Australia Aquaculture Market Size, Share, Trends and Forecast by Fish Type, Environment, Distribution Channel, and Region, 2025-2033

Australia Aquaculture Market Size and Share:

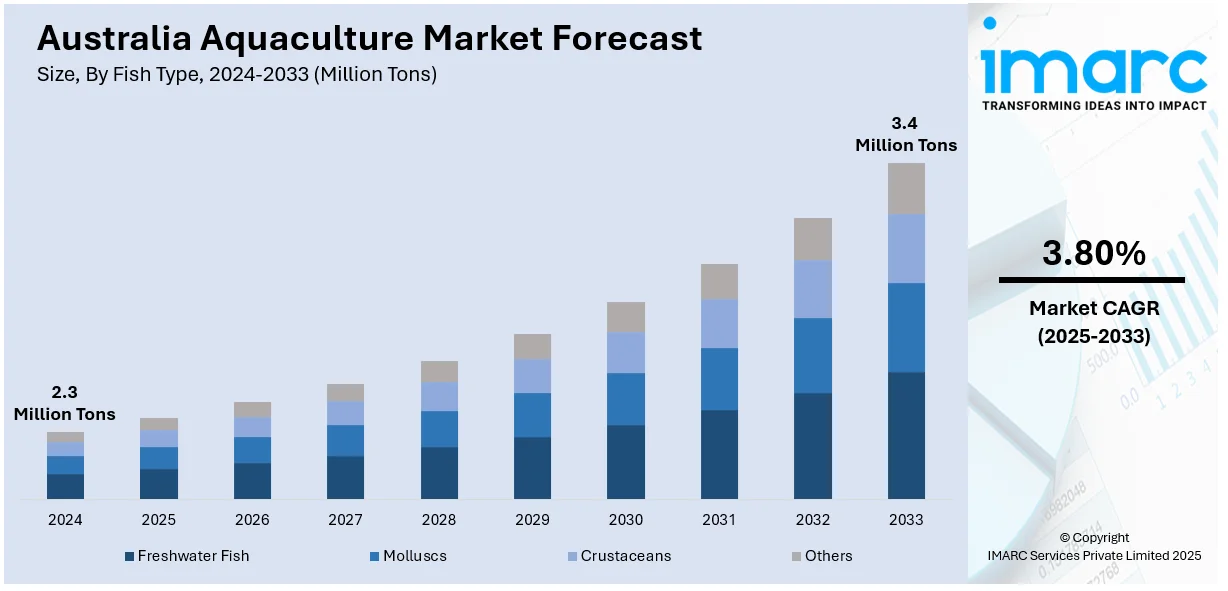

The Australia aquaculture market size reached 2.3 Million Tons in 2024. Looking forward, the market is expected to reach 3.4 Million Tons by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The market is driven by rising seafood demand, sustainable farming practices, technological advancements, government support, and export growth. Climate change resilience, biosecurity measures, species diversification and consumer preference for high-quality, locally sourced seafood also fuels the Australia aquaculture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 2.3 Million Tons |

| Market Forecast in 2033 | 3.4 Million Tons |

| Market Growth Rate 2025-2033 | 3.80% |

Key Trends of Australia Aquaculture Market:

Technological Advancements

Innovations in aquaculture technology, such as automated feeding systems, precision water quality monitoring, and disease management tools, are revolutionizing the industry. Recirculating aquaculture systems (RAS) enable land-based fish farming, reducing environmental impact and improving productivity. Genetic improvements in breeding programs enhance fish growth rates, disease resistance, and overall yield. Advanced data analytics and artificial intelligence (AI) optimize farm operations, reducing costs and improving sustainability, thereby driving the Australia aquaculture market growth. The pursuit of research and development (R&D) remains active as it generates operational efficiencies that lead to superior seafood quality. Advanced technology systems increase the sector's competitiveness, which gives Australia's aquaculture industry better performance in market delivery while making it sustainable. For instance, in November 2024, an aquaculture company based in Adelaide intends to use saline groundwater reserves that have been pumped deep from beneath the soil to build an inland fish farm hundreds of kilometers from the sea. In South Australia, A-Culture acquired a 50-hectare plot of land close to the Riverland town of Waikerie, where it intends to raise yellowtail kingfish.

To get more information on this market, Request Sample

Government Support and Regulations

According to the Australia aquaculture market analysis, the government actively promotes aquaculture through funding, policy frameworks, and regulatory measures. Financial incentives, research grants, and tax benefits encourage investment in the sector. Strict environmental regulations ensure sustainable operations, protecting marine ecosystems while fostering industry growth. State and federal initiatives focus on biosecurity measures, helping prevent disease outbreaks and ensuring food safety. Farmed seafood gains higher consumer trust through independent certification programs, which are backed by government entities and industry practices. The continuous development of innovation is supported by the strategic collaborations formed between government institutions alongside research organizations as well as private enterprises. This regulatory and financial support plays a crucial role in positioning Australia as a leader in sustainable aquaculture, thus creating a positive impact on the Australia aquaculture market outlook. For instance, in March 2025, the Albanese Labor Government announced that it would invest AUD 28 million, approximately USD 18.4 million, to upgrade the environmental conditions and water quality of Macquarie Harbor, thereby supporting a more sustainable salmon sector. This project intends to enhance and expand Macquarie Harbor's oxygenation, support breeding initiatives, and advance environmental and species monitoring, compliance, and community involvement.

Growth Drivers of Australia Aquaculture Market:

Ecological and Geographic Benefits

Australia's dramatic coastline and varied marine environments are at the core of propelling its aquaculture market growth. Spanning enormous coastlines, from the tropical oceans of the northern Kimberley and Arnhem Land regions, through the temperate regions of New South Wales and Victoria, to the cold southern bays of Tasmania, the country provides a dramatic variety of water ecosystems well-suited to cultivating various species. Unusual in this regard is the potential to grow both warm‑water stocks like tropical reef fish or prawns in the north or cold‑water stocks like salmonids and oysters in the south. Local producers avail themselves of protected bays and unspoiled waters to keep high‑quality production free from many of the disease threats that assail inland or more highly managed systems. The interaction between the natural upwellings along the east coast and the polar nutrient‑enriched currents down south is supportive of an efficient marine ecosystem, which increases feeding regime efficiency and sustainability. This ecological diversity provides Australia with a competitive advantage in generating a diverse portfolio of aquaculture species under ecologically sustainable and regionally specific methods. In addition, indigenous coastal communities in particular areas are involved through traditional knowledge and co‑management frameworks, promoting the connection between locally rooted stewardship and contemporary aquaculture growth on the continent.

Market Demand and Premium Positioning Support Development

Another central growth factor fueling the Australia aquaculture market demand is derived from increasing local and international demand for ethically produced, premium‑grade seafood, and the capacity of Australia to establish a unique reputation in this respect. Australian farmers take great care to promote their products as clean, green, traceable and responsibly grown qualities strongly linked with consumers' widespread desire for sustainability and food safety. Regional branding focuses on the clean waters of regions such as Tasmania's Derwent estuary, Eyre Peninsula of South Australia, and Western Australia's remote coastal regions, marketing their oysters, abalone, and finfish as boutique, premium products. This is more than marketing hype, as the comparatively low‑density population, lack of heavy coastal industrialization in major growing areas, and robust state‑level biosecurity measures ensure that product integrity is well maintained along the supply chain. Demand from consumers for indigenous‑grown or harvested species like native rock lobsters, sea cucumbers, or culturally important fish species further roots the industry in place identity. As consumers both in Australia's high-end restaurants and export markets, e.g., Asia's health-aware premium segment search for better and responsibly sourced seafood, producers can secure premium positioning. That demand immediately spurs investment in hatchery technology, selective breeding for local adaptability and taste profiles, and infrastructure such as offshore cage technology well-suited to Australian coastal waters.

Innovation and Cooperation Enhance Sustainability

The third pillar growth driver in Australia's aquaculture industry is the dynamic interaction of innovation, research institutions, and collaborative forms of governance adapted to local needs. Australia is home to a network of specialized marine science and aquaculture research facilities including Tasmanian, South Australian, Queensland, and Western Australian university clusters, that work closely with industry stakeholders to create region-specific breeding programs, disease‑proof stock, and environmentally friendly feed substitutes. Efforts to minimize feed footprints by utilizing regional ingredients, such as Australian seaweed or other regional industry by-products, demonstrate innovation adapted to the ecosystems of the continent. Some cooperative efforts with indigenous populations integrate traditional ecological knowledge like tidal cycles, native species behavior, and cultural management practices, into aquaculture zone planning and management, supporting sustainable growth that honors local values and biodiversity. Moreover, adaptive permitting systems and state government-designed regional marine spatial planning frameworks enable specific zoning of aquaculture facilities around vulnerable marine parks, fisheries zones, and shipping routes, thereby ensuring a peaceful coexistence. Industry expansion is encouraged while maintaining environmental protection at the forefront through regional customization. At the same time, integrated multi‑trophic aquaculture systems, in which seaweed, shellfish, and finfish are cultivated together to naturally cycle nutrients, are starting to catch on in appropriate areas such as Tasmania's southern, cooler waters and sections of the Gulf of Carpentaria. This raises productivity while it also fits Australia's coastal conservation culture perfectly. Comprehensively taken, innovation based on local research and partnerships ensures that Australia's aquaculture market is growing responsibly, resiliently, and with a distinctly local character.

Australia Aquaculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on fish type, environment, and distribution channel.

Fish Type Insights:

- Freshwater Fish

- Molluscs

- Crustaceans

- Others

The report has provided a detailed breakup and analysis of the market based on the fish type. This includes freshwater fish, molluscs, crustaceans, and others.

Environment Insights:

- Fresh Water

- Marine Water

- Brackish Water

A detailed breakup and analysis of the market based on the environment have also been provided in the report. This includes fresh water, marine water, and brackish water.

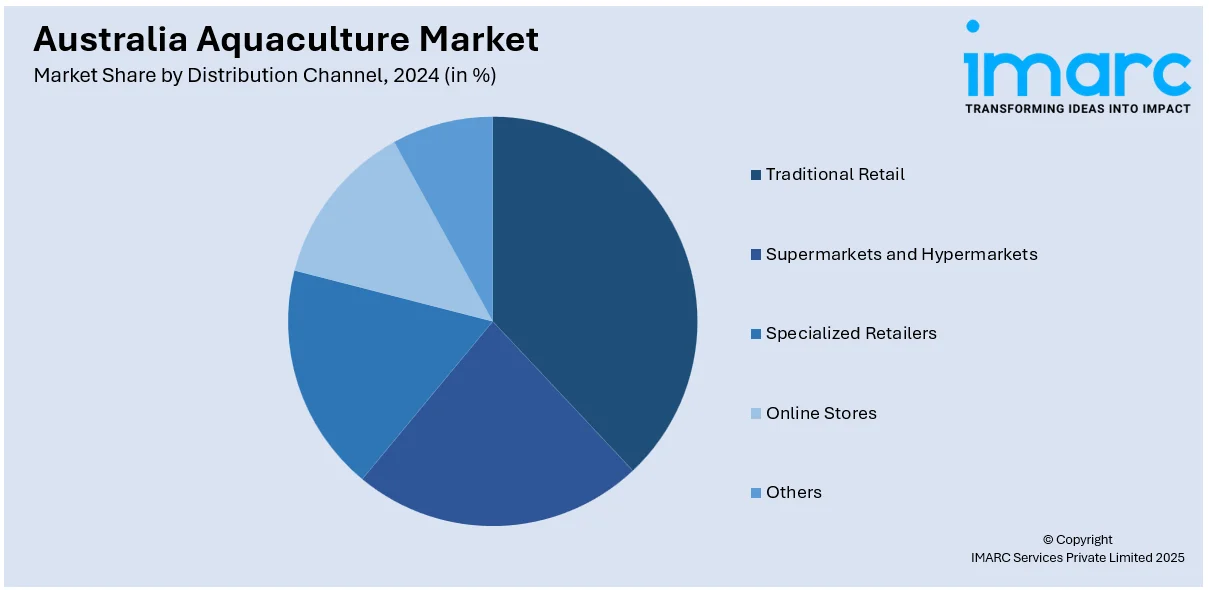

Distribution Channel Insights:

- Traditional Retail

- Supermarkets and Hypermarkets

- Specialized Retailers

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes traditional retail, supermarkets and hypermarkets, specialized retailers, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Aquaculture Market News:

- In January 2024, Genics, an Australian biotechnology company, introduced Shrimp MultiPath 2.0, a cutting-edge technology designed for the early identification of shrimp diseases. The technology sets itself apart from conventional kits and services by allowing the detection of 18 shrimp pathogens in a single test rather than only one pathogen per sample.

- In March 2025, The Community-Based Aquaculture Training (CBATT) Project's two-day workshop marked the beginning of the Aboriginal Sea Company's (ASC) and Skills Insight collaboration, which is off to a great start in 2025. ASC, Skills Insight, and important community stakeholders came together for the event to work on creating culturally relevant aquaculture training materials that will strengthen First Nations communities.

Australia Aquaculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fish Types Covered | Freshwater Fish, Molluscs, Crustaceans, Others |

| Environments Covered | Fresh Water, Marine Water, Brackish Water |

| Distribution Channels Covered | Traditional Retail, Supermarkets and Hypermarkets, Specialized Retailers, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia aquaculture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia aquaculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia aquaculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia aquaculture market reached a volume of 2.3 Million Tons in 2024.

The Australia aquaculture market is projected to exhibit a CAGR of 3.80% during 2025-2033.

The Australia aquaculture market is expected to reach a volume of 3.4 Million Tons by 2033.

Key trends in Australia aquaculture market include growth in offshore farming, increased adoption of sustainable practices, expansion of native species cultivation, and integration of technology for monitoring and efficiency. Consumer demand for traceable, eco-friendly seafood is shaping production, while research partnerships drive innovation in disease resistance and feed alternatives.

The Australia aquaculture market is driven by pristine coastal environments, strong biosecurity regulations, rising global demand for sustainable seafood, and regional expertise. Diverse climates support various species, while innovation in breeding and feed efficiency enhances productivity. Indigenous partnerships and eco-certifications further strengthen consumer trust and international market competitiveness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)