Australia Air Cargo Market Size, Share, Trends and Forecast by Type, Service, Destination, End User, and Region, 2025-2033

Australia Air Cargo Market Overview:

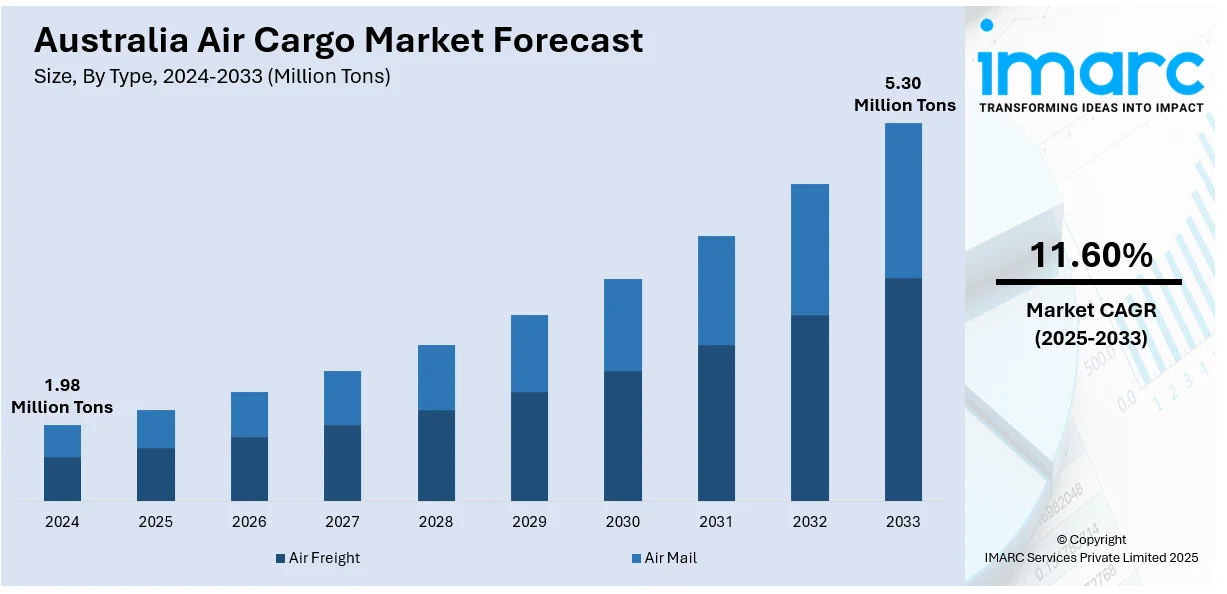

The Australia air cargo market size reached 1.98 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 5.30 Million Tons by 2033, exhibiting a growth rate (CAGR) of 11.60% during 2025-2033. The market is driven by expanding e-commerce volumes, rising demand for high-value and time-sensitive goods, and increased cross-border trade with other Asia-Pacific nations. Strong growth in pharmaceutical, electronics, and perishable food shipments is extending air freight activity, while infrastructure upgrades at key airports, including Sydney and Melbourne, are enhancing handling capacity. Moreover, the integration of digital tracking systems and logistics automation are further expanding the Australia air cargo market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 1.98 Million Tons |

| Market Forecast in 2033 | 5.30 Million Tons |

| Market Growth Rate 2025-2033 | 11.60% |

Australia Air Cargo Market Trends:

Surge in Cross-Border E-Commerce and Express Delivery Services

Australia is witnessing a steady rise in cross-border e-commerce, which is significantly shaping the market. Growing international consumer demand is putting increased pressure on freight operators to deliver faster and more reliable services. Categories like apparel, electronics, beauty products, and specialty foods dominate cross-border retail transactions and require timely fulfillment, reinforcing air freight’s role as the preferred transport mode due to its speed and dependability. According to industry reports, in 2023, China accounted for 55% of cross-border shopping transactions involving Australia, followed by the United States at 48%. These shares represented year-on-year growth of 6% and 2%, respectively. This momentum is further supported by streamlined customs processes and increased digitalization, which allow for more agile and responsive logistics operations tailored to the needs of international e-commerce.A key development in the air cargo landscape is Australia’s implementation of stricter air cargo security measures for shipments originating from 55 countries in Europe and the Commonwealth of Independent States (CIS), effective September 26, 2025. Under the new directive, only cargo from shippers with an Established Business Relationship (EBR) with freight forwarders is permitted on passenger flights to or through Australia; shipments over 500 grams from unknown senders are restricted to freighter aircraft, subject to additional screening. These regulations, aligning with similar policies in the US and Canada following security threats in European parcel networks, have raised operational concerns among freight forwarders. In addition to these regulatory changes, international shopping festivals and promotions continue to contribute to seasonal spikes, prompting increased use of chartered freighter services and dedicated cargo flights. Also, B2C and B2B platforms are demanding integrated logistics solutions, leading to growth in express delivery partnerships between airlines and e-commerce companies. This trend is also supported by improvements in customs processing and last-mile delivery networks, enhancing the overall reliability of international air cargo services.

To get more information on this market, Request Sample

Expansion and Modernization of Airport Cargo Infrastructure

Infrastructure developments at major Australian airports are contributing to the Australia air cargo market growth. Apart from this, facilities at airports such as Sydney Kingsford Smith, Melbourne Tullamarine, and Brisbane are undergoing upgrades to improve cargo handling efficiency, increase throughput, and accommodate freighter aircraft. Also, projects including expanding warehousing capacity, advancing cargo terminals, temperature-controlled storage for perishables and pharmaceuticals, and upgraded apron space for wide-body aircraft. Notably, the Western Sydney International (Nancy-Bird Walton) Airport is set to open in late 2026 and will initially serve up to 10 million domestic and international passengers annually. Its development aims to ease capacity limits in the Sydney basin while significantly improving air travel access for residents of Western Sydney. Beyond passenger traffic, the airport is poised to become a major logistics hub, with dedicated freight precincts and round-the-clock operations designed to support continuous cargo movement. Additionally, digitalization of cargo operations through electronic airway bills, automated handling systems, and real-time cargo tracking is enabling smoother coordination among freight forwarders, ground handlers, and carriers. These infrastructure and technological upgrades are essential for supporting long-term growth, especially in high-value cargo segments and international trade volumes.

Australia Air Cargo Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, destination, and end user.

Type Insights:

- Air Freight

- Air Mail

The report has provided a detailed breakup and analysis of the market based on the type. This includes air freight and air mail.

Service Insights:

- Express

- Regular

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes express and regular.

Destination Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international.

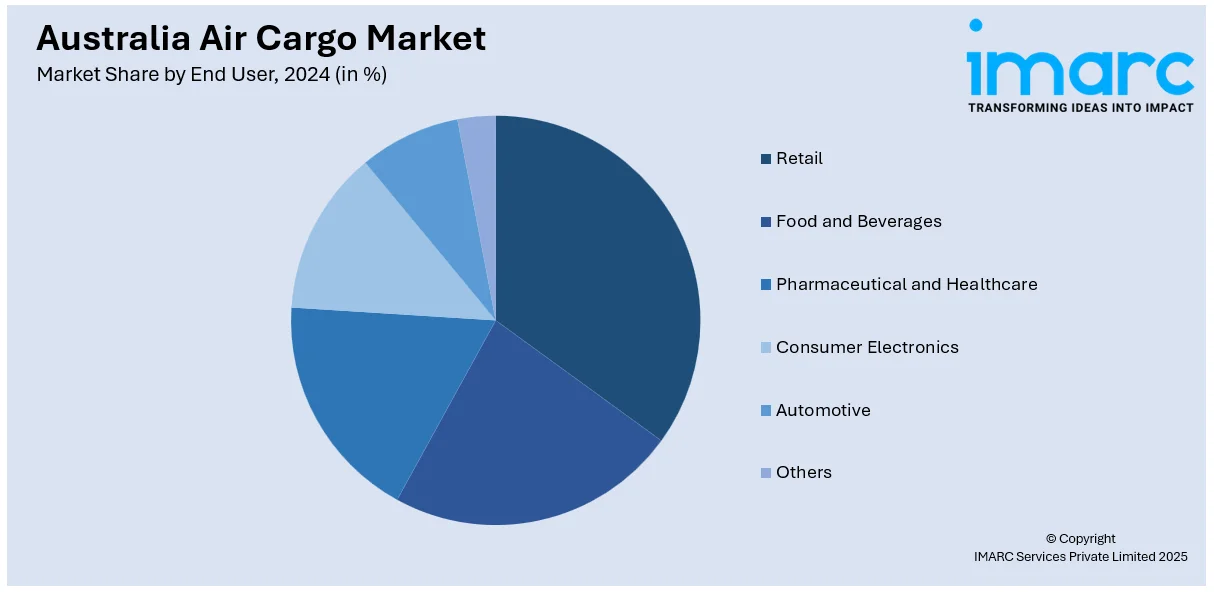

End User Insights:

- Retail

- Food and Beverages

- Pharmaceutical and Healthcare

- Consumer Electronics

- Automotive

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes retail, food and beverages, pharmaceutical and healthcare, consumer electronics, automotive, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Air Cargo Market News:

- 5 November 2024: Qantas Freight has joined Freightos’ digital air cargo booking platform, allowing freight forwarders to access and book capacity for Qantas and Jetstar services across key US, Australia, and New Zealand routes. This collaboration enhances operational efficiency with digital booking options, offering greater capacity and instant rate quotes for both ground and air freight.

- 6 February 2025: Swissport International announced that it is going to expand its air cargo handling operations in Australia with new facilities in Melbourne and Sydney in March 2025. This expansion will enhance operational efficiency and support growing air cargo demand, offering advanced services such as temperature-controlled spaces and state-of-the-art equipment.

- 6 November 2024: OIA Global has expanded its presence in Oceania by acquiring BTi Logistics and Airmark Ocean & Air Logistics, enhancing its capabilities in Australia, New Zealand. This acquisition strengthens OIA's service offerings in industries such as automotive, healthcare, and energy, while also boosting its logistics capacity across these regions.

Australia Air Cargo Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Air Freight, Air Mail |

| Services Covered | Express, Regular |

| Destinations Covered | Domestic, International |

| End Users Covered | Retail, Food and Beverages, Pharmaceutical and Healthcare, Consumer Electronics, Automotive, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia air cargo market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia air cargo market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia air cargo industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The air cargo market in Australia reached 1.98 Million Tons in 2024.

The Australia air cargo market is projected to exhibit a CAGR of 11.60% during 2025-2033, reaching 5.30 Million Tons by 2033.

Australia air cargo market is experiencing significant growth propelled by rising e-commerce and express delivery demand, increasing international trade, and growth in time-sensitive shipments. Additionally, investments in modern logistics infrastructure, technological advancements in tracking and handling, and the need for rapid transportation of perishable and high-value goods support market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)