Australia Automotive Pneumatic Actuators Market Size, Share, Trends and Forecast by Vehicle Type, Application Type, and Region, 2025-2033

Australia Automotive Pneumatic Actuators Market Size and Share:

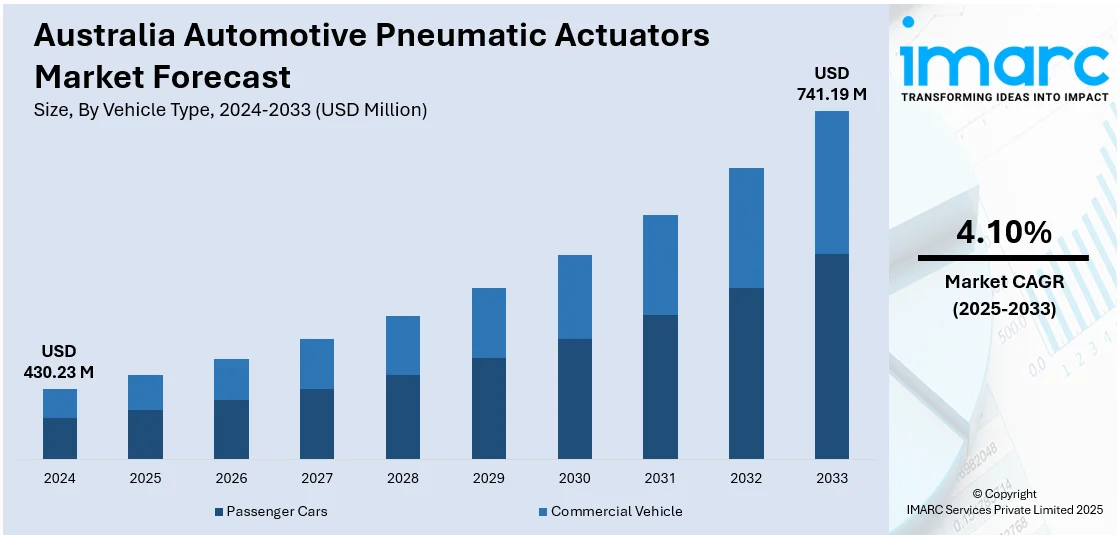

The Australia automotive pneumatic actuators market size reached USD 430.23 Million in 2024. Looking forward, the market is expected to reach USD 741.19 Million by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The growing use of advanced driver assistance systems (ADAS), fuel-efficient vehicle demand, commercial vehicle fleet expansion, pneumatic system integration in heavy-duty applications, and government programs promoting vehicle safety and emission control technologies, with continuous innovation and component optimization are some of the factors escalating the automotive pneumatic actuators market demand in Australia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 430.23 Million |

| Market Forecast in 2033 | USD 741.19 Million |

| Market Growth Rate 2025-2033 | 4.10% |

Key Trends of Australia Automotive Pneumatic Actuators Market:

Integration of Advanced Driver Assistance Systems (ADAS)

The market for automotive pneumatic actuators in Australia is developing rapidly, with the highest growth rate caused by the escalating adoption of Advanced Driver Assistance Systems (ADAS) in vehicles. While vehicle manufacturers upgrade the safety, efficiency, and automation of cars, the requirement for accurate and dependable actuation systems has gone up. Pneumatic actuators are at the center of ADAS by providing features like adaptive cruise control, lane departure warning, and automatic braking systems. Government policies and safety programs in Australia are also driving ADAS adoption further, making pneumatic actuators a critical part of vehicle design. With more stringent crash prevention regulations and customer demand for technologically advanced vehicles, manufacturers are integrating pneumatic actuation technology to provide smoother, more responsive system operation. Furthermore, while fuel efficiency and emissions reduction are the top-of-mind priorities within the Australian market, pneumatic actuators continue to assist with next-generation engine control and aerodynamic optimization—both of which are aligned with ADAS capabilities. Together, the expansion of ADAS and the emphasis on fuel-efficient technologies are driving a high level of demand for automotive pneumatic actuators, making them an imperative component in the future of the Australia automotive pneumatic actuators market share.

To get more information on this market, Request Sample

Demand for Fuel-Efficient Vehicles

The escalating need for fuel-efficient cars in Australia is one of the major drivers for the automotive pneumatic actuators market. Due to fluctuating fuel prices and growing environmental awareness, car manufacturers are concentrating on technologies that reduce fuel consumption and emissions. Pneumatic actuators are vital in attaining these objectives through enhancing engine efficiency, managing air intake and exhaust systems, and improving vehicle performance. Government measures favoring fuel efficiency and lower emissions have further enhanced market growth. Incentives on fuel-efficient automobiles persuade automobile manufacturers to include advanced parts such as pneumatic actuators that help in lowering fuel consumption. The percentage of diesel cars, being fuel-efficient vehicles, went up from 20.9% in 2016 to 26.4% in 2021, as per the Australian Bureau of Statistics. It is indicative of escalating demand from consumers for fuel-efficient technologies that is leading the way for Australia automotive pneumatic actuators demand.

Increasing Use of Pneumatic Actuators in Heavy-Duty and Off-Road Vehicles

In Australia, one of the most important trends observed in the market for automotive pneumatic actuators is the rising use of actuators in heavy-duty, off-road, and specialized vehicles. In contrast to most regions where demand for automotive components is led by passenger car manufacturing, Australia's specific market emphasizes mining trucks, agricultural equipment, and long-distance freight vehicles because of its huge geographic spread and resource-based economy. Pneumatic actuators are preferred within these industries due to their durability, reliability, and ease of maintenance in hostile and remote conditions. The mining industry, for instance, depends on pneumatic systems for critical functions like suspension control and braking, where strong and accurate actuator performance is invaluable for safety and operation efficiency. Additionally, Australia's focus on enhancing fleet safety and adherence to rigorous local standards has triggered pneumatic system upgrades in current heavy-duty vehicles. This development is complementary to growing automation and intelligent vehicle integration in the nation's transport segments, making pneumatic actuators cornerstone elements for future-proof automotive use, according to the Australia automotive pneumatic actuators market analysis.

Growth Factors of Australia Automotive Pneumatic Actuators Market:

Increasing Automotive Production and Aftermarket Demand

The automotive industry in Australia, while no longer producing passenger cars locally in large numbers, still has a robust sector of specialized vehicle production and a healthy aftermarket industry. These involve the production of heavy vehicles, buses, mining haulage, and military vehicles—markets in which pneumatic actuators are crucial in braking, suspension management, and engine control. The need for customization and performance upgrades in off-road and commercial vehicles is increasing, opening new avenues for pneumatic actuator suppliers. Moreover, Australia's large geography requires vehicles suited for long-distance driving and off-road conditions, which are usually based on robust and dynamic actuator systems. Local part distributors and workshops are also fueling demand through an emphasis on performance upgrades, which typically involve pneumatic applications. This synergy of a robust specialized vehicle market and expanding aftermarket culture is supporting steady demand for automotive pneumatic actuators.

Adoption of Advanced Vehicle Technologies

The transition toward advanced driver-assistance systems (ADAS) and semi-automated features in commercial and heavy vehicles in Australia is promoting the use of dependable and responsive actuator technologies. Pneumatic actuators are often preferred for their speed, simplicity, and robustness, especially in braking systems, clutch control, and air suspension systems. In Australia's logistics and freight industry—essential due to the country's large internal distances—fleet operators are increasingly investing in smart vehicles equipped with efficient actuator-driven systems for enhanced performance and safety. In addition, local regulations in regard to safety and emissions are inducing operators to upgrade their fleets of vehicles, which usually entails retrofitting or substitution of mechanical systems with automated pneumatic systems. The mining and agricultural sectors, both crucial to the economy of Australia, also embrace automation and telematics technologies in their vehicles, wherein pneumatic actuators become pivotal for operational efficiency as well as remote control features.

Favorable Regulatory Environment and Infrastructure Expansion

Australia's favorable regulatory environment and continued investment in transport infrastructure are principal drivers of expansion in the automotive pneumatic actuators market. Initiatives by the government to enhance road safety, lower vehicle emissions, and fleet efficiency have increased demand for technologies based on pneumatic actuation. Safety regulations for heavy vehicles, including the Heavy Vehicle National Law (HVNL), also focus heavily on vehicle performance standards and push towards adopting sophisticated systems that involve actuators for precise control. Concurrently, vast infrastructure projects, particularly mining logistics, regional connectivity, and port access, are elevating the demand for high-performance commercial vehicles. These cars, which run in harsh conditions, need strong and effective pneumatic actuation systems for long-term reliability. Local vocational training and skills development programs also guarantee a labor force able to sustain and maintain these systems, which supports long-term market stability and expansion in Australia.

Australia Automotive Pneumatic Actuators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vehicle type, and application type.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars and commercial vehicle.

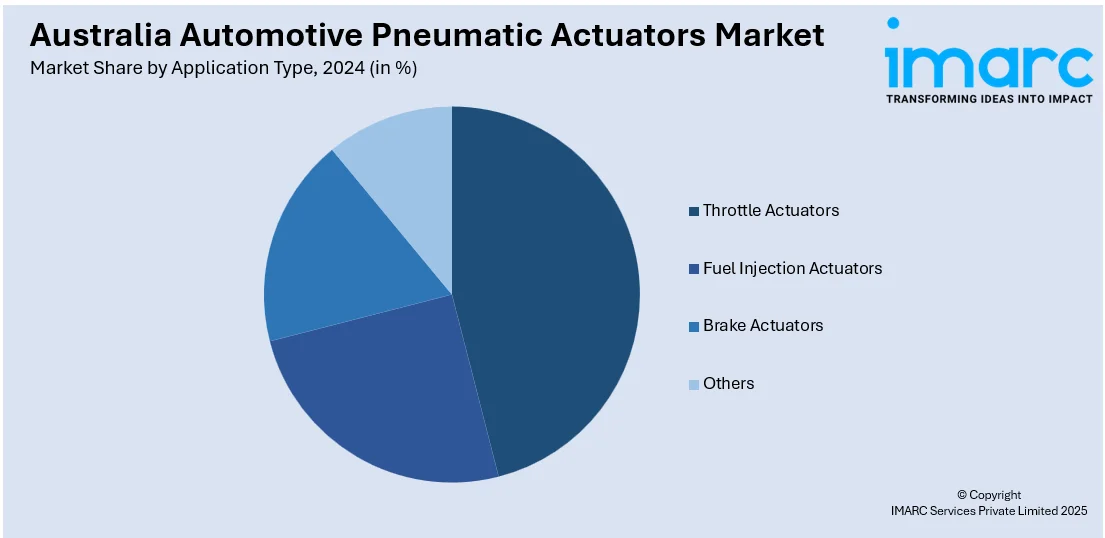

Application Type Insights:

- Throttle Actuators

- Fuel Injection Actuators

- Brake Actuators

- Others

A detailed breakup and analysis of the market based on the application type have also been provided in the report. This includes throttle actuators, fuel injection actuators, brake actuators, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive Pneumatic Actuators Market News:

- January 2025: Chinese automaker GAC is set to enter the Australian market in mid-2025 with its Aion brand, introducing the Aion V electric SUV and Aion UT electric hatchback. This expansion is increasing competition in the EV sector, prompting manufacturers to enhance vehicle automation and efficiency. The demand for pneumatic actuators in areas like braking and suspension systems is strengthening as automakers refine their designs for performance and comfort.

- January 2025: Tesla introduced the refreshed 2025 Model Y, which boasts a more streamlined look, greater range, and more interior features. This redesign reflects the car industry's transition toward electric vehicles, affecting the dynamics of Australia's market.

Australia Automotive Pneumatic Actuators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Cars, Commercial Vehicle |

| Application Types Covered | Throttle Actuators, Fuel Injection Actuators, Brake Actuators, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive pneumatic actuators market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive pneumatic actuators market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive pneumatic actuators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia automotive pneumatic actuators market was valued at USD 430.23 Million in 2024.

The Australia automotive pneumatic actuators market is projected to exhibit a CAGR of 4.10% during 2025-2033.

The Australia automotive pneumatic actuators market is expected to reach a value of USD 741.19 Million by 2033.

Australia's automotive pneumatic actuators industry is fueled by their application towards improving engine efficiency and emissions reduction. Moreover, the inclusion of pneumatic actuators in advanced driver assistance systems (ADAS) is increasingly common, enhancing vehicle safety and automation. The commercial vehicle market is also on the rise, pushing the demand for pneumatic actuators in heavy-duty applications.

Australia's automotive pneumatic actuators industry is fueled by demand from heavy industries such as mining, agriculture, and logistics. Australia's vast geography and dependence on commercial transport raise the demand for robust, effective actuation systems. Government regulation efforts around vehicle safety and fleet upgrades further drive adoption of actuators in these industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)