Australia Aviation Market Size, Share, Trends and Forecast by Aircraft Type and Region, 2025-2033

Australia Aviation Market Size and Share:

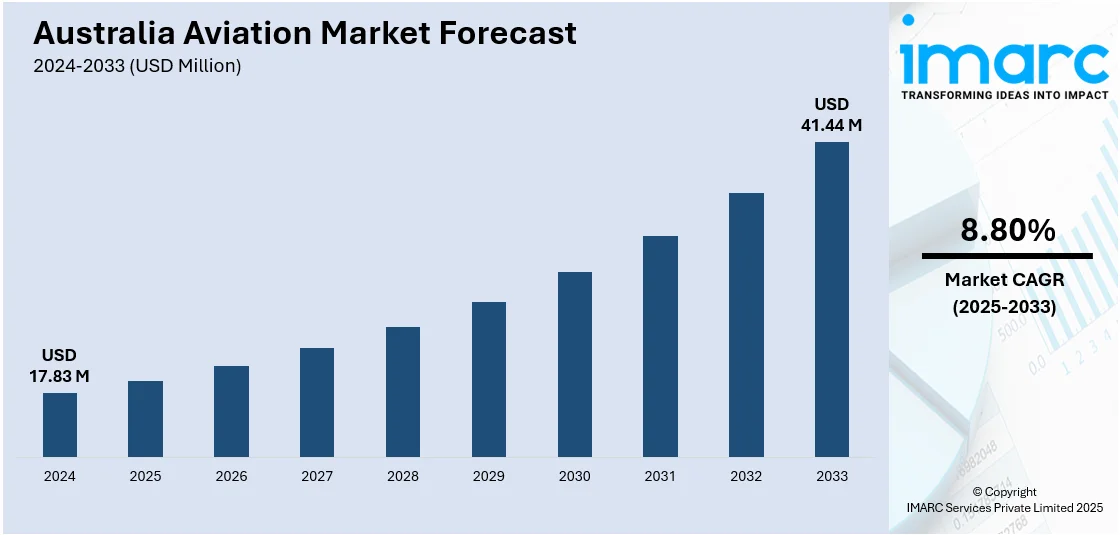

The Australia aviation market size reached USD 17.83 Million in 2024. Looking forward, the market is projected to reach USD 41.44 Million by 2033, exhibiting a growth rate (CAGR) of 8.80% during 2025-2033. The market is growing on the back of the expansion of regional air travel, investments in green technologies, and rising demand for air cargo. Regional connectivity has been enhanced through more flights and bigger aircraft, and environmentally friendly innovations such as sustainable aviation fuel and hybrid engines are transforming the industry. The growth of e-commerce and global trade has also spurred air cargo demand. These developments are boosting Australia aviation market share, setting it up for further growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.83 Million |

| Market Forecast in 2033 | USD 41.44 Million |

| Market Growth Rate 2025-2033 | 8.80% |

Key Trends of Australia Aviation Market:

Increase in Regional Air Travel

Australia's aviation industry has seen a significant rise in regional air travel, fueled by domestic demand as well as growing tourism activities. With the increasing urbanization of cities like Sydney, Melbourne, and Brisbane, there is an accompanying need for improved access to regional destinations. The growth is most prominent in holiday spots like the Great Barrier Reef, Tasmania, and other isolated destinations. Airlines have optimized their timetables, putting on more regular flights and taking on bigger aircraft to accommodate rising passenger volumes. For example, in April 2023, Nexus Airlines, Australia's newest scheduled passenger carrier, commenced operations on July 10, 2023, with DHC-8-Q400 turboprops, connecting cities along Western Australia’s west coast, including Perth, Darwin, Geraldton, and Broome. Furthermore, this boost in regional aviation correlates with wider tendencies of economic decentralization and interest in less busy travel options. The growth has assisted tourism and enabled quicker entry to underserved regions, thus adding to overall aviation growth in Australia. It's also interesting to mention that increased demand for low-cost routes and budget travel has catalyzed the construction of new facilities in regional airports.

To get more information of this market, Request Sample

Investment in Sustainable Aviation Technologies

Sustainability has emerged as a major priority in Australia's aviation sector, with green technologies poised to transform the industry. For instance, in April 2024, Victoria's Dovetail Electric Aviation Development Centre at Latrobe Regional Airport will equip regional aircraft with battery and hydrogen power, paving the way for zero-emission flying and net-zero emissions by 2045. Moreover, airlines, airports, and governments have been working actively to find environmentally friendly solutions to lower carbon emissions and fuel consumption. Some of the innovations include heightened interest in the application of sustainable aviation fuel (SAF), electric planes, and hybrid engines. Additionally, the introduction of more energy-efficient ground handling operations and air traffic management system modernization is enhancing environmental performance. Australia's aviation expansion will likely be defined by these investments in the broader effort towards global sustainability across industries. The Australian government has also adopted ambitious targets to minimize carbon footprints, demanding cleaner, more efficient planes and technologies that reduce operational waste. This shift will contribute to ensuring the sustainability of the aviation business over the long term and facilitating environmental and economic benefits.

Rising Demand for Air Cargo and Freight

Australia's air industry has also witnessed a consistent growth in demand for air freight and cargo services. The development has been driven primarily by the growth of e-commerce and overseas trade. Since Australia is geographically far from most countries, air cargo is responsible for ensuring timely delivery of products, particularly perishable products, drugs, and high-value goods. Freight industry growth has also resulted in increased investment in cargo facilities at strategic airports, with the facilities being expanded to accommodate greater amounts of commodities. Also, innovations in logistics technology, including real-time tracking systems, are bringing about efficiency and customer care improvements in the freight industry. This accelerating demand for air freight will continue as global trade networks strengthen, bolstered by enhancements in air transport connectivity and logistics efficiency. The contribution of the aviation industry to the country's economy continues to be central, with air freight holding a critical position in Australia's import-export structure.

Growth Drivers of Australia Aviation Market:

Technological Advancements

Technological innovation is deeply impacting the future of the Australian aviation industry. Advances like fuel-efficient aircraft, improved aerodynamics, and new materials are reducing operating costs while minimizing the environmental impact of air travel. In addition, the introduction of advanced booking systems, in the form of mobile apps and AI-based services, is enhancing the passenger experience through easier and more convenient flight bookings, check-ins, and customized services. These technologies also enhance operational effectiveness, making it possible for airlines to maximize schedules, track airplanes efficiently, and reduce maintenance processes. As technology in aviation progresses, these developments will continue to fuel the Australia aviation market demand and competition within the market, providing airlines with cost-saving advantages and enhancing convenience for travelers.

Rising Trade and Global Connectivity

Australia's advantageous position as a global trade center is driving considerable growth in the aviation industry, especially in cargo flights. The country's extensive trade relations with major global markets, such as Asia, North America, and Europe, are increasing the demand for efficient air freight services needed to transport goods like perishables, electronics, and industrial items. The rise of e-commerce and international supply chains is further intensifying the need for timely and reliable air cargo solutions. As global connectivity improves, Australia is making significant investments in its air freight infrastructure to meet this growing demand. This escalation in air cargo activity contributes to the overall growth of the Australian aviation sector, offering businesses quicker and more reliable international shipping options. According to Australia aviation market analysis, this trend is poised to continue, with air freight playing an essential role in future expansion.

Government Investments in Infrastructure

Government investment in infrastructure is crucial for the development and efficiency of Australia's aviation sector. Huge sums of money are being invested in the upgrading of airports, the remodeling of terminals, and the modernization of air traffic management systems. These investments raise airport capacity, reduce congestion, and enhance the overall passenger experience. In addition, modernized air traffic control facilities also ensure improved flight safety and operating efficiency through efficient air traffic management. With the aviation industry in Australia expanding steadily, continuous development of aviation infrastructure will be important to ensure airports are able to handle increasing passenger traffic, ensure seamless operations, and cope with future needs. Government spending in this area is imperative for the sustenance of Australia's competitive advantage in the international aviation industry and guaranty of long-term market growth.

Australia Aviation Market Segmentation:

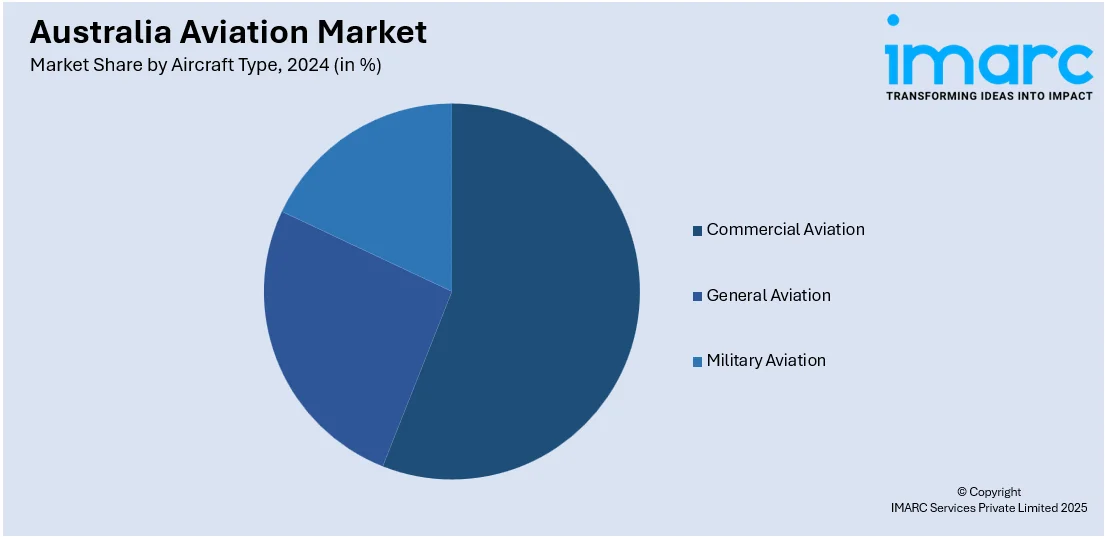

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on aircraft type.

Aircraft Type Insights:

- Commercial Aviation

- General Aviation

- Military Aviation

The report has provided a detailed breakup and analysis of the market based on the aircraft type. This includes commercial aviation, general aviation, and military aviation.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Aviation Market News:

- In February 2025, Textron Aviation has announced the construction of a bigger service facility at Melbourne's Essendon Fields Airport that will open early in 2026. The new facility will improve support for Cessna, Beechcraft, and Hawker airplanes, with enhanced maintenance capacity, quicker parts availability, and improved customer services.

- In December 2024, Global Crossing Airlines Group (GlobalX) and ATB Aviation Australia have established a joint venture to form a new Melbourne-headquartered airline. The airline will provide charter and ACMI passenger and cargo flying to Australia and major Asia-Pacific markets, and operations are projected to begin later in 2025. The airline intends to grow its fleet to 10 Airbus A320 aircraft in its first five years of operation.

Australia Aviation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Aircraft Types Covered | Commercial Aviation, General Aviation, Military Aviation |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia aviation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia aviation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia aviation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aviation market in the Australia was valued at USD 17.83 Million in 2024.

The Australia aviation market is projected to exhibit a compound annual growth rate (CAGR) of 8.80% during 2025-2033.

The Australia aviation market is expected to reach a value of USD 41.44 Million by 2033.

The Australia aviation market is witnessing a rise in sustainable aviation fuel adoption, digital transformation in passenger services, and expanded regional connectivity. Growth in low-cost carrier routes and investments in airport infrastructure modernization are also shaping the market. Additionally, demand for air freight services is gaining momentum.

Increasing domestic tourism, rising disposable incomes, and strong government focus on regional development are key growth drivers. The expansion of airline fleets, improving international travel confidence, and growing trade volumes are also contributing. Moreover, favorable regulatory reforms and increased foreign airline participation are supporting market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)