Australia Air Conditioner Market Report by Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), Application (Residential, Healthcare, Commercial and Retail, Hospitality, and Others), and Region 2025-2033

Australia Air Conditioner Market Size and Share:

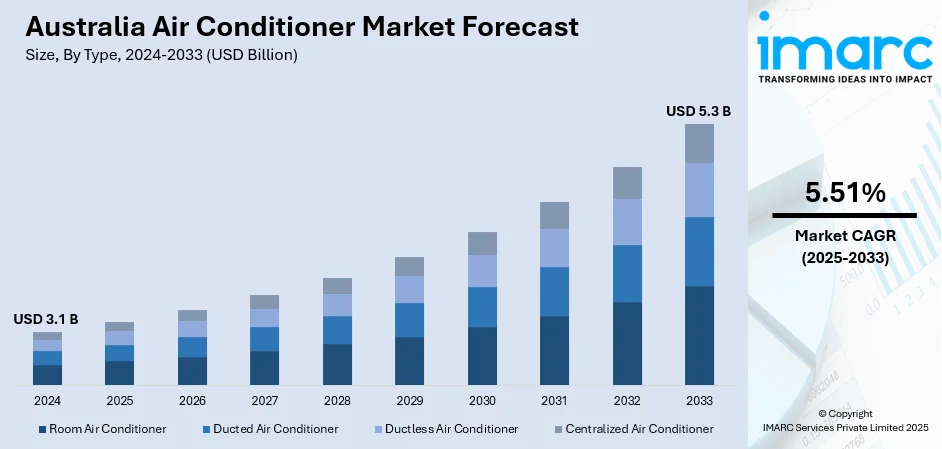

Australia air conditioner market size reached USD 3.1 Billion in 2024. Looking forward, the market is expected to reach USD 5.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.51% during 2025-2033. The expansion of industries, which has led to the construction of larger commercial and industrial spaces that require effective air conditioning for both comfort and productivity, is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 5.3 Billion |

| Market Growth Rate (2025-2033) | 5.51% |

An air conditioner is a device designed to regulate indoor temperature and humidity by extracting heat from the air in a confined space. It consists of components such as a compressor, condenser, evaporator, and refrigerant, which work in tandem to cool and dehumidify the air. The compressor pressurizes and circulates the refrigerant while the condenser releases heat outside. As the refrigerant evaporates in the evaporator, it absorbs heat from the indoor air, cooling it before being recirculated. This process not only creates a comfortable living or working environment but also improves air quality by reducing moisture levels. Air conditioners are widely used in residences, commercial buildings, and vehicles to enhance comfort, particularly in regions with hot climates. Efficient and properly maintained air conditioning systems contribute to energy conservation and overall well-being.

To get more information on this market, Request Sample

Key Trends of Australia Air Conditioner Market:

Smart Air Conditioning Integration

The Australian air conditioner market is also experiencing an unprecedented transition towards smart technologies, powered by consumers' need for convenience and energy efficiency. Improvements on the Internet of Things (IoT) have made it possible for the creation of air conditioning systems that can be accessed remotely through mobile apps, enabling users to monitor and control units from anywhere. This integration allows for improved energy management, as users can maximize cooling schedules and modes according to occupancy and time of day. Moreover, compatibility with smart home systems, including voice-operated assistants, is increasing on the cards, improving user comfort and experience. Manufacturers are accordingly adapting to this trend by including features such as programmable timers, energy monitoring, and adaptive cooling modes that respond to environmental conditions. These innovations, in addition to enhancing the performance of air conditioning systems, also help save overall energy usage and operational costs, while increasing the Australia air conditioner market share.

Adoption of Energy-Efficient Systems

Being energy-efficient is now a top priority in the Australian air conditioner industry, driven by increasing electricity prices and increased environmental consciousness. Shoppers are increasingly turning to higher energy-rated air conditioning systems, which include variable refrigerant flow (VRF) systems and inverter technologies. These equipments modulate compressor speeds to control temperatures, resulting in drastically lower electricity usage than older units. Government policies, such as rebates and incentives, also promote the use of energy-efficient units by balancing upfront investment with costs. For example, initiatives such as the Victorian Energy Upgrades (VEU) and the Retailer Energy Productivity Scheme (REPS) in South Australia offer financial incentives for the installation of high-efficiency air conditioners, incentivizing take-up across residential and commercial levels.

Regulatory Influence and Building Standards

Regulatory policy and building codes heavily influence the Australia air conditioner market demand, while focusing on efficiency and environmental implications. Recent changes in tenancy laws in states such as Victoria require rental homes to have fixed heating and air conditioning systems that adhere to certain levels of energy efficiency. These regulations work to provide all residents with comfortable living conditions while encouraging the use of sustainable energy. Furthermore, domestic policies for reducing greenhouse gas emissions are pushing the shift towards low-global warming potential (GWP) refrigerants and the use of environmentally sound technologies in air conditioning units. Consequently, manufacturers are working to innovate and address these demanding standards, and systems have been developed that not only offer efficient cooling but also fit within Australia's environmental ambitions.

Growth Drivers of Australia Air Conditioner Market:

Rising Temperatures and Climate Extremes

Australia's varied climate with hot summers and rising incidence of heatwaves largely fuels the need for air conditioning systems. Places such as Sydney, Melbourne, and Brisbane have record-breaking temperatures, leading to the necessity for air conditioning for comfort as well as health. The urban heat island phenomenon further adds to this problem, as densely populated urban areas tend to be a lot warmer compared to rural areas. The phenomenon creates increased energy usage as residents find a refuge from the heat, thus driving the air conditioner market. Further, extended periods of heat, particularly during the summer months, are making air conditioning an essential component of day-to-day life in Australia. Moreover, the frequency and severity of extreme weather conditions are also fueling increased consumer awareness of the necessity of cooling technology.

Government Incentives and Energy Efficiency Regulations

According to the Australia air conditioner market analysis, the government's efforts to decrease carbon emissions and increase energy efficiency have been the driving force behind the uptake of sophisticated air conditioning technologies. Programs like rebates and incentives prompt consumers to pay for energy-efficient systems, which not only save on electricity bills but also help in maintaining environmental sustainability. For example, the Victorian government's plan to make energy-efficient heating and cooling systems compulsory in rented properties would help decrease energy consumption while enhancing indoor comfort. Moreover, the government initiative to use low-GWP (Global Warming Potential) refrigerants goes in line with international efforts to combat climate change, further propelling the market towards green alternatives.

Technological Innovations and Customer Preferences

Technological advancements in air conditioning have been a major driver of market expansion. Smart technologies, including Wi-Fi and voice control, enable users to switch on and off, as well as monitor, their air conditioning systems from any location, offering greater convenience and energy control. In addition, the innovation of inverter technology has resulted in energy-efficient systems that can slow down compressor speeds to maintain set temperatures, saving electricity. These technologies address increasing consumer needs for comfort, convenience, and saving money, thus driving Australia's air conditioner market.

Australia Air Conditioner Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

The report has provided a detailed breakup and analysis of the market based on the type. This includes room air conditioner, ducted air conditioner, ductless air conditioner, and centralized air conditioner.

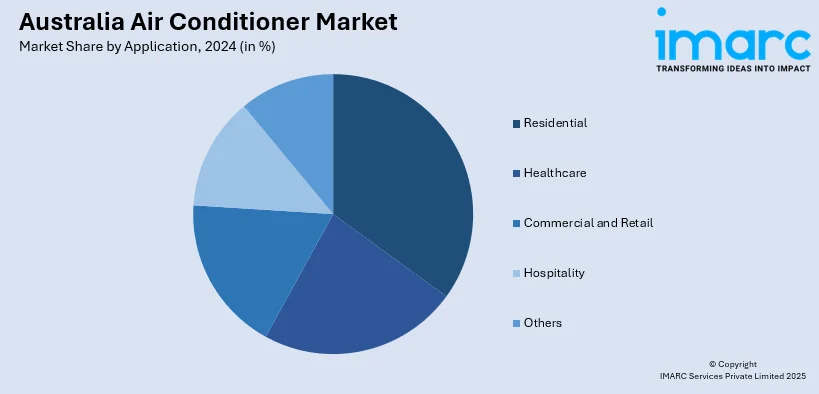

Application Insights:

- Residential

- Healthcare

- Commercial and Retail

- Hospitality

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, healthcare, commercial and retail, hospitality, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Air Conditioner Market News:

- Starting April 1, 2025, Rinnai revealed that certain air conditioner systems will be offered with a seven-year warranty. Rinnai states that increasing the standard warranty from five years to seven provides homeowners and installers with long-term performance and assurance.

- In October 2024, the wholesaler Beijer Ref announced that it would supply the whole continent with Fujitsu air conditioners, one of Australia's top brands. In the field of air conditioning, Fujitsu won the Reader's Digest Most Trusted Brand award from 2018 to 2022. In 2023, the company was recognized with a highly commended rating. Fujitsu General was just named the Most Loved and Top Value Brand in Finder's 2024 Customer Satisfaction Awards, and it has won the 2023 ProductReview.com.au Best Appliance Brands award.

- In June 2024, Daikin initiated the construction of a new 7,500m2 research and development facility as part of an expansion of its production site in the Sydney neighborhood of Chipping Norton. The new location will be utilized for both training and production purposes. The completion of construction was anticipated by March 2025.

Australia Air Conditioner Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner |

| Applications Covered | Residential, Healthcare, Commercial and Retail, Hospitality, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia air conditioner market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia air conditioner market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia air conditioner industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia air conditioner market was valued at USD 3.1 Billion in 2024.

The Australia air conditioner market is projected to exhibit a CAGR of 5.51% during 2025-2033.

The Australia air conditioner market is expected to reach a value of USD 5.3 Billion by 2033.

Australia's air conditioner market is influenced by increasing temperatures, urbanization, and the need for energy-efficient systems. Government subsidies, new building codes, and customer preference for smart, green systems also drive growth. Support for local manufacturing and advancement in technology further contribute to the market's consistent growth in varied climate zones.

Australia's air conditioner industry is moving toward intelligent, energy-efficient, and environmentally friendly systems. Climate extremes and regulatory refreshes are driving adoption, with companies developing new solutions to address demand for comfort, cost-effectiveness, and environmental sustainability for residential and commercial applications across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)