Australia Auto Financing Market Size, Share, Trends and Forecast by Type, Source Type, Vehicle Type, and Region, 2025-2033

Australia Auto Financing Market Overview:

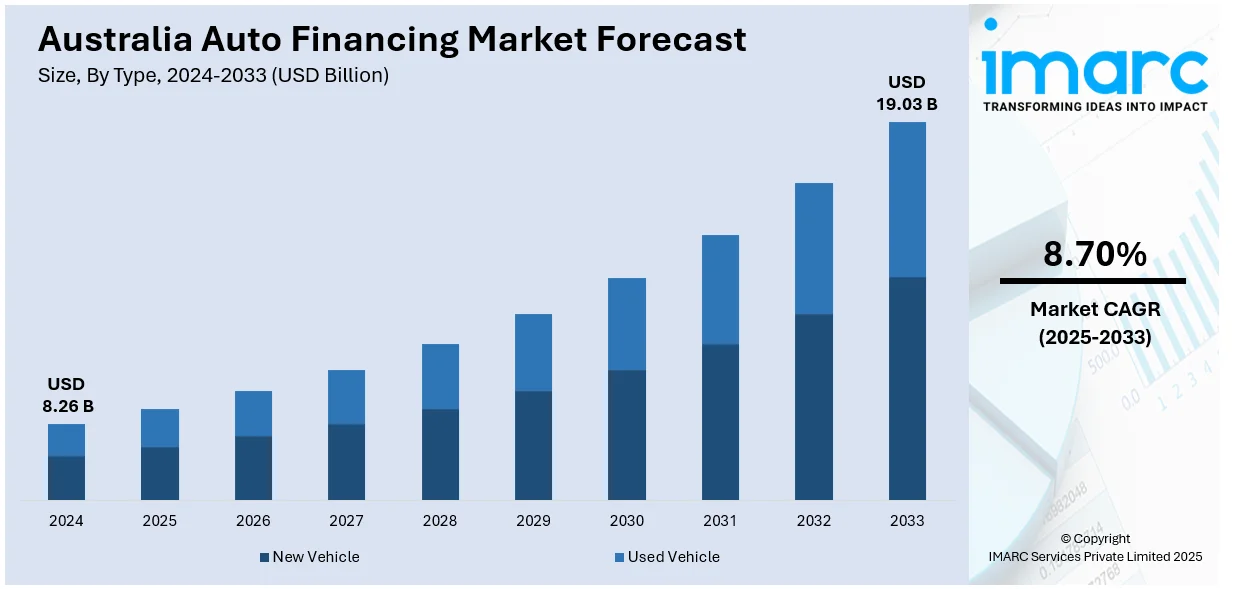

The Australia auto financing market size reached USD 8.26 Billion in 2024. Looking forward, the market is expected to reach USD 19.03 Billion by 2033, exhibiting a growth rate (CAGR) of 8.70% during 2025-2033. Technological advancements and digital platforms are simplifying the auto financing process in Australia, making it more accessible, especially for younger, tech-savvy individuals. Additionally, the increasing interest in electric vehicles (EVs), attributed to sustainability concerns, government incentives, and evolving user preferences, are contributing to the expansion of the Australia auto financing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.26 Billion |

| Market Forecast in 2033 | USD 19.03 Billion |

| Market Growth Rate 2025-2033 | 8.70% |

Key Trends of Australia Auto Financing Market:

Technological Advancements and Digital Platforms

Technological innovations are transforming the auto financing sector in Australia, especially with the emergence of digital platforms and mobile apps. The transition towards online funding resources is streamlining and improving the process of applying for and obtaining auto loans. Borrowers can easily evaluate loan proposals, track their funding progress, and manage payments using straightforward, user-friendly platforms. This digital shift attracts younger, tech-savvy individuals who prefer completing transactions online, thereby eliminating the need for physical visits to dealerships or banks. Furthermore, sophisticated data analysis and machine learning (ML) enable lenders to evaluate risk more precisely, allowing them to provide customized financing options and expedite loan approvals. These advancements are enhancing auto financing accessibility, even for those with minimal credit backgrounds, by reducing entry barriers. A notable illustration of this change is Hyundai Capital's introduction of Hyundai Finance in Australia in 2024. The firm launched a digital-first strategy featuring online applications and artificial intelligence (AI)-enhanced assistance, as well as Guaranteed Future Value (GFV) loans that provide customized financing for Hyundai and Genesis cars. This established Hyundai Capital's 12th worldwide subsidiary, greatly improving flexibility and affordability for clients in Australia. Through the integration of cutting-edge technologies and adaptable financing solutions, Hyundai Finance is contributing to the increasing digitalization of the Australian auto financing industry, simplifying access for clients to the vehicles they desire.

To get more information on this market, Request Sample

Shifting User Preferences Toward Electric Vehicles

The rising interest in EVs is significantly influencing the Australia auto financing market growth, driven by a heightened focus on environmental sustainability and a desire to reduce carbon emissions. With an increasing number of people seeking sustainable transportation solutions, EVs are emerging as a popular option. In response to this change, lenders are introducing specialized financing solutions tailored for EV purchasers, offering distinct terms, such as reduced interest rates, extended repayment periods, and perks like deferred payments. Government programs, such as subsidies and tax breaks for purchasing EVs, are also catalyzing the demand for these vehicles, creating a favorable environment for the expansion of the auto financing sector. A significant instance of this trend is the collaboration between Plenti and NAB, which introduced the ‘NAB powered by Plenti’ car and EV loan in 2024. Originally accessible to NAB employees, this loan offered a seamless digital application and management experience, financed and approved by NAB, and aimed to deliver a novel, user-centric solution for funding both conventional cars and EVs. This partnership highlights how financial organizations are responding to the growing interest in EVs by developing flexible, accessible loan options.

Growth Drivers of Australia Auto Financing Market:

Rising Vehicle Ownership in Urban and Regional Areas

The steady rise in vehicle ownership across both metropolitan and regional Australia is significantly boosting the demand for auto financing services. As population density increases in major cities and outer suburban areas, personal vehicles are becoming a necessity due to inconsistent access to efficient public transportation. Simultaneously, regional communities also rely heavily on private vehicles for mobility. This growing dependence is leading more Australians to seek accessible and structured financing options. Auto loans, leases, and flexible repayment plans are helping bridge affordability gaps for consumers, making vehicle purchases more viable. As a result, the expanding automotive user base is directly contributing to a robust and resilient growth environment for the Australian auto financing market across geographic and demographic segments.

Intensifying Competition in the Lending Space

Australia's auto financing market benefits from a highly competitive lending landscape, with participation from traditional banks, credit unions, fintech lenders, and original equipment manufacturer (OEM) financing arms. This competition drives innovation in loan structuring and results in favorable terms such as lower interest rates, minimal upfront costs, and longer repayment durations. Consumers gain from this environment as they can compare and choose tailored solutions that align with their financial capacity and vehicle preferences. The accessibility of multiple financing providers has reduced entry barriers, encouraging even first-time buyers to finance their vehicles. This market dynamic supports deeper loan penetration across urban and rural Australia and enables auto financiers to develop niche offerings that target specific vehicle types or buyer segments, further fueling the Australia auto financing market growth.

Economic Resilience and Growing Consumer Confidence

Australia’s stable macroeconomic environment plays a pivotal role in fostering growth within the auto financing industry. Low inflation volatility, steady GDP growth, and falling unemployment levels have collectively boosted consumer confidence, leading to greater financial optimism. As personal incomes recover and disposable earnings rise, more Australians feel secure in making long-term financial commitments, including auto loans. The improved economic sentiment is also reflected in increased retail spending, higher credit activity, and willingness to invest in big-ticket items like vehicles. Lenders benefit from this favorable outlook, as credit risks decline and loan default rates remain manageable. Together, these conditions create a supportive ecosystem that promotes consistent growth in vehicle financing, positioning the industry as a key contributor to the broader financial services sector.

Opportunities of Australia Auto Financing Market

Growing Potential in Used Car Financing

The rising popularity of used vehicles in Australia, driven by affordability concerns and limited availability of new cars, presents a promising opportunity for auto financiers. As more budget-conscious buyers explore the second-hand market, lenders can expand their portfolios by offering tailored financing solutions for pre-owned vehicles. These loans often carry lower principal amounts and shorter tenures, making them less risky and more accessible to a wider demographic. Financing providers that introduce flexible repayment terms, vehicle verification tools, and warranty-backed lending products can build trust among consumers while capturing market share. Additionally, partnerships with used car platforms and certified dealers can streamline approval processes and enhance reach. The growing shift toward used vehicle purchases offers a scalable and stable growth path for the auto financing sector.

Introduction of Green Finance and Eco-Incentive Models

As environmental consciousness rises in Australia, auto financiers can lead the shift toward sustainable transport through green financing. By introducing loan schemes that reward customers for purchasing electric, hybrid, or fuel-efficient vehicles, lenders can align their offerings with growing eco-friendly preferences. According to the Australia auto financing market analysis, these programs may include reduced interest rates, extended repayment periods, or bonus rebates for eligible models. Backed by federal and state-level incentives for clean vehicle adoption, green loans can also strengthen lenders’ corporate social responsibility profiles and brand equity. Beyond environmental benefits, such initiatives attract a new segment of sustainability-focused borrowers and help build long-term customer loyalty. Offering transparent, reward-driven green finance options enables institutions to position themselves as forward-thinking players in both the financial and environmental sectors.

Strategic Dealership Collaborations to Streamline Financing

Forming close partnerships with automotive dealerships provides auto financing companies with an effective channel to increase loan conversions and improve customer retention. By embedding financing solutions directly into the vehicle purchasing process, lenders can deliver a seamless, integrated experience. On-site loan desks, co-branded financing plans, and bundled service offerings such as insurance or maintenance packages make transactions more convenient for buyers. These collaborations enable quicker approvals, personalized finance options, and simplified documentation, enhancing overall satisfaction. Dealerships also benefit from increased sales velocity, while financiers gain direct access to targeted customer segments. This mutually beneficial relationship fosters trust, accelerates market penetration, and enhances competitive positioning. As dealerships remain a primary touchpoint in the buyer journey, close cooperation can significantly boost financing uptake and market presence.

Australia Auto Financing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, source type, and vehicle type.

Type Insights:

- New Vehicle

- Used Vehicle

The report has provided a detailed breakup and analysis of the market based on the type. This includes new vehicle and used vehicle.

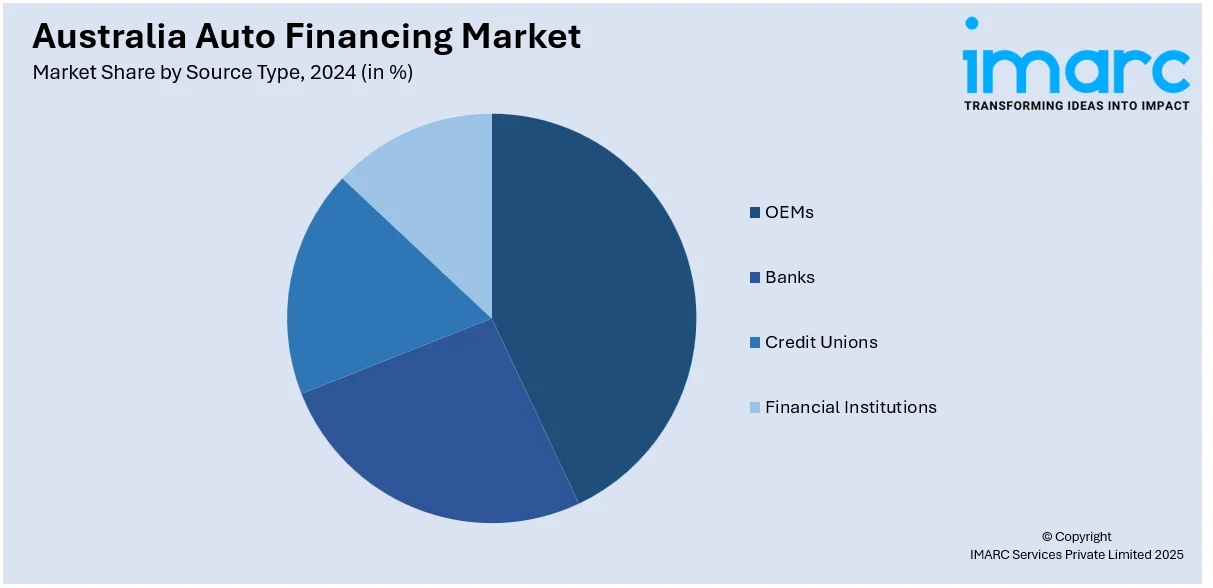

Source Type Insights:

- OEMs

- Banks

- Credit Unions

- Financial Institutions

A detailed breakup and analysis of the market based on the source type have also been provided in the report. This includes OEMs, banks, credit unions, and financial institutions.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars and commercial vehicles.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Auto Financing Market News:

- In June 2025, Hyundai Capital Australia launched Kia Finance, expanding its auto finance offerings in Australia to cover all Hyundai Motor Group brands — Hyundai, Genesis, and Kia. The move includes products like Guaranteed Future Value (GFV), aiming to enhance customer access and boost automotive sales through flexible financing.

- In May 2025, Ford Australia partnered with Angle Auto Finance to launch Ford Finance, replacing MyFord Finance. This new initiative offers tailored vehicle finance solutions for both individual and business customers, including Guaranteed Future Value (GFV) options. The program aims to create a seamless, brand-integrated financing experience to boost automotive sales and client satisfaction.

Australia Auto Financing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | New Vehicle, Used Vehicle |

| Sources Covered | OEMs, Banks, Credit Unions, Financial Institutions |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia auto financing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia auto financing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia auto financing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The auto financing market in Australia was valued at USD 8.26 Billion in 2024.

The Australia auto financing market is projected to exhibit a CAGR of 8.70% during 2025-2033.

The Australia auto financing market is projected to reach a value of USD 19.03 Billion by 2033.

The key trends in Australia’s auto financing market include a growing shift toward personalized and flexible loan structures like balloon payments and subscription models. Lenders are also increasingly adopting AI and advanced analytics to streamline credit decisions. Additionally, green financing solutions for electric and hybrid vehicles are gaining momentum amid rising sustainability priorities.

The Australian auto financing market is propelled by increasing vehicle ownership in both urban and regional areas, supported by rising mobility needs. A competitive lending environment, with attractive rates and flexible terms, encourages credit-based purchases. Additionally, steady economic conditions and growing consumer confidence further strengthen long-term loan adoption across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)