Australia Asset Performance Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Industry Vertical, and Region, 2025-2033

Australia Asset Performance Management Market Size and Share:

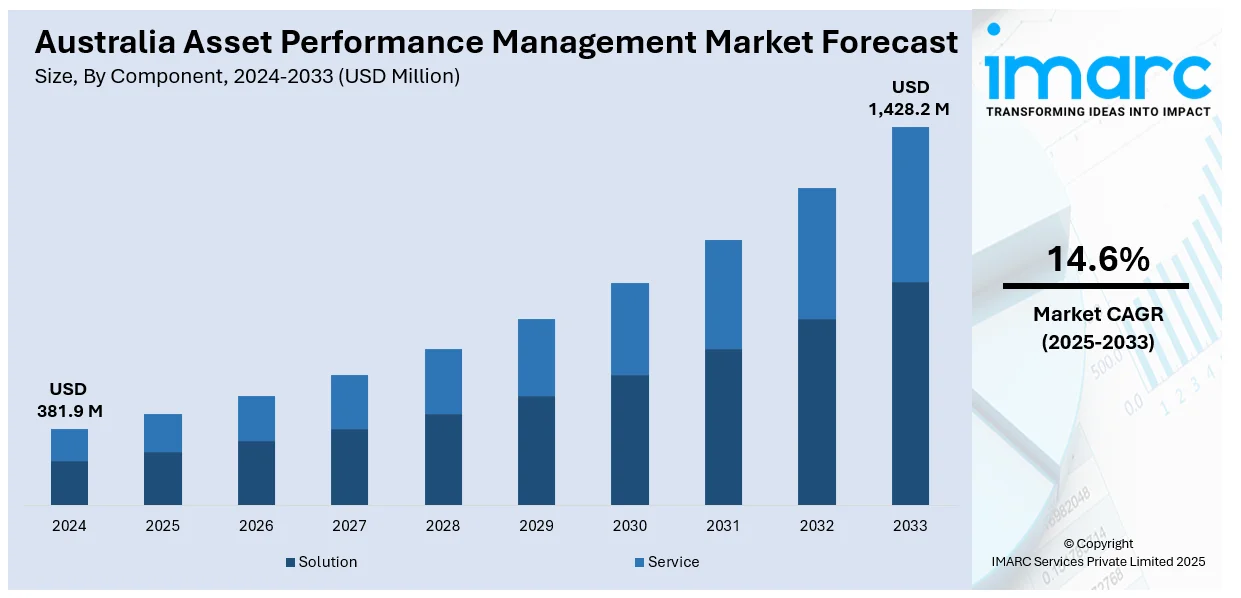

The Australia asset performance management market size reached USD 381.9 Million in 2024. Looking forward, the market is expected to reach USD 1,428.2 Million by 2033, exhibiting a growth rate (CAGR) of 14.6% during 2025-2033. Rising predictive maintenance adoption, cloud-based platform growth, government incentives, industrial digitalization, surging mining sector demand, real-time diagnostics, energy efficiency targets, and regulatory compliance pressures are factors stimulating the Australia asset performance management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 381.9 Million |

| Market Forecast in 2033 | USD 1,428.2 Million |

| Market Growth Rate 2025-2033 | 14.6% |

Key Trends of Australia Asset Performance Management Market:

Rise in Predictive Maintenance Investments

The burgeoning investments in predictive maintenance solutions is the key factor driving the Australian asset performance management market growth. Industrial operators across mining, energy, and manufacturing sectors are moving away from reactive maintenance models toward predictive frameworks that rely on data-driven forecasts to preempt equipment failures. This shift is supported by the growing availability of affordable sensors and analytics software, allowing real-time monitoring of asset conditions such as vibration, temperature, and pressure. In line with this, companies are increasingly leveraging historical maintenance data, machine learning (ML) algorithms, and digital twins to anticipate failure points and optimize maintenance schedules. This reduces unplanned downtime, lowers repair costs, and extends asset life cycles. Predictive maintenance is particularly valuable in the region’s remote operations which further increases Australia asset performance management market share, as repair logistics are costly and time-consuming.

To get more information on this market, Request Sample

Government Incentives for Smart Manufacturing

Supportive government policies are playing a catalytic role in expanding Australia’s asset performance management capabilities. Programs such as the “Modern Manufacturing Strategy” and industry-specific grants are incentivizing digital upgrades in production facilities. These initiatives aim to enhance competitiveness and resilience in sectors like food processing, critical minerals, and defense manufacturing. Asset management systems integrated with condition monitoring and failure prediction are being positioned as essential components of advanced manufacturing infrastructure. By supporting the adoption of connected machinery and industrial automation, these incentives are facilitating the transition from traditional maintenance regimes to performance-based asset oversight. This policy-backed shift is fostering a culture of digital readiness, particularly among small and mid-sized enterprises, which previously lacked the capital to invest in such systems.

Expansion of Cloud-Based APM Platforms

The rapid deployment of cloud-based asset performance management platforms is a key factor reshaping the Australia asset performance management market demand. These platforms allow organizations to centralize asset monitoring, data analytics, and reporting across geographically dispersed sites. Cloud-native APM solutions offer scalability, faster implementation timelines, and reduced Information Technology (IT) overheads, making them ideal for industries with widespread field operations such as mining, utilities, and logistics. The ability to access real-time data from any location is enhancing decision-making and response times, especially in remote and rugged environments where downtime can lead to high opportunity costs. Cloud integration also facilitates the use of artificial intelligence (AI) and machine learning (ML) for deeper asset insights, enabling continuous improvement in reliability strategies, which is fueling the market growth.

Growth Drivers of Australia Asset Performance Management Market:

Government Policies and Investment in Infrastructure

The proactive stance of the Australian government toward infrastructure development plays a crucial role in the expansion of the Asset Performance Management (APM) market. The National Infrastructure Plan and the Digital Business Plan prioritize the upkeep and enhancement of infrastructure assets. These policies urge companies to embrace digital solutions, such as APM software, to improve asset reliability and performance. By investing in infrastructure and driving digital transformation, the government establishes a conducive environment for the uptake of APM technologies in numerous sectors such as utilities, transport, and public services. Such strategic emphasis drives economic growth and guarantees that key assets are run efficiently with minimal downtime while their lifecycle is prolonged.

Technological Advancements and Industry Adoption

Emerging technologies are the key drivers of the adoption of Asset Performance Management solutions in Australia. Businesses may monitor asset conditions in real time by integrating big data analytics, artificial intelligence (AI), and Internet of Things (IoT) sensors; forecast possible failures; and optimize maintenance planning. Mining, energy, and manufacturing industries are relying more on these technologies to maximize operating effectiveness and minimize cost. The deployment of sophisticated APM solutions specifically designed for the specific requirements of Australian industries further catalyzes their implementation. With these technologies advancing further, companies can handle their assets in a more proactive manner, causing enhanced performance and lower operation risks.

Sustainability Goals and Regulatory Compliance

According to the Australia asset performance management market analysis, the region’s dedication to sustainability and environmental stewardship is fueling the need for asset management solutions. With greater focus on environmental, social, and governance (ESG) factors, companies are looking for methods to maximize asset performance and reduce their environmental footprint. APM solutions offer functionality for tracking energy usage, lowering emissions, and maintaining environmental compliance. Sectors like transport and utilities are embracing APM technologies in line with sustainability objectives and compliance with regulations. By incorporating APM solutions, companies are able to make their operations more efficient, lower costs, and help Australia's overall environmental agenda toward a sustainable future.

Australia Asset Performance Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, and industry vertical.

Component Insights:

- Solution

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and service.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium-sized enterprises.

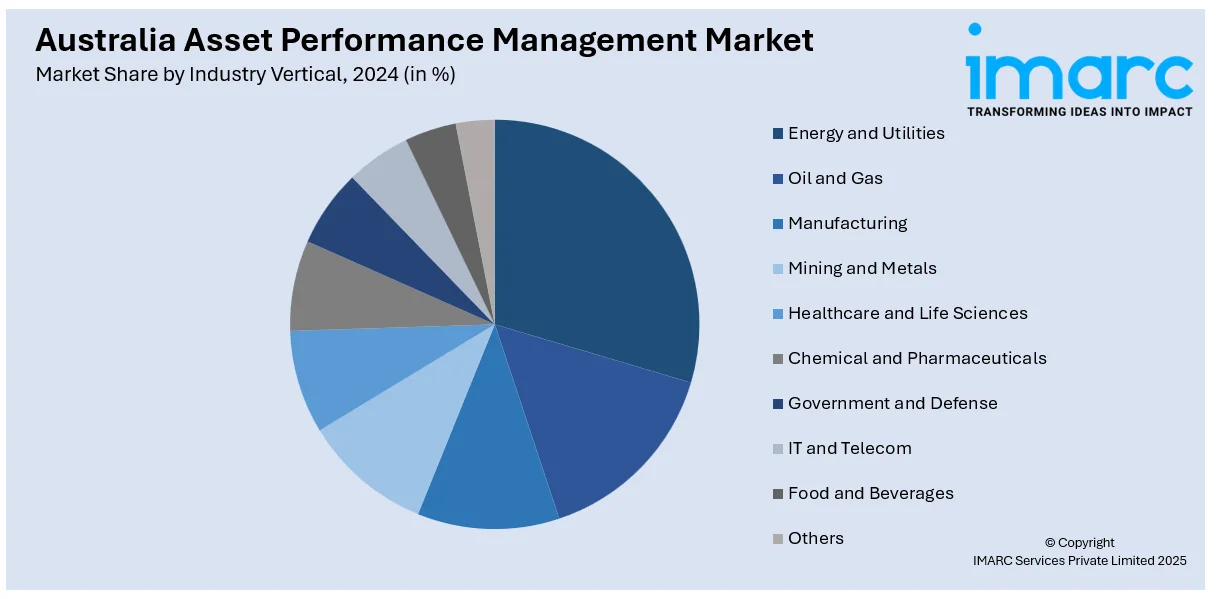

Industry Vertical Insights:

- Energy and Utilities

- Oil and Gas

- Manufacturing

- Mining and Metals

- Healthcare and Life Sciences

- Chemical and Pharmaceuticals

- Government and Defense

- IT and Telecom

- Food and Beverages

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes energy and utilities, oil and gas, manufacturing, mining and metals, healthcare and life sciences, chemical and pharmaceuticals, government and defense, IT and telecom, food and beverages, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Asset Performance Management Market News:

- In 2025, Macquarie Asset Management expanded its active exchange-traded fund (ETF) platform with the launch of the Macquarie National High-Yield Municipal Bond ETF (HTAX). This ETF provides investors with access to the firm's national high-yield municipal bond strategy.

Australia Asset Performance Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Service |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | Energy and Utilities, Oil and Gas, Manufacturing, Mining and Metals, Healthcare and Life Sciences, Chemical and Pharmaceuticals, Government and Defense, IT and Telecom, Food and Beverages, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia asset performance management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia asset performance management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia asset performance management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia asset performance management market was valued at USD 381.9 Million in 2024.

The Australia asset performance management market is projected to exhibit a CAGR of 14.6% during 2025-2033.

The Australia asset performance management market is expected to reach a value of USD 1,428.2 Million by 2033.

Australia's Asset Performance Management market is moving toward cloud-based services, improving scalability and access to real-time data. Adoption of predictive maintenance technology and Internet of Things (IoT) devices is becoming increasingly popular. Moreover, industries are concentrating on sustainability by following green asset management practices, thereby minimizing environmental footprint.

Australia's asset performance management market is fueled by increasing infrastructure spending, technological innovations such as IoT and AI integration, and robust government support for digitalization. Growing emphasis on operational efficiency, and regulatory compliance in industries such as mining, utilities, and transportation also drives demand for sophisticated asset management solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)