Australia Agribusiness Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Australia Agribusiness Market Size and Share:

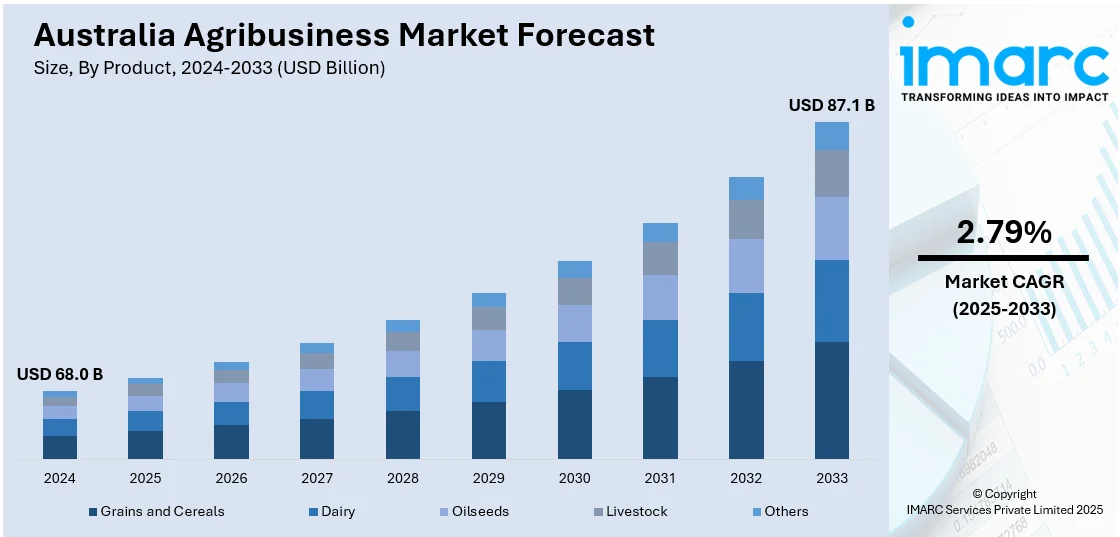

The Australia agribusiness market size reached USD 68.0 Billion in 2024. Looking forward, the market is expected to reach USD 87.1 Billion by 2033, exhibiting a growth rate (CAGR) of 2.79% during 2025-2033. Technological advancements, growing demand for sustainable farming, export opportunities, government policies, climate change adaptation, increasing global food demand, advancements in supply chain logistics, and investment in ag-tech innovation and infrastructure development are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 68.0 Billion |

| Market Forecast in 2033 | USD 87.1 Billion |

| Market Growth Rate 2025-2033 | 2.79% |

Key Trends of Australia Agribusiness Market:

Increase in Solar Installations

Australia is witnessing significant growth in agribusiness due to a shift toward sustainable agricultural practices through the adoption of ag-tech innovations. As environmental sustainability becomes a priority, partnerships between financial institutions and ag-tech companies are empowering farmers to reduce carbon emissions. By leveraging advanced tools like emissions calculators and scenario planners, farmers can better manage their environmental impact. These technologies not only help in meeting carbon reduction goals but also improve overall efficiency and long-term viability in agriculture. The increasing integration of sustainable practices in agribusiness is driving a future-focused approach, enhancing both productivity and environmental responsibility within the sector. This move signals a broader commitment to sustainability and innovation, ensuring that Australian farmers stay competitive in an increasingly eco-conscious global market. For example, in May 2024, the Agribusiness CEO Summit convened over 40 agribusiness leaders in Sydney to discuss key priorities for the sector. Hosted by KPMG and supported by corporate members, including Elders and BDO in Australia, the summit emphasized collaboration and strategic planning.

To get more information on this market, Request Sample

Sustainability through Ag-Tech Innovations

In Australia, the agribusiness market is increasingly focusing on sustainability, with a growing emphasis on using ag-tech solutions to reduce carbon emissions. Advanced tools, such as emissions calculators and scenario planners, are being integrated into farming operations, enabling farmers to track and manage their environmental impact. These technologies not only support efforts to meet carbon reduction targets but also enhance operational efficiency. This shift reflects a broader movement within the industry towards sustainable farming practices, combining technology with environmental responsibility. By adopting such innovations, Australian farmers can improve their productivity while contributing to global sustainability goals. As the industry evolves, these solutions are becoming essential for farmers seeking to maintain competitiveness and align with evolving regulatory standards. For instance, in May 2024, the Commonwealth Bank of Australia announced a strategic partnership with ag-tech company Ruminati. This collaboration would provide CBA's agribusiness customers access to Ruminati's emissions calculator and scenario planner, supporting efforts to reduce carbon emissions and enhance sustainability in agriculture.

Growth Drivers of Australia Agribusiness Market:

Expanding Global Demand and Market Access

Australia’s agribusiness sector continues to benefit from rising global demand for its premium, safe, and sustainably produced food products. This trend is especially true of Asian and Middle Eastern countries, which are attracted to Australian high-quality standards and clean agriculture. New export channels are also being opened with trade agreements such as the Comprehensive and Progressive Agreement on Trans-Pacific Partnership (CPTPP), free trade agreements with India, and with ASEAN countries. The deals lower the tariffs, open markets, and allow the Australian producers to be competitive in the international markets. This growing appetite for Australian commodities, supported by strong trade frameworks, is playing a vital role in propelling agribusiness revenues and reinforcing the country’s standing as a reliable and preferred supplier of agricultural goods.

Foreign Investment and Farm Consolidation

Foreign investment is emerging as a significant factor fueling the Australia agribusiness market share. Global investors are increasingly acquiring and consolidating farmland, attracted by the country’s stable economy, advanced farming infrastructure, and favorable agro-climatic conditions. The investments attract the influx of capital required in the large-scale modernization, such as the deployment of precision agriculture, automation, and better land use practices. In addition, foreign competitors bring with them global knowledge and advanced technology that contributes to the effectiveness and sustainability of operations. Due to the amalgamation of small farms into bigger and more productive ventures, there are economies of scale reaped, which enable the producers to compete favorably in the global market. Such a trend towards consolidation is transforming the agribusiness sector, achieving efficiency through this process and strengthening the competitive advantage of Australia in agricultural exports.

Climate-Resilient Production Strategies

In response to increasing climate variability and environmental stressors, Australian agribusinesses are embracing adaptive, climate-resilient production strategies. Techniques such as water-efficient irrigation systems, drought-resistant crop varieties, and advanced soil moisture monitoring tools are being implemented to maintain productivity despite shifting weather patterns. These strategies not only ensure better resource management but also help minimize risks associated with prolonged dry spells, unpredictable rainfall, and rising temperatures. By incorporating science-based solutions and sustainable land use practices, farmers can stabilize yields, reduce long-term operating costs, and preserve natural ecosystems. This shift toward climate-smart agriculture is essential for ensuring the resilience and sustainability of the agribusiness sector, positioning Australia to meet both domestic and international food demands amid growing environmental challenges.

Government Support of Australia Agribusiness Market:

Biosecurity and Trade Infrastructure Investment

The Australian government continues to prioritize investments in biosecurity systems and trade infrastructure to safeguard the nation’s agricultural output and strengthen its global trade capabilities. Robust biosecurity measures help prevent the entry and spread of pests and diseases, ensuring the safety and integrity of domestic food production. Simultaneously, infrastructure upgrades—particularly to regional roadways, freight corridors, and port facilities—are enabling faster, more reliable export logistics. These improvements reduce transit times and supply chain disruptions, helping producers meet international demand efficiently. By enhancing both protection and accessibility, these government actions not only support the productivity and resilience of the agribusiness sector but also reinforce Australia’s global reputation as a dependable supplier of high-quality agricultural products in an increasingly competitive market.

Research, Development, and Innovation Funding

Government-backed research, development, and innovation (RDI) programs are vital to sustaining the Australia agribusiness market demand. Key agencies like the Commonwealth Scientific and Industrial Research Organisation (CSIRO) and Grains Research and Development Corporation (GRDC) spearhead research in areas such as crop improvement, pest and disease resistance, precision farming, and soil health. These initiatives help farmers boost crop yields, manage inputs more efficiently, and lower production costs while maintaining environmental sustainability. Funding for RDI not only supports technological breakthroughs but also ensures the practical application of scientific knowledge on the ground. Through continuous innovation, these programs enable producers to remain competitive in both domestic and global markets, adapting to evolving consumer demands, climate challenges, and shifting trade dynamics.

Skills Development and Regional Support Programs

To strengthen the agribusiness workforce and address demographic challenges in rural areas, the Australian government has implemented a range of skills development and regional support initiatives. According to the Australia agribusiness market analysis, these programs offer vocational training, digital literacy education, and business development resources to enhance the capabilities of the existing workforce and attract younger generations to farming. Special grants and incentives are also available for young farmers and start-ups entering the sector. Additionally, regional development schemes fund essential infrastructure and services to improve the quality of life in rural communities, making them more attractive for long-term settlement. By equipping individuals with modern skills and supporting vibrant rural economies, these programs play a critical role in ensuring the long-term viability and sustainability of Australian agribusiness.

Australia Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Grains and Cereals

- Dairy

- Oilseeds

- Livestock

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains and cereals, dairy, oilseeds, livestock, and others.

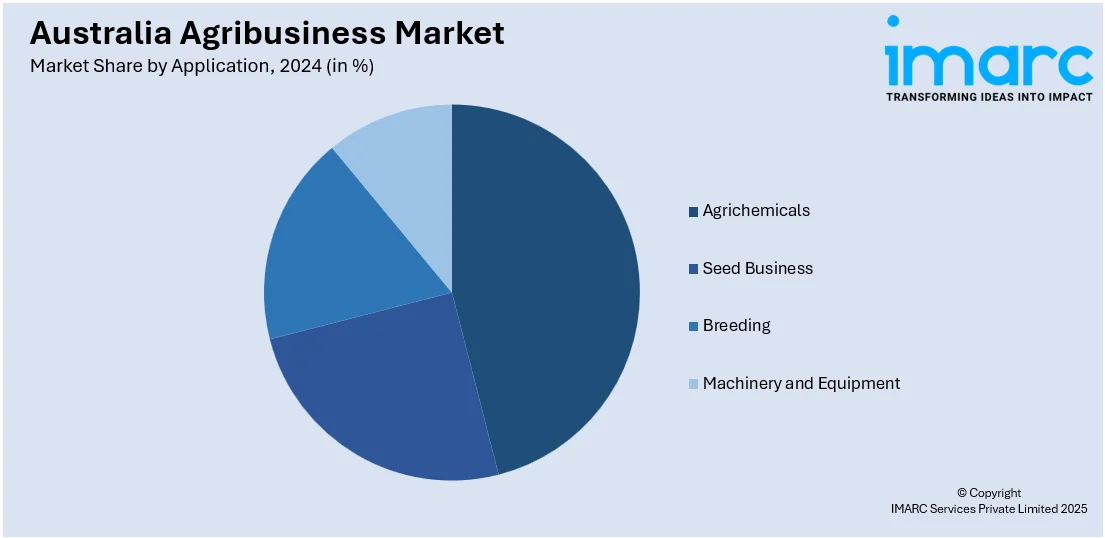

Application Insights:

- Agrichemicals

- Seed Business

- Breeding

- Machinery and Equipment

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes agrichemicals, seed business, breeding, and machinery and equipment.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Agribusiness Market News:

- In January 2025, the Australian government planned to invest an additional USD 20 Million in the On Farm Connectivity Program (OFCP) to enhance ag-tech adoption among farmers. This initiative aims to address connectivity gaps, boosting productivity and sustainability. The program provides rebates for technology, helping farmers implement smarter solutions, optimize resources, and improve efficiency.

- In November 2024, Elders Limited entered into an agreement to acquire Delta Agribusiness for USD 475 Million. Delta operates 68 locations and serves approximately 40 independent wholesale customers. The acquisition aims to enhance Elders' capabilities and expand its presence in key rural markets. Completion is expected in the first half of 2025.

Australia Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Grains and Cereals, Dairy, Oilseeds, Livestock, Others |

| Applications Covered | Agrichemicals, Seed Business, Breeding, Machinery and Equipment |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia agribusiness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agribusiness market in Australia was valued at USD 68.0 Billion in 2024.

The Australia agribusiness market is projected to exhibit a CAGR of 2.79% during 2025-2033.

The Australia agribusiness market is projected to reach a value of USD 87.1 Billion by 2033.

Australia’s agribusiness sector is evolving through precision agriculture, AI-driven solutions, and sustainable practices like carbon farming. Growing consumer demand for traceable, high-quality produce and expanding export markets through trade agreements are also shaping the landscape. Increased agri-tech adoption and rural investment further reinforce the industry’s push toward innovation and efficiency.

The rising global demand for Australian grains, meat, and dairy, supported by favorable climate zones and trade agreements, represent the major growth driver of Australia agribusiness market. Government investments in biosecurity, infrastructure, and agri-innovation, along with strong foreign investor interest, are also propelling the sector. Technological advancements and diversification into Asian and Middle Eastern markets also fuel expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)