Australia Artificial Insemination Market Size, Share, Trends and Forecast by Type, Source Type, End Use, and Region, 2025-2033

Australia Artificial Insemination Market Size and Share:

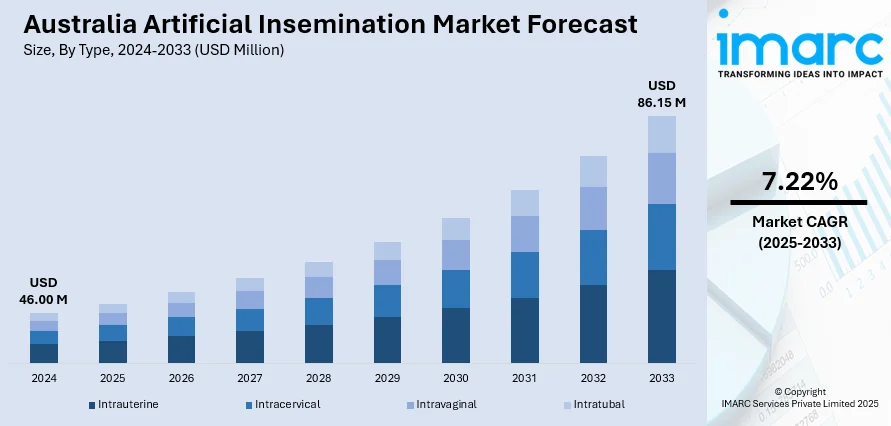

The Australia artificial insemination market size reached USD 46.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 86.15 Million by 2033, exhibiting a growth rate (CAGR) of 7.22% during 2025-2033. Rising infertility rates among both humans and livestock, advancements in reproductive technologies like AI-driven embryo selection and ambient-temperature semen storage, improving healthcare accessibility in remote regions, and the escalating demand for genetic quality and breeding efficiency are among the key factors driving the Australia artificial insemination market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 46.00 Million |

| Market Forecast in 2033 | USD 86.15 Million |

| Market Growth Rate 2025-2033 | 7.22% |

Australia Artificial Insemination Market Trends:

Rising Demand for Livestock Genetic Improvement

Australia’s agricultural sector, particularly the beef and dairy industries, relies heavily on livestock production. A major driver for the adoption of artificial insemination (AI) is the increasing demand for genetic improvement within cattle herds. AI facilitates the selective breeding of livestock from superior genetics, often sourced from elite sires located in distant regions. This practice has significant implications for productivity, profitability, and sustainability in livestock farming. It enables the controlled introduction of desirable traits, such as enhanced milk production, disease resistance, improved fertility, and improved feed efficiency. These traits are crucial, especially given the harsh Australian climate and expansive, semi-arid grazing areas, where efficient resource utilization is essential. AI circumvents the limitations associated with natural mating, enabling remote farms to access high-quality genetics without the need to transport live animals. Furthermore, government-backed programs like BREEDPLAN, which provide performance data to support informed breeding decisions, further enhance AI adoption. The nation's focus on beef and dairy exports also catalyzes improving product quality, thus encouraging the widespread implementation of AI technologies.

To get more information on this market, Request Sample

Advances in Human Fertility Treatments and Societal Changes

AI is also experiencing substantial growth in Australia due to evolving societal values, increasing infertility rates, and advancements in reproductive medicine. The rising average age at which individuals choose to start families, often driven by career and financial considerations, has led to a rise in age-related infertility. Artificial insemination, particularly intrauterine insemination (IUI), is increasingly seen as an affordable and minimally invasive initial treatment for fertility challenges. Additionally, same-sex couples and single women are increasingly opting for AI services. Changes in social attitudes, alongside progressive legislation (such as anti-discrimination laws and revised access rights to fertility treatments), have made assisted reproduction more widely accepted. Medical advancements have contributed to this growth by improving AI success rates through enhanced sperm processing techniques, hormone therapies, and ultrasound-assisted insemination methods. Private fertility clinics are also improving their services, driven by increased private health insurance coverage and government funding for fertility treatments through Medicare.

Australia Artificial Insemination Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, source type, end use, and region.

Type Insights:

- Intrauterine

- Intracervical

- Intravaginal

- Intratubal

The report has provided a detailed breakup and analysis of the market based on the type. This includes intrauterine, intracervical, intravaginal, and intratubal.

Source Type Insights:

- AIH-Husband

- AID-Donor

A detailed breakup and analysis of the market based on the source type have also been provided in the report. This includes AIH-husband and AID-donor.

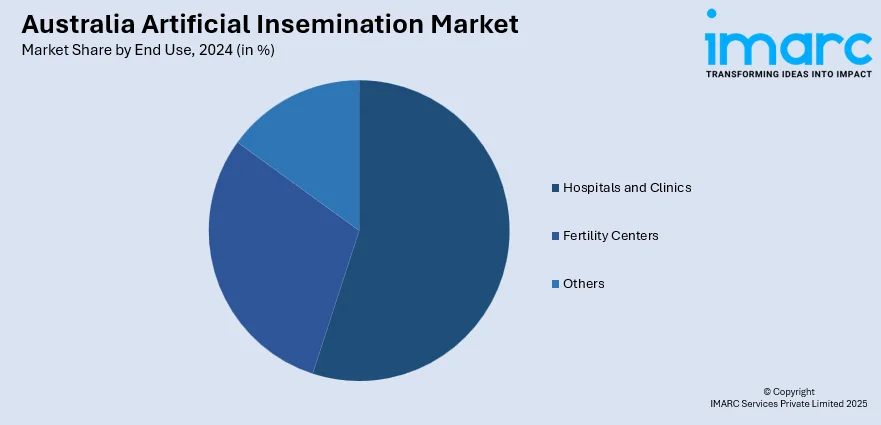

End Use Insights:

- Hospitals and Clinics

- Fertility Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes hospitals and clinics, fertility centers, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Artificial Insemination Market News:

- July 2024: AIVF introduced its artificial intelligence-driven IVF solutions to the Australian market, aiming to enhance treatment outcomes through predictive analytics and decision support for healthcare professionals. This launch provides clinics with advanced tools to improve success rates and streamline the IVF process, potentially leading to faster pregnancies and less invasive procedures for patients. By integrating sophisticated AI models trained on extensive embryo data, AIVF's entry is poised to influence the Australian artificial insemination market by offering cutting-edge reproductive technologies.

- January 2024: Memphasys, an Australian med-tech company, reported promising results from trials of its AI‑Port system, an innovation in artificial insemination. The system enables semen storage and transport at ambient temperature for up to three days without freezing, preserving sperm quality. Trials in cattle, pigs, horses, and sheep reportedly showed improved sperm motility and reduced DNA damage.

Australia Artificial Insemination Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Intrauterine, Intracervical, Intravaginal, Intratubal |

| Source Types Covered | AIH-Husband, AID-Donor |

| End Uses Covered | Hospitals and Clinics, Fertility Centers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia artificial insemination market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia artificial insemination market on the basis of type?

- What is the breakup of the Australia artificial insemination market on the basis of source type?

- What is the breakup of the Australia artificial insemination market on the basis of end use?

- What is the breakup of the Australia artificial insemination market on the basis of region?

- What are the various stages in the value chain of the Australia artificial insemination market?

- What are the key driving factors and challenges in the Australia artificial insemination market?

- What is the structure of the Australia artificial insemination market and who are the key players?

- What is the degree of competition in the Australia artificial insemination market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia artificial insemination market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia artificial insemination market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia artificial insemination industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)