Asia Pacific Polyols Market Size, Share, Trends and Forecast by Type, Application, Industry, and Country, 2025-2033

Market Overview:

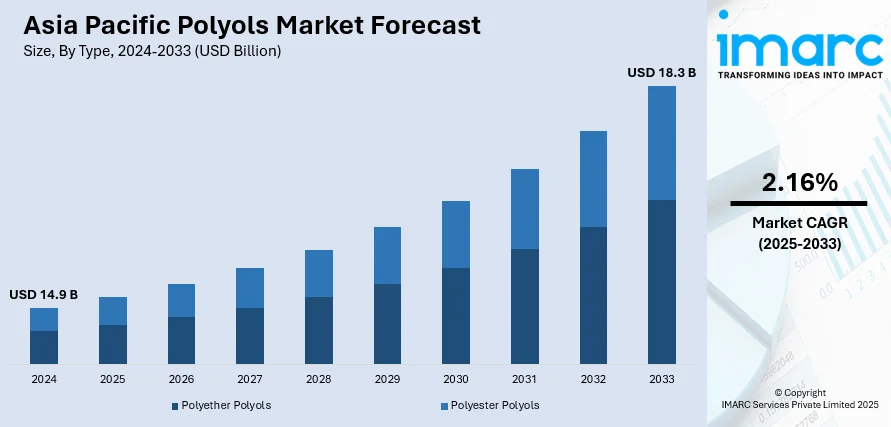

The Asia Pacific polyols market size reached USD 14.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.3 Billion by 2033, exhibiting a growth rate (CAGR) of 2.16% during 2025-2033. The growing occurrence of diabetes among the masses, increasing demand for polyurethane foam in the construction industry, and rising number of brands launching healthy beverages and snacks devoid of refined sugar are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 14.9 Billion |

|

Market Forecast in 2033

|

USD 18.3 Billion |

| Market Growth Rate 2025-2033 | 2.16% |

Polyols, also known as sugar alcohols, are a type of carbohydrate that is used in the food industry due to their lower calorific value compared to traditional sugars. They are chemically derived from sugars by replacing the aldehyde or ketone group in a sugar molecule with an alcohol group. They are available as xylitol, erythritol, sorbitol, maltitol, and isomalt. They have a less significant impact on blood glucose levels, making them popular among those with diabetes or people looking to lose weight. They also serve as excipients in tablets, syrups, and elixirs due to their moisture-retaining properties and ability to improve texture.

To get more information on this market, Request Sample

At present, the increasing demand for polyols as they reduce tooth-decay-causing bacteria and plaque in the mouth is impelling the growth of the market in the Asia Pacific region. Besides this, the rising occurrence of chronic diseases caused by the adoption of sedentary lifestyle habits and consumption of unhealthy diets is contributing to the growth of the market. In addition, the growing awareness about the beneficial aspects of consuming xylitol and erythritol instead of refined sugar is offering a favorable market outlook in Asia Pacific. Apart from this, the increasing number of brands launching healthy beverages and snacks devoid of refined sugar and containing polyols for fitness enthusiasts and health-conscious consumers is supporting the growth of the market in the region. Additionally, the rising utilization of polyurethane foam in the automotive sector to manufacture seats, headrests, and armrests is supporting the growth of the market in Asia Pacific.

Asia Pacific Polyols Market Trends/Drivers:

Rising occurrence of diabetes

At present, there is an increase in the occurrence of diabetes among the masses due to the adoption of unhealthy lifestyle habits and the consumption of calorie-rich diets. In addition, more people are opting for healthier, low-sugar, or sugar-free alternatives in their diet, leading to a rise in the consumption of polyol-based products. The human body metabolizes polyols slower than sugar, leading to less dramatic spikes in blood glucose and insulin levels. Foods sweetened with polyols are, therefore, a safe and more palatable option for diabetes management. These growing applications and the rising prevalence of diabetes are driving the food and beverage (F&B) industry to incorporate polyols into their products, fueling the polyol market growth.

Increasing demand for polyurethane foam in the construction sector

At present, there is an increase in the demand for polyols in the construction sector for manufacturing polyurethane foams. Polyurethane foam, a product derived from polyols, is increasingly being recognized for its excellent insulation properties, durability, and versatility, making it a vital ingredient in modern construction. This burgeoning demand for polyurethane foam is significantly contributing to the positive trajectory of the polyol market. Moreover, polyurethane foam helps in achieving better energy efficiency, reducing greenhouse gas emissions, and minimizing the environmental footprint of buildings. As more constructors adopt sustainable construction methods, the demand for eco-friendly and high-performance materials like polyurethane foam is rising, thus driving the growth of the polyol market.

Growing investments in drug development activities

The pharmaceutical industry is witnessing a rise in drug development activities, primarily driven by increasing healthcare needs, advancements in technology, and incidence of chronic diseases. Polyols are versatile compounds used in various aspects of drug development, including drug stabilization, tablet coating, and improving drug solubility. As pharmaceutical companies ramp up drug development efforts, the demand for these compounds is also growing. Besides this, certain medications are sensitive to moisture, which can degrade their active pharmaceutical ingredients (APIs). Polyols, such as sorbitol and mannitol, can protect these APIs by creating a stable, low-moisture environment, thus maintaining the effectiveness of the medication. In drug formulation, polyols are also used as excipients to provide bulk to solid dosage forms like tablets, improve the organoleptic properties of the medication, and ensure uniformity.

Asia Pacific Polyols Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific polyols market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on type, application and industry.

Breakup by Type:

- Polyether Polyols

- Polyester Polyols

Polyether polyols dominate the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes polyether polyols and polyester polyols. According to the report, polyether polyols represented the largest segment.

Polyether polyols are a type of polymer derived from the reaction between polyfunctional alcohols and ethylene or propylene oxides. This reaction results in a three-dimensional polymer network with hydroxyl functional groups (-OH). Polyether polyols are characterized by their low cost, ease of handling, and ability to form products with a wide range of rigidity, durability, and density. They are highly versatile and customizable, enabling manufacturers to tailor the final polyurethane product to meet specific application requirements. There are various types of polyether polyols, such as polypropylene glycol (PPG), polyethylene glycol (PEG), and polytetramethylene glycol (PTMG). Polyether polyols are utilized in several industries, especially the automotive, construction, and furniture sectors, where polyurethane products are extensively used for their insulation properties, resilience, and comfort.

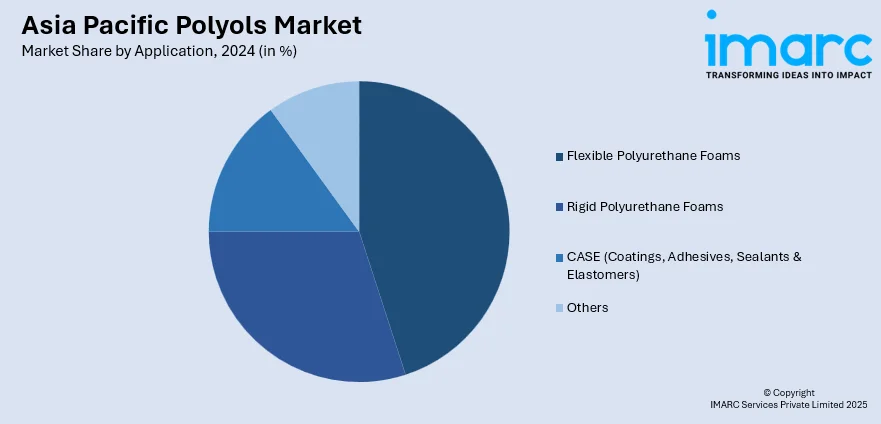

Breakup by Application:

- Flexible Polyurethane Foams

- Rigid Polyurethane Foams

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Others

Flexible polyurethane foams hold the largest share in the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes flexible polyurethane foams, rigid polyurethane foams, CASE (coatings, adhesives, sealants, and elastomers), and others. According to the report, flexible polyurethane foams accounted for the largest market share.

Flexible polyurethane foam is a versatile material derived from the reaction of polyols, primarily polyether polyols, with isocyanates in the presence of suitable catalysts and additives. They are resistant to wear and tear, and they maintain their shape and comfort properties over an extended period. This makes them a cost-effective choice for manufacturers and consumers alike. They are used in the furniture and bedding industry due to their unparalleled comfort and durability. Flexible polyurethane foams are also utilized in packaging to protect delicate items during transit. Their ability to conform to the shape of the item and absorb shocks makes them ideal for packaging electronics, glassware, and other fragile items. Moreover, they find application in the manufacturing of dashboards, armrests, and door panels, contributing to the aesthetics and comfort of vehicle interiors.

Breakup by Industry:

- Carpet Backing

- Packaging

- Furniture

- Automotive

- Building & Construction

- Electronics

- Footwear

- Others

Carpet backing holds the biggest share of the market

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes carpet backing, packaging, furniture, automotive, building and construction, electronics, footwear, and others. According to the report, carpet backing accounted for the largest market share.

Carpet backing is an essential component of a carpet that forms the underside or 'back' of the carpet structure. It helps maintain the shape of the carpet, provides structure and stability, and extends the overall lifespan. Polyols play a crucial role in the production of foamed urethane used for secondary carpet backing. The foamed urethane carpet backing is made by applying a layer of polyurethane foam to the underside of the primary backing. Polyurethane foam backing provides better thermal insulation compared to other types of backing, contributing to energy savings. It also improves the acoustic properties of carpets by absorbing sound and reducing noise levels. Furthermore, polyurethane foam is resistant to moisture, which can help restrict the growth of mold and mildew in certain environments.

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China exhibits a clear dominance, accounting for the largest Asia Pacific polyols market share

The report has also provided a comprehensive analysis of all the major regional markets, which include China, Japan, India, South Korea, Australia, Indonesia, and others. According to the report, China represented the largest market.

China held the biggest market share due to the increasing production of polyurethane foam used in various industries, including construction, automotive, and furniture. Besides this, the rising construction of various luxury apartments and commercial buildings is propelling the growth of the market.

Apart from this, the increasing popularity of EVs, as they are sustainable and do not produce harmful exhausts, is supporting the growth of the market. In addition, the growing focus on adopting sustainable and energy-efficient practices, particularly in construction and renovation, if offering a favorable market outlook.

India is estimated to expand further in this domain due to the increasing investment in drug development activities to manufacture various novel drugs for the disease is strengthening the growth of the market.

Competitive Landscape:

Key market players are setting up new manufacturing plants or enhancing the capabilities of existing ones to increase their output. They are also focusing on developing polyols with enhanced properties and efficiency as well as eco-friendly polyols derived from renewable sources to meet the growing demand for sustainable products. Top companies are examining local market dynamics, establishing distribution networks, and complying with local regulations and standards. They are working closely with their clients to analyze their requirements and deliver customized solutions. Leading companies are investing in technological innovations to improve their manufacturing processes by using novel catalysts and process technologies. They are also developing polyols for synthetic lubricants that offer better oxidative stability and lower volatility.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Asia Pacific Polyols Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Polyether Polyols, Polyester Polyols |

| Applications Covered | Flexible Polyurethane Foams, Rigid Polyurethane Foams, CASE (Coatings, Adhesives, Sealants & Elastomers), Others |

| Industries Covered | Carpet Backing, Packaging, Furniture, Automotive, Building & Construction, Electronics, Footwear, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific polyols market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific polyols market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific polyols industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific polyols market was valued at USD 14.9 Billion in 2024.

We expect the Asia Pacific polyols market to exhibit a CAGR of 2.16% during 2025-2033.

The rising consumer health consciousness, along with the increasing demand for polyols in the F&B industry as artificial sweeteners to produce various sugar-free products, including chewing gum, candies, ice cream, etc., is primarily driving the Asia Pacific polyols market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several Asia Pacific nations, resulting in the temporary halt in numerous production activities for polyols.

Based on the type, the Asia Pacific polyols market can be categorized into polyether polyols and polyester polyols. Currently, polyether polyols account for the majority of the total market share.

Based on the application, the Asia Pacific polyols market has been segregated into flexible polyurethane foams, rigid polyurethane foams, CASE (Coatings, Adhesives, Sealants & Elastomers), and others. Among these, flexible polyurethane foams currently exhibit a clear dominance in the market.

Based on the industry, the Asia Pacific polyols market can be bifurcated into carpet backing, packaging, furniture, automotive, building & construction, electronics, footwear, and others. Currently, carpet backing holds the largest market share.

On a regional level, the market has been classified into China, Japan, India, South Korea, Australia, Indonesia, and others, where China currently dominates the Asia Pacific polyols market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)