hybrid Electric Vehicles (PHEV)

Hybrid electric vehicles (HEVs) accounts for the majority of the market share at 90.1%. These vehicles integrate a traditional internal combustion engine with an electric propulsion system, resulting in a diverse set of components that demand precise metal casting. Additionally, the growing popularity of HEVs, thanks to their enhanced fuel efficiency and lower emissions without the range restrictions of fully electric vehicles, is driving market expansion. Additionally, the rising demand for HEVs and their metal casting components, owing to the implementation of strict environmental regulations and increasing consumer interest in sustainable transportation, is favoring the market growth.

Analysis by Automotive and Transportation Market: Application:

- Body Assemblies

- Engine Parts

- Transmission Parts

- Others

Body assemblies represent the largest segment, with a total of 28.5% of the market share. It includes a very large number of parts that contribute to the construction and design of a car’s frame, chassis, doors, and panels. Also, the increased usage of body assembly parts due to advanced vehicle design, safety requirements, and the latest trends of ergonomically and aesthetically appealing and low-drag designs are highly influencing the market growth. Additionally, the emergent shift in automobile manufacturing from larger and heavier vehicles to lightweight and highly fuel-efficient vehicles where there is the need for lightweight materials such as aluminum and magnesium in body assemblages is favoring the market growth.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

The Asia Pacific region leads the market, accounting for 54.9% of the metal casting market share. The demand in this area is largely fueled by the rapid growth of the automotive, construction, and industrial sectors. Moreover, the region's extensive manufacturing base, rising urbanization, and growing investments in infrastructure and transportation are providing a thrust to the market growth. Moreover, the presence of key automotive manufacturers and suppliers in the region, along with the rising demand for vehicles, is significantly driving market growth. The growing emphasis on embracing new technologies in Asia Pacific, along with improved manufacturing efficiency, is also contributing to the market's expansion.

Metal Casting Market Regional Takeaways:

Metal Casting Industry Analysis in North America

The North America metal casting market is experiencing steady growth, driven by the thriving automotive, aerospace, defense, and energy sectors. The United States, a key contributor, has experienced a rising demand for lightweight and durable metal components, especially for electric vehicles (EVs) and hybrid vehicles. For example, in July of 2024, the United States Department of Defense inked with the Singapore Ministry of Defense the Statement of Intent (SOI) in data, analytics, and AI. The SOI deploys a holistic method for technological collaboration, allowing both defense establishments to examine approaches and discuss the best practices for leveraging data, analytics, and AI capabilities at speed and scale. Furthermore, innovative technologies of metal casting, like additive manufacturing, and 3D printing, are improving the projector accuracy and productivity of the casting process, along with automation and robotics, improving the casting process. Also, the high standards of regulation on quality and the environment in the region are supporting the development of sustainable casting processes. Apart from this, the resurgence and reshoring of domestic manufacturing for locally made metal castings is significantly contributing to the market expansion.

Metal Casting Industry Analysis in United States

The U.S. market for cast metal is a high-growth sector fueled by increased automotive demands for lighter weights in automotive structures. As estimated, using the two major lightweights- magnesium and aluminum alloys by the US Department of Energy-may save vehicles 50 percent body and chassis weight. These materials aid fuel efficiency enhancement by reducing 10% weightage in the vehicles, equivalent to a fuel-economy benefit of 6%–8%. The focus of industry on low weightage comes primarily from having an environment-friendlier policy of reducing carbon and meeting ever stringent environmental regulation standards. Apart from this, such material is quite useful in the assembly of electric vehicle manufacturers, in which efficiency or miles per battery recharging holds very high importance. As automakers increasingly incorporate advanced casting techniques to meet the demands, this market for lightweight metal castings is expected to grow, with innovation driving expansion in the U.S. metal casting industry.

Metal Casting Industry Analysis in Europe

The Europe metal casting market is supported by its vast infrastructure and high production capacity, which makes the region a global leader in the industry. According to the CAEF (The European Foundry Association), there were around 6,000 metal casting facilities in Europe in 2021, which shows that the region has a well-established and strong manufacturing base. These facilities produced a total of 14 million tons of metal castings for an assortment of end-user industries, such as automotive, aerospace, construction, and energy. The region's leadership in innovation and sustainability further drives growth, with many facilities adopting advanced casting methods and environmentally friendly practices. In addition, Europe's strong automotive industry, a key consumer of metal castings, fuels demand for lightweight, durable components to meet evolving emission standards and efficiency requirements. This combination of a large production base, advanced technology adoption, and diverse applications continues to propel the Europe metal casting market forward.

Metal Casting Industry Analysis in Asia Pacific

The Asia Pacific metal casting market is expected to flourish buoyantly because of the rapidly growing automotive and electric vehicle industries in such key economies as Japan and China. According to CEIC, in December 2023, Japan's motor vehicle production exceeded 8,997,440 units, whereas in December 2022, this figure had reached 7,835,539 units. This phenomenal increase reflects the increases in demand for high-quality metal cast components by the region's automotive sector. China, the largest country in the adoption of EVs, accounted for 8.1 million new electric car registrations in 2023, a 35% increase from 2022, according to the International Energy Agency. The increased production of EVs is creating the need for lightweight metal castings that should be used for improving energy efficiency and performance. With advancements in casting techniques and material innovations, the Asia Pacific region remains a significant hub for metal casting to meet the expanding demand from automotive and EV manufacturers.

Metal Casting Industry Analysis in Latin America

The rapid growth in the electric vehicle market in Latin America is generating demand for metal casting, with Brazil being at the forefront. The Brazilian EV market sold 9,537 units in October 2023, a record 114% increase from the sales recorded in September 2022, MDPI reports. This is due to the high adoption of EVs, which require lightweight, strong, and highly durable cast parts such as battery housings, motor cases, and structural parts to enhance efficiency and safety. Along with the automotive industry, increasing investments in infrastructure throughout Latin America boost the demand for cast metal products in construction equipment, pipelines, and machinery. New technologies, including low-pressure and die casting, have enhanced the quality and complexity of the components that can be produced. Metal casting will continue to play a key role in Latin America's evolving industrial landscape, driven by increasing interest in sustainability and innovation.

Metal Casting Industry Analysis in the Middle East and Africa

This industry is experiencing enormous growth in the Middle East and Africa, attributed to the development of the South African automotive market. South Africa ranks 22nd globally for vehicle production. The country presently produces 0.65% of the annual global market, with a strategic intention to increase vehicle production to 1.4 million units every year by 2035 while capturing 1% of the global market, based on SAAM 2021-2035. The region will witness a growth in demand for metal casting components, backed by this strategic plan supported by increased foreign direct investment and stronger global trade ties. The need for lightweight, durable, and high-quality cast parts will be the driving force behind technological advancements in casting processes as the automotive sector continues to expand and modernize. This will positively impact the Middle East and Africa market as metal casting technologies evolve to meet the demands of the automotive and other key industries, including construction and renewable energy.

Top Metal Casting Companies & Manufacturers:

The leading players in the market are actively engaging in various strategic initiatives to strengthen their market position and meet the evolving demands of the industry. They are focusing on technological advancements, particularly in automation and digitalization, to enhance efficiency, precision, and environmental sustainability in their casting processes. Moreover, many companies are investing in research and development (R&D) to create new alloys and improve existing ones to offer better performance and cost-effectiveness. Besides this, they are forming collaborations and partnerships to leverage each other's strengths in technology, distribution networks, and market expertise.

The report provides a comprehensive analysis of the top companies & manufacturers in the metal casting market with detailed profiles of all major companies, including:

- Alcast Technologies Ltd.

- Ahresty Corporation

- Calmet Inc.

- Dynacast Ltd.

- Endurance Technologies Limited

- GF Casting Solutions (Georg Fischer AG)

- MES Inc. (Metrics Holdings)

- Proterial Ltd.

- Rheinmetall AG

- Ryobi Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- January 2024: Nemak announced a partnership with Xpeng Motors to design battery enclosures for electric vehicles. This partnership is intended to enhance the range and performance of Xpeng's electric vehicles through the use of advanced aluminum casting technologies by Nemak.

- January 2024: Ryobi Limited said it increased the scope of aluminum die-casting operations in North America by building a new USD 50-million facility in Kentucky to raise the level of its aluminum casting volume for automobiles and electronics products.

- May 2022: GF Casting Solutions (Georg Fischer AG), a division of GF, Schaffhausen (Switzerland), signed an agreement with Bocar Group, Mexico City (Mexico) to develop and invest in new technologies and services to support customers in North America, Europe, and Asia on their way to sustainable mobility.

- December 2020: Ryobi Aluminum Casting (UK) Ltd obtained a new major multi-million-pound deal with a new emergent transmission provider for electrified drivetrain for 150,000 clutch and transmission cases per annum for new hybrid vehicles from 2023.

- April 2019: Aisin Seiki Co., Ltd. established Aisin (Anqing) Auto Parts Co., Ltd. along with Anhui Ring New Group Co., Ltd. for manufacturing aluminum die-cast parts, such as transmission cases for automatic transmissions.

Metal Casting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processes Covered | Sand Casting. Gravity Casting, High-Pressure Die Casting (HPDC), Low-Pressure Die Casting (LPDC), Others |

| Material Types Covered | Cast Iron, Aluminum, Steel, Zinc, Magnesium, Others |

| End Uses Covered | Automotive and Transportation, Equipment and Machine, Building and Construction, Aerospace and Military, Others |

| Components Covered | Alloy Wheel, Clutch Casing, Cylinder Head, Cross Car Beam, Crank Case, Battery Housing, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Electric and Hybrid Types Covered | Hybrid Electric Vehicles (HEV), Battery Electric Vehicles (BEV), Plug-In Hybrid Electric Vehicles (PHEV) |

| Applications Covered | Body Assemblies, Engine Parts, Transmission Parts, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Alcast Technologies Ltd., Ahresty Corporation, Calmet Inc, Dynacast Ltd., Endurance Technologies Limited, GF Casting Solutions (Georg Fischer AG), MES Inc. (Metrics Holdings), Proterial Ltd., Rheinmetall AG, Ryobi Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the metal casting market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global metal casting market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the metal casting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The metal casting market was valued at USD 190.5 Billion in 2025.

IMARC Group estimates the market to reach USD 352.4 Billion by 2034, exhibiting a CAGR of 6.70% from 2026-2034.

The global metal casting market is driven by rising demand for lightweight and durable components in the automotive and aerospace industries, advancements in casting technologies like 3D printing, increasing infrastructure development, and growing adoption of sustainable manufacturing practices using recyclable materials, boosting efficiency, and reducing environmental impact.

Asia Pacific currently dominates the market due to industrialization, rising automotive production, and demand for lightweight materials. Countries like China and India dominate, driven by robust infrastructure development, urbanization, and technological advancements in precision casting processes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)