Australia Automotive Sensors Market Size, Share, Trends and Forecast by Type, Vehicle Type, Sales Channel, Application, and Region, 2025-2033

Australia Automotive Sensors Market Overview:

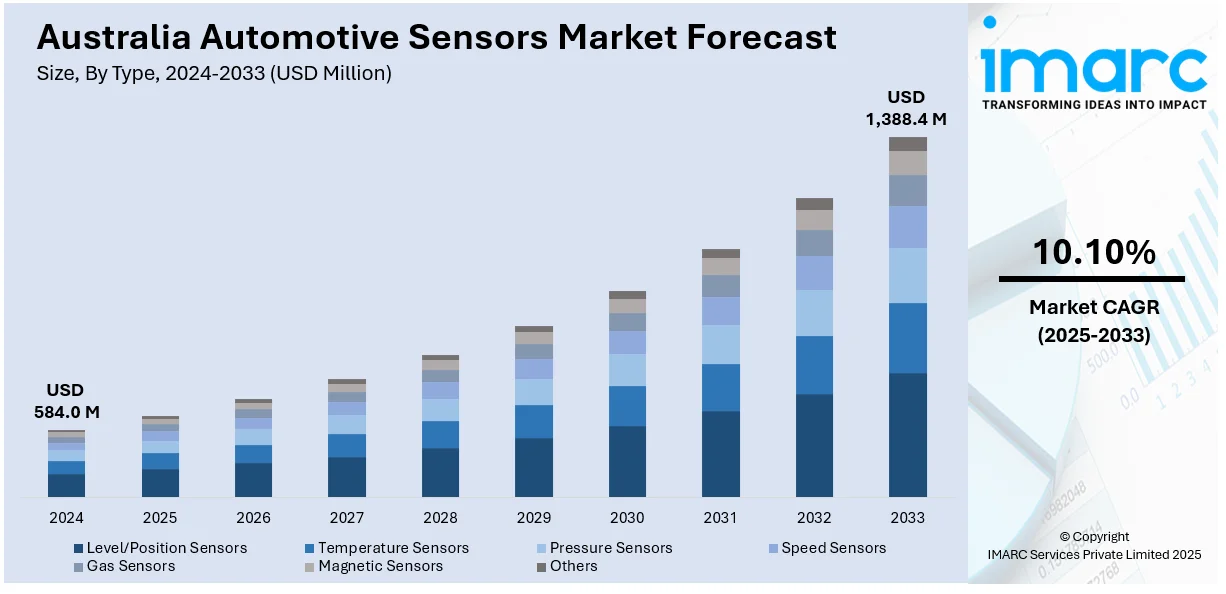

The Australia automotive sensors market size reached USD 584.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,388.4 Million by 2033, exhibiting a growth rate (CAGR) of 10.10% during 2025-2033. The market is driven by the increased adoption of advanced driver-assistance systems (ADAS) in vehicles, heightened demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs), and rising interest in vehicle connectivity and incorporation of Internet of Things (IoT) technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 584.0 Million |

| Market Forecast in 2033 | USD 1,388.4 Million |

| Market Growth Rate 2025-2033 | 10.10% |

Australia Automotive Sensors Market Trends:

Increasing Integration of Advanced Driver-Assistance Systems (ADAS)

The rising acceptance of advanced driver-assistance systems (ADAS) in vehicles is impelling the growth of the market. Car manufacturers are increasingly implementing various types of sensors such as radar, ultrasonic, and light detection and ranging (LiDAR) to provide enhanced vehicle safety, improve driving comfort, and meet changing safety requirements. These vehicles are making features like lane departure warning, adaptive cruise control, and automatic emergency braking possible, all of which are reliant upon sensor technologies to be accurate and reliable. The Australian government's emphasis on minimizing road deaths and its embracement of international vehicle safety regulation are also driving manufacturers to integrate sophisticated sensor-based systems in new vehicles. Moreover, the demand for semi-autonomous and autonomous driving features is on the rise, driving the demand for strong sensor ecosystems. This is forcing both local players and foreign brands that have a presence in Australia to invest in sensor innovation, calibration, and integration, which is accelerating overall market growth. The IMARC Group predicts that the Australia automotive market size reached 2.50 Million Units by 2033.

To get more information on this market, Request Sample

Rising Demand for Electric and Hybrid Vehicles

The market for automotive sensors in Australia is driven by the growing demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs). Electric car sales hit record levels in Australia, accounting for nearly one in every 10 cars purchased in 2024, with their popularity set to nearly double within the next two years. The most recent annual state of EVs report, published by the Electric Vehicle Council, reported a 150% rise in sales over 2022, to the existing sales proportion of 9.5% of new light vehicle deals with around 110,000 estimated to have been sold in 2024. As the country is progressing toward sustainability and reduced carbon emissions, the uptake of EVs is accelerating, with state and federal incentives playing a key role. EVs and HEVs require a greater number and variety of sensors compared to traditional internal combustion engine vehicles. These include battery management sensors, current sensors, temperature sensors, and pressure sensors, all critical for monitoring and optimizing energy usage, safety, and performance. Sensor technology is continuously being refined to meet the specific requirements of EV platforms, particularly in terms of high-voltage safety and efficient energy management. This shift is also encouraging local suppliers and tech companies to develop innovative solutions tailored for electric mobility, thus creating a robust supply chain and further propelling the growth of the market in Australia.

Growing Focus on In-Vehicle Connectivity and Internet of Things (IoT) Integration

The interest in vehicle connectivity and incorporation of Internet of Things (IoT) technology is bolstering the market growth. Technology firms and automakers alike are increasingly integrating sensors to enable connected vehicle capabilities like real-time diagnostics, predictive maintenance, infotainment systems, and remote monitoring of vehicles. These intelligent sensors are making the gathering and transportation of enormous quantities of data to improve user experience and vehicle performance possible. Vehicle-to-everything (V2X) communication frameworks used by the automotive industry in Australia rely on complex sensor arrays for enabling interaction among vehicles, infrastructure, and digital networks. This digital revolution is driven by advances in network infrastructure, like the deployment of 5G, and the increasing appetite for connected vehicle experiences. In Australia, one of its key telecom operators, Telstra, provided more than 200 5G-powered mobile sites in 2024. More than 3,000 suburbs and 200 cities enjoy 5G coverage from all the big telecom services, including Sydney, Brisbane, Melbourne, Perth, Adelaide, Canberra, Tasmania, Queensland, and Hobart, among many others. The aim is to extend 5G reach to more than 95% of Australia's population by mid-2025 from the current 85% connectivity. As a result, automakers are giving preference to sensor integration as a vital element of new-generation automotive design.

Australia Automotive Sensors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, vehicle type, sales channel, and application.

Type Insights:

- Level/Position Sensors

- Temperature Sensors

- Pressure Sensors

- Speed Sensors

- Gas Sensors

- Magnetic Sensors

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes level/position sensors, temperature sensors, pressure sensors, speed sensors, gas sensors, magnetic sensors, and others.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars and commercial vehicles.

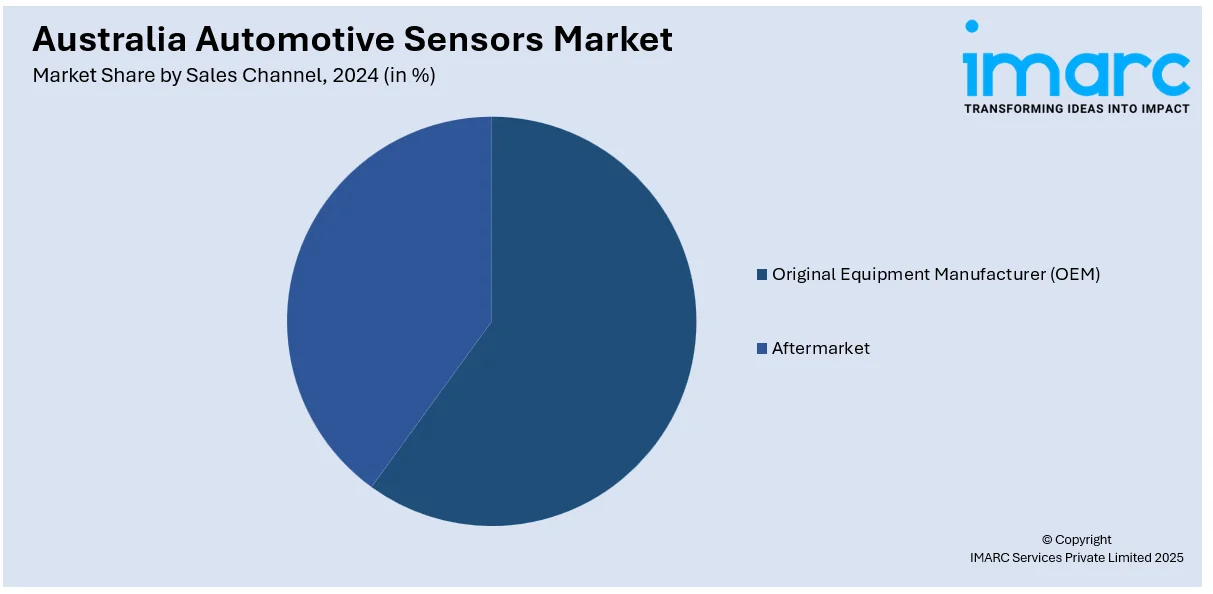

Sales Channel Insights:

- Original Equipment Manufacturer (OEM)

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes original equipment manufacturer (OEM) and aftermarket.

Application Insights:

- Powertrain

- Chassis

- Vehicle Body Electronics

- Safety and Security

- Telematics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes powertrain, chassis, vehicle body electronics, safety and security, telematics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive Sensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Level/Position Sensors, Temperature Sensors, Pressure Sensors, Speed Sensors, Gas Sensors, Magnetic Sensors, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Sales Channels Covered | Original Equipment Manufacturer (OEM), Aftermarket |

| Applications Covered | Powertrain, Chassis, Vehicle Body Electronics, Safety And Security, Telematics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automotive sensors market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automotive sensors market on the basis of type?

- What is the breakup of the Australia automotive sensors market on the basis of vehicle type?

- What is the breakup of the Australia automotive sensors market on the basis of sales channel?

- What is the breakup of the Australia automotive sensors market on the basis of application?

- What is the breakup of the Australia automotive sensors market on the basis of region?

- What are the various stages in the value chain of the Australia automotive sensors market?

- What are the key driving factors and challenges in the Australia automotive sensors market?

- What is the structure of the Australia automotive sensors market and who are the key players?

- What is the degree of competition in the Australia automotive sensors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive sensors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive sensors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)