Australia Assisted Reproductive Technology Market Size, Share, Trends and Forecast by Product, Type, End Use, and Region, 2025-2033

Australia Assisted Reproductive Technology Market Overview:

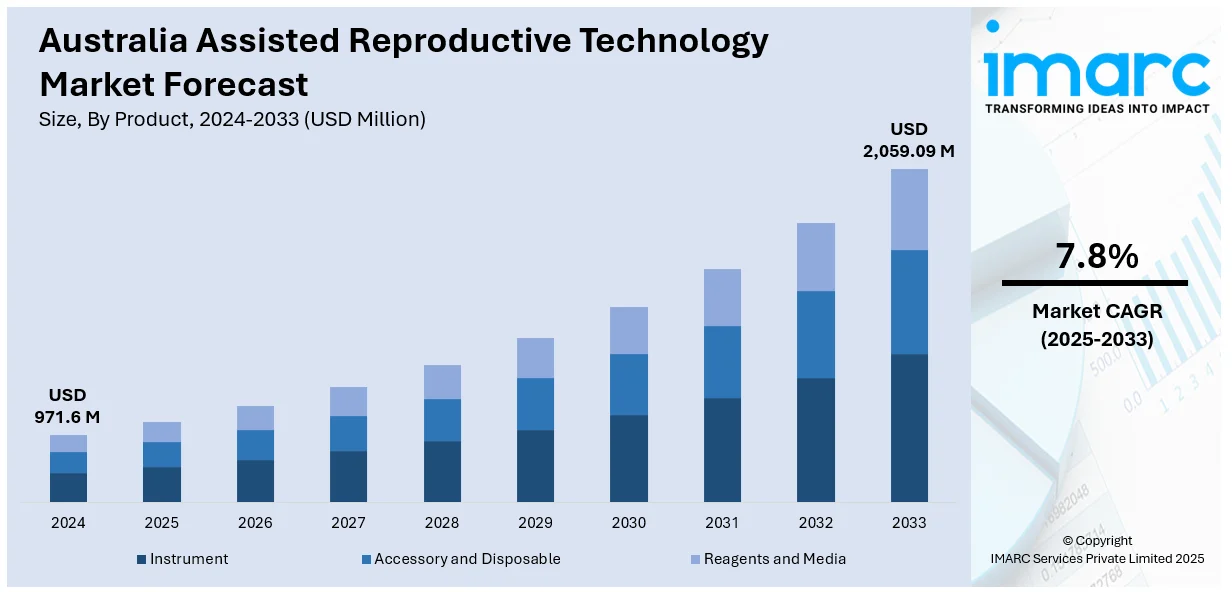

The Australia assisted reproductive technology market size reached USD 971.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,059.09 Million by 2033, exhibiting a growth rate (CAGR) of 7.8% during 2025-2033. Rising infertility rates, delayed parenthood, supportive government regulations, increasing awareness of fertility treatments, improved success rates of procedures, technological advancements in IVF, and growing acceptance of same-sex parenting and single-parent fertility options are some of the factors contributing to Australia assisted reproductive technology market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 971.6 Million |

| Market Forecast in 2033 | USD 2,059.09 Million |

| Market Growth Rate 2025-2033 | 7.8% |

Australia Assisted Reproductive Technology Market Trends:

Global Alliances Reshaping Fertility Solutions

Australia’s assisted reproductive technology space is seeing increased strategic collaboration with global players. A notable development involves the deepening of exclusive partnerships to facilitate the distribution of internationally developed fertility solutions. This movement reflects growing demand for advanced technologies and integrated fertility care within the country. By aligning with international medical innovators, local fertility service providers are improving access to sophisticated reproductive tools, potentially enhancing treatment outcomes and procedural efficiency. The expansion of distribution channels through exclusive agreements points to rising confidence in cross-border technological capabilities. With a sharper focus on tailored reproductive solutions and platform integration, Australia’s market continues to evolve through strategic alliances that extend beyond domestic innovation. This international alignment indicates a broader shift toward premiumization and patient-centric reproductive care, shaped by global expertise and domestic implementation. These factors are intensifying the Australia assisted reproductive technology market growth. For example, in September 2024, Genea Biomedx solidified its exclusive partnership with Genea Fertility in Australia, aiming to distribute Basecare Medical's assisted reproductive technology internationally.

To get more information of this market, Request Sample

Collaborative Efforts Enhancing Regional Fertility Care

The assisted reproductive technology landscape in Australia is witnessing increased collaboration aimed at improving regional access to high-quality fertility services. In South Australia, new partnerships are fostering the introduction of advanced reproductive tools and clinical expertise, elevating standards of care and broadening treatment availability. These alliances are narrowing the gap between metropolitan and regional offerings by enabling more localized access to cutting-edge procedures previously limited to select urban centers. As patient expectations rise, fertility providers are focusing on personalized, efficient, and technologically enriched services. The integration of advanced embryology systems and experienced specialists is expected to improve success rates and patient satisfaction. Such coordinated efforts reflect a broader momentum toward decentralized access to premium fertility care, allowing a wider demographic to benefit from innovation and best practices without the need to travel extensively for top-tier treatment. For instance, in November 2024, Fertility SA announced a partnership with Genea Fertility to bring advanced fertility technology and expertise to South Australia, enhancing patient care and access to leading reproductive treatments.

Australia Assisted Reproductive Technology Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, type, and end use.

Product Insights:

- Instrument

- Sperm Separation System

- Cryosystem

- Incubator

- Imaging System

- Ovum Aspiration Pump

- Cabinet

- Micromanipulator

- Laser Systems

- Others

- Accessory and Disposable

- Reagents and Media

- Cryopreservation Media

- Semen Processing Media

- Ovum Processing Media

- Embryo Culture Media

The report has provided a detailed breakup and analysis of the market based on the product. This includes instrument (sperm separation system, cryosystem, incubator, imaging system, ovum aspiration pump, cabinet, micromanipulator, laser systems, and others), accessory and disposable, and reagents and media (cryopreservation media, semen processing media, ovum processing media, and embryo culture media).

Type Insights:

- In-Vitro Fertilization (IVF)

- Fresh Donor

- Frozen Donor

- Fresh Non-Donor

- Frozen Non-Donor

- Artificial Insemination

- Intrauterine Insemination

- Intracervical Insemination

- Intravaginal Insemination

- Intratubal Insemination

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes in-vitro fertilization (IVF) (fresh donor, frozen donor, fresh non-donor, and frozen non-donor) and artificial insemination (intrauterine insemination, intracervical insemination, intravaginal insemination, and intratubal insemination).

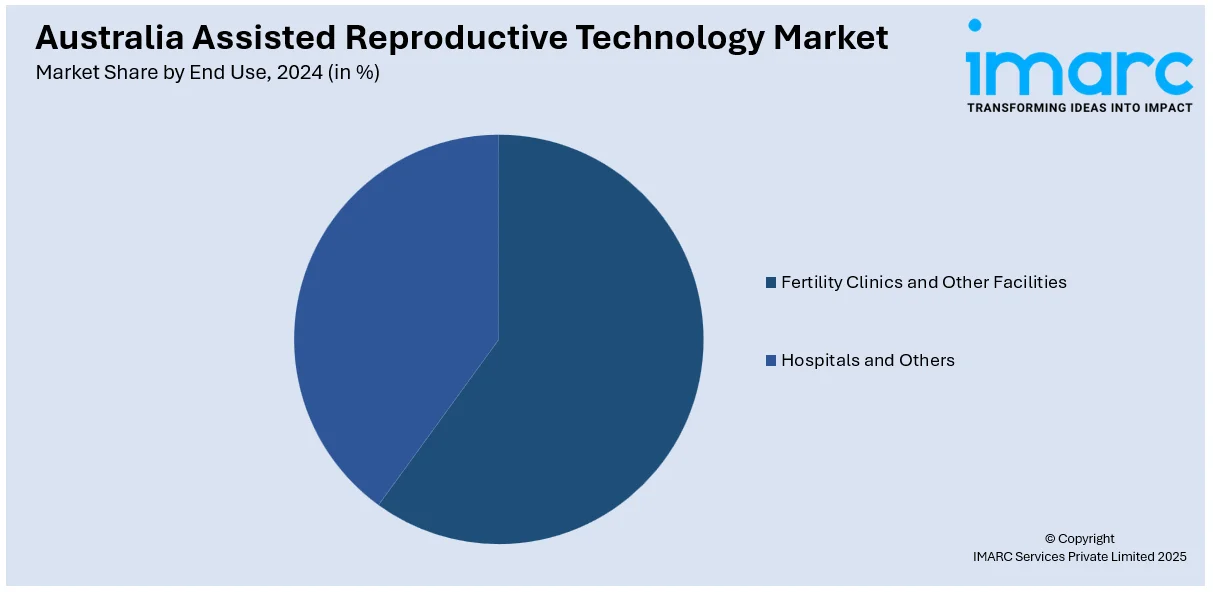

End Use Insights:

- Fertility Clinics and Other Facilities

- Hospitals and Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes fertility clinics and other facilities and hospitals and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Assisted Reproductive Technology Market News:

- In March 2025, the Albanese government announced that, starting May 1, new drugs for contraception, endometriosis, and IVF would be subsidized under Australia’s Pharmaceutical Benefits Scheme (PBS), potentially saving women thousands of dollars annually.

- In December 2024, Gameto, a women's health biotechnology company, partnered with IVFAustralia, part of the Virtus Health group, to make its product, Fertilo, available for patients at select IVFA/Virtus clinics in Australia.

Australia Assisted Reproductive Technology Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Types Covered |

|

| End Uses Covered | Fertility Clinics and Other Facilities, Hospitals and Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia assisted reproductive technology market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia assisted reproductive technology market on the basis of product?

- What is the breakup of the Australia assisted reproductive technology market on the basis of type?

- What is the breakup of the Australia assisted reproductive technology market on the basis of end use?

- What is the breakup of the Australia assisted reproductive technology market on the basis of region?

- What are the various stages in the value chain of the Australia assisted reproductive technology market?

- What are the key driving factors and challenges in the Australia assisted reproductive technology?

- What is the structure of the Australia assisted reproductive technology market and who are the key players?

- What is the degree of competition in the Australia assisted reproductive technology market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia assisted reproductive technology market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia assisted reproductive technology market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia assisted reproductive technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)