Australia Air Compressor Market Size, Share, Trends and Forecast by Type, Technology, Lubrication Method, Power Rating, End User, and Region, 2025-2033

Australia Air Compressor Market Overview:

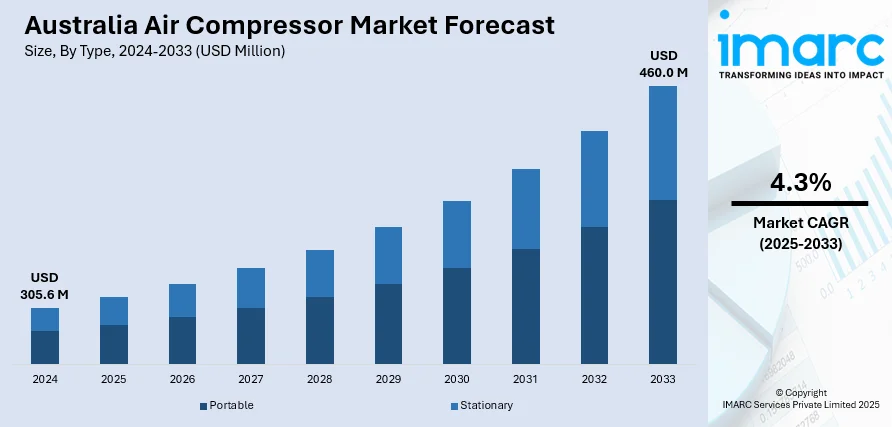

The Australia air compressor market size reached USD 305.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 460.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.3% during 2025-2033. Rising energy costs and sustainability goals are increasing demand for energy-efficient compressors across the country, while strict regulations in healthcare and food processing drive oil-free compressor adoption. Additionally, industrial growth in mining and manufacturing further fuels market expansion. Technological advancements, such as IoT-enabled monitoring and VSD systems, enhance efficiency, augmenting the Australia air compressor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 305.6 Million |

| Market Forecast in 2033 | USD 460.0 Million |

| Market Growth Rate 2025-2033 | 4.3% |

Australia Air Compressor Market Trends:

Growing Demand for Energy-Efficient Air Compressors

The market is experiencing a rising demand for energy-efficient models, driven by increasing energy costs and environmental regulations. During the fiscal year 2022–23, Australia's net energy use grew 2% to 23,294 PJ, with residential and industrial consumption growing 3% and 4%, respectively. At the same time, renewable sources grew by 12% to 325 PJ or 33% of the nation's electricity supply. Energy use from the transport sector jumped by 19% and agriculture by 12%, while manufacturing fell by 4%. With increasing energy intensity and demand in other sectors, the use of effective air compressor systems has become more important within the industrial setup of Australia. Businesses are prioritizing sustainable operations, leading to a shift toward variable speed drive (VSD) compressors, which adjust motor speed based on demand, declining energy consumption by up to 35% compared to fixed-speed units. Industries such as mining, manufacturing, and construction are adopting these compressors to lower operational costs and meet carbon emission targets. Government incentives for green technology further drive the Australia air compressor market growth, encouraging companies to upgrade outdated systems. Additionally, advancements in compressor design, such as improved heat recovery systems and IoT-enabled monitoring, enhance efficiency and predictive maintenance. As Australia continues to emphasize sustainability, the market for energy-efficient air compressors is expected to grow steadily, with manufacturers focusing on innovation to meet changing industry needs.

To get more information on this market, Request Sample

Expansion of Oil-Free Air Compressors in Healthcare and Food Sectors

The Australian market is witnessing increased adoption of oil-free air compressors, particularly in healthcare, pharmaceuticals, and food processing, where air purity is critical. Strict hygiene standards and contamination risks are pushing these industries to replace traditional lubricated compressors with oil-free alternatives, which eliminate the risk of oil carryover. The healthcare sector, in particular, relies on oil-free compressors for medical air systems, dental equipment, and laboratory applications. Similarly, food and beverage manufacturers use them to ensure compliance with food safety regulations. Technological advancements, such as scroll and centrifugal compressors, offer quieter operation and longer lifespans, further increasing demand. With Australia’s stringent regulatory environment and growing focus on product safety, the oil-free compressor segment is projected to expand significantly, with manufacturers investing in R&D to enhance performance and reliability. Australia's Tariff Concession Orders list continues to favor the air compressor sector, with many listings under HS Code 8414.80.19 that cover oil-free, rotary, piston, and screw compressors. More recent permits are a skid-mounted pulse compressor system (TCO 24459223) and compressed air supply systems for rail locomotives (TCO 20234164), facilitating the importation of advanced compressed air technologies. Such concessions reflect constant demand for highly efficient, oil-free compressor alternatives from Australia's transportation and manufacturing sectors.

Australia Air Compressor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, technology, lubrication method, power rating, and end user.

Type Insights:

- Portable

- Stationary

The report has provided a detailed breakup and analysis of the market based on the type. This includes portable and stationary.

Technology Insights:

- Reciprocating/Piston

- Rotary/Screw

- Centrifugal

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes reciprocating/piston, rotary/screw, and centrifugal.

Lubrication Method Insights:

- Oil-filled

- Oil-free

The report has provided a detailed breakup and analysis of the market based on the lubrication method. This includes oil-filled and oil-free.

Power Rating Insights:

- 0-100 kW

- 101-300 kW

- 301-500 kW

- 501 kW and Above

A detailed breakup and analysis of the market based on the power rating have also been provided in the report. This includes 0-100 kW, 101-300 kW, 301-500 kW, and 501 kW and above.

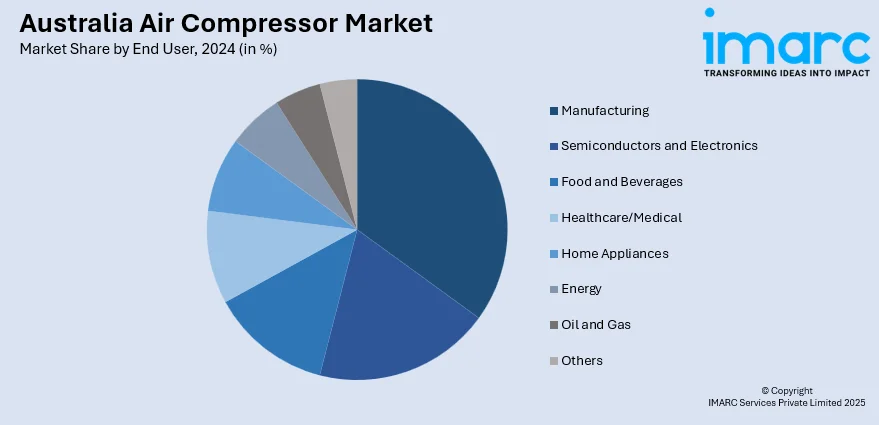

End User Insights:

- Manufacturing

- Semiconductors and Electronics

- Food and Beverages

- Healthcare/Medical

- Home Appliances

- Energy

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes manufacturing, semiconductors and electronics, food and beverages, healthcare/medical, home appliances, energy, oil and gas, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Air Compressor Market News:

- February 25, 2025: Australia sanctioned AUD 638 Million Silver City Energy Storage Centre in the vicinity of Broken Hill, its first underground compressed air energy storage (CAES) project, which will power 80,000 homes. Developed by Hydrostor, the facility will compress air during times of excess electricity for storage underground, which will then be released through turbines at times of high demand. This massive progress adds more to the requirement of high-efficiency air compressors and bolsters the relevance of compressed air technology in the renewable energy arena of Australia.

Australia Air Compressor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Portable, Stationary |

| Technologies Covered | Reciprocating/Piston, Rotary/Screw, Centrifugal |

| Lubrication Methods Covered | Oil-filled, Oil-free |

| Power Ratings Covered | 0-100 kW, 101-300 kW, 301-500 kW, 501 kW and Above |

| End Users Covered | Manufacturing, Semiconductors and Electronics, Food and Beverages, Healthcare/Medical, Home Appliances, Energy, Oil and Gas, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia air compressor market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia air compressor market on the basis of type?

- What is the breakup of the Australia air compressor market on the basis of technology?

- What is the breakup of the Australia air compressor market on the basis of lubrication method?

- What is the breakup of the Australia air compressor market on the basis of power rating?

- What is the breakup of the Australia air compressor market on the basis of end user?

- What is the breakup of the Australia air compressor market on the basis of region?

- What are the various stages in the value chain of the Australia air compressor market?

- What are the key driving factors and challenges in the Australia air compressor market?

- What is the structure of the Australia air compressor market and who are the key players?

- What is the degree of competition in the Australia air compressor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia air compressor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia air compressor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia air compressor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)