Australia Aerospace and Defense Market Size, Share, Trends and Forecast by Sector and Region, 2025-2033

Australia Aerospace and Defense Market Overview:

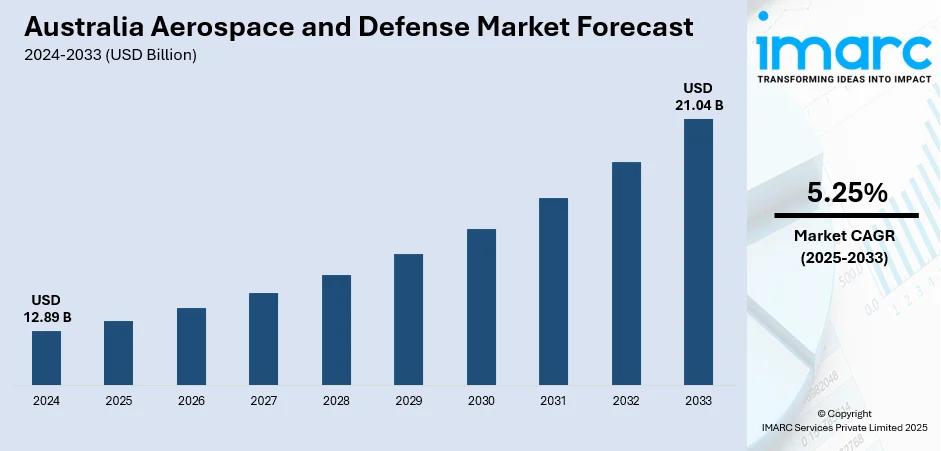

The Australia aerospace and defense market size reached USD 12.89 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 21.04 Billion by 2033, exhibiting a growth rate (CAGR) of 5.25% during 2025-2033. The rising government defense spending, modernization of military equipment, ongoing advancements in technology, expanding strategic partnerships with defense companies, and increased domestic manufacturing capabilities for civilian and military aerospace sectors are some of the key factors contributing to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.89 Billion |

| Market Forecast in 2033 | USD 21.04 Billion |

| Market Growth Rate (2025-2033) | 5.25% |

Australia Aerospace and Defense Market Trends:

Increased government defense spending:

One of the primary trends driving the Australia aerospace and defense market is the significant increase in government defense spending. In recent years, Australia has made a strategic shift to enhance its defense capabilities in response to rising geopolitical tensions, particularly in the Indo-Pacific region. The Australian government’s Defense Strategic Update and the associated Defense Integrated Investment Program (DIIP) outline plans for massive investments in defense assets over the next decade, including naval ships, aircraft, and advanced defense technologies. Furthermore, Australia plans to invest up to A$18 billion in domestic missile manufacturing, aiming to produce 4,000 guided missile systems annually from 2029. The purpose of these investments is to strengthen Australia's capacity to protect its interests and advance regional security. The acquisition of fifth-generation (5-Gen) fighter jets and sophisticated maritime patrol aircraft for modernizing and enhancing military capabilities is also bolstering the market growth.

To get more information on this market, Request Sample

Push for domestic manufacturing and technology development:

Australia is developing its defense manufacturing self-sufficiency through major investments and policy efforts. The government has pledged AU$1.16 billion over 2038–39 to design and operate four new satellites, enhancing local space capabilities and minimizing dependence on overseas Earth observation data. Initiatives such as the Australian Industry Capability (AIC) program and the Australian Defense Export Office facilitate domestic industry engagement in defense ventures, encouraging interaction between local companies and international defense primes. A focus on high-technology production and R&D in advanced materials, autonomous systems, and aerospace technology is paramount. The Australian Space Agency also highlights the country's focus on aerospace innovation, with a priority on satellite technology, space defense, and exploration. These initiatives are driving Australia's aerospace and defense industry growth.

Growing emphasis on strategic partnerships and international collaboration:

Strategic partnerships and international collaboration are playing a crucial role in the expansion of Australia’s aerospace and defense market. Australia has strengthened alliances with key international players, such as the United States and the United Kingdom, through agreements like Australia-United Kingdom-United States (AUKUS) to develop advanced defense technologies, including nuclear-powered submarines. Australia is also part of joint development and procurement programs, such as the F-35 Joint Strike Fighter program, which allows the country to access cutting-edge defense technologies while contributing to international defense projects. These collaborations enhance Australia’s defense capabilities, open doors to international supply chains, and facilitate technology transfer and skill development, fueling the market growth.

Australia Aerospace and Defense Market Segmentation:

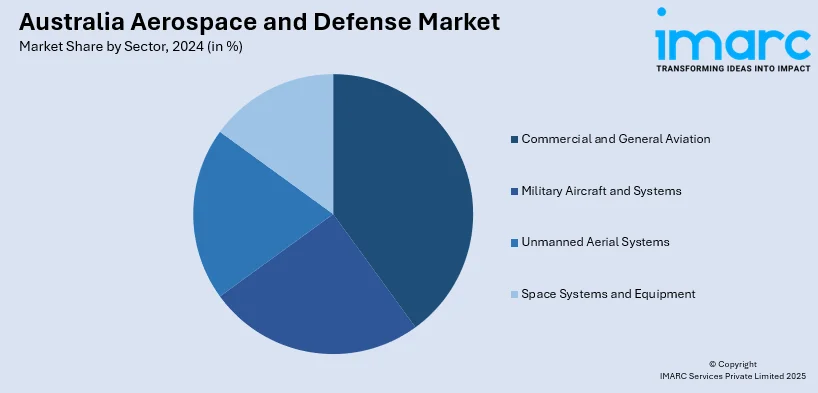

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on sector.

Sector Insights:

- Commercial and General Aviation

- Commercial Aircraft

- Air Traffic

- Training and Flight Simulators

- Airport Services (Ground Support Equipment and Logistics)

- Structures

- Airframe

- Engine and Engine Systems

- Cabin Interiors

- Landing Gear

- Avionics and Control Systems

- Electrical Systems

- Environmental Control Systems

- Fuel and Fuel Systems

- MRO

- General Aviation

- Air Traffic

- Training and Flight Simulators

- Airport Services (Ground Support Equipment and Logistics)

- Structures

- Airframe

- Engine and Engine Systems

- Cabin Interiors

- Landing Gear

- Avionics and Control Systems

- Electrical Systems

- Environmental Control Systems

- Fuel and Fuel Systems

- MRO

- Military Aircraft and Systems

- Combat Aircraft

- Commercial Aircraft

- Structures

- Airframe

- Engine and Engine Systems

- Landing Gear

- Avionics and Control Systems

- General Avionics

- Mission Specific Avionics

- Missiles and Weapons

- Non-Combat Aircraft

- Structures

- Airframe

- Engine and Engine Systems

- Landing Gear

- Avionics and Control Systems

- General Avionics

- Mission Specific Avionics

- Missiles and Weapons

- Unmanned Aerial Systems

- Commercial

- Military

- Space Systems and Equipment

- Space Launch Vehicle

- Spacecraft

- Ground Systems

- Satellites

- By Subsystem

- Command and Control System

- Telemetry, Tracking, Commanding and Monitoring (TTCM)

- Antenna System

- Transponders

- Power System

- By Application

- Military

- Commercial

The report has provided a detailed breakup and analysis of the market based on the sector. This includes Commercial and General Aviation [Commercial Aircraft (Air Traffic, Training and Flight Simulators, Airport Services (Ground Support Equipment and Logistics), Structures {Airframe, Engine and Engine Systems, Cabin Interiors, Landing Gear, Avionics and Control Systems, Electrical Systems, Environmental Control Systems, Fuel and Fuel Systems, MRO }, (General Aviation [Air Traffic, Training and Flight Simulators, Airport Services (Ground Support Equipment and Logistics), Structures] {Airframe, Engine and Engine Systems, Cabin Interiors, Landing Gear, Avionics and Control Systems, Electrical Systems, Environmental Control Systems, Fuel and Fuel Systems, MRO}, Military Aircraft and Systems (Combat Aircraft [Structures {Airframe, Engine and Engine Systems, Landing Gear}, Avionics and Control Systems {General Avionics, Mission Specific Avionics, Missiles and Weapons} Non-Combat Aircraft [Structures {Airframe, Engine and Engine Systems, Landing Gear}, [Avionics and Control Systems {General Avionics, Mission Specific Avionics, Missiles and Weapons}, Unmanned Aerial Systems [Commercial, Military], Space Systems and Equipment [Space Launch Vehicle, Spacecraft, Ground Systems, Satellites (By Subsystem, {Command and Control System, Telemetry, Tracking, Commanding and Monitoring (TTCM), Antenna System, Transponders, Power System, and By application{ Military, Commercial})

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia , Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Aerospace and Defense Market News:

- In September 2024, Australia signed an AUD142 million (USD96 million) contract with Kongsberg Defence & Aerospace to acquire Joint Strike Missiles (JSMs) for its F-35A Lightning II aircraft. The deal will enhance Australia's long-range strike capabilities while preserving the aircraft's stealth. The precision-guided JSM, with a range exceeding 275 km, employs infrared, GPS, and inertial navigation systems.

Australia Aerospace and Defense Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia , Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia aerospace and defense market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia aerospace and defense market on the basis of sector?

- What is the breakup of the Australia aerospace and defense market on the basis of region?

- What are the various stages in the value chain of the Australia aerospace and defense market?

- What are the key driving factors and challenges in the Australia aerospace and defense?

- What is the structure of the Australia aerospace and defense market and who are the key players?

- What is the degree of competition in the Australia aerospace and defense market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia aerospace and defense market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia aerospace and defense market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia aerospace and defense industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)