Australia Advanced Ceramics Market Size, Share, Trends and Forecast by Material Type, Class Type, End Use Industry, and Region, 2025-2033

Australia Advanced Ceramics Market Overview:

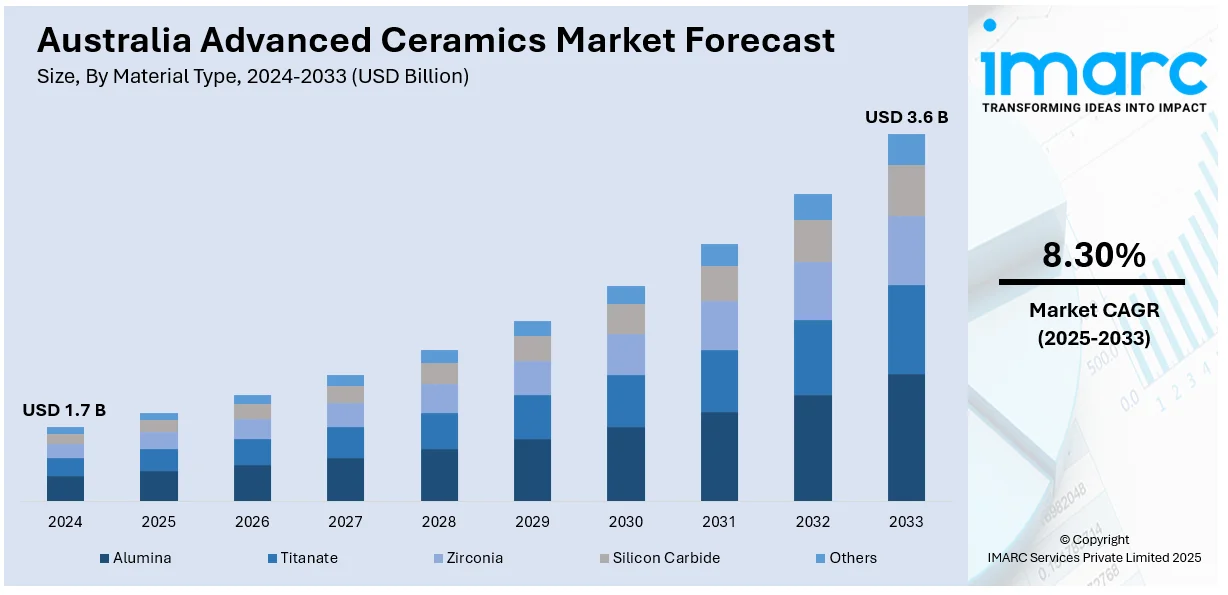

The Australia advanced ceramics market size reached USD 1.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.6 Billion by 2033, exhibiting a growth rate (CAGR) of 8.30% during 2025-2033. Rising demand in defense, electronics, and medical sectors, along with increased focus on renewable energy and industrial efficiency, are some of the factors contributing to Australia advanced ceramics market share. Their superior thermal, electrical, and mechanical properties support expanding applications in harsh environments and precision component manufacturing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.7 Billion |

| Market Forecast in 2033 | USD 3.6 Billion |

| Market Growth Rate 2025-2033 | 8.30% |

Australia Advanced Ceramics Market Trends:

Expansion of High-Precision Ceramic Additive Manufacturing

Australia is advancing its capabilities in ceramic additive manufacturing through investments in high-end equipment that enable the fabrication of complex, customized components. This development is supporting a range of sectors, including environmental restoration, biomedical research, and defense. Enhanced local production capacity is also encouraging greater collaboration between research institutions and industry. With the ability to produce durable, intricate ceramic structures, Australia is reinforcing its role in next-generation materials engineering. These factors are intensifying the Australia advanced ceramics market growth. For example, in October 2024, James Cook University (JCU) in Townsville upgraded its ceramic 3D printing capabilities by installing the C100 Easy Fab system from France-based 3DCeram Sinto. This move supports JCU’s expanding industrial collaborations and advanced research, including projects like coral reef restoration. The C100 Easy Fab enables the production of complex, high-precision ceramic parts, enhancing Australia's position in the advanced ceramics sector.

To get more information on this market, Request Sample

Rising Role of Ceramics in Medical Implants

Australia is witnessing the growing integration of advanced ceramics in high-precision medical applications, particularly in orthopedics. Ceramic materials are gaining ground for their biocompatibility, durability, and resistance to wear, making them suitable for long-term implants. Regulatory support and clinical validation are accelerating adoption, with performance metrics such as low revision rates reinforcing trust in these solutions. This progress is establishing Australia as a key player in high-performance ceramic-based healthcare innovation. For instance, in December 2024, Australia’s Therapeutic Goods Administration (TGA) approved MatOrtho’s ReCerf Hip Resurfacing Arthroplasty, making it the world’s first all-ceramic hip resurfacing system to gain regulatory clearance. This milestone strengthens Australia's position in advanced ceramics innovation, especially in medical applications. ReCerf showed a low revision rate of 0.3% over three years, according to the Australian Orthopaedic Association’s 2024 report, highlighting its potential to reshape the joint replacement market.

Australia Advanced Ceramics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material type, class type, and end use industry.

Material Type Insights:

- Alumina

- Titanate

- Zirconia

- Silicon Carbide

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes alumina, titanate, zirconia, silicon carbide, and others.

Class Type Insights:

- Monolithic Ceramics

- Ceramic Coatings

- Ceramic Matrix Composites

- Others

A detailed breakup and analysis of the market based on the class type have also been provided in the report. This includes monolithic ceramics, ceramic coatings, ceramic matrix composites, and others.

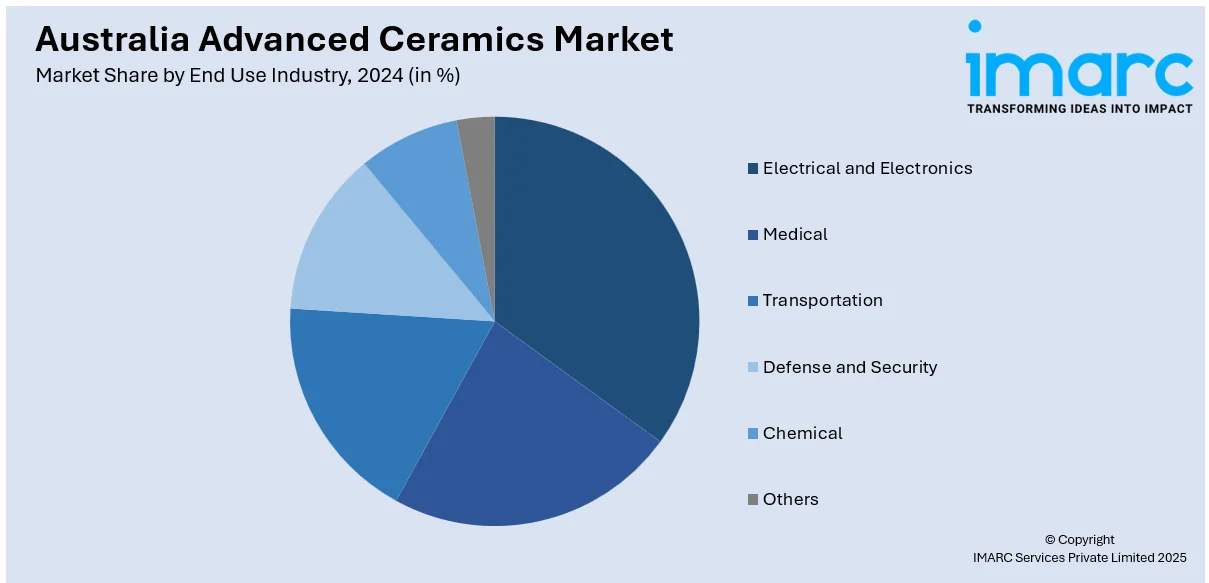

End Use Industry Insights:

- Electrical and Electronics

- Medical

- Transportation

- Defense and Security

- Chemical

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes electrical and electronics, medical, transportation, defense and security, chemical, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Advanced Ceramics Market News:

- In April 2025, James Cook University, in partnership with Lockheed Martin, announced plans to test a 3D-printed bendable ceramic capable of withstanding 10,000 flexing cycles and extreme temperatures. The innovation, developed in Townsville, Queensland, aims to support hypersonic aerospace applications. Funded partly by the Queensland Defence Science Alliance, this project positions northern Australia as a rising hub for advanced ceramics and aerospace-grade additive manufacturing technologies.

Australia Advanced Ceramics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Alumina, Titanate, Zirconia, Silicon Carbide, Others |

| Class Types Covered | Monolithic Ceramics, Ceramic Coatings, Ceramic Matrix Composites, Others |

| End Use Industries Covered | Electrical and Electronics, Medical, Transportation, Defense and Security, Chemical, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia advanced ceramics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia advanced ceramics market on the basis of material type?

- What is the breakup of the Australia advanced ceramics market on the basis of class type?

- What is the breakup of the Australia advanced ceramics market on the basis of end use industry?

- What is the breakup of the Australia advanced ceramics market on the basis of region?

- What are the various stages in the value chain of the Australia advanced ceramics market?

- What are the key driving factors and challenges in the Australia advanced ceramics market?

- What is the structure of the Australia advanced ceramics market and who are the key players?

- What is the degree of competition in the Australia advanced ceramics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia advanced ceramics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia advanced ceramics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia advanced ceramics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)