Australia Automotive Composites Market Size, Share, Trends and Forecast by Production Process, Application, Material, and Region, 2026-2034

Australia Automotive Composites Market Overview:

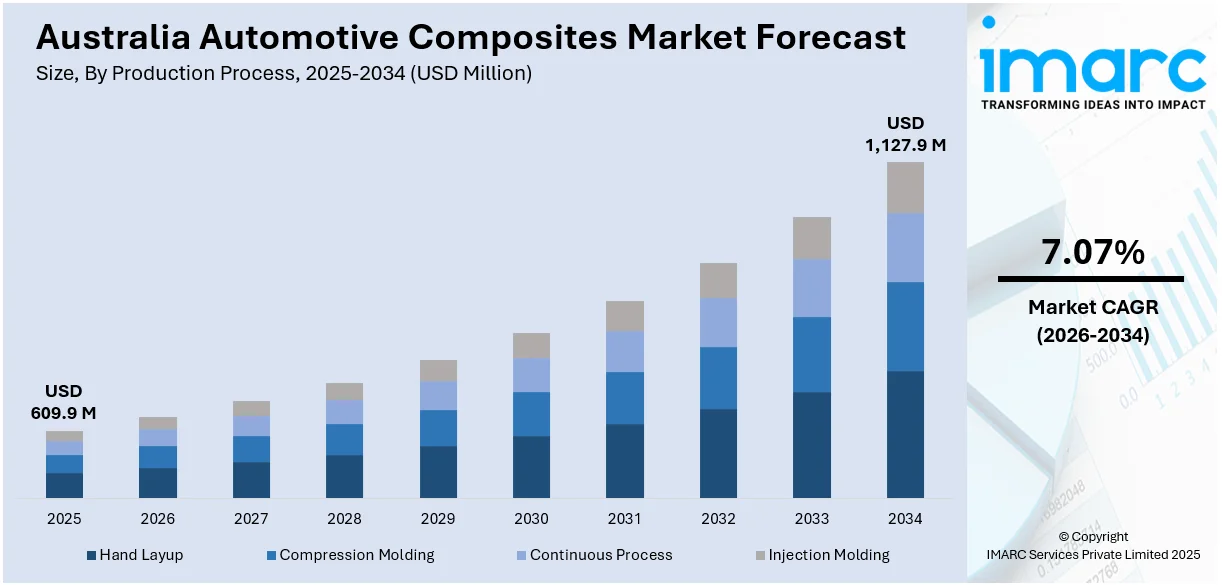

The Australia automotive composites market size reached USD 609.9 Million in 2025. Looking forward, the market is expected to reach USD 1,127.9 Million by 2034, exhibiting a growth rate (CAGR) of 7.07% during 2026-2034. The market is driven by the rising demand for lightweight materials to enhance fuel efficiency and EV performance, advancements in composite manufacturing technologies improving cost-effectiveness, and growing EV adoption supported by government initiatives. Sustainability concerns and recycling innovations further accelerate composite integration in automotive production, fueling the Australia automotive composites market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 609.9 Million |

| Market Forecast in 2034 | USD 1,127.9 Million |

| Market Growth Rate 2026-2034 | 7.07% |

Key Trends of Australia Automotive Composites Market:

Increasing Need for Light Vehicles

Australian automotive manufacturers are increasingly using composite materials to reduce the weight of vehicles as well as improve fuel economy. Harsh emission norms and the move towards electric vehicles (EVs) have also contributed to this demand. Advanced composites such as carbon fiber-reinforced plastics (CFRP) and glass fiber-reinforced plastics (GFRP) are taking center stage because of their better strength-to-weight ratio. This trend is most evident in hybrid and electric vehicles, where reduced weight directly enhances battery performance and driving range, and composites are a top material selection for contemporary automotive design.

To get more information on this market Request Sample

Advancements in Composite Manufacturing Technologies

Innovations in composite manufacturing processes, including resin transfer molding (RTM) and automated fiber placement (AFP), are enhancing production efficiency and cost-effectiveness. These advancements enable large-scale adoption of composites in mainstream vehicles, reducing manufacturing complexities. Australian automotive suppliers are investing in automated and digitalized production lines to cater to growing demand. Additionally, improved recycling techniques are supporting sustainability goals, making composites a more viable alternative to traditional materials while addressing concerns about end-of-life disposal and environmental impact.

Expansion of Electric Vehicle Production

The adoption of electric vehicles (EVs) in Australia is accelerating, with new EV purchases more than doubling in 2023 compared to 2022, bringing the total number of EVs on Australian roads to over 180,000. Moreover, the integration of lightweight composites to optimize battery performance and overall vehicle efficiency is aiding the market demand. Automakers are using carbon fiber and advanced polymer composites to counterbalance the weight of battery packs while maintaining structural integrity. This trend is further supported by government initiatives promoting EV adoption and local manufacturing capabilities. With increased focus on domestic EV production and battery technology advancements, composites are playing a crucial role in developing energy-efficient and high-performance electric mobility solutions.

Growth Factors of Australia Automotive Composites Market:

Rising Demand for Fuel Efficiency and Performance

Australian consumers and car manufacturers are now focusing on cars that achieve improved fuel economy without sacrificing performance. Automotive composites, which are much lighter but stronger than materials used in the past, allow for less fuel usage and better vehicle handling. Aside from weight savings, composites provide superior thermal stability, corrosion resistance, and impact performance, promoting safer and more efficient vehicles overall. With fuel prices continuing to be a concern for both individuals and businesses owning cars, manufacturers are looking to composites to maximize efficiency. The trend is consistent with overall sustainability efforts in Australia, and so composites become an appealing option for manufacturers wishing to meet economic and environmental considerations. According to the Australia automotive composites market analysis, this growing focus on high-performing yet efficient vehicles is a strong growth catalyst for the market.

Rising Adoption of Advanced Safety and Durability Standards

The Australian automotive industry is witnessing a heightened emphasis on vehicle safety and long-term durability, which is pushing demand for composite materials. Composites are known for their high strength-to-weight ratio, impact resistance, and design flexibility, enabling manufacturers to create safer and more durable automotive structures. Regulatory bodies and consumer expectations are increasingly focused on crashworthiness and material reliability, encouraging automakers to adopt composites in key structural applications such as body panels, bumpers, and underbody systems. Additionally, composites contribute to reducing maintenance costs by offering corrosion resistance, extending the lifespan of vehicles in diverse Australian climatic conditions, which is boosting the Australia automotive composites market growth. As safety and durability remain top purchase drivers for consumers, their role as a growth factor in the composites market continues to expand.

Growing Demand from Luxury and High-Performance Vehicles

The premium and luxury vehicle segment in Australia is expanding steadily, creating strong demand for advanced materials like composites. High-performance vehicles require materials that not only reduce weight but also provide superior aesthetics, precision engineering, and enhanced speed dynamics. Composites meet these requirements while enabling innovative and aerodynamic designs, giving luxury brands a competitive edge. With rising consumer spending power and increasing interest in premium cars, the market for composite integration in sports cars and luxury sedans is growing. Automakers are also leveraging composites for interior components, offering both lightweight and stylish finishes. This growing adoption within the premium segment highlights composites as a critical enabler of innovation and market differentiation in Australia’s automotive landscape.

Government Initiatives for Australia Automotive Composites Market:

Policies Supporting Emission Reduction and Green Mobility

The Australian government is actively implementing policies aimed at reducing carbon emissions and promoting green mobility. These initiatives encourage automakers to explore lightweight and eco-friendly materials such as composites that reduce fuel consumption and emissions. By setting stricter emission targets and supporting the transition toward sustainable vehicle technologies, regulatory authorities are indirectly driving composite adoption. Incentives such as tax benefits, grants, and rebates for manufacturers investing in sustainable automotive solutions further support this growth. As emission standards tighten, composites are emerging as a preferred material to help automakers achieve compliance while improving performance. Government backing of emission reduction efforts thus plays a pivotal role in accelerating the Australia automotive composites market demand.

Funding for Research and Innovation in Materials

The government of Australia is increasingly supporting research and development projects that advance material innovation in the automotive sector. Funding programs and grants are directed toward universities, research institutes, and industry collaborations to explore new applications of composites, improve cost-efficiency, and enhance recyclability. This commitment to innovation allows local manufacturers and global players in Australia to adopt cutting-edge composite technologies, giving the domestic industry a competitive edge. Public-private partnerships are particularly significant, enabling knowledge sharing and rapid commercialization of advanced composites. Through these initiatives, the government is fostering a strong foundation for the country’s automotive composites industry, ensuring its readiness to meet both global standards and evolving domestic demands.

Support for Local Manufacturing and Supply Chain Development

To reduce reliance on imports and strengthen domestic capabilities, the Australian government is prioritizing initiatives that enhance local composite manufacturing and supply chains. Programs promoting local production capacity, workforce training, and investment in advanced manufacturing facilities are central to this agenda. By creating a resilient supply ecosystem, these initiatives aim to lower production costs, improve turnaround times, and ensure the availability of high-quality composites for automotive applications. Moreover, government-backed efforts to integrate small and medium enterprises into the composites value chain further stimulate industry participation. This localized approach not only supports job creation but also enhances the competitiveness of Australia’s automotive sector, making it better equipped to adopt composites on a larger scale.

Australia Automotive Composites Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on production process, application, and material.

Production Process Insights:

- Hand Layup

- Compression Molding

- Continuous Process

- Injection Molding

The report has provided a detailed breakup and analysis of the market based on the production process. This includes hand layup, compression molding, continuous process, and injection molding.

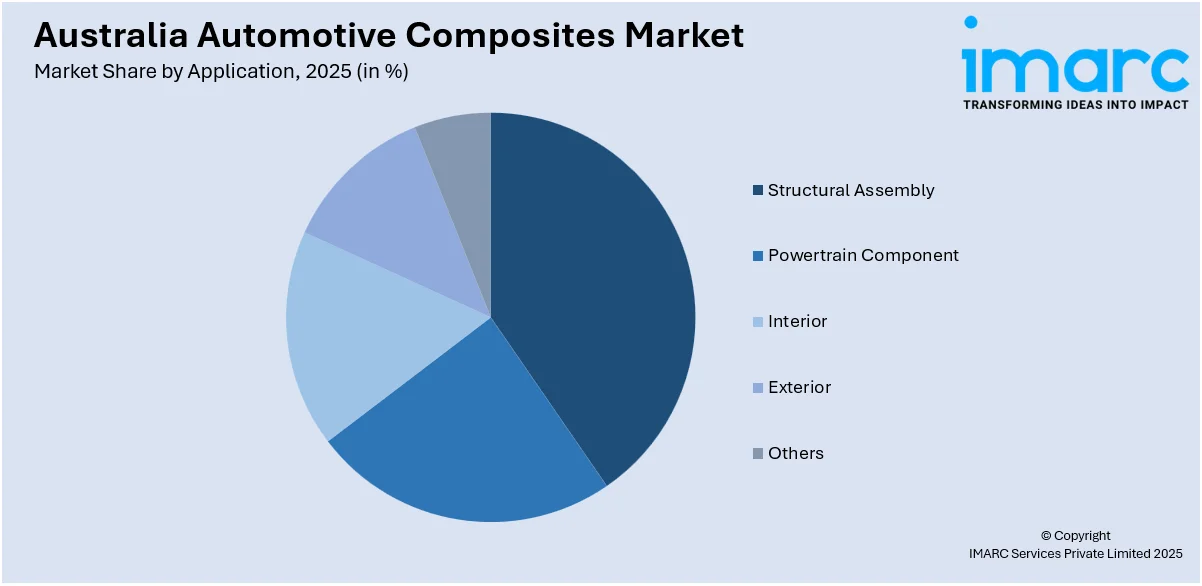

Application Insights:

Access the comprehensive market breakdown Request Sample

- Structural Assembly

- Powertrain Component

- Interior

- Exterior

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes structural assembly, powertrain component, interior, exterior, and others.

Material Insights:

- Thermoset Polymer

- Thermoplastic Polymer

- Carbon Fiber

- Glass Fiber

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes thermoset polymer, thermoplastic polymer, carbon fiber, and glass fiber.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive Composites Market News:

- In January 2025, Decem, an Australian consulting firm, has acquired Penguin Composites through voluntary administration. Penguin Composites specializes in composite and metal manufacturing for industrial, commercial, marine, and recreational vehicle sectors. The company supports Thales Australia’s Hawkei vehicle production and Hanwha Defence Australia's Huntsman vehicle construction, highlighting its defense sector involvement. Its expertise spans mould design, fibreglass manufacturing, carbon fibre laminations, and specialist composite production, strengthening Decem’s market position.

Australia Automotive Composites Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Production Processes Covered | Hand Layup, Compression Molding, Continuous Process, Injection Molding |

| Applications Covered | Structural Assembly, Powertrain Component, Interior, Exterior, Others |

| Materials Covered | Thermoset Polymer, Thermoplastic Polymer, Carbon Fiber, Glass Fiber |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive composites market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive composites market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive composites industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive composites market in Australia was valued at USD 609.9 Million in 2025.

The Australia automotive composites market is projected to exhibit a CAGR of 7.07% during 2026-2034.

The Australia automotive composites market is projected to reach a value of USD 1,127.9 Million by 2034.

The Australia automotive composites market is witnessing key trends such as rising adoption of lightweight materials for fuel efficiency, growing demand for electric vehicles, and increased use of sustainable, recyclable composites. Advanced manufacturing technologies and heightened focus on performance, durability, and safety standards are further shaping market developments.

The growth of the Australia automotive composites market is driven by rising demand for lightweight vehicles, stricter emission regulations, and increasing electric vehicle adoption. Advancements in composite manufacturing, coupled with consumer preference for durable and high-performance materials, further accelerate market expansion across passenger and commercial vehicle segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)