Australia Air Purifier Market Size, Share, Trends and Forecast by Technology, Size, Application, Distribution Channel, and Region, 2026-2034

Australia Air Purifier Market Summary:

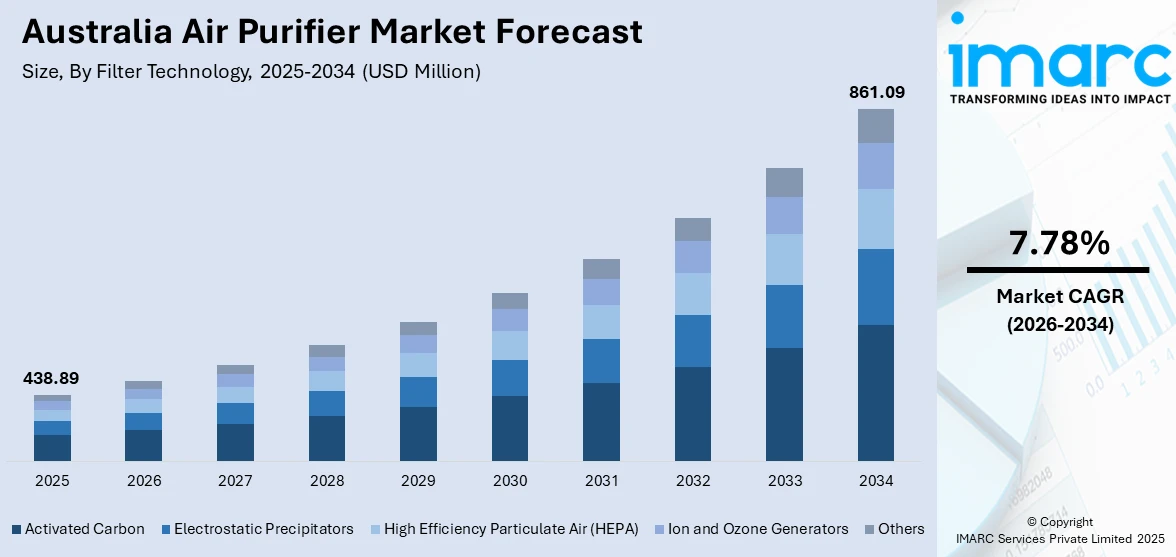

The Australia air purifier market size was valued at USD 438.89 Million in 2025 and is projected to reach USD 861.09 Million by 2034, growing at a compound annual growth rate of 7.78% from 2026-2034.

The air purifier market in Australia is recording significant growth due to rising awareness among individuals about indoor air quality and its direct impact on respiratory health. Increasing urbanization, frequent bushfires affecting air quality, and growing prevalence of allergies and asthma among the population further drives the demand for air purifiers. Technological advancement in the filtration system is noticed in the market, where smart and portable variants are gaining huge consumer preference in both residential and commercial sectors.

Key Takeaways and Insights:

-

By Filter Technology: High Efficiency Particulate Air (HEPA) dominates the market with a share of 36% in 2025, driven by its superior filtration efficiency in capturing fine particles including dust, pollen, and allergens, making it the preferred choice for health-conscious Australian consumers seeking effective indoor air purification solutions.

- By Size: Small units lead the market with a share of 41% in 2025, owing to their portability, affordability, and suitability for compact living spaces in urban apartments and single rooms, appealing to consumers seeking cost-effective air purification solutions for personal use environments.

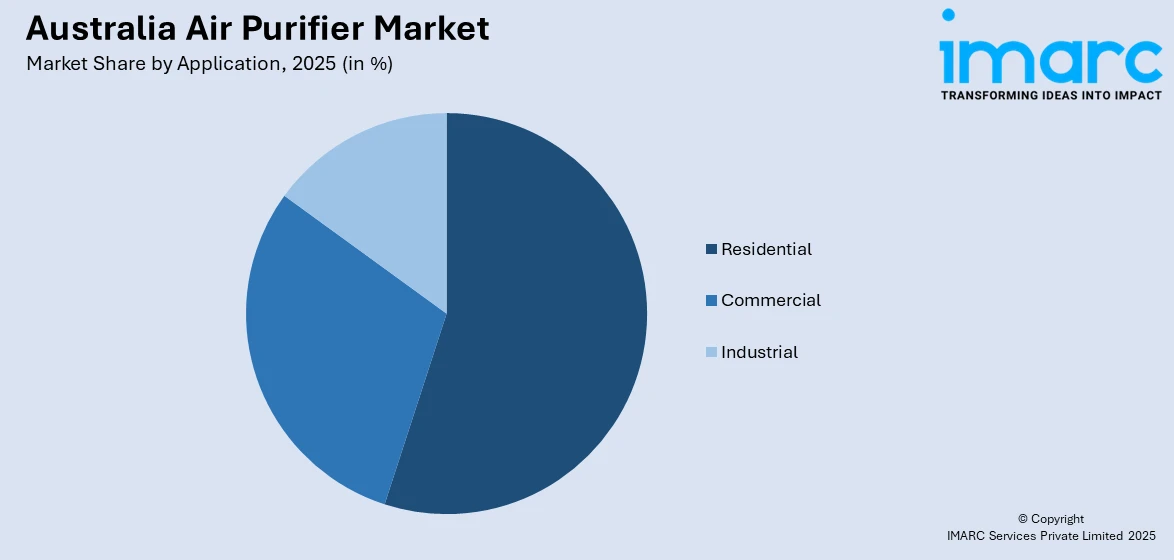

- By Application: Residential represents the largest segment with a market share of 40% in 2025, fueled by increasing health awareness among Australian households, rising incidence of respiratory conditions, and growing consumer demand for cleaner indoor environments to protect family health and wellbeing.

- By Distribution Channel: Offline dominates with a share of 61% in 2025, as consumers prefer in-store purchasing experiences that allow physical product examination, expert consultation, and immediate availability, particularly through electronics retailers, home appliance stores, and specialized air quality outlets.

- By Region: Australia Capital Territory & New South Wales lead the market with a share of 31% in 2025, driven by high population density in Sydney metropolitan areas, elevated urban pollution levels, and greater consumer awareness regarding indoor air quality and its health implications.

- Key Players: The Australia air purifier market exhibits moderate competitive intensity, characterized by the presence of established multinational corporations alongside regional manufacturers competing across various price segments. Market players are focusing on technological innovation, product differentiation through advanced filtration technologies, and strategic partnerships with healthcare organizations to strengthen their market positioning.

To get more information on this market Request Sample

The Australia air purifier market is witnessing robust growth propelled by escalating concerns over deteriorating indoor air quality and its adverse health effects. Rising health consciousness among Australian consumers is significantly influencing purchasing decisions, particularly in urban centers like Sydney and Melbourne where respiratory ailments such as asthma, bronchitis, and allergic rhinitis are increasingly prevalent. According to reports, Panasonic Australia launched a clean air initiative incorporating its nanoe™ X technology, backed by in-depth research showing broad consumer concern around indoor air quality and designed to bring advanced purification beyond traditional standalone units into homes and workplaces. The frequent occurrence of bushfire events has heightened public awareness regarding airborne particulate matter, driving demand for effective air purification solutions. Additionally, the growing emphasis on wellness and preventive healthcare is encouraging households and businesses to invest in air purifiers as essential appliances. Technological advancements introducing smart features, IoT connectivity, and enhanced filtration capabilities are further stimulating market expansion, while declining unit prices are making these products accessible to a broader consumer base.

Australia Air Purifier Market Trends:

Integration of Smart Technology and IoT Connectivity

The Australian air purifier market is witnessing a significant shift toward smart technology integration, with manufacturers incorporating IoT connectivity, smartphone applications, and real-time air quality monitoring features. In September 2025, Dyson unveiled its HushJet Purifier Compact, featuring intelligent sensors that automatically monitor and adjust air quality in real time, along with app compatibility and voice assistant support, marking a notable advancement in smart purification technology. Consumers are increasingly favoring air purifiers that offer remote operation capabilities, automated adjustment based on air quality sensors, and integration with smart home ecosystems. These advanced features enable users to monitor indoor air quality metrics including particulate matter levels, humidity, and odour concentrations from their mobile devices, enhancing user experience and operational convenience.

Rising Demand for Multi-Stage Filtration Systems

Australian consumers are demonstrating growing preference for air purifiers equipped with multi-stage filtration systems that combine HEPA filters with activated carbon and UV-C light technologies. This trend reflects increasing consumer sophistication and desire for comprehensive air purification solutions capable of addressing diverse pollutants including fine particles, volatile organic compounds, bacteria, and viruses. In November 2025, Dyson expanded its Hot+Cool purifier range with new models featuring HEPA H13 and enhanced activated carbon filters to capture ultrafine particles, odours, and gases such as nitrogen dioxide, alongside real-time air quality sensors and app connectivity, showing how manufacturers are pushing multi-stage filtration and smart features together in their latest products. Manufacturers are responding by developing products featuring multiple filtration layers that deliver enhanced purification performance and broader spectrum pollutant removal capabilities.

Expansion in Commercial and Healthcare Applications

The market is experiencing substantial growth in commercial and healthcare sector applications as businesses prioritize employee wellness and regulatory compliance with indoor air quality standards. Offices, educational institutions, hospitality establishments, and healthcare facilities are increasingly installing air purification systems to create healthier indoor environments. In December 2025, Australian manufacturer INOVA Purifiers was recognised as Air Purifier Manufacturer of the Year by Environmental Business Review for its sustainable design and use of medical-grade HEPA and activated carbon filters in systems deployed across hospitals and high-traffic commercial settings. This trend is supported by growing awareness that improved air quality enhances productivity, reduces absenteeism, and demonstrates organizational commitment to occupant health and safety standards.

Market Outlook 2026-2034:

The Australia air purifier industry has optimistic growth potential over the forecast period, driven by continuous interest in healthcare and wellness products. Urbanization and construction of residential properties, combined with concern for indoor air pollution, are expected to propel growth of this industry. The commercial sector has immense potential for growth, given increasing investment by various industries to manage indoor air quality. Technological advancements offering energy-efficient products, advanced filters, and intelligent features are also set to promote growth of this industry. The market generated a revenue of USD 438.89 Million in 2025 and is projected to reach a revenue of USD 861.09 Million by 2034, growing at a compound annual growth rate of 7.78% from 2026-2034.

Australia Air Purifier Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Filter Technology |

High Efficiency Particulate Air (HEPA) |

36% |

|

Size |

Small Units |

41% |

|

Application |

Residential |

40% |

|

Distribution Channel |

Offline |

61% |

|

Region |

Australia Capital Territory & New South Wales |

31% |

Filter Technology Insights:

- Activated Carbon

- Electrostatic Precipitators

- High Efficiency Particulate Air (HEPA)

- Ion and Ozone Generators

- Others

High Efficiency Particulate Air (HEPA) dominates with a market share of 36% of the total Australia air purifier market in 2025.

The High Efficiency Particulate Air (HEPA) segment dominates the Australia air purifier market, holding the largest share among all filter technologies. HEPA technology maintains its leadership position owing to its exceptional efficiency in capturing microscopic particles including dust, pollen, pet dander, mould spores, and other allergens. The technology demonstrates the capability to remove ultrafine particles with remarkably high efficiency rates, making it the preferred choice for consumers.

The segment benefits from endorsements by healthcare organizations including the National Asthma Council Australia, which enhances consumer confidence in HEPA-equipped products. Additionally, manufacturers are increasingly combining HEPA filtration with complementary technologies such as activated carbon and UV-C light to deliver comprehensive air purification solutions that address diverse pollutant types and evolving consumer requirements across residential and commercial applications.

Size Insights:

- Small Units

- Large Units

- HVAC Units

The small units leads with a share of 41% of the total Australia air purifier market in 2025.

Small unit air purifiers dominate the Australian market due to their versatility, portability, and affordability, making them ideal for individual rooms, apartments, and personal workspaces. The compact design appeals to urban consumers living in smaller residences who require effective air purification solutions without compromising valuable floor space or aesthetic appeal. For example, in July 2025 Coway launched its Airmega 50, the most compact model in its Airmega series, to the Australian market, specifically designed for bedrooms, home offices, and desktops with a lightweight, portable form factor, reinforcing demand for small, high-performance units. These compact purifiers are increasingly preferred in urban households where space is limited but concerns over allergens, dust and indoor pollutants remain high.

The segment growth is supported by declining unit prices and expanding product availability across diverse retail channels including online platforms and specialty stores, enabling broader consumer accessibility. Additionally, the rising trend of remote working arrangements has significantly increased demand for personal air purifiers that can be easily relocated between rooms and home office spaces, further strengthening the small units segment position in the Australian market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Industrial

- Residential

The residential dominates with a market share of 40% of the total Australia air purifier market in 2025.

The residential application segment leads the market driven by increasing consumer awareness regarding indoor air quality and its direct impact on family health and overall wellbeing. Australian households are increasingly investing in air purifiers to mitigate allergens, reduce respiratory illness risks, and create healthier living environments. This trend is particularly evident among families with vulnerable members including young children, elderly individuals, and those with pre-existing respiratory conditions such as asthma.

The growing residential construction activity and rising homeownership rates across major Australian cities contribute to sustained demand for household air purification solutions. Furthermore, the recurring impact of bushfire smoke events on residential areas has significantly heightened awareness among Australian homeowners regarding the critical importance of maintaining clean indoor air quality, driving widespread adoption of air purifiers as essential household appliances rather than optional luxury items.

Distribution Channel Insights:

- Offline

- Online

The offline leads with a share of 61% of the total Australia air purifier market in 2025.

Offline retail channels maintain market leadership as Australian consumers continue to prefer physical shopping experiences when purchasing air purifiers. Electronics retailers, home appliance stores, and specialty air quality outlets provide valuable opportunities for consumers to physically examine products, compare technical specifications across different brands, and receive expert guidance from trained sales personnel before making informed purchase decisions regarding these significant household investments.

The offline segment benefits from well-established retail networks, immediate product availability, and convenient after-sales service accessibility across metropolitan and regional areas. Major retailers and brand-exclusive stores offer live product demonstrations and comprehensive educational resources that help consumers understand advanced product features and select appropriate air purification solutions tailored to their specific requirements, contributing to sustained offline channel dominance in the Australian market.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales exhibits a clear dominance with a 31% share of the total Australia air purifier market in 2025.

The Australian Capital Territory and New South Wales region leads the market due to its high population concentration, particularly in the Sydney metropolitan area, which represents the largest urban center in Australia. The region experiences elevated pollution levels from vehicular emissions, industrial activities, and recurring bushfire smoke events that significantly impact air quality. These environmental factors drive strong consumer demand for effective air purification solutions across both residential and commercial applications.

Higher disposable income levels among residents in this region enable greater spending capacity on health and wellness products including premium air purifiers with advanced filtration technologies. Additionally, the substantial concentration of commercial establishments, healthcare facilities, educational institutions, and corporate offices throughout the region contributes to significant demand from the commercial segment, further strengthening the overall regional market position and maintaining its leadership in the Australian air purifier market.

Market Dynamics:

Growth Drivers:

Why is the Australia Air Purifier Market Growing?

Rising Health Awareness and Respiratory Disease Prevalence

The increasing awareness among Australian consumers regarding the correlation between indoor air quality and respiratory health represents a primary growth driver for the air purifier market. Australia demonstrates one of the highest asthma prevalence rates globally, with significant portions of the population affected by allergic rhinitis and other respiratory conditions. This health consciousness is driving households to invest in air purification solutions as preventive healthcare measures. According to reports, global hygiene firm Rentokil Initial partnered with Asthma Australia to educate the public on the importance of indoor air quality during Asthma Week, promoting its InspireAir 72 HEPA air purification devices as part of initiatives to reduce fine particles and allergens in homes, reinforcing consumer focus on air purifiers for respiratory health. The growing understanding that indoor air can be significantly more polluted than outdoor air, combined with the extended time individuals spend indoors, is accelerating adoption of air purifiers across residential settings. Healthcare professionals increasingly recommend air purifiers for patients with respiratory conditions, lending credibility to these products and expanding their perceived necessity among health-conscious consumers.

Impact of Bushfire Events and Environmental Concerns

The recurring bushfire events across Australia have significantly heightened consumer awareness regarding air quality and the need for indoor air protection. These seasonal occurrences release substantial quantities of particulate matter, smoke, and harmful pollutants into the atmosphere, severely affecting air quality across vast regions including major metropolitan areas. The environmental impact of these events has created lasting awareness among consumers regarding the importance of maintaining clean indoor air environments. In response to these challenges, the New South Wales Government’s NSW Clean Air Strategy 2021–2030 includes enhanced air quality monitoring and forecasting models and expanded public information systems to better prepare communities for bushfire smoke and other pollution events, helping residents understand risks and protective actions including the use of indoor air purification measures. Climate change patterns suggest increasing frequency and intensity of such events, sustaining long-term demand for air purification solutions. Additionally, growing environmental consciousness among Australian consumers regarding urban pollution from vehicular emissions and industrial activities continues to drive interest in air purifiers as essential household appliances for protecting family health.

Technological Advancements and Product Innovation

Continuous technological innovations in air purification are driving market expansion by offering enhanced performance, user convenience, and broader functionality. Manufacturers are introducing advanced features including smart connectivity, real-time air quality monitoring, automated operation modes, and integration with home automation systems. The development of multi-stage filtration systems combining HEPA, activated carbon, UV-C, and ionization technologies delivers comprehensive pollutant removal capabilities that address diverse consumer requirements. In September 2025, IQAir launched the Atem Earth air purifier, the world’s first unit with a sustainably sourced wood housing that integrates HyperHEPA filtration with real‑time indoor and outdoor air quality insights and ENERGY STAR Most Efficient‑rated energy performance, demonstrating how innovation is combining advanced purification with sustainability and smart monitoring. Energy-efficient designs are reducing operational costs, making air purifiers more economically viable for continuous operation. Additionally, aesthetic improvements and compact designs are enhancing product appeal for residential environments. These innovations are expanding market reach by attracting technology-savvy consumers and those seeking premium air purification solutions with enhanced functionality and performance capabilities.

Market Restraints:

What Challenges the Australia Air Purifier Market is Facing?

High Initial Cost and Ongoing Maintenance Expenses

The relatively high upfront cost of quality air purifiers, particularly those featuring advanced multi-stage filtration technologies, presents a significant barrier to broader market adoption among price-sensitive consumers. Additionally, recurring expenses associated with periodic filter replacements and ongoing energy consumption create continuous financial considerations that may deter cost-conscious Australian households from purchasing or consistently maintaining air purifiers over extended periods.

Limited Consumer Awareness in Regional Areas

The relatively high upfront cost of quality air purifiers, particularly those featuring advanced multi-stage filtration technologies, presents a significant barrier to broader market adoption among price-sensitive consumers. Additionally, recurring expenses associated with periodic filter replacements and ongoing energy consumption create continuous financial considerations that may deter cost-conscious Australian households from purchasing or consistently maintaining air purifiers over extended periods.

Market Fragmentation and Product Selection Complexity

The presence of numerous brands offering diverse filtration technologies and varying specifications creates considerable confusion among consumers attempting to select appropriate products for their specific needs. The technical complexity of different filtration technologies and inconsistent performance claims across manufacturers make accurate product comparison challenging, potentially leading to prolonged purchase hesitation or consumer dissatisfaction resulting from unsuitable product selections.

Competitive Landscape:

The Australian market for air purifiers has low to moderate levels of competition, with well-established global giants operating along with local companies at different pricing tiers. Companies are using differentiation by innovation, better filtration, and intelligent functionalities. Collaborations with healthcare associations and endorsements from organizations such as National Asthma Council Australia provide companies with a competitive edge. Extending distribution networks across both offline retailing and online shopping sites is a critical area of focus for companies. Companies are working on consumer awareness campaigns to generate product awareness and market positioning on the basis of innovation and health advantages. The market observes steady launches of new products equipped with newest innovations such as UV-C sterilization, multi-stage filtration, or internet connectivity due to consumer preference shifting on different innovation lines by various companies.

Recent Developments:

- In November 2025, South Korean wellness tech company Coway has introduced the Airmega 350 air purifier to the Australian market, featuring its HyperVortex™ filtration system for powerful, quiet performance in spaces up to 182 m². The product expands Coway’s Airmega lineup with premium home and office air quality solutions.

Australia Air Purifier Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Activated Carbon, Electrostatic Precipitators, High Efficiency Particulate Air (HEPA), Ion and Ozone Generators, Others |

| Sizes Covered | Small Units, Large Units, HVAC Units |

| Applications Covered | Commercial, Industrial, Residential |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia air purifier market size was valued at USD 438.89 Million in 2025.

The Australia air purifier market is expected to grow at a compound annual growth rate of 7.78% from 2026-2034 to reach USD 861.09 Million by 2034.

High Efficiency Particulate Air (HEPA) technology dominated the market with a share of 36%, owing to its exceptional filtration efficiency in capturing microscopic particles and endorsements from healthcare organizations including the National Asthma Council Australia.

Key factors driving the Australia air purifier market include rising health awareness and respiratory disease prevalence, impact of bushfire events and environmental concerns, technological advancements and product innovation, increasing urbanization, and growing demand from commercial and healthcare sectors.

Major challenges include high initial costs and ongoing maintenance expenses, limited consumer awareness in regional areas, market fragmentation creating product selection complexity, and price sensitivity among cost-conscious consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)