Asia Pacific Silica Sand Market Size, Share, Trends and Forecast by End Use and Country, 2025-2033

Asia Pacific Silica Sand Market Size and Share:

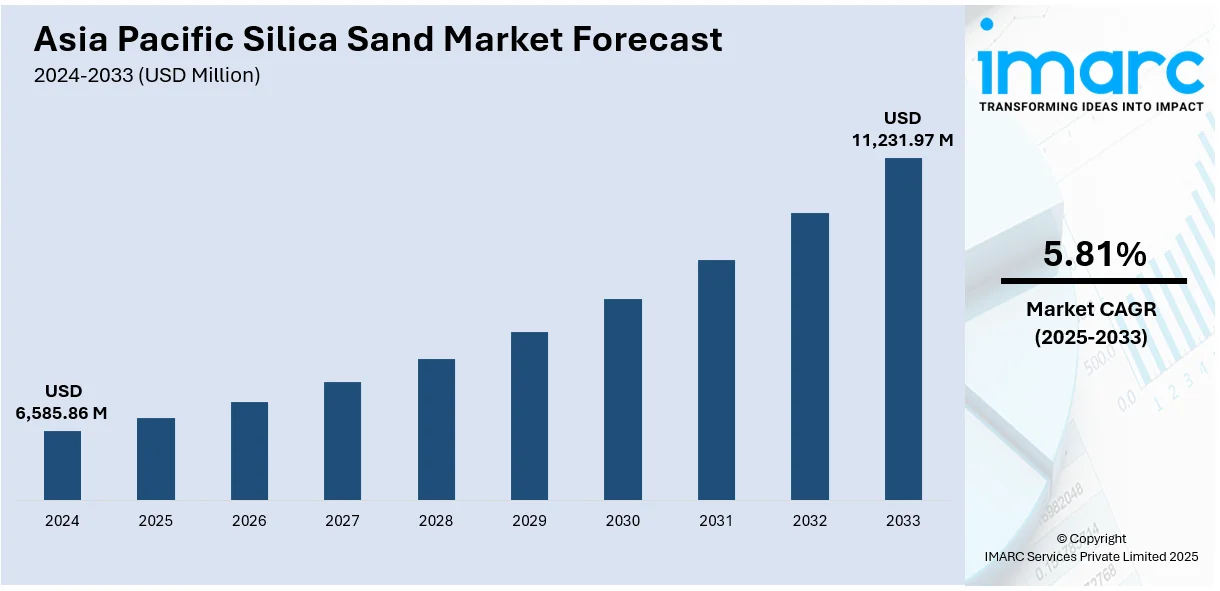

The Asia Pacific silica sand market size was valued at USD 6,585.86 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 11,231.97 Million by 2033, exhibiting a CAGR of 5.81% from 2025-2033. China dominates the Asia Pacific silica sand market share, driven by its robust industrial growth, in sectors like construction, glass manufacturing, and electronics, rising demand for high-quality silica sand in fracking, rapid urbanization, and ongoing infrastructure development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6,585.86 Million |

|

Market Forecast in 2033

|

USD 11,231.97 Million |

| Market Growth Rate (2025-2033) | 5.81% |

The Asia Pacific silica sand market demand is primarily driven by rapid industrialization and urbanization, particularly in China, which is a key consumer of silica sand in the region. In addition, the growth of the construction sector is fueled by large-scale infrastructure projects, residential development, and urban expansion, which is increasing the demand for silica sand, especially for concrete and glass production. Furthermore, the growing electronics industry requires high-purity silica sand for semiconductor manufacturing, contributing to the market expansion. For instance, in February 2024, Sibelco North America joined Ojing Technology in a USD 350 million agreement for high-purity quartz sand distribution, strengthening their position in the high-purity silica sand market. In confluence with this, increasing government incentives for infrastructure development are boosting demand for construction materials like silica sand, thus impelling the market growth.

To get more information on this market, Request Sample

Concurrently, the rising adoption of hydraulic fracturing (fracking) for oil and gas extraction plays a significant role in driving the demand for silica sand in the Asia Pacific region. Moreover, fracking requires specialized high-quality silica sand, known as frac sand, to enhance extraction efficiency, providing an impetus to the market. For example, Jiangsu Fujinyan Construction Engineering Co. together with Hunan Dongting Resources Holding Group agreed to build a CNY 500 million quartz sand facility in Hunan Province's Xiangyin County for photovoltaic products production. This highlights the increasing need for premium-grade silica sand within the solar and energy industries. Besides this, as the energy sector advances and exploration activities intensify, the need for frac sand is set to grow, particularly in emerging markets, fueling the market demand. Apart from this, continuous technological advancements in high-purity silica sand production are expanding its applications in the electronics and energy sectors, thereby enhancing the Asia Pacific silica sand market outlook.

Asia Pacific Silica Sand Market Trends:

Growing Demand for High-Purity Silica Sand

The shifting trends towards elevated requirements for high-purity silica sand and its applications in electronics and solar energy production are strengthening the Asia Pacific silica sand market share. Modern technological development demands industrial organizations to use improved silica grades when manufacturing semiconductors alongside photovoltaic cells and advanced glass products. For instance, in 2024, Corning Incorporated and Optiemus Infracom Limited signed an MoU with Tamil Nadu to set up a ₹1,003 crore factory near Chennai for front-cover glass production, creating 840 jobs at SIPCOT-Pillaipakkam Industrial Estate in Kancheepuram. This new facility will further drive the demand for high-purity silica sand in glass production for electronic devices. Besides this, high-purity silica sand consumption in China has surged due to fast-growing electronic components and solar panel markets. Furthermore, the production of efficient and durable products depends on high-purity silica sand to meet the technological innovation and sustainability targets of the region, which is contributing to the market expansion.

Expansion of Hydraulic Fracturing (Fracking)

Hydraulic fracturing is gaining momentum in the Asia Pacific region, with China leading the charge in unconventional oil and gas extraction. For instance, in January 2025, National Energy Administration (NEA) data states that China achieved a significant milestone when its oil and gas production exceeded 400 million tons of oil equivalent. This milestone underscores China's growing energy production capacity, which further fuels the demand for frac sand and supports the expansion of the silica sand market in the region. In line with this, the increased requirements for frac sand used during hydraulic fracturing operations, drive commercial interest in silica sand that meets durability and size consistency standards. Moreover, the adoption of energy extraction technologies by numerous regional countries is driving the market growth for silica sand because of their shale reserves. Concurrent with this, the increased demand from electronics manufacturing and construction activities together with rising investments in renewable energy (RE) projects are significantly transforming the Asia Pacific silica sand market trends.

Sustainability and Eco-friendly Initiatives

The rising importance of environmental issues drives the expanded demands for sustainable silica sand mining operations and processing activities approach. Asia Pacific's silica sand industry actively implements environmental initiatives through the development of sustainable extraction approaches combined with recycling practices. For example, the Sarawak Corridor of Renewable Energy (SCORE) offers a 100% Pioneer Status tax exemption program spanning 5 years (extending to 10 years for strategic investments) to promote responsible industrial growth. This program is a key government incentive that supports the adoption of sustainable practices in the silica sand industry and fosters responsible industrial growth. Additionally, businesses are working to decrease their environmental footprint by cutting down their production-related water use and power usage. Apart from this, the region demonstrates a strong commitment to sustainable development through increased tendencies to reuse silica sand for manufacturing and construction purposes, thereby expanding the Asia Pacific silica sand market size.

Asia Pacific Silica Sand Industry Segmentation:

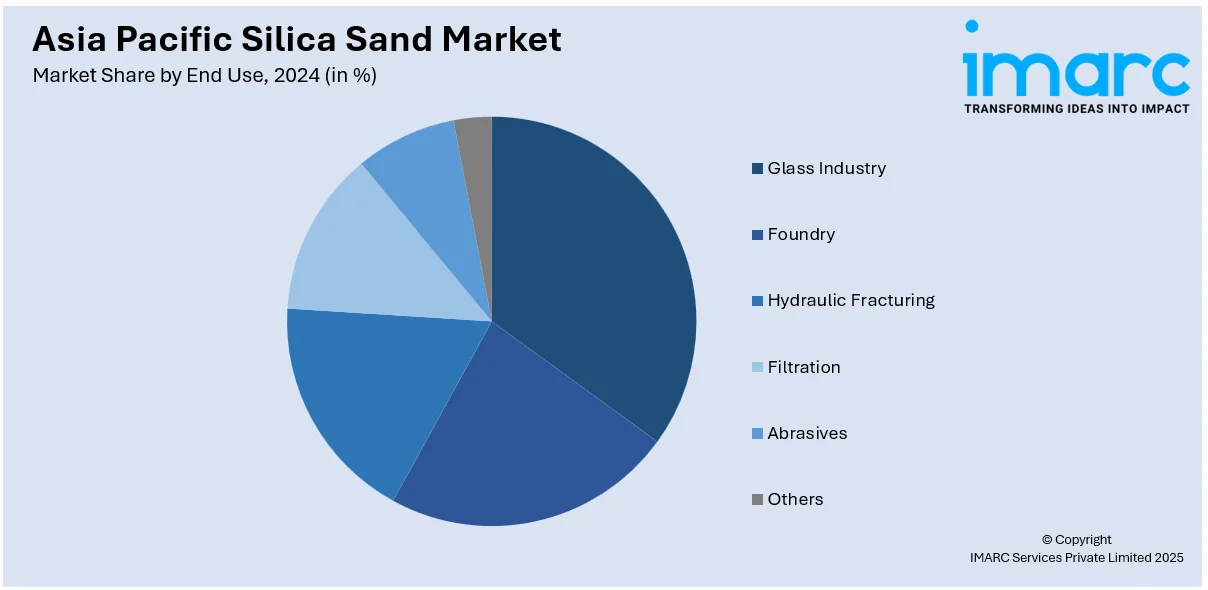

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific silica sand market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on end use.

- Glass Industry

- Foundry

- Hydraulic Fracturing

- Filtration

- Abrasives

- Others

The glass industry serves as the primary driver of growth in the Asia Pacific silica sand market growth. This segment is expanding primarily due to the increasing demand for glass products in the construction, automotive, and packaging sectors. Glass manufacturers require silica sand as their fundamental material because it enables them to produce excellent glass products. Besides this, the rapid urbanization along with new infrastructure developments across China India, and Southeast Asia drives construction glass and window and facade requirements, fostering the market growth. Moreover, the growing car industry throughout the area drives the demand for state-of-the-art glass components including windows automotive mirror systems, and display technologies. Furthermore, the food and beverage (F&B) packaging market supports the glass industry because consumers opt for glass containers as they protect the products and have an aesthetic appeal while sustaining environmental sustainability principles. As a result, the surging growth of the glass sector will sustain its position as the major force in the silica sand market to drive steady market expansion during future years.

Country Analysis:

- China

- India

- Malaysia

- South Korea

- Japan

- Australia

- Others

China holds a dominant position in the Asia Pacific silica sand market, accounting for a substantial share. For instance, Ningxia province holds the ninth largest silica sand reserves in China at 5 billion metric tons which demonstrates the nation's abundant natural resources. The demand in the region is spurring due to rapid industrial expansion and rapid urbanization. The silica sand market demand is also driven by the Chinese economic growth, through the fundamental sectors of building construction, glass production, and electronic systems. Furthermore, the expanding infrastructure development of the region combined with its rising automotive sector and packaging market requires ever more superior quality silica sand products. Besides this, the expanding hydraulic fracturing operations for energy extraction lead to enhanced frac sand requirements. Apart from this, China remains dominant in the silica sand market because of its ongoing technological strength coupled with its manufacturing leadership which forecasts continuous market expansion.

Competitive Landscape:

The Asia Pacific silica sand market operates under intense competition where multiple important companies work to build their manufacturing capabilities and diversify their product lines. Enterprises are progressively increasing their research efforts to develop superior silica sand materials which include top-tier applications in glass production and hydraulic fracturing. The market positions of firms strengthen through their common execution of strategic partnerships while they acquire and merge businesses. Additionally, players benefit from emerging economies' growing needs by constructing regional manufacturing facilities to serve expanding industrial requirements in the construction, automotive, and electronics sectors.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific silica sand market with detailed profiles of all major companies, including:

- Chongqing Changjiang River Moulding Material (Group) Co. Ltd

- Diatreme Resources Limited

- JFE Mineral Company Ltd.

- Mangal Minerals

- Mitsubishi Corporation

- PUM Group

- Raghav Productivity Enhancers Limited

- Rock Energy International

- TOCHU Corporation

- VRX Silica Ltd

- Xinyi Golden Ruite Quartz Materials Co., Ltd.

Latest News and Developments:

- In November 2024, VRX Silica received a positive endorsement from the Environmental Protection Agency (EPA), advancing toward critical project approvals. This milestone strengthens its position in the silica sand market, driving growth in Asia Pacific's construction, glass, and manufacturing sectors by ensuring reliable, high-quality supply.

- In November 2024, Japan's Mitsubishi Corp and Nissan announced that they plan to form a joint venture focused on autonomous driving and electric vehicle battery storage, launching by March 2025. This collaboration aims to boost the demand for high-quality silica sand, essential in electronics and automotive glass manufacturing in the Asia Pacific.

- In September 2024, Japan's Mitsubishi Corporation announced to buy a stake and secure an ammonia off-take from ExxonMobil's Texas facility, to strengthen its energy portfolio. This strategic move, along with other industrial investments, aims to increase demand for silica sand in the infrastructure and energy sectors across the Asia Pacific.

- In July 2024, Diatreme Resources initiated a hostile takeover of Metallica Minerals, a silica sand miner. The takeover has led to a board restructure at Metallica, with Diatreme now controlling approximately 71.2% of Metallica's shares. This acquisition further strengthens Diatreme’s market position and expands its footprint in the rapidly growing Asia Pacific silica sand market, which is driven by increasing demand from the construction, glass, and energy sectors.

- In May 2024, Mitsubishi Corporation allocated ¥3.0 trillion for investments, with a portion directed toward the Materials Solution segment, which includes the silica sand business. This investment is focused on improving the company's operations and strengthening its market footprint.

Asia Pacific Silica Sand Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Metric Tons, Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| End Uses Covered | Glass Industry, Foundry, Hydraulic Fracturing, Filtration, Abrasives, Others |

| Countries Covered | China, India, Malaysia, South Korea, Japan, Australia, Others |

| Companies Covered | Chongqing Changjiang River Moulding Material (Group) Co. Ltd, Diatreme Resources Limited, JFE Mineral Company Ltd., Mangal Minerals, Mitsubishi Corporation, PUM Group, Raghav Productivity Enhancers Limited, Rock Energy International, TOCHU Corporation, VRX Silica Limited and Xinyi Golden Ruite Quartz Materials Co., Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific silica sand market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific silica sand market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific silica sand industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific silica sand market was valued at USD 6,585.86 Million in 2024.

Key factors driving the growth of the Asia Pacific silica sand market include rapid industrialization, rising urbanization, expanding infrastructure development, increasing demand from construction, spurring glass manufacturing, and electronics sectors, as well as the rising adoption of hydraulic fracturing in energy extraction.

IMARC estimates the Asia Pacific silica sand market to exhibit a CAGR of 5.81% during 2025-2033, reaching a value of USD 11,231.97 Million by 2033.

In 2024, the glass industry accounted for the largest market share based on end use, fueled by the strong demand from the construction, automotive, and packaging sectors, rapid urbanization, increasing infrastructure development, and the growth of the automotive and packaging industries.

Some of the major players in the Asia Pacific silica sand market include Chongqing Changjiang River Moulding Material (Group) Co. Ltd, Diatreme Resources Limited, JFE Mineral Company Ltd., Mangal Minerals, Mitsubishi Corporation, PUM Group, Raghav Productivity Enhancers Limited, Rock Energy International, TOCHU Corporation, VRX Silica Limited and Xinyi Golden Ruite Quartz Materials Co., Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)