Australia Airborne ISR Market Size, Share, Trends and Forecast by Platform, System, Type, Fuel Type, Application, and Region, 2025-2033

Australia Airborne ISR Market Size:

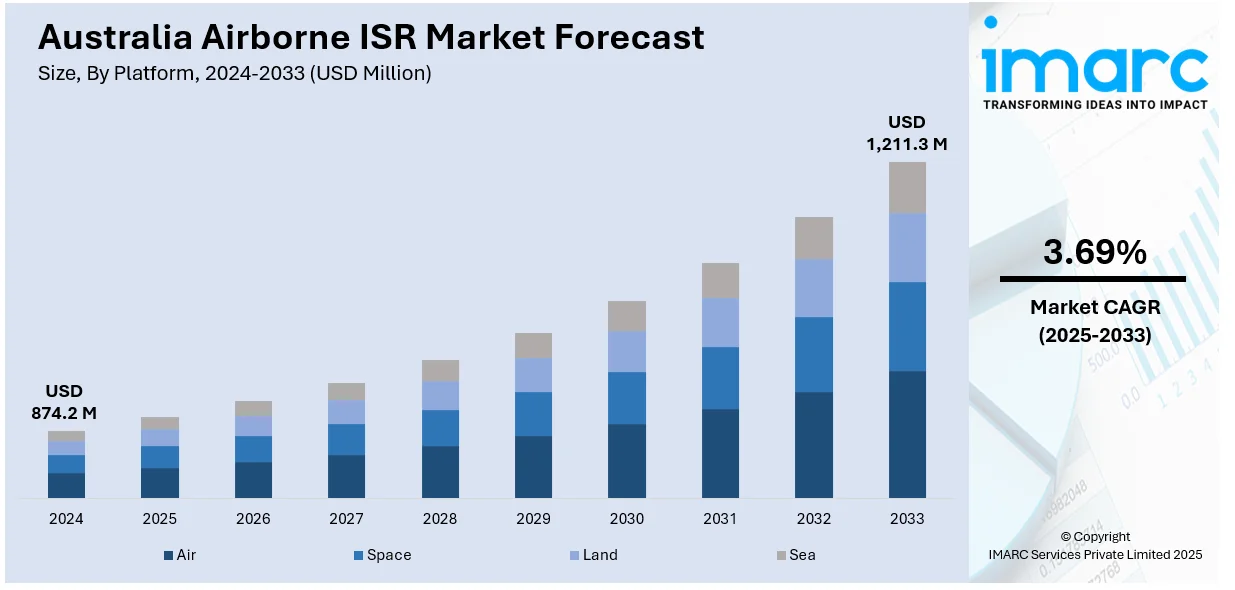

The Australia airborne ISR market size reached USD 874.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,211.3 Million by 2033, exhibiting a growth rate (CAGR) of 3.69% during 2025-2033. The market is expanding with increased investment in SIGINT platforms, autonomous UAVs, and next-generation surveillance systems. Moreover, regional security needs, technological upgrades, and a shift toward flexible, unmanned solutions supporting long-range intelligence and defense operations are impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 874.2 Million |

| Market Forecast in 2033 | USD 1,211.3 Million |

| Market Growth Rate 2025-2033 | 3.69% |

Australia Airborne ISR Market Trends:

Growing Emphasis on SIGINT Platforms

Australia's airborne ISR market has seen increased focus on signal intelligence (SIGINT) and electronic warfare (EW) capabilities, driven by changing regional threat dynamics and the need for strategic situational awareness. The country is actively investing in platforms that offer deep surveillance coverage, high endurance, and multi-role functionality. This shift is part of a broader defense modernization push aimed at integrating advanced surveillance tools into its long-term security planning. Platforms capable of collecting, analyzing, and interpreting electronic signals are gaining importance, particularly as regional communications and radar systems become more complex. In January 2025, Australia's MC-55A Peregrine aircraft, built on the Gulfstream G550 airframe, began its new round of test flights in Texas. The aircraft was spotted bearing Royal Australian Air Force (RAAF) markings, indicating its readiness for operational validation. Fully modified for SIGINT and EW operations, the MC-55A aims to replace older assets with enhanced airborne data-gathering and threat-detection capabilities. This development highlights Australia's commitment to next-generation surveillance systems and demonstrates a clear move toward autonomous data-driven operations. As security needs evolve, such specialized aircraft are set to play a central role in protecting airspace, supporting joint missions, and extending ISR coverage well beyond national boundaries.

To get more information on this market, Request Sample

Advancing Autonomous ISR Capabilities

The push for unmanned and autonomous solutions is reshaping Australia's approach to ISR, with a growing emphasis on flexibility, rapid deployment, and reduced crew risk. The market is witnessing increasing demand for systems that can support both intelligence gathering and tactical engagement, particularly in environments where traditional assets may be limited. These trends are being driven by the need for platforms that operate independently, offer versatile payload configurations, and adapt quickly to mission-specific requirements. In December 2024, BAE Systems Australia completed the successful first flight of its STRIX VTOL uncrewed aerial vehicle. Designed for ISR and strike missions, STRIX features a hybrid-electric propulsion system, VTOL capabilities, and a unique tilt-body design. The full-scale prototype was developed and tested entirely in Australia, with its flight trials proving autonomous control in complex maneuvers, including take-off, hover, and recovery, without pilot intervention. This milestone underscored Australia's growing expertise in developing sovereign autonomous technologies. By combining vertical lift with fixed-wing efficiency, STRIX is well-positioned to support defense missions in remote or contested zones. The project reflects how unmanned aerial systems are increasingly influencing procurement priorities, offering scalable ISR solutions that align with evolving strategic and operational goals in the region.

Australia Airborne ISR Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on platform, system, type, fuel type, and application.

Platform Insights:

- Air

- Space

- Land

- Sea

The report has provided a detailed breakup and analysis of the market based on the platform. This includes air, space, land, and sea.

System Insights:

- Maritime Patrol

- Electronic Warfare

- Airborne Early Warning and Control (AEWC)

- Airborne Ground Surveillance (AGS)

- Signals Intelligence (SIGNIT)

A detailed breakup and analysis of the market based on the system have also been provided in the report. This includes maritime patrol, electronic warfare, airborne early warning and control (AEWC), airborne ground surveillance (AGS), and signals intelligence (SIGNIT).

Type Insights:

- Surveillance

- Reconnaissance

- Intelligence

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes surveillance, reconnaissance, and intelligence.

Fuel Type Insights:

- Hydrogen Fuel-Cells

- Solar Powered

- Alternate Fuel

- Battery Operated

- Gas-Electric Hybrids

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes hydrogen fuel-cells, solar powered, alternate fuel, battery operated, and gas-electric hybrids.

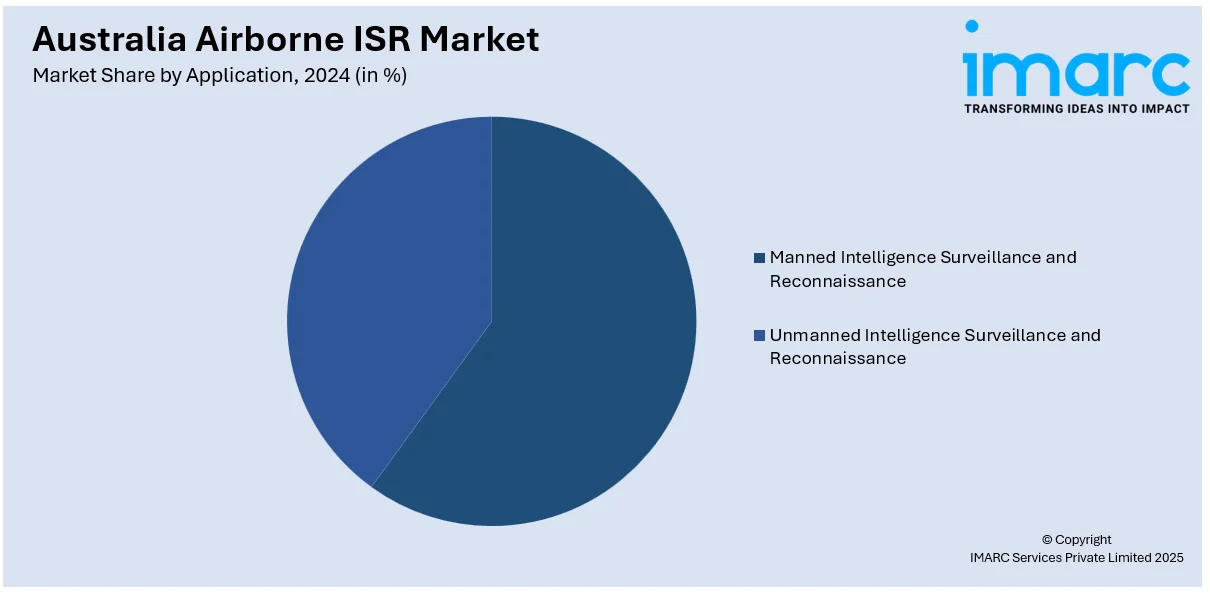

Application Insights:

- Manned Intelligence Surveillance and Reconnaissance

- Unmanned Intelligence Surveillance and Reconnaissance

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes manned intelligence surveillance and reconnaissance, and unmanned intelligence surveillance and reconnaissance.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Airborne ISR Market News:

- March 2025: Bombardier Defense secured a contract to supply two Challenger 650 jets for Australia’s ISR operations. With delivery set for 2026, the deal expanded airborne ISR capabilities through enhanced range and performance, strengthening surveillance infrastructure, and driving defense market growth.

- February 2025: SiNAB showcased its Phoenix Pod and Phoenix Mini at Avalon, demonstrating real-time ISR capabilities on a QinetiQ Learjet 60. This strengthened Australia’s airborne ISR ecosystem by introducing agile, next-gen solutions, supporting tactical flexibility, and expanding domestic ISR technology development.

Australia Airborne ISR Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Air, Space, Land, Sea |

| Systems Covered | Maritime Patrol, Electronic Warfare, Airborne Early Warning and Control (AEWC), Airborne Ground Surveillance (AGS), Signals Intelligence (SIGNIT) |

| Types Covered | Surveillance, Reconnaissance, Intelligence |

| Fuel Types Covered | Hydrogen Fuel-Cells, Solar Powered, Alternate Fuel, Battery Operated, Gas-Electric Hybrids |

| Applications Covered | Manned Intelligence Surveillance and Reconnaissance, Unmanned Intelligence Surveillance and Reconnaissance |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia airborne ISR market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia airborne ISR market on the basis of platform?

- What is the breakup of the Australia airborne ISR market on the basis of system?

- What is the breakup of the Australia airborne ISR market on the basis of type?

- What is the breakup of the Australia airborne ISR market on the basis of fuel type?

- What is the breakup of the Australia airborne ISR market on the basis of application?

- What are the various stages in the value chain of the Australia airborne ISR market?

- What are the key driving factors and challenges in the Australia airborne ISR?

- What is the structure of the Australia airborne ISR market and who are the key players?

- What is the degree of competition in the Australia airborne ISR market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia airborne ISR market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia airborne ISR market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia airborne ISR industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)