Australia B2B Payments Market Size, Share, Trends and Forecast by Payment Type, Payment Mode, Enterprise Size, Industry Vertical, and Region, 2026-2034

Australia B2B Payments Market Overview:

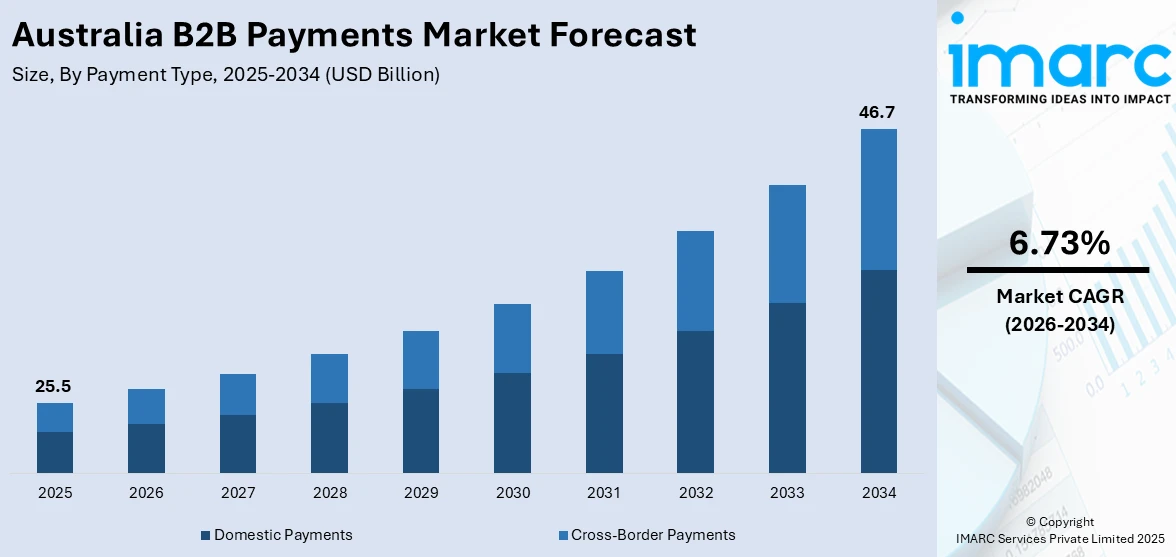

The Australia B2B payments market size reached USD 25.5 Billion in 2025. Looking forward, the market is expected to reach USD 46.7 Billion by 2034, exhibiting a growth rate (CAGR) of 6.73% during 2026-2034. The shift to digital B2B payments is driven by demand for efficiency, automation, and real-time transactions. Key factors include the adoption of cloud-based platforms, integration with accounting software, and the New Payments Platform (NPP). Additionally, flexible financing options such as BNPL and enhanced cybersecurity measures are further augmenting the Australia B2B payments market share, supported by regulatory advancements and SME cash flow needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 25.5 Billion |

| Market Forecast in 2034 | USD 46.7 Billion |

| Market Growth Rate 2026-2034 | 6.73% |

Key Trends of Australia B2B Payments Market:

Rise of Digital Payment Platforms in Australia’s B2B Sector

The rapid shift toward digital payment platforms, driven by the need for efficiency, security, and faster transactions is favoring the Australia B2B payments market growth. A research report from the IMARC Group indicates that the digital payment market in Australia was valued at USD 118.0 Billion in 2024. It is projected to grow to USD 667.0 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 20.89% from 2025 to 2033. Traditional payment methods including checks and bank transfers are declining as businesses adopt cloud-based solutions such as Stripe, PayPal, and local platforms such as Airwallex. These platforms offer seamless integration with accounting software, reducing manual processing and errors. Additionally, real-time payments (RTP) through the New Payments Platform (NPP) are gaining traction, enabling instant fund transfers 24/7. The push for automation is further fueled by SMEs and enterprises seeking cost savings and improved cash flow management. With cybersecurity threats on the rise, digital payment providers are also prioritizing fraud prevention through AI-driven verification and encryption. As regulatory support for digital transactions grows, Australian businesses are expected to increasingly favor digital-first payment solutions over legacy systems.

To get more information on this market Request Sample

Growth of Buy Now, Pay Later (BNPL) in B2B Transactions

Buy Now, Pay Later (BNPL) solutions, initially popular in B2C markets, are now penetrating Australia’s B2B payments sector. Therefore, this is creating a positive Australia B2B payments market growth. In Australia, new legislation was introduced to require credit checks for Buy Now, Pay Later (BNPL) services in 2024, which will require BNPL providers to acquire a credit license, as overseen by ASIC. With 7 million active BNPL accounts, the proposed initiative aims to rein in overspending among Gen Z consumers and bring BNPL services up to par with regulated credit products. Bringing a low-risk credit category on board along with plans for regulatory enforcement underscores a low-risk approach in an Australian B2B payments market poised for significant growth. Providers are offering flexible payment terms to businesses, helping SMEs manage cash flow and working capital. This trend is particularly beneficial for industries with high upfront costs, such as manufacturing, wholesale, and retail. BNPL for B2B allows buyers to defer payments while ensuring suppliers receive funds upfront, reducing financial strain. The shift is also driven by younger business owners accustomed to BNPL in personal finance, demanding similar convenience in commercial transactions. Moreover, the B2B BNPL market is projected to expand as more fintech tailor solutions to business needs, fostering smoother trade relationships and liquidity management.

Growth Drivers of Australia B2B Payments Market:

Digital Transformation Accelerating Business Operations

Australian businesses are rapidly embracing digital transformation initiatives to streamline payment processes and enhance operational efficiency. The adoption of cloud-based payment systems will allow them to be easily integrated with already existing enterprise resource planning systems to minimize manual involvement and processing time. Automation is being considered a priority by companies to remove the use of paper-based transactions, enhance accuracy, and provide real-time monitoring of the status of payments. The market research on B2B payments in Australia suggests that costs in administrative overhead will be significantly reduced when organizations implement digital payment solutions, and that the organizations have higher cash flow visibility. Digital platforms also facilitate faster reconciliation processes and provide comprehensive audit trails, making financial management more transparent and compliant with regulatory requirements.

New Payments Platform (NPP) Infrastructure Enhancement

The deployment of Australia's New Payments Platform has revolutionized the B2B payment landscape by enabling instant, 24/7 fund transfers between financial institutions. This infrastructure advancement supports real-time settlement capabilities that eliminate traditional banking delays, allowing businesses to optimize their working capital management. The NPP's PayID system simplifies payment addressing, reducing errors and enhancing transaction security through advanced verification protocols. Australian enterprises are increasingly leveraging NPP's capabilities to improve supplier relationships through faster payments, while benefiting from reduced banking fees and enhanced transaction transparency. This infrastructure foundation is driving sustained Australia B2B payments market demand as organizations seek competitive advantages through improved payment speed and reliability.

Small and Medium Enterprise (SME) Cash Flow Requirements

Australia's extensive SME sector is driving significant demand for flexible B2B payment solutions to address critical cash flow challenges and working capital constraints. Small businesses require payment platforms that offer extended payment terms, early payment discounts, and invoice financing options to maintain operational stability. The integration of Buy Now, Pay Later (BNPL) solutions specifically designed for B2B transactions enables SMEs to manage seasonal fluctuations and unexpected expenses more effectively. Payment providers are developing specialized products that cater to SME needs, including simplified onboarding processes, competitive pricing structures, and integration capabilities with popular accounting software. This focus on SME requirements continues to expand market opportunities and enhance the overall Australia B2B payments market analysis across diverse industry verticals.

Opportunities of Australia B2B Payments Market:

Cross-Border Payment Digitalization Expansion

The growing international trade relationships between Australia and Asia-Pacific markets present substantial opportunities for cross-border B2B payment solutions. Australian businesses are expanding their export activities, particularly in mining, agriculture, and services sectors, creating demand for efficient international payment platforms. Digital payment providers can capitalize on this trend by offering competitive foreign exchange rates, faster settlement times, and comprehensive compliance features for international transactions. The integration of blockchain technology and central bank digital currencies (CBDCs) presents additional opportunities for innovation in cross-border payments. Companies that develop specialized solutions for Australian exporters and importers can capture significant market share as global trade volumes continue to expand, driving substantial Australia B2B payments market demand across international business corridors.

Industry-Specific Payment Solution Development

Different industry verticals in Australia present unique opportunities for customized B2B payment solutions tailored to specific operational requirements and regulatory frameworks. The mining and resources sector requires solutions that can handle large-value transactions, complex supply chain payments, and compliance with environmental and social governance standards. Manufacturing industries need platforms that integrate with production planning systems and support just-in-time payment scheduling. Healthcare organizations require HIPAA-compliant solutions with robust security features, while government entities need platforms that meet strict procurement and transparency requirements. Payment providers that develop vertical-specific solutions can command premium pricing and establish long-term partnerships. This specialization approach enhances competitive positioning and supports sustained growth in the Australia B2B payments market analysis through targeted innovation and customer acquisition strategies.

Artificial Intelligence Integration for Enhanced Services

The incorporation of artificial intelligence and machine learning technologies presents significant opportunities to enhance B2B payment platforms with predictive analytics, fraud detection, and automated decision-making capabilities. AI-powered solutions can analyze transaction patterns to provide cash flow forecasting, identify potential payment risks, and suggest optimal payment timing for businesses. Machine learning algorithms can continuously improve fraud detection accuracy while reducing false positive rates, enhancing overall platform reliability. Payment providers can develop AI-driven features such as intelligent invoice processing, automated reconciliation, and predictive maintenance for payment systems. These advanced capabilities differentiate service offerings and create additional revenue streams through premium feature tiers. The integration of AI technologies positions companies to capture emerging opportunities as Australian businesses increasingly seek sophisticated, automated payment solutions that drive operational efficiency and strategic decision-making.

Government Support of Australia B2B Payments Market:

Regulatory Framework Modernization and Open Banking

The Australian government has implemented comprehensive open banking regulations that facilitate secure data sharing between financial institutions and third-party payment providers. These regulations enable innovative B2B payment solutions to access banking infrastructure through standardized APIs, promoting competition and innovation in the payments sector. The Consumer Data Right (CDR) framework allows businesses to share their financial data securely with authorized payment providers, enabling more personalized and efficient payment solutions. Government agencies continue to refine regulatory frameworks to balance innovation with consumer protection, creating a supportive environment for fintech companies developing B2B payment solutions. The Australian Prudential Regulation Authority (APRA) and Australian Securities and Investments Commission (ASIC) provide clear guidance on compliance requirements, reducing regulatory uncertainty for payment providers. This supportive regulatory environment enhances investor confidence and encourages international companies to establish operations in Australia, strengthening the Australia B2B payments market analysis through increased competition and innovation.

Digital Economy Strategy and Infrastructure Investment

The Australian government's Digital Economy Strategy allocates substantial funding for digital infrastructure development, including payment system modernization and cybersecurity enhancement initiatives. Government investment in 5G networks, cloud computing infrastructure, and cyber resilience programs directly benefits B2B payment providers by improving transaction speeds, reliability, and security. The establishment of the Digital Transformation Agency supports public sector adoption of digital payment solutions, creating significant market opportunities for B2B payment providers serving government clients. Tax incentives for research and development activities encourage innovation in payment technologies, while grant programs support fintech startups developing specialized B2B payment solutions. The government's commitment to becoming a leading digital economy by 2030 creates sustained support for payment system advancement. These initiatives collectively drive Australia B2B payments market demand by creating favorable conditions for technology adoption and business growth across multiple sectors.

Financial Services Licensing and Consumer Protection Enhancement

Government implementation of Australian Financial Services (AFS) licensing requirements ensures that B2B payment providers maintain high standards of operational integrity and customer protection. The licensing framework builds trust among businesses considering digital payment adoption by establishing clear accountability and dispute resolution mechanisms. Enhanced consumer protection measures, including mandatory insurance coverage and segregated client funds requirements, provide additional security for businesses using B2B payment platforms. The government's proactive approach to payment system regulation includes regular consultation with industry stakeholders to ensure regulations remain relevant and supportive of innovation. Compliance with government standards becomes a competitive advantage for payment providers, as businesses prioritize partnerships with licensed and regulated service providers. The establishment of clear regulatory pathways for new payment technologies reduces market entry barriers while maintaining high safety standards, creating an environment that supports sustainable growth in the Australia B2B payments market analysis through increased business confidence and adoption rates.

Challenges of Australia B2B Payments Market:

Cybersecurity Threats and Data Protection Compliance

The increasing sophistication of cyber attacks targeting financial systems poses significant challenges for B2B payment providers operating in Australia. Payment platforms must continuously invest in advanced security infrastructure, including multi-factor authentication, encryption technologies, and real-time fraud monitoring systems. The implementation of comprehensive cybersecurity measures requires substantial ongoing investment in both technology and specialized personnel, increasing operational costs for payment providers. Compliance with data protection regulations, including the Privacy Act and upcoming data breach notification requirements, demands robust data governance frameworks and regular security audits. Small and medium-sized payment providers face challenges in maintaining enterprise-level security standards while remaining cost-competitive. The evolving threat landscape requires constant adaptation of security protocols, creating ongoing operational complexity and potential service disruptions. These security requirements can impact the Australia B2B payments market analysis by influencing customer acquisition costs and platform development timelines as providers balance security needs with user experience expectations.

Legacy System Integration and Technical Complexity

Australian businesses operating with established enterprise resource planning (ERP) systems and legacy banking infrastructure face significant challenges when integrating modern B2B payment solutions. The complexity of connecting new payment platforms with existing accounting systems, supplier databases, and financial reporting tools often requires substantial technical expertise and customization. Legacy system integration frequently involves lengthy implementation timelines, extensive testing procedures, and potential service disruptions during transition periods. Many established businesses resist payment system changes due to concerns about operational disruption and employee training requirements. The diversity of existing technical environments across different industries creates additional complexity for payment providers developing scalable integration solutions. These technical challenges can slow market adoption rates and increase customer acquisition costs, particularly for large enterprise clients with complex technical requirements. The integration complexity influences Australia B2B payments market demand by creating barriers to adoption that require specialized technical support and potentially longer sales cycles.

Competitive Market Fragmentation and Price Pressure

The Australian B2B payments market experiences intense competition from multiple player categories, including traditional banks, international payment processors, local fintech companies, and emerging blockchain-based solutions. This competitive landscape creates downward pressure on transaction fees and service pricing, potentially reducing profit margins for payment providers. Market fragmentation makes it challenging for individual companies to achieve significant scale advantages or establish dominant market positions. The proliferation of payment options can create confusion for business customers evaluating different solutions, potentially slowing decision-making processes. International competitors with substantial resources can undercut local providers on pricing while offering comprehensive global capabilities. The competitive environment requires continuous innovation and feature development to maintain differentiation, increasing research and development costs. These competitive pressures affect the Australia B2B payments market analysis by creating challenges for sustainable profitability and long-term strategic planning as companies navigate pricing competition while investing in technology advancement and customer service capabilities.

Australia B2B Payments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on payment type, payment mode, enterprise size, and industry vertical.

Payment Type Insights:

- Domestic Payments

- Cross-Border Payments

The report has provided a detailed breakup and analysis of the market based on the payment type. This includes domestic payments and cross-border payments.

Payment Mode Insights:

- Traditional

- Digital

A detailed breakup and analysis of the market based on the payment mode have also been provided in the report. This includes traditional and digital.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

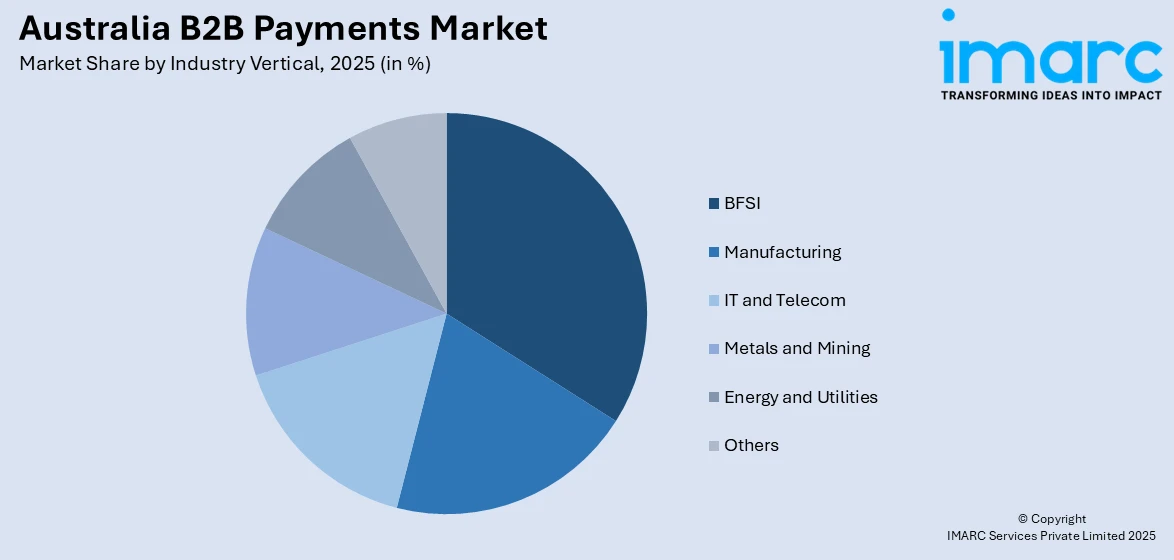

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Manufacturing

- IT and Telecom

- Metals and Mining

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, manufacturing, IT and telecom, metals and mining, energy and utilities, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia B2B Payments Market News:

- March 19, 2025: Visa launched B2B Integrated Payments (VBIP) in partnership with the banks ANZ, NAB, HSBC and Westpac in Australia. This program enables automated supplier payments, even for those who do not accept card payments. Using the SAP Business Technology Platform, it plugs in B2B workflows, better access to working capital, and lower administrative time for Australian businesses. This change marks an important milestone in the digitization of B2B payment flows through commercial supply chains in the country.

- April 18, 2024: MYOB launched integrated B2B payment solutions in New Zealand with Stripe Connect, with implementation in under two months, onboard most customers in under an hour. With an invoice button built into its payment solution, MYOB users can get paid three times faster and accept all card and wallet payments. This is an exciting development for MYOB and strengthens our position in the B2B payments sector across Australia and New Zealand while making compliance and onboarding more efficient via the robust infrastructure provided by Stripe.

Australia B2B Payments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Payment Types Covered | Domestic Payments, Cross-Border Payments |

| Payment Modes Covered | Traditional, Digital |

| Enterprises Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | BFSI, Manufacturing, IT and Telecom, Metals and Mining, Energy and Utilities, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia B2B payments market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia B2B payments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia B2B payments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia B2B payments market was valued at USD 25.5 Billion in 2025.

The Australia B2B payments market is projected to exhibit a CAGR of 6.73% during 2026-2034.

The Australia B2B payments market is projected to reach a value of USD 46.7 Billion by 2034.

The market is experiencing rapid digital transformation with the adoption of cloud-based payment platforms and real-time payment capabilities through the New Payments Platform. Buy Now, Pay Later solutions are also expanding into B2B transactions, offering flexible payment terms for businesses. Integration with accounting software and AI-powered fraud detection is further becoming an essential feature for payment providers.

The Australia B2B payments market is driven by accelerating digital transformation initiatives, new payments platform infrastructure enabling instant 24/7 transfers, and SME cash flow management requirements. Enhanced cybersecurity measures, BNPL integration, and regulatory support for open banking further accelerate adoption across diverse enterprise segments and industry verticals.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)