Australia Adult Diaper Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Australia Adult Diaper Market Summary:

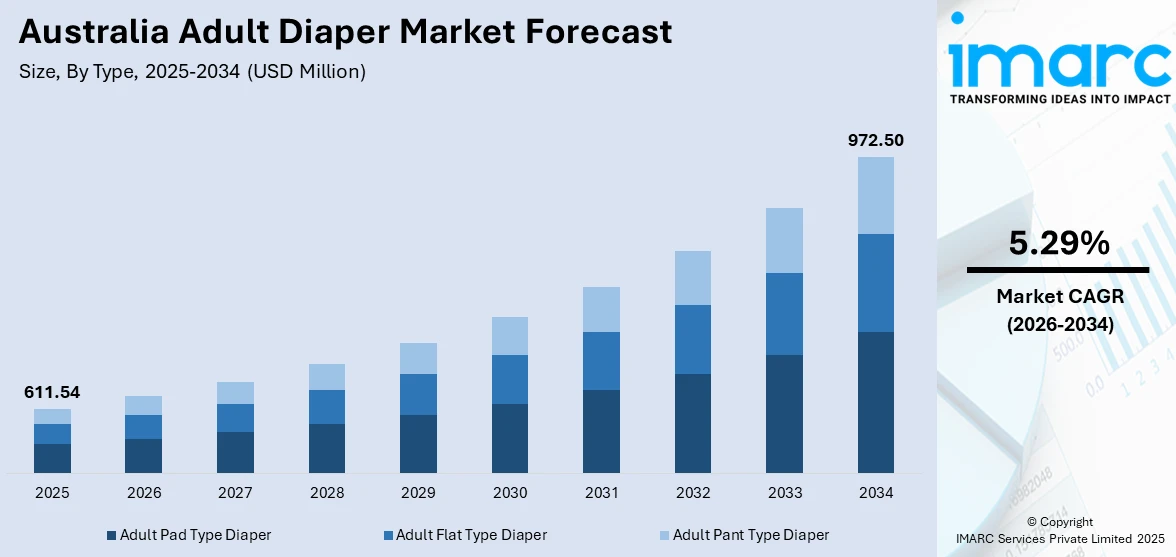

The Australia adult diaper market size was valued at USD 611.54 Million in 2025 and is projected to reach USD 972.50 Million by 2034, growing at a compound annual growth rate of 5.29% from 2026-2034.

The Australia adult diaper market is registering significant growth with increasing geriatric population and awareness regarding incontinence management solutions. The market is also benefiting due to greater emphasis on personal and patient hygiene and dignity preservation for such patients along with greater acceptability of adult incontinence products in healthcare settings and within home care settings. Moreover, technological advancements and increasing availability of convenient and discreet products are fueling this market.

Key Takeaways and Insights:

- By Type: Adult pad type diaper dominates the market with a share of 52% in 2025, driven by its cost-effectiveness, ease of use, and psychological acceptability for users transitioning to incontinence management products for the first time.

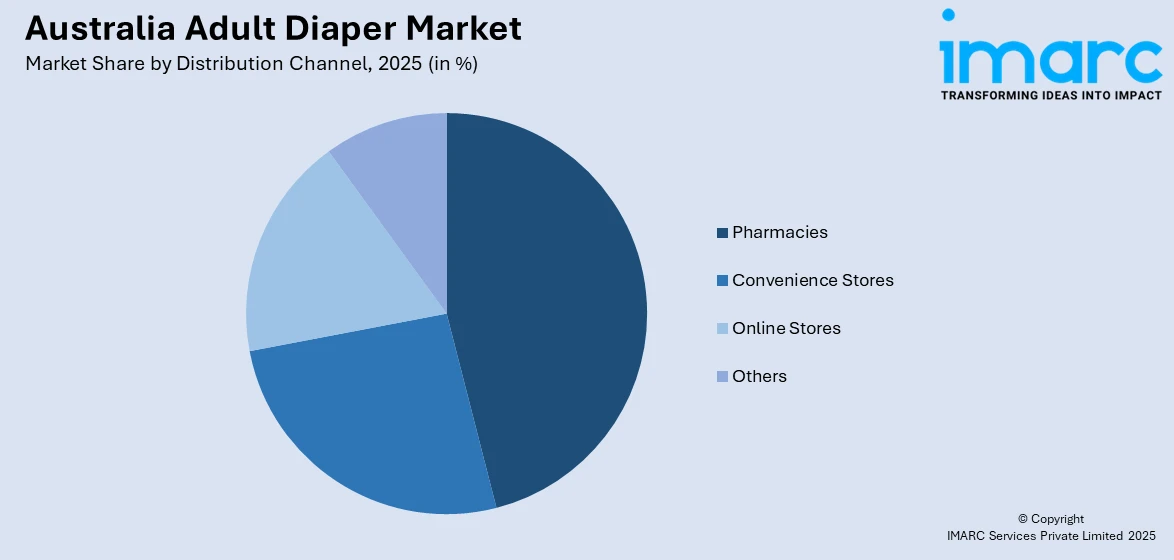

- By Distribution Channel: Pharmacies leads the market with a share of 44% in 2025, owing to healthcare-related trust associations that reduce purchasing discomfort, superior product assortment, and professional guidance from pharmacists.

- By Region: Australia Capital Territory & New South Wales represents the largest segment with a market share of 25% in 2025, attributed to the concentration of elderly population in Sydney metropolitan areas, advanced healthcare infrastructure, and higher disposable incomes.

- Key Players: The Australia adult diaper market exhibits moderate competitive intensity, with multinational personal care corporations competing alongside regional manufacturers across price segments. Key player operating in the market include, Abena Group, Attends Healthcare Products, Inc., Conni, Depend Australia (Kimberly-Clark Worldwide Inc.), Ontex Healthcare, PAUL HARTMANN Pty. Ltd, and Tena (Essity AB).

To get more information on this market Request Sample

The Australia adult diaper market is experiencing transformative growth as demographic shifts and changing healthcare dynamics reshape consumer needs. In July 2025, a nationwide survey commissioned by Continence Health Australia revealed that over 7.2 million Australians experience incontinence each year, yet 70% of the community still lacks awareness about the condition, highlighting both the scale of the need and the importance of education in driving product adoption and destigmatization. The aging population, combined with increasing life expectancy, has created sustained demand for reliable incontinence management solutions that ensure comfort, dignity, and quality of life. Healthcare institutions, including hospitals, nursing homes, and aged care facilities, are increasingly adopting adult diapers as standard care components to ensure patient hygiene and prevent infection risks. The market is further bolstered by growing awareness campaigns that are progressively destigmatizing incontinence product usage, encouraging more individuals to seek appropriate solutions. Product innovations focusing on enhanced absorbency, skin-friendly materials, and discreet designs continue to expand the consumer base and drive adoption across various demographic segments.

Australia Adult Diaper Market Trends:

Growing Emphasis on Discreet and Comfortable Product Designs

The Australia adult diaper market is witnessing a significant trend toward products that prioritize discretion and user comfort. In October 2025, global hygiene and health company Essity, whose TENA range is widely distributed in Australia, launched its TENA Stylish™ Incontinence Underwear, a form‑fitting, discreet product designed to look and feel like real underwear while offering high absorbency and comfort for everyday life, underscoring the shift toward dignity‑focused product design. Manufacturers are developing thinner, more absorbent designs that closely resemble regular underwear, enabling users to maintain their active lifestyles without visible indication of incontinence management. This focus on dignity-preserving products is particularly important for younger adults experiencing temporary or lifestyle-related incontinence, as well as active seniors who refuse to compromise their mobility and social engagement. The trend reflects a broader shift in market positioning from medical necessity to lifestyle adaptation.

Expansion of E-Commerce and Subscription-Based Purchasing Models

Online retail channels are experiencing remarkable growth in the Australia adult diaper market as consumers increasingly value the privacy and convenience of home delivery. According to reports, global hygiene and health company Essity, which owns the TENA brand in Australia, expanded its direct‑to‑consumer and e‑commerce footprint by acquiring Australian leakproof apparel maker Modibodi and Canadian direct‑to‑consumer brand Knix Wear, strengthening its online sales capabilities for incontinence and related discreet products across digital channels. E-commerce platforms offer subscription-based purchasing options that ensure regular product supplies while providing cost savings and eliminating the potential embarrassment associated with in-store purchases. This digital transformation is particularly appealing to caregivers managing incontinence needs for family members, as well as individuals who prefer the anonymity of online ordering.

Rising Demand for Eco-Friendly and Sustainable Incontinence Products

Environmental consciousness is increasingly influencing purchasing decisions in the Australian adult diaper market, with consumers and institutions seeking products that minimize ecological impact. In July 2025, global personal care manufacturer Ontex announced the introduction of bio‑based superabsorbent polymers (bioSAP) in its diaper products, aiming to reduce the carbon footprint of absorbent cores and advance sustainable diaper solutions, a development that signals growing industry commitment to greener materials that could extend to adult incontinence ranges sold in Australia. Manufacturers are responding by developing biodegradable options featuring plant-based absorbent cores, sustainable packaging, and reduced plastic content. Aged care facilities and healthcare organizations are particularly interested in sustainable solutions as they work to meet environmental responsibility targets while maintaining care quality. This sustainability trend is driving innovation in materials science and production processes across the industry.

Market Outlook 2026-2034:

The Australia adult diaper market has strong potential for growth over the forecasted years owing to positive demographics and the development of the country's healthcare system. The progressive increase in the country's geriatric population, predicted to account for over twenty percent of the country's population by mid-century, will create steady demand for products that can manage incontinence. The support and investment by the country's government in terms of the construction of care facilities for the elderly and the awareness generated through education programs for incontinence treatments will be catalysts for the demand for adult diapers in Australia. The market generated a revenue of USD 611.54 Million in 2025 and is projected to reach a revenue of USD 972.50 Million by 2034, growing at a compound annual growth rate of 5.29% from 2026-2034.

Australia Adult Diaper Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Adult Pad Type Diaper | 52% |

| Distribution Channel | Pharmacies | 44% |

| Region | Australia Capital Territory & New South Wales | 25% |

Type Insights:

- Adult Pad Type Diaper

- Adult Flat Type Diaper

- Adult Pant Type Diaper

The adult pad type diaper dominates with a market share of 52% of the total Australia adult diaper market in 2025.

Adult pad type diapers have established themselves as the leading product category in the Australian market, primarily due to their cost-effectiveness and versatility in addressing varying levels of incontinence severity. In April 2025, the Western Australian Government’s Continence Product Subsidy Scheme (CPSS) provides eligible residents with annual subsidies to help cover the cost of continence products, including adult pads, for people with ongoing continence conditions, enhancing affordability and access outside of federal programs. These products offer users the flexibility to maintain their regular underwear while providing reliable protection against leakage, making them particularly suitable for individuals with light to moderate incontinence who seek minimal lifestyle disruption. The psychological acceptability of pad type products facilitates easier adoption for first-time users adjusting to incontinence management.

The widespread preference for adult pad type diapers is reinforced by their lower per-unit costs compared to alternative product formats, making them economically accessible for long-term users and institutional buyers managing budgetary constraints. Healthcare facilities and aged care homes frequently specify pad type products as standard inventory items due to their ease of changing and disposal efficiency. The segment continues to benefit from ongoing product improvements, including enhanced absorbent core technologies, skin-friendly topsheet materials, and odor control features that improve user comfort and confidence.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Pharmacies

- Convenience Stores

- Online Stores

- Others

The pharmacies lead with a share of 44% of the total Australia adult diaper market in 2025.

Pharmacies have been observed as the most preferred distribution channel in purchasing adult diapers in Australia, taking advantage of their healthcare-focused surroundings, which works well in overcoming any negativity of purchasing incontinence-related products. The consumers believe that purchasing incontinence products in a pharmacy setup is fit for their requirements and utilizes the advantages of consulting pharmacists for assistance in choosing the right products according to their needs. The largest pharmacies offer the widest range of products in different brands and categories that meet specific requirements of their customers.

The advantage of the pharmacy channel goes beyond the products to include the trust relationships that are built between the consumers and the healthcare providers. The pharmacists are important sources of information concerning the products and skin care, thus offering an improved overall experience to the customers. The loyalty schemes of the pharmacy channel, as well as the marketing activities, promote repeat business. The pharmacy channel has continued to broaden its products in the incontinence market in order to meet the growing demand.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales exhibits a clear dominance with a 25% share of the total Australia adult diaper market in 2025.

The Australia Capital Territory and New South Wales region commands the largest share of the national adult diaper market, reflecting its position as the most populous and economically developed region in Australia. Sydney, as the nation's largest metropolitan center, hosts a substantial concentration of elderly residents, healthcare facilities, and aged care homes that drive significant product consumption. The region's higher average disposable incomes enable greater spending on premium incontinence products that offer enhanced comfort and performance features.

The advanced healthcare infrastructure in New South Wales supports comprehensive incontinence management services, including specialized clinics, continence advisory services, and institutional procurement programs that facilitate product access. The concentration of major pharmacy chains, medical supply retailers, and e-commerce fulfillment centers ensures efficient distribution and product availability throughout the region. Additionally, the state's well-developed aged care sector, encompassing both residential facilities and home care programs, generates sustained institutional demand for adult diaper products across various quality tiers.

Market Dynamics:

Growth Drivers:

Why is the Australia Adult Diaper Market Growing?

Rapidly Expanding Elderly Population and Increasing Life Expectancy

Australia's aging demographic profile represents the primary catalyst for adult diaper market expansion, as longer lifespans translate to extended periods requiring incontinence management solutions. The proportion of Australians aged sixty-five and above continues to increase, with projections indicating this demographic will exceed twenty percent of the total population within coming decades. According to the Australian Bureau of Statistics, more than 17% of Australians were aged 65 and over in 2022, and this proportion is projected to rise to nearly one in four by 2066, highlighting the long‑term demographic trend toward an older population that will increasingly need products such as adult incontinence solutions. Age-related health conditions, including urinary incontinence, reduced mobility, and chronic diseases, become increasingly prevalent among elderly individuals, creating sustained demand for reliable hygiene products. The growing preference for aging in place rather than institutional care further drives demand, as home-based elderly individuals require accessible incontinence solutions that support independent living. Healthcare systems and aged care programs are increasingly recognizing incontinence management as essential to elderly wellbeing, incorporating product provision into standard care protocols.

Rising Awareness and Destigmatization of Incontinence Conditions

Growing public awareness about incontinence conditions and available management solutions is progressively breaking down the stigma that historically discouraged affected individuals from seeking help. In June 2025, World Continence Week, a national awareness campaign led by Continence Health Australia, reached millions of Australians with educational resources, expert advice, and media coverage designed to “shine a light on incontinence” and encourage open conversations about bladder and bowel health. Educational campaigns by healthcare organizations, advocacy groups, and product manufacturers are normalizing conversations about bladder and bowel control issues, encouraging more people to address their needs openly. Healthcare professionals are increasingly trained to discuss incontinence sensitively with patients, facilitating appropriate product recommendations and improving quality of life outcomes. Media coverage and celebrity endorsements have contributed to shifting perceptions, positioning adult diapers as practical lifestyle tools rather than embarrassing necessities. This cultural transformation is expanding the addressable market by encouraging previously reluctant individuals to adopt incontinence products and seek professional continence advice.

Advancements in Product Technology and Material Innovation

Continuous innovation in absorbent technologies, materials science, and product design is enhancing the performance and appeal of adult diapers, driving broader consumer adoption. In 2025, Kimberly‑Clark expanded its Depend adult incontinence product line with the launch of Depend FIT‑FLEX Underwear featuring Confidence Core technology for fast absorption and a flexible, body‑moving fit that enhances comfort and discretion for users, reflecting ongoing product innovation to better meet consumer needs. Modern products feature advanced superabsorbent polymers that provide superior moisture retention while maintaining slim profiles for discretion and comfort. Breathable materials and skin-friendly topsheets reduce irritation risks for long-term users, addressing concerns about dermatological health. Manufacturers are developing specialized products for different incontinence levels, activity types, and body shapes, enabling precise matching to individual requirements. These technological advancements are converting hesitant potential users into regular customers while encouraging existing users to upgrade to higher-performing premium products that improve their daily comfort and confidence.

Market Restraints:

What Challenges the Australia Adult Diaper Market is Facing?

Persistent Social Stigma and Psychological Barriers

Despite progress in awareness campaigns, significant social stigma continues to surround adult incontinence in Australia, deterring many affected individuals from acknowledging their condition or purchasing appropriate products. The association of diapers with dependency and loss of autonomy creates psychological barriers that prevent timely adoption of management solutions. Many individuals suffer in silence, avoiding social activities and experiencing reduced quality of life rather than seeking help, resulting in underreporting of incontinence prevalence and constrained market penetration.

Environmental Concerns Related to Disposable Product Waste

The environmental impact of disposable adult diapers presents growing challenges for the Australian market as ecological awareness intensifies among consumers and regulatory bodies. Non-biodegradable products contribute substantially to landfill waste, with limited recycling infrastructure currently available for used incontinence products. Environmental advocacy groups are increasingly scrutinizing the industry, potentially influencing purchasing decisions among ecologically conscious consumers. While manufacturers are developing sustainable alternatives, biodegradable options typically command premium prices that may limit accessibility for cost-sensitive consumers.

Cost Considerations and Limited Insurance Coverage

The ongoing expense of adult diaper purchases presents financial challenges for many affected individuals, particularly those on fixed incomes or without adequate healthcare coverage. While government programs such as the Continence Aids Payment Scheme provide some financial assistance, eligibility requirements and payment caps leave many consumers bearing substantial out-of-pocket costs. Premium products offering enhanced comfort and performance often remain unaffordable for price-sensitive consumers, forcing compromises in product quality that may affect wellbeing and satisfaction.

Competitive Landscape:

The competitive landscape of the Australia adult diaper market is moderately consolidated, with large multinational companies engaged in personal care products holding significant positions in the market, while specialized regional players also operate in important niches. The leading companies in the market compete on product differentiation strategies that include absorption technology, comfort features, sustainability credentials, and brand positioning. Significant investments are being made by participants in research and development to create new products that meet changing consumer preferences for discretion, skin health, and environmental responsibility. Distribution agreements with pharmacy chains, healthcare institutions, and e-commerce sites form essential competitive advantages that allow access to the market and reach consumers. Companies are increasingly targeting digital marketing strategies and direct-to-consumer channels as a means of communicating brand awareness and customer loyalty while collecting valued insight into purchase behaviors and preferences.

Some of the key players include:

- Abena Group

- Attends Healthcare Products, Inc.

- Conni

- Depend Australia (Kimberly-Clark Worldwide Inc.)

- Ontex Healthcare

- PAUL HARTMANN Pty. Ltd

- Tena (Essity AB)

Recent Developments:

- In July 2025, Essity’s TENA brand, widely sold in Australia, published an Environmental Product Declaration for its TENA Flex and TENA Pants adult incontinence products under ISO standards, reinforcing its 2025 commitment to sustainability and product transparency.

Australia Adult Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Adult Pad Type Diaper, Adult Flat Type Diaper, Adult Pant Type Diaper |

| Distribution Channels Covered | Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Abena Group, Attends Healthcare Products, Inc., Conni, Depend Australia (Kimberly-Clark Worldwide Inc.), Ontex Healthcare, PAUL HARTMANN Pty. Ltd, Tena (Essity AB), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia adult diaper market size was valued at USD 611.54 Million in 2025.

The Australia adult diaper market is expected to grow at a compound annual growth rate of 5.29% from 2026-2034 to reach USD 972.50 Million by 2034.

Adult Pad Type Diaper dominated the Australia adult diaper market with a share of 52%, driven by its cost-effectiveness compared to alternative product formats, psychological acceptability for users adjusting to incontinence management, and versatility in addressing varying levels of incontinence severity across different user demographics.

Key factors driving the Australia adult diaper market include the rapidly expanding elderly population with increasing life expectancy, rising awareness and destigmatization of incontinence conditions, advancements in absorbent technology and material innovation, growing government investment in aged care facilities, and expanding e-commerce distribution channels.

Major challenges include persistent social stigma and psychological barriers preventing product adoption, environmental concerns related to disposable product waste and limited recycling infrastructure, cost considerations and limited insurance coverage for incontinence products, and competition from reusable alternatives among environmentally conscious consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)