Australia Aluminum Extrusion Market Size, Share, Trends and Forecast by Product Type, Alloy Type, and End-Use Industry, and Region, 2025-2033

Australia Aluminum Extrusion Market Overview:

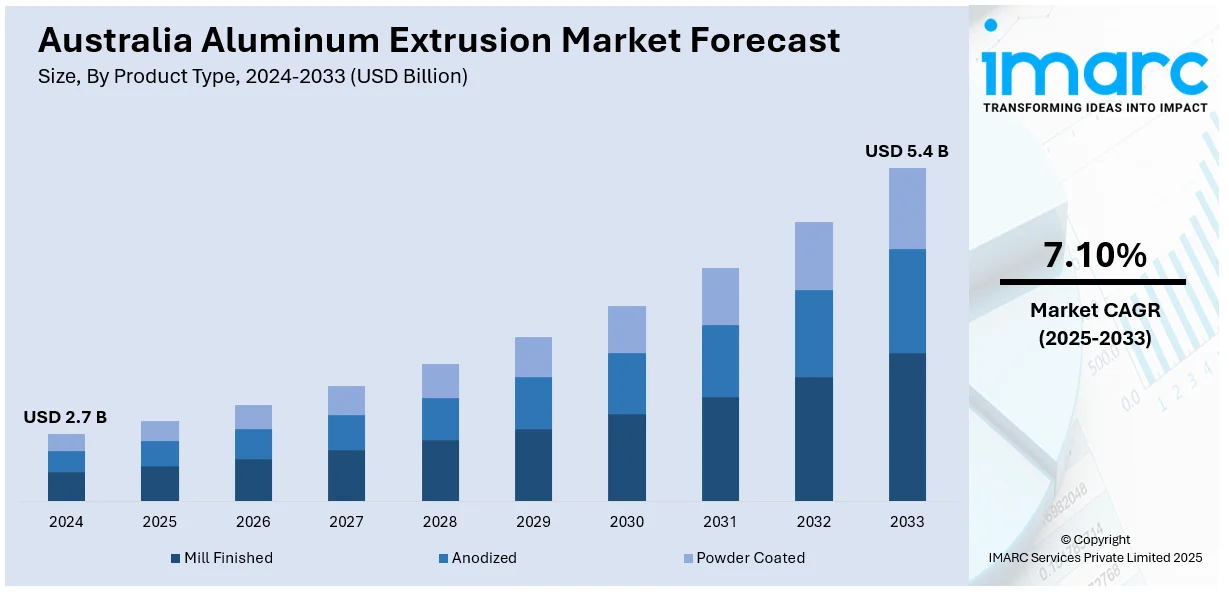

The Australia aluminum extrusion market size reached USD 2.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.4 Billion by 2033, exhibiting a growth rate (CAGR) of 7.10% during 2025-2033. Robust product demand across construction, transport, renewable energy, automotive lightweighting, development of prefabricated buildings, defense manufacturing, architectural customization, local raw material availability, sustainability initiatives, advancements in extrusion technology, growing export potential, and supportive regulations are factors strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.7 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Market Growth Rate 2025-2033 | 7.10% |

Australia Aluminum Extrusion Market Trends:

Construction Sector Demand

The construction industry remains a fundamental pillar supporting the Australia aluminum extrusion market growth. In 2024, The Australian Construction Industry Forum forecasts a modest growth of 0.9% in the 2024–2025 period, with total activity reaching USD 299 billion. As Australia witnesses ongoing urban expansion and high-density housing developments in cities like Sydney, Melbourne, and Brisbane, demand for aluminum-based architectural components has remained consistent. Additionally, government-backed infrastructure programs and public housing initiatives are creating long-term growth opportunities. The industry’s emphasis on sustainability also promotes aluminum, which is 100% recyclable, enhancing its appeal in green-certified buildings. Aluminum extrusions are widely used in residential, commercial, and industrial buildings due to their strength-to-weight ratio, corrosion resistance, and design versatility. Key applications include window and door frames, curtain wall systems, handrails, and façade elements. Moreover, the increased preference for modern aesthetics and customized architectural finishes supports demand for precision-extruded profiles.

To get more information on this market, Request Sample

Transport Infrastructure and Rail Manufacturing

Australia’s continued investment in transport infrastructure, particularly in rail and light rail projects, plays a significant role in driving aluminum extrusion consumption. In the 2024–2025 federal budget, the Australian Government allocated over USD 1 billion for resilient and reliable rail infrastructure. This funding is part of the broader USD 13.2 billion commitment to nationally significant rail projects under the Infrastructure Investment Program, spanning the next four years. Extruded aluminum is preferred in railcar body panels, structural components, and interior fittings due to its light weight, durability, and ease of fabrication. Projects such as the Sydney Metro, Melbourne’s Suburban Rail Loop, and Brisbane’s Cross River Rail demand large volumes of extruded profiles for rolling stock and station infrastructure. Reducing vehicle weight is a priority for public and freight transport operators seeking greater fuel efficiency and lower emissions, making aluminum an ideal material choice. Furthermore, the localization of rail manufacturing to support sovereign capability goals has created more opportunities for the extrusion firms to supply engineered aluminum components domestically, which is creating a positive Australia aluminum extrusion market outlook.

Renewable Energy Installations

The expansion of renewable energy installations, particularly in solar photovoltaics, is a key driver boosting the Australia aluminum extrusion market share. Aluminum extrusions are essential for constructing mounting systems, panel frames, and structural supports in solar farms and rooftop solar installations. The material’s corrosion resistance, light weight, and recyclability make it well-suited for outdoor energy systems, especially in harsh environments across Australia’s rural and coastal regions. Government incentives such as the Small-scale Renewable Energy Scheme (SRES) and various state-level clean energy targets are accelerating the deployment of solar and wind infrastructure. As utility-scale projects increase, there is growing demand for robust, standardized, and modular aluminum systems that reduce installation time and lifecycle costs.

Australia Aluminum Extrusion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, alloy type, and end-use industry.

Product Type Insights:

- Mill Finished

- Anodized

- Powder Coated

The report has provided a detailed breakup and analysis of the market based on the product type. This includes mill finished, anodized, and powder coated.

Alloy Type Insights:

- 1000 Series Aluminum Alloy

- 2000 Series Aluminum Alloy

- 3000 Series Aluminum Alloy

- 5000 Series Aluminum Alloy

- 6000 Series Aluminum Alloy

- 7000 Series Aluminum Alloy

A detailed breakup and analysis of the market based on the alloy type have also been provided in the report. This includes 1000 series aluminum alloy, 2000 series aluminum alloy, 3000 series aluminum alloy, 5000 series aluminum alloy, 6000 series aluminum alloy, and 7000 series aluminum alloy.

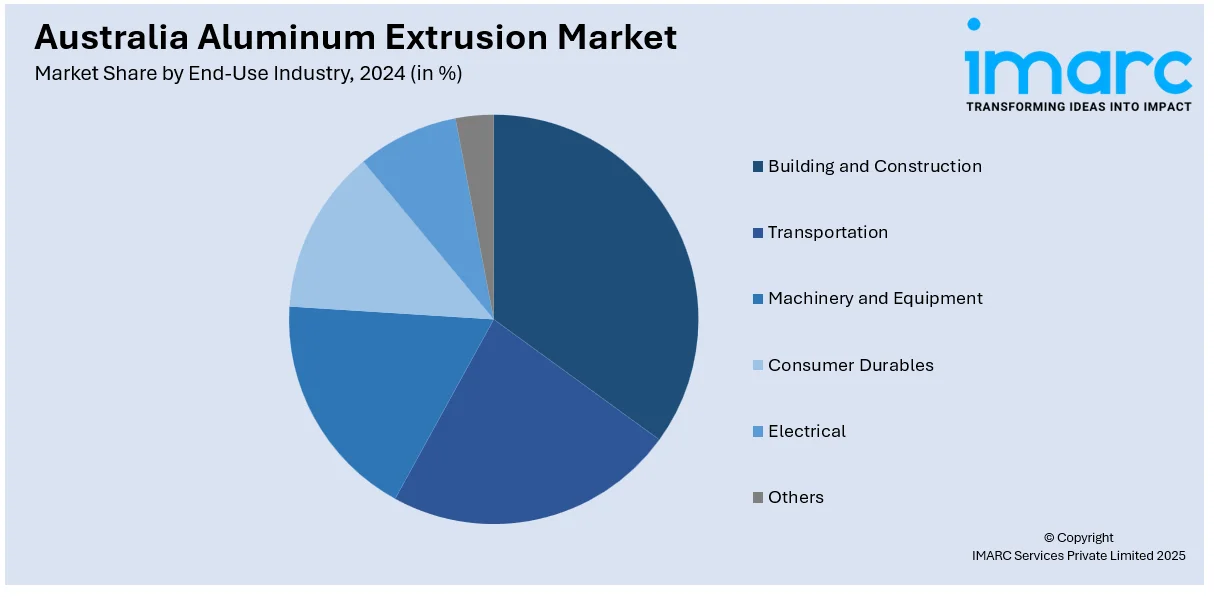

End-Use Industry Insights:

- Building and Construction

- Transportation

- Machinery and Equipment

- Consumer Durables

- Electrical

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes building and construction, transportation, machinery and equipment, consumer durables, electrical, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Aluminum Extrusion Market News:

- In 2025, Capral partnered with the Australian Made Campaign to promote locally manufactured aluminium extrusions, aiming to mitigate the impact of global trade tensions and tariffs. Additionally, Capral has implemented AI-powered industrial packing robots, reducing freight volumes by 50% and enhancing competitiveness in the global market.

- In 2024, Alcoa Australia acquired Alumina Limited for USD 2.2 billion, gaining full ownership of the Alcoa World Alumina and Chemicals (AWAC) joint venture. This acquisition strengthens Alcoa's position in the Australian aluminium industry, encompassing bauxite mining, alumina refining, and aluminium smelting operations.

Australia Aluminum Extrusion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mill Finished, Anodized, Powder Coated |

| Alloy Types Covered | 1000 Series Aluminum Alloy, 2000 Series Aluminum Alloy, 3000 Series Aluminum Alloy, 5000 Series Aluminum Alloy, 6000 Series Aluminum Alloy, 7000 Series Aluminum Alloy |

| End-Use Industries Covered | Building and Construction, Transportation, Machinery and Equipment, Consumer Durables, Electrical, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia aluminum extrusion market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia aluminum extrusion market on the basis of product type?

- What is the breakup of the Australia aluminum extrusion market on the basis of alloy type?

- What is the breakup of the Australia aluminum extrusion market on the basis of end-use industry?

- What is the breakup of the Australia aluminum extrusion market on the basis of region?

- What are the various stages in the value chain of the Australia aluminum extrusion market?

- What are the key driving factors and challenges in the Australia aluminum extrusion market?

- What is the structure of the Australia aluminum extrusion market and who are the key players?

- What is the degree of competition in the Australia aluminum extrusion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia aluminum extrusion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia aluminum extrusion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia aluminum extrusion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)