Australia Amino Acids Market Size, Share, Trends and Forecast by Type, Raw Material, Application, and Region, 2025-2033

Australia Amino Acids Market Overview:

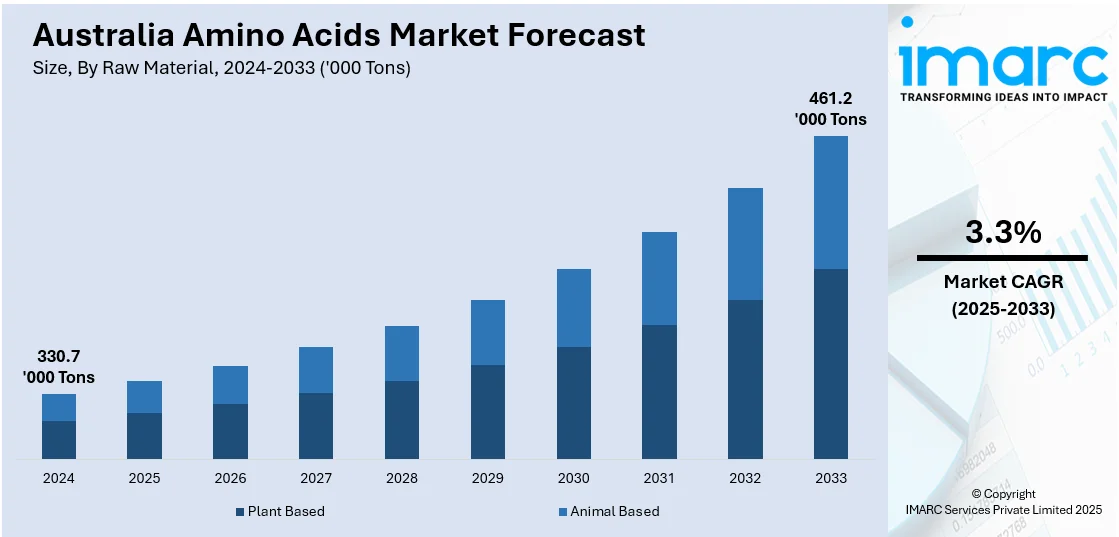

The Australia amino acids market size reached 330.7 Thousand Tons in 2024. Looking forward, IMARC Group expects the market to reach 461.2 Thousand Tons by 2033, exhibiting a growth rate (CAGR) of 3.3% during 2025-2033. The market is driven by increasing demand for protein-rich dietary supplements, rising health awareness, expanding sports nutrition sector, and growing applications in animal feed and pharmaceuticals. Advancements in fermentation technologies and consumer preference for plant-based amino acid sources also contribute to market expansion and diversification.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 330.7 Thousand Tons |

| Market Forecast in 2033 | 461.2 Thousand Tons |

| Market Growth Rate 2025-2033 | 3.3% |

Australia Amino Acids Market Trends:

Rising Demand for Functional Foods and Nutraceuticals

Australia is witnessing a significant rise in the consumption of functional foods and nutraceuticals, largely influenced by growing consumer awareness of preventive healthcare and wellness. Amino acids, particularly glutamine, leucine, and arginine, are increasingly incorporated into functional food formulations due to their roles in immunity, muscle repair, and metabolic function. For instance, in April 2024, Else Nutrition debuted its dairy- and soy-free plant-based infant formula and toddler drink in Australia, using almonds, buckwheat, and tapioca. The clean-label products meet infant nutritional standards, including essential amino acids, and respond to rising demand for allergen-free, environmentally responsible options. Australia’s regulatory rigor positioned it as an ideal entry point for regional expansion. The aging population in Australia is also contributing to demand, as amino acids are used in products targeting joint health, cognitive performance, and sarcopenia. Food manufacturers are responding by launching fortified food products, such as amino acid-enriched beverages, protein bars, and fortified cereals. Regulatory support for health claims and clean-label products further incentivizes innovation, leading to the proliferation of amino acid-based functional food offerings across supermarkets and health food retail chains.

To get more information on this market, Request Sample

Expanding Application in Animal Feed and Livestock Health

Australia’s livestock industry is increasingly embracing amino acid-based feed strategies to enhance animal health, growth, and feed efficiency. Key amino acids such as lysine, methionine, threonine, tryptophan, and valine are being incorporated into poultry, swine, and aquaculture diets to improve protein utilization and reduce nitrogen emissions. With global meat markets demanding high-quality exports, producers are investing in precision nutrition to maintain competitiveness. The decline in antibiotic growth promoter usage is also driving demand for amino acid supplementation as a natural alternative. Companies like Ajinomoto Health & Nutrition are meeting this demand by supplying targeted feed-grade amino acids tailored to livestock dietary needs. Their solutions not only improve productivity and sustainability but also support environmentally conscious farming through reduced nitrogen excretion and better nutrient absorption.

Growing Popularity of Plant-Based and Fermentation-Derived Amino Acids

Consumer preference in Australia is steadily shifting toward plant-based and fermentation-derived ingredients, reflecting broader trends in clean-label and sustainable nutrition. This has led to rising demand for amino acids sourced from soy, peas, and microbial fermentation processes rather than animal-derived or synthetic variants. For instance, Australian Plant Proteins has developed products derived from faba beans and lentils, which are gaining popularity due to their alignment with sustainability and ethical consumption trends. Vegan and vegetarian populations, along with flexitarian consumers, are increasingly seeking protein and amino acid supplements compatible with their dietary ethics. In parallel, manufacturers are investing in bio-fermentation technologies to produce high-purity amino acids at scale with lower environmental impact. This trend is supported by Australia’s regulatory openness to biotech innovation and its strong agricultural base, which ensures availability of plant feedstocks. The resulting market evolution is encouraging diverse product development in both human and animal nutrition segments.

Australia Amino Acids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, raw material, and application.

Type Insights:

- Glutamic Acids

- Lysine

- Methionine

- Threonine

- Phenylalanine

- Tryptophan

- Citrulline

- Glycine

- Glutamine

- Creatine

- Arginine

- Valine

- Leucine

- Iso-Leucine

- Proline

- Serine

- Tyrosine

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes glutamic acids, lysine, methionine, threonine, phenylalanine, tryptophan, citrulline, glycine, glutamine, creatine, arginine, valine, leucine, iso-leucine, proline, serine, tyrosine, and others.

Raw Material Insights:

- Plant Based

- Animal Based

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes plant based and animal based.

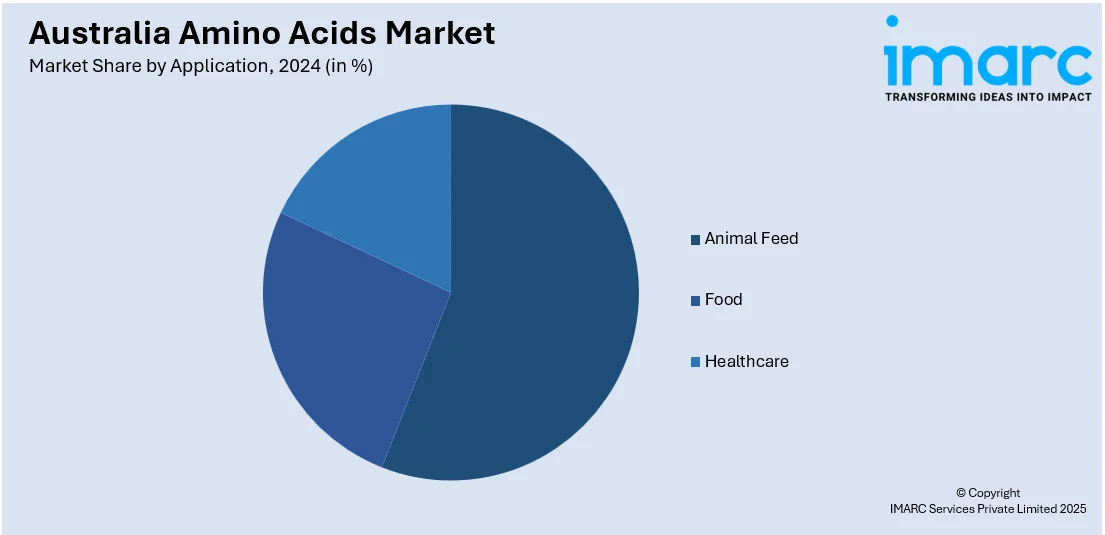

Application Insights:

- Animal Feed

- Food

- Healthcare

The report has provided a detailed breakup and analysis of the market based on the application. This includes animal feed, food, and healthcare.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Amino Acids Market News:

- In November 2024, Curtin University partnered with Draslovka’s Mining Process Solutions in a USD 3 Million project to commercialize glycine leaching, a safer, more sustainable alternative to hazardous chemicals like cyanide in mineral extraction. The research focuses on using the non-toxic amino acid glycine to extract metals such as gold, copper, cobalt, and nickel. Supported by the Trailblazer Universities Program, the initiative aims to advance critical minerals processing and drive innovation in Australia's resource sector.

- In May 2024, CSIRO launched “Just Meat,” a nutrient-rich, allergen-free red meat protein powder designed for use in products like shakes, energy drinks, and protein balls. Developed with Meat & Livestock Australia, the powder offers complete amino acids and high iron, zinc, and magnesium content. It targets the USD 3.8 Billion health and wellness market and aims to boost Australia’s USD 75.4 Billion red meat sector by utilizing more of each carcase. The shelf-stable format also enhances food security and global meat export versatility.

Australia Amino Acids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Glutamic Acids, Lysine, Methionine, Threonine, Phenylalanine, Tryptophan, Citrulline, Glycine, Glutamine, Creatine, Arginine, Valine, Leucine, Iso-Leucine, Proline, Serine, Tyrosine, Others |

| Raw Materials Covered | Plant Based, Animal Based |

| Applications Covered | Animal Feed, Food, Healthcare |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia amino acids market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia amino acids market on the basis of type?

- What is the breakup of the Australia amino acids market on the basis of raw material?

- What is the breakup of the Australia amino acids market on the basis of application?

- What are the various stages in the value chain of the Australia amino acids market?

- What are the key driving factors and challenges in the Australia amino acids market?

- What is the structure of the Australia amino acids market and who are the key players?

- What is the degree of competition in the Australia amino acids market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia amino acids market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia amino acids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia amino acids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)