Australia Ammonia Market Size, Share, Trends and Forecast by Physical Form, Application, End Use Industry, and Region, 2026-2034

Australia Ammonia Market Overview:

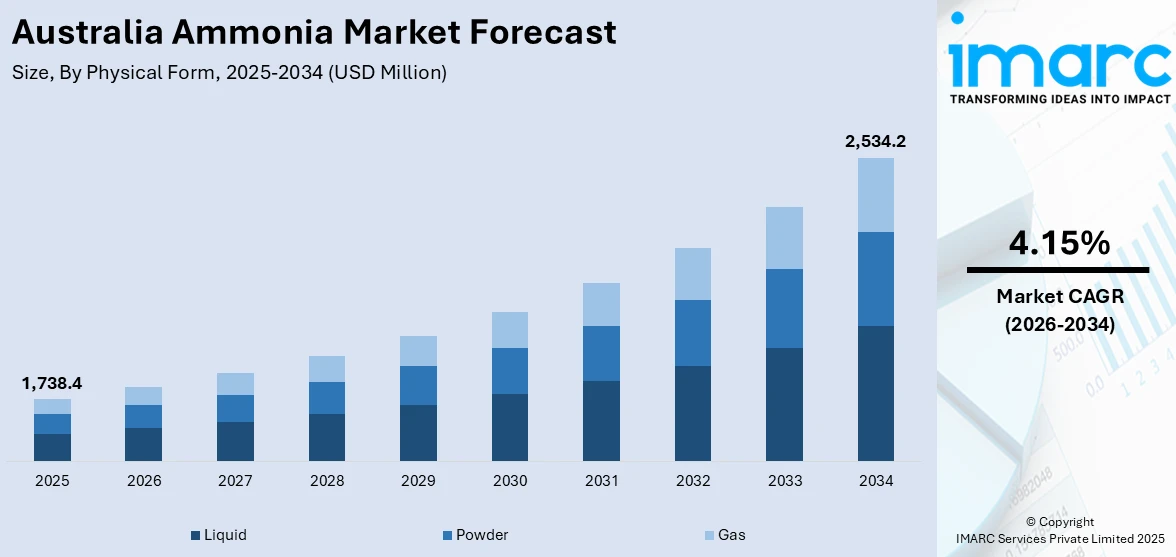

The Australia ammonia market size reached USD 1,738.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,534.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.15% during 2026-2034. The market is primarily driven by demand from fertilizer manufacturing, industrial chemicals, and explosives for mining operations. Rising investments in green ammonia projects, government support for low-carbon technologies, and global export opportunities, particularly in Asia, are also accelerating domestic production capacity and fostering infrastructure development in the ammonia value chain.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,738.4 Million |

| Market Forecast in 2034 | USD 2,534.2 Million |

| Market Growth Rate 2026-2034 | 4.15% |

Australia Ammonia Market Trends:

Transition to Green Ammonia Production

Australia is witnessing a shift toward green ammonia, produced using renewable energy sources and electrolysis. This transition is supported by both federal and state-level initiatives aiming to reduce carbon emissions in industrial sectors. Several large-scale projects, particularly in Western Australia and the Northern Territory, are in development stages to produce green ammonia for both domestic consumption and export. Companies are partnering with global players to leverage Australia’s solar and wind potential to produce hydrogen, a key input for green ammonia. Industry developments highlight Australia’s growing role in clean ammonia. Woodside Energy acquired OCI Clean Ammonia to strengthen its position ahead of projected demand doubling by 2050. NH3 Clean Energy is advancing its WAH2 project through Chevron gas discussions and an AUD 725,000 equity raise. Sprintex concluded an AUD 1 Million emissions reduction tech trial targeting livestock. InterContinental Energy is also progressing its 50GW Western Green Energy Hub, aiming to supply renewable ammonia at AUD 1,000 per tonne by 2034. This trend is further reinforced by increasing demand from countries like Japan and South Korea, which are seeking low-emission energy carriers. As the green hydrogen economy scales, green ammonia is positioned as a critical vector for renewable energy trade and decarbonization.

To get more information on this market Request Sample

Growth in Agricultural and Fertilizer Demand

Ammonia remains a fundamental input in the production of nitrogen-based fertilizers such as urea and ammonium nitrate, which are essential for Australia's grain and horticulture sectors. The continued expansion of agricultural exports, coupled with rising food security concerns globally, has driven sustained domestic fertilizer demand. Moreover, volatility in global fertilizer supply chains has encouraged a greater emphasis on local ammonia production to reduce reliance on imports. Government incentives for agricultural innovation and soil health programs have further incentivized ammonia-based fertilizer usage. As Australia seeks to enhance its crop yields and export competitiveness, the stability and affordability of ammonia supply will remain a strategic priority for both producers and policymakers. For instance, in May 2024, Plug Power signed a BEDP agreement with Allied Green Ammonia (AGA) to support a 3 GW electrolyzer plant for AGA’s green ammonia facility in Australia’s Northern Territory, targeting 2,700 metric tons per day or 958,500 tons annually. The plant aims to be one of the most efficient globally, with FID expected by Q4 2025. The output will strengthen domestic and export fertilizer supply chains by reducing reliance on volatile global markets. As a vital component of urea and ammonium nitrate, green ammonia supports Australia’s agricultural sectors with a stable, renewable input source.

Australia Ammonia Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on physical form, application, and end use industry.

Physical Form Insights:

- Liquid

- Powder

- Gas

A detailed breakup and analysis of the market based on the physical form have provided have also been provided in the report. This includes liquid, powder, and gas.

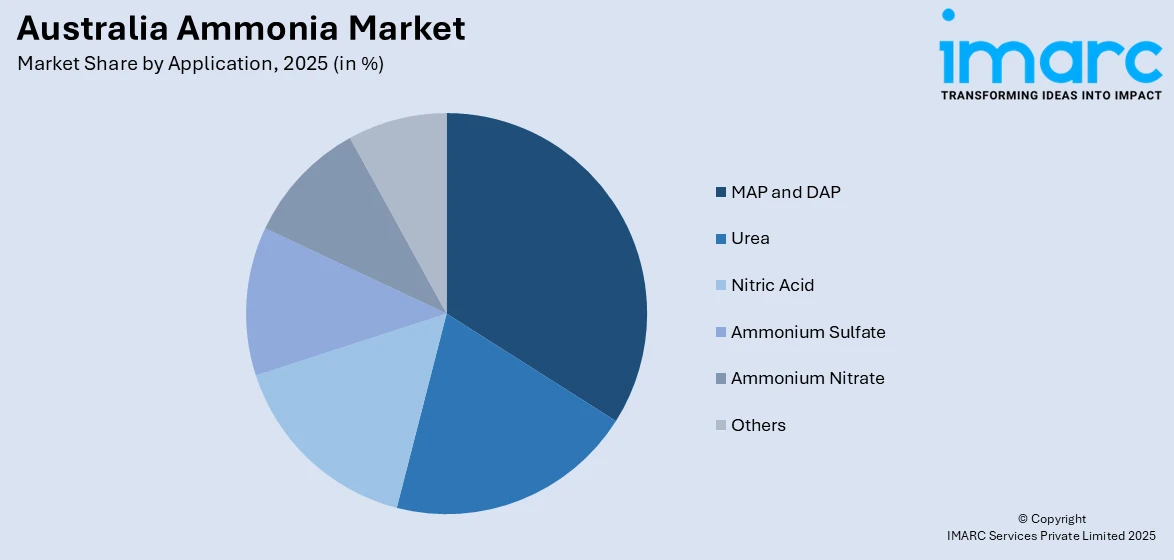

Application Insights:

Access the comprehensive market breakdown Request Sample

- MAP and DAP

- Urea

- Nitric Acid

- Ammonium Sulfate

- Ammonium Nitrate

- Others

A detailed breakup and analysis of the market based on the application have provided have also been provided in the report. This includes MAP and DAP, urea, nitric acid, ammonium sulfate, ammonium nitrate, and others.

End Use Industry Insights:

- Agrochemical

- Industrial Chemical

- Mining

- Pharmaceutical

- Textiles

- Others

A detailed breakup and analysis of the market based on the end use industry have provided have also been provided in the report. This includes agrochemical, industrial chemical, mining, pharmaceutical, textiles, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Ammonia Market News:

- In March 2025, Allied Green Ammonia (AGA) partnered with ABB through a Memorandum of Understanding to support the development of a large-scale green ammonia plant in Australia’s Northern Territory. The facility aims to produce 958,500 tons of ammonia annually, powered by a 4.75 GW solar farm and a 3 GW hydrogen electrolyzer. ABB will provide advanced electrification and automation solutions, including modular electrical systems and digital platforms, to enhance efficiency, scalability, and system performance.

- In March 2025, Copenhagen Infrastructure Partners (CIP) secured AUD 814 Million in funding from Australia’s Hydrogen Headstart program for its Murchison Green Hydrogen project in Western Australia. Backed by 6 GW of wind and solar power, the project aims to produce 1.8 million tonnes of green ammonia annually for export to Asia. This initiative strengthens Australia’s position in the global green hydrogen market and is expected to generate local jobs, support skills development, and share benefits with First Nations communities. CIP’s Australian renewable energy pipeline now exceeds 30 GW.

- In December 2024, APA Group and Wesfarmers Chemicals, Energy & Fertilisers (WesCEF) advanced a feasibility study to decarbonize WesCEF’s existing 300,000-ton-per-year ammonia plant in Western Australia using renewable hydrogen. The plan involves producing green hydrogen via electrolysis near Pinjarra and transporting it 43 km via the repurposed Parmelia Gas Pipeline to the Kwinana site. The study outlines a phased expansion—ultimately reaching 900 MW electrolyzer capacity to support over 600,000 tons of ammonia annually.

- In July 2024, Trammo SAS and Allied Green Ammonia (AGA) signed an MoU granting Trammo the option to purchase up to 100% of the 950,000 tonnes per year of green ammonia expected from AGA’s upcoming facility in Nhulunbuy, Northern Territory. The plant, one of the world’s largest, will operate a 2,700 tpd process using renewable energy to cut 1.8 million tonnes of CO₂ annually. First sales are expected in Q4 2028, supporting global decarbonization goals in ammonia supply.

Australia Ammonia Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Physical Forms Covered | Liquid, Powder, Gas |

| Applications Covered | MAP and DAP, Urea, Nitric Acid, Ammonium Sulfate, Ammonium Nitrate, Others |

| End Use Industries Covered | Agrochemical, Industrial Chemical, Mining, Pharmaceutical, Textiles, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia ammonia market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia ammonia market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia ammonia industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ammonia market in Australia was valued at USD 1,738.4 Million in 2025.

The Australia ammonia market is projected to exhibit a CAGR of 4.15% during 2026-2034, reaching a value of USD 2,534.2 Million by 2034.

The market is witnessing significant growth mainly driven by the rising demand from the agriculture sector for fertilizers, rising use in industrial applications such as chemicals and refrigeration, and increasing focus on sustainable and green ammonia production. Expanding domestic and export markets further support industry growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)