Asia Pacific OTR Tire Market Size, Share, Trends and Forecast by Demand, Tire Type, Tire Size, Vehicle Type, and Country, 2025-2033

Market Overview:

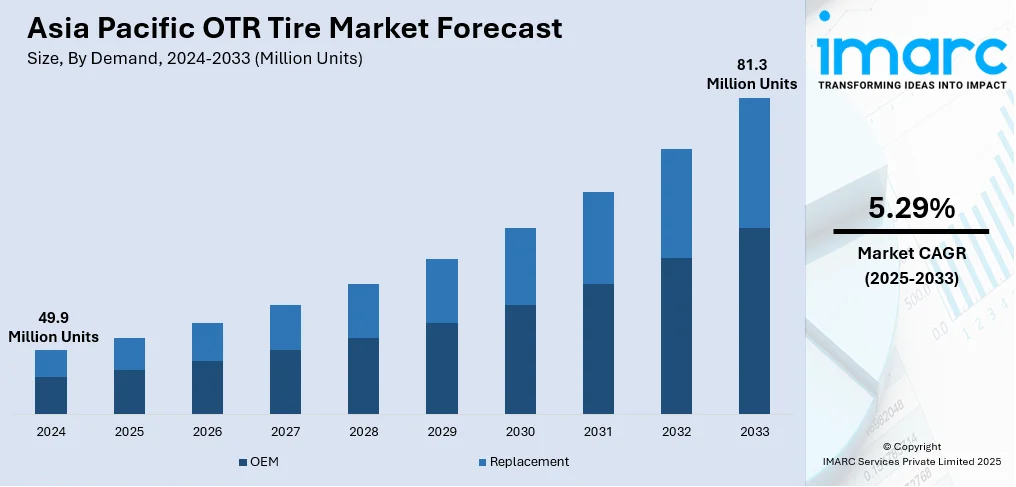

The Asia Pacific OTR tire market size reached 49.9 Million Units in 2024. Looking forward, IMARC Group expects the market to reach 81.3 Million Units by 2033, exhibiting a growth rate (CAGR) of 5.29% during 2025-2033. The rising improvement in the automobile industry, technological advancements in the OTR tires, and the increasing traction of heavy-duty vehicles for recreational purposes represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

49.9 Million Units |

|

Market Forecast in 2033

|

81.3 Million Units |

| Market Growth Rate 2025-2033 | 5.29% |

Rising Demand for OTR Tires in Recreational Sector Supporting Market Growth

The OTR tire market has been experiencing continuous growth. The rising demand for OTR tires in the recreational sector represents one of the primary drivers resulting in the increasing sales of OTR tires. Besides this, the growing number of amusement parks, country clubs, fitness and recreational sports centers, bowling arenas, and arcades is offering a favorable market outlook. In addition, the rising traction of heavy-duty vehicles for recreational activities is positively influencing the market.

To get more information on this market, Request Sample

Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The market structure is consolidated with the presence of few international players accounting for the majority of the market share. The volume of new entrants is moderate as the low product differentiation and switching cost attract new entrants while high capital investments, consolidated market structure and moderate market growth prevent many players to enter the market.

What is OTR Tire?

Off the road (OTR) tire refers to a deeply treaded tire that is designed to provide high traction over rugged terrains, such as mud, rock, loose dirt, sharp stones, and wet, abrasive, or complex terrain. It is widely available as a radial and bias tire that offers better durability, enhanced vehicular performance, optimum stability, easy mobility, and reduced contact patch area. It is heat and rolling resistant and can be installed in various vehicles, such as cranes, wheel loaders, telescopic handlers, tractors, all-terrain vehicles (ATVs), military trucks, and specialized purpose vehicles. It is utilized in articulated or rigid loaders, dump trucks, reach stackers, forklifts, and other specialty vehicles. As it is easy to monitor tire pressure and temperature and proactively addresses any potential hazards in OTR tire, it is employed in the agriculture, construction, industrial, recreation, and mining industries across the globe.

COVID-19 Impact:

The COVID-19 pandemic outbreak has caused a severe problem for the OTR tire industry and imposed unprecedented challenges on numerous countries. Various production plants have temporarily suspended their manufacturing operations. Social distancing and lockdown measures have also caused companies to downscale or temporarily pause output. Moreover, operational capacities scaled down significantly due to labor shortages and disruption in supplies of raw materials. Apart from this, the demand for OTR tires has been hampered in the initial period of the pandemic due to the shutting down of manufacturing operations across many countries in the Asia-Pacific region. In addition, the overall demand from various end-user industries, such as construction, agriculture, and mining, for OTR tire has declined due to the shutting down of construction, industries and warehouses, along with the economic slowdown and supply-side issues. Furthermore, imports of primary feedstocks, such as natural rubber, carbon black, and fabrics, for manufacturing off-the-road tire have been affected due to the pandemic. The coronavirus outbreak severely disrupted the value chain in the Asia Pacific region as China is the major raw material supplier for the feedstocks.

Asia Pacific OTR Tire Market Trends:

At present, the increasing demand for OTR tires in the agriculture industry due to the rising trend of farm mechanization represents one of the major factors influencing the market positively in the Asia Pacific region. Besides this, the growing number of mining activities across the region is offering a positive market outlook. In addition, the rising demand for OTR tires due to high investments in various commercial construction projects, such as highways, power supply grids, bridges, and dams, is propelling the growth of the market. Apart from this, the increasing focus on developing new polymers and tread compounds that ensure sustainable manufacturing of OTR tiresto offer enhanced speed, load capacity, and performance over longer distances is offering lucrative growth opportunities to industry players. Additionally, the rapid implementation of automated technologies in tire production to improve production capacities and reduce downtime is offering a favorable market outlook. Furthermore, increasing improvements in the automobile industry are contributing to the growth of the market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on demand, tire type, tire size and vehicle type.

Demand Insights:

- OEM

- Replacement

The report has provided a detailed breakup and analysis of the market based on the demand. This includes OEM and replacement. According to the report, replacement represented the largest segment as it is cheaper as compared to purchasing new OTR vehicles. In addition, the heavy loads and rough terrain put pressure on the tires and reduce their lifespan that requires regular replacements of tires, which is impelling the market growth.

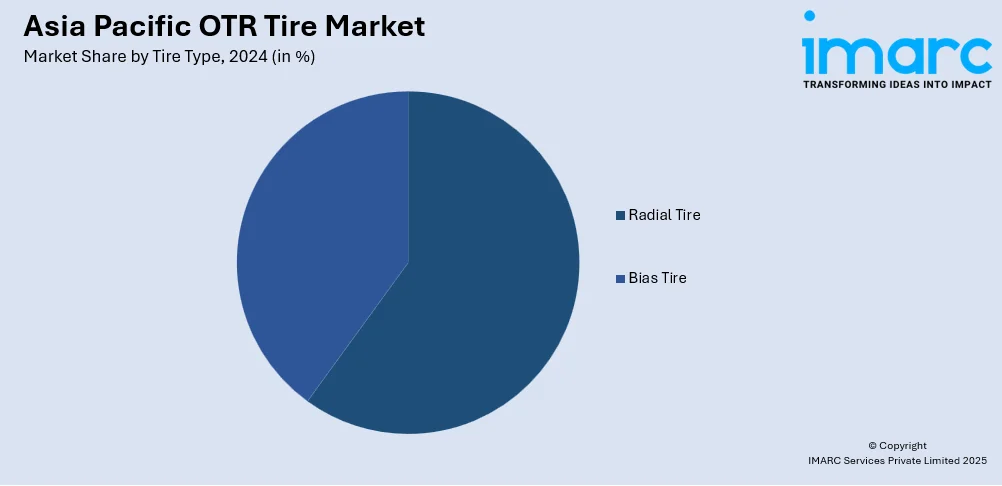

Tire Type Insights:

- Radial Tire

- Bias Tire

A detailed breakup and analysis of the market based on the tire type has also been provided in the report. This includes radial tire and bias tire. According to the report, bias tire accounted for the largest market share as it is less expensive as compared to radial tire. Moreover, the rising demand for bias tires in the heavy-duty carriage trucks in mining and construction sectors is positively influencing the market.

Tire Size Insights:

- Top Tire Sizes in 24’’-30’’

- Top Tire Sizes in 31’’-35’’

- Top Tire Sizes in 36’’-39’’

- Top Tire Sizes in 40’’-50’’

- Top Tire Sizes in 51’’-55’’

- Top Tire Sizes in 56’’-63’’

A detailed breakup and analysis of the market based on the tire size has also been provided in the report. This includes top tire sizes in 24’’-30’’, top tire sizes in 31’’-35’’, top tire sizes in 36’’-39’’, top tire sizes in 40’’-50’’, top tire sizes in 51’’-55’’, and top tire sizes in 56’’-63’’. According to the report, top tire sizes in 24’’-30’’ accounted for the largest market share as these tires are widely used in tractors. In addition to this, the rising number of agricultural activities in various regions is contributing to the market growth.

Vehicle Type Insights:

- Agriculture Vehicles

- Construction and Industrial Vehicles

- Mining Vehicles

- Others

A detailed breakup and analysis of the market based on the vehicle type has also been provided in the report. This includes agriculture vehicles, construction and industrial vehicles, mining vehicles, and others. According to the report, construction and industrial vehicles accounted for the largest market share due to the increasing investment in infrastructure projects and industrial development. Additionally, the rising demand for tire retreads in construction and industrial vehicles is bolstering the growth of respective segment.

Country Insights:

- China

- India

- Japan

- Australia

- Indonesia

- New Zealand

- Others

The report has also provided a comprehensive analysis of all the major country markets, which include China, India, Japan, Australia, Indonesia, New Zealand, and others. According to the report, China was the largest market for OTR tire. Some of the factors driving the China OTR tire market included the huge production base for OTR tires, presence of a large number of regional players in the market, and the rising demand for OTR tires due to the implementation of advanced mining technologies, along with the continuous farm mechanization.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Some of the companies covered in the report include:

- Apollo Tyres Ltd.

- Balkrishna Industries Limited (BKT)

- Bridgestone Corporation

- CEAT Limited

- Cheng Shin Rubber Industry Co. Ltd.

- Guizhou Tyre Co. Ltd.

- JK Tyre and Industries Ltd

- Michelin

- MRF Limited

- PT Gajah Tunggal Tbk

- Sumitomo Rubber Industries Ltd.

- The Goodyear Tire & Rubber Company

- The Yokohama Rubber Co. Ltd.

- Toyo Tire Corporation

- Triangle Tyre Co. Ltd

Please note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Units |

| Segment Coverage | Demand, Tire Type, Tire Size, Vehicle Type, Country |

| Countries Covered | China, Japan, India, New Zealand, Australia, Indonesia, Others |

| Companies Covered | Apollo Tyres Ltd., Balkrishna Industries Limited (BKT), Bridgestone Corporation, CEAT Limited, Cheng Shin Rubber Industry Co. Ltd., Guizhou Tyre Co. Ltd., JK Tyre and Industries Ltd, Michelin, MRF Limited, PT Gajah Tunggal Tbk,Sumitomo Rubber Industries Ltd., The Goodyear Tire & Rubber Company, The Yokohama Rubber Co. Ltd.,Toyo Tire Corporation and Triangle Tyre Co. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific OTR tire market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific OTR tire market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia-Pacific OTR tire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific OTR tire market reached a volume of 49.9 Million Units in 2024.

We expect the Asia Pacific OTR tire market to exhibit a CAGR of 5.29% during 2025-2033.

The rising development of roads, highways, power plants, etc., along with the increasing awareness towards numerous benefits of OTR tires, such as high heat and rolling resistance, better durability, easy mobility, etc., is primarily driving the Asia Pacific OTR tire market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several Asia Pacific nations resulting in the temporary closure of numerous manufacturing units for OTR tires.

Based on the demand, the Asia Pacific OTR tire market has been segmented into OEM and replacement, where replacement currently holds the majority of the total market share.

Based on the tire type, the Asia Pacific OTR tire market can be divided into radial tire and bias tire. Currently, bias tire exhibits a clear dominance in the market.

Based on the tire size, the Asia Pacific OTR tire market has been categorized into top tire sizes in 24’’-30’’, top tire sizes in 31’’-35’’, top tire sizes in 36’’-39’’, top tire sizes in 40’’-50’’, top tire sizes in 51’’-55’’, and top tire sizes in 56’’-63’’. Among these, top tire sizes in 24’’-30’’ currently account for the largest market share.

Based on the vehicle type, the Asia Pacific OTR tire market can be segregated into agriculture vehicles, construction and industrial vehicles, mining vehicles, and others. Currently, construction and industrial vehicles exhibit a clear dominance in the market.

On a regional level, the market has been classified into China, India, Japan, Australia, Indonesia, New Zealand, and others, where China currently dominates the Asia Pacific OTR tire market.

Some of the major players in the Asia Pacific OTR tire market include Apollo Tyres Ltd., Balkrishna Industries Limited (BKT), Bridgestone Corporation, CEAT Limited, Cheng Shin Rubber Industry Co. Ltd., Guizhou Tyre Co. Ltd., JK Tyre and Industries Ltd, Michelin, MRF Limited, PT Gajah Tunggal Tbk,Sumitomo Rubber Industries Ltd., The Goodyear Tire & Rubber Company, The Yokohama Rubber Co. Ltd.,Toyo Tire Corporation and Triangle Tyre Co. Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)