Australia Baby Care Products Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, and Region, 2026-2034

Australia Baby Care Products Market Summary:

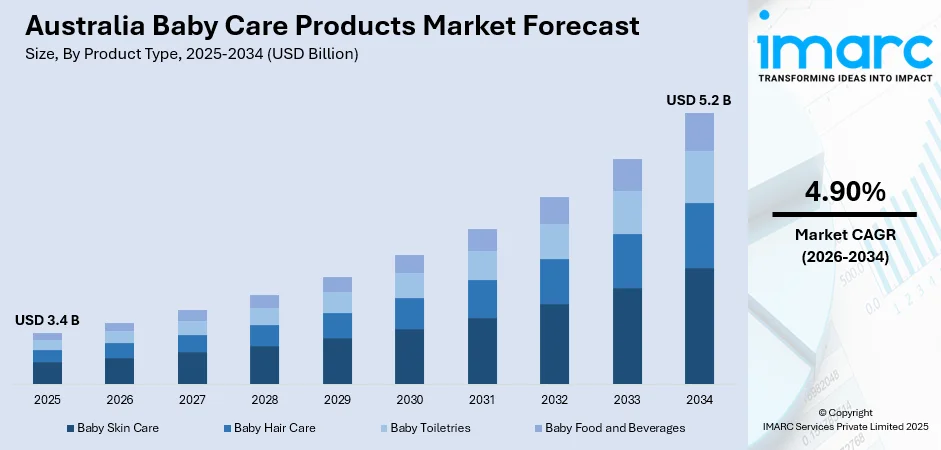

The Australia baby care products market size was valued at USD 3.4 Billion in 2025 and is projected to reach USD 5.2 Billion by 2034, growing at a compound annual growth rate of 4.90% from 2026-2034.

The market is driven by rising parental awareness regarding infant health and hygiene, increasing preference for organic and natural baby care formulations, and the growing influence of e-commerce platforms expanding product accessibility. Additionally, health-conscious millennials and Gen Z parents are actively seeking premium, dermatologically tested, and hypoallergenic solutions for their infants. The expanding retail infrastructure and innovative product development in baby toiletries, skincare, and nutrition segments continue to support substantial Australia baby care products market share.

Key Takeaways and Insights:

-

By Product Type: Baby toiletries dominate the market with a share of 40.02% in 2025, driven by daily necessity of diapers and wipes, rising demand for gentle formulations, premium absorption features, and dermatologically tested infant care products.

-

By Category: Mass leads the market with a share of 80.05% in 2025, owing to wide retail availability, affordable pricing, strong brand trust, and preference among budget-conscious parents seeking consistent quality and reliability.

-

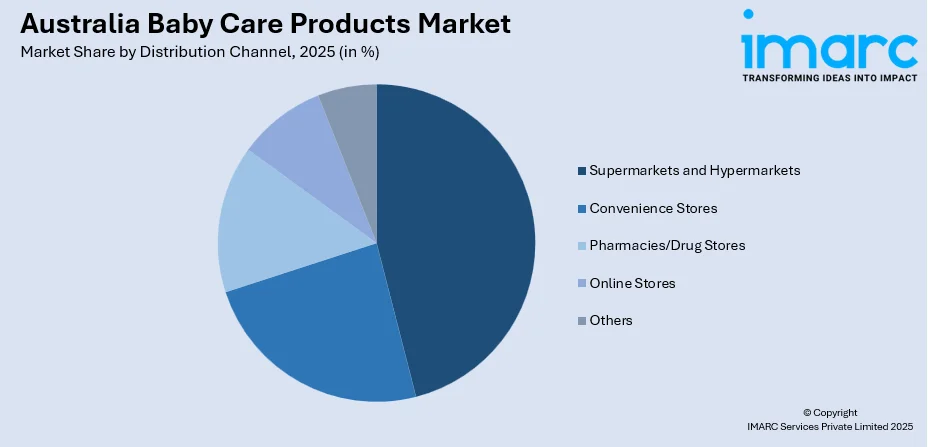

By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a market share of 45.56% in 2025, driven by one-stop shopping convenience, broad product assortments, competitive pricing, and consumer preference for physical product evaluation.

-

By Region: Australia Capital Territory & New South Wales leads the market with a share of 29% in 2025, owing to urban density, increased disposable incomes, sophisticated retail infrastructure, and greater uptake of premium baby care.

-

Key Players: The Australia baby care products market is moderately consolidated, with multinational personal care companies competing alongside domestic organic brands. Players emphasize product innovation, sustainable packaging, and wider distribution expansion to address evolving consumer preferences across price segments.

To get more information on this market Request Sample

The Australia baby care products market is experiencing substantial expansion, propelled by the growing awareness among the modern parents regarding infant health, safety, and well-being. According to reports, in July 2024, Australia introduced two mandatory infant sleep product standards covering safety design and warning information, with compulsory compliance from January 2026 to reduce risks of infant death and injury. Moreover, parents particularly of new generation consumers, are conducting thorough research before purchasing baby care items, favouring products that are free from toxins, artificial fragrances, and potential allergens. This shift in consumer behaviour has catalysed demand for premium, hypoallergenic, and dermatologically tested formulations across skincare, toiletries, and nutrition categories. The robust organic agriculture sector in Australia, combined with the environmentally conscious population, further supports the preference for natural and sustainably produced baby care solutions. E-commerce platforms are significantly reshaping purchasing patterns by offering convenience, comprehensive product selections, and doorstep delivery services to time-pressed parents.

Australia Baby Care Products Market Trends:

Growing Preference for Clean Label and Organic Formulations

Australian parents are increasingly prioritising ingredient transparency and safety, driving substantial demand for clean label baby care products. As per sources, in June 2024, Pod Organics won the Beauty Shortlist Best Natural Baby Brand Australia award for the second consecutive year, reinforcing rising consumer preference for certified organic, clean-label baby skincare solutions. Furthermore, consumers are actively avoiding formulations containing parabens, sulfates, synthetic fragrances, and other potentially harsh chemicals, instead opting for products featuring botanical extracts such as aloe vera, coconut oil, shea butter, and chamomile. This trend reflects the broader wellness movement influencing consumer choices across the personal care sector. Manufacturers are responding by developing certified organic ranges and prominently displaying ingredient information to build trust with discerning parents seeking gentle, natural solutions for their infants.

Expansion of Plant-Based and Allergen-Free Nutrition Options

The baby food sector is evolving, driven by growing demand for plant-based, dairy-free, and allergen-free nutritional options. Parents are highly being attentive to nutritional transparency and ingredient origins, preferring products without artificial additives or common allergens such as dairy, soy, and gluten. This shift is fostering innovation in infant formulas and toddler nutrition made from coconut, oat, almond, quinoa, and other plant-based sources. According to sources, in April 2024, Else Nutrition entered the Asia-Pacific market by launching its plant-based, soy-free infant and toddler formulas in Australia, marking its first global commercial infant formula release. Additionally, the rise in vegan and flexitarian households across Australia is contributing to this trend, with brands offering minimally processed alternatives that cater to diverse dietary requirements and sensitivities.

Digital Retail Transformation and Omnichannel Distribution

E-commerce platforms are significantly reshaping the baby care products landscape by offering unprecedented convenience and extensive product selections to Australian parents. Online channels are expanding market reach beyond major urban centres, improving accessibility for rural and regional households seeking premium and niche baby care offerings. In August 2025, Marquise Baby expanded retail reach by distributing nappies and wipes to 700 7Eleven stores and Ampol service stations across Australia, improving convenience for busy parents. Furthermore, digital platforms leverage machine learning algorithms to provide personalised product recommendations based on infant age, skin sensitivity, and parental preferences. This transformation is complemented by omnichannel strategies where traditional retailers are integrating online and offline experiences to enhance customer engagement and satisfaction.

Market Outlook 2026-2034:

The Australia baby care products market is positioned for sustained revenue growth throughout the forecast period, supported by evolving consumer preferences favouring premium, organic, and sustainably produced formulations. The market revenue is expected to expand as health-conscious parents continue prioritising safety and quality in their purchasing decisions. Technological innovations in product development, including smart baby monitoring devices and advanced absorption technologies in diapers, are anticipated to create additional revenue streams. The market generated a revenue of USD 3.4 Billion in 2025 and is projected to reach a revenue of USD 5.2 Billion by 2034, growing at a compound annual growth rate of 4.90% from 2026-2034.

Australia Baby Care Products Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Baby Toiletries |

40.02% |

|

Category |

Mass |

80.05% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

45.56% |

|

Region |

Australia Capital Territory & New South Wales |

29% |

Product Type Insights:

- Baby Skin Care

- Baby Hair Care

- Baby Toiletries

- Baby Bath Products and Fragrances

- Baby Diapers and Wipes

- Baby Food and Beverages

Baby toiletries dominate with a market share of 40.02% of the total Australia baby care products market in 2025.

Baby toiletries maintain its leading position within the Australia baby care products market, encompassing essential daily-use items including diapers, wipes, bath products, and fragrances designed specifically for infant care needs. This segment benefits significantly from the non-discretionary nature of these products, as parents require consistent supplies throughout infancy and toddlerhood stages. The growing demand for gentle, skin-friendly formulations has driven manufacturers to develop hypoallergenic and dermatologically tested options that effectively minimise irritation risks for delicate infant skin.

Innovation within the baby toiletries focuses on enhanced absorption technologies, eco-friendly materials, and biodegradable alternatives that address environmental concerns among increasingly conscious consumers. Premium nighttime diapers featuring advanced leakage barriers and extended dryness technology are gaining substantial traction among parents seeking improved comfort for their infants during sleep. As per sources, in May 2025, Millie Moon Luxury Nappies launched at Woolworths Australia, offering ultra-absorbent, fragrance-free, dermatologically tested nappies and wipes, providing gentle, premium daily-use baby care solutions nationwide. Further, the convenience of baby wipes for on-the-go use continues driving steady demand, with brands introducing plant-based and fragrance-free variants catering specifically to sensitive skin requirements.

Category Insights:

- Premium

- Mass

Mass leads with a share of 80.05% of the total Australia baby care products market in 2025.

The mass dominates the Australia baby care products market, reflecting mainstream consumer preference for accessible and reasonably priced products from established trusted brands. This segment benefits significantly from extensive distribution through supermarkets, hypermarkets, and pharmacies, ensuring widespread product availability across both urban and regional areas throughout Australia. Mass-market products strongly appeal to budget-conscious parents who seek reliable quality without premium price points, making essential baby care products accessible to families across diverse income levels.

Established multinational brands maintain strong competitive positions within the mass through consistent product quality, recognisable packaging designs, and substantial marketing investments that effectively build lasting consumer trust. The segment continues evolving with manufacturers introducing improved formulations and sustainable packaging options to meet changing consumer expectations regarding environmental responsibility. Promotional activities and competitive pricing strategies play significant roles in driving consumer choices within this price-sensitive segment where value perception substantially influences purchasing decisions among Australian families.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies/Drug Stores

- Online Stores

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 45.56% share of the total Australia baby care products market in 2025.

Supermarkets and hypermarkets represent the dominant distribution channel for baby care products in Australia, offering consumers the substantial convenience of comprehensive one-stop shopping experiences under single roofs. These retail formats provide extensive product assortments spanning multiple brands and diverse price points, enabling parents to compare available options and make informed purchasing decisions. The ability to physically examine products before purchase remains an important factor driving consistent traffic to these stores among cautious parents.

Major retail chains operating through supermarkets and hypermarkets leverage their substantial purchasing power to offer competitive pricing and attractive promotional deals that effectively attract price-conscious consumers seeking optimal value. According to sources, the ACCC reported that over 85 percent of Australians belong to supermarket loyalty programs, which may influence spending habits and affect perceptions of value at Coles and Woolworths. Moreover, strategic product placement and effective in-store merchandising significantly influence consumer choices at the point of purchase within these retail environments. These retailers are increasingly integrating digital capabilities including click-and-collect services and mobile applications to enhance overall customer convenience and maintain competitive advantages against pure-play online retailers expanding market presence.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales dominates with a market share of 29% of the total Australia baby care products market in 2025.

Australia Capital Territory and New South Wales commands the largest share of the national baby care products market, reflecting the significant concentration of population and economic activity concentrated in these areas. Sydney and surrounding metropolitan areas house substantial numbers of young families with higher disposable incomes and greater access to premium retail infrastructure and specialised stores. Urban consumers in this region demonstrate heightened awareness of product quality, ingredient safety standards, and sustainable practices.

The region benefits from superior retail density including flagship stores of international brands and specialised baby care boutiques catering specifically to discerning parents seeking premium quality options. E-commerce adoption rates are particularly high among time-pressed urban professionals seeking convenient shopping solutions for essential baby care products and accessories. The diverse multicultural population in these areas drives substantial demand for varied product offerings catering to different cultural preferences, traditions, and specific infant care practices.

Market Dynamics:

Growth Drivers:

Why is the Australia Baby Care Products Market Growing?

Rising Parental Awareness of Infant Health and Safety

Australian parents, particularly millennials and Generation Z consumers, are demonstrating heightened awareness regarding infant health, hygiene, and overall well-being. As per sources, in October 2024, the Australian government introduced a mandatory industry code for baby formula advertising to protect parents from misleading marketing and ensure safer, well-informed infant-feeding decisions. Furthermore, these demographic conducts extensive research before purchasing baby care items, carefully scrutinising ingredient lists and seeking products that are free from potentially harmful substances including toxins, artificial fragrances, and common allergens. The proliferation of parenting blogs, social media communities, and healthcare professional recommendations has amplified access to information about infant care best practices. Parents are increasingly willing to invest in premium, hypoallergenic, and dermatologically tested products that promise enhanced safety for their children's delicate skin and developing bodies. This behavioural shift has created substantial demand for high-quality formulations across skincare, toiletries, and nutrition categories.

Expanding E-Commerce Infrastructure and Digital Retail Channels

The rapid expansion of e-commerce platforms has fundamentally transformed how Australian parents purchase baby care products, offering unprecedented convenience and comprehensive product selections. Online retail channels provide doorstep delivery services that appeal to time-pressed working parents juggling multiple responsibilities. Digital platforms extend market reach beyond metropolitan centres, enabling rural and regional households to access premium and specialised baby care offerings previously unavailable in their localities. According to reports, 103 Million parcels were delivered during November and December 2024, with 7.6 Million households making online purchases, highlighting rising ecommerce adoption across Australia. Furthermore, machine learning (ML) algorithms power personalised product recommendations based on individual preferences, purchase history, and infant-specific requirements. The integration of subscription services for essential items like diapers and wipes ensures consistent supply while offering cost savings, further driving adoption of online purchasing channels among Australian families.

Growing Demand for Organic and Natural Product Formulations

Australian consumers are increasingly gravitating toward organic, natural, and sustainably produced baby care products, reflecting broader wellness and environmental consciousness trends. Parents are actively seeking formulations featuring botanical extracts, plant-derived ingredients, and certified organic components that align with their values regarding health and sustainability. The robust organic agriculture sector in Australia supports domestic production of natural baby care ingredients, fostering consumer trust in locally sourced products. This preference extends across all product categories including skincare featuring aloe vera and coconut oil, bath products with chamomile and oat extracts, and nutrition options using plant-based protein sources. In January 2025, KidsBliss launched its ACO Certified Organic Aloe Vera Gel in Australia, providing a gentle, plant-based solution for sensitive baby skin with eco-friendly packaging. Moreover, manufacturers are responding by expanding organic product ranges and obtaining certifications that validate their clean label credentials to discerning consumers.

Market Restraints:

What Challenges the Australia Baby Care Products Market is Facing?

Declining Birth Rates Affecting Consumer Base

Australia is experiencing declining fertility rates driven by economic pressures including rising living costs, housing affordability challenges, and increasing childcare expenses. This demographic trend results in a smaller consumer base for baby care products, intensifying competition among brands for a limited audience. Delayed parenthood among younger generations further compounds this challenge, as couples increasingly postpone starting families until later stages of their careers.

Stringent Regulatory Requirements and Compliance Costs

The baby care industry operates under strict regulatory frameworks designed to ensure product safety for vulnerable infant consumers. While essential for protecting infant health, these stringent requirements create challenges for manufacturers and suppliers through increased compliance costs and extended approval timelines. Rigorous testing, documentation, and certification processes can slow product innovations and market introductions, particularly for smaller brands lacking resources for extensive regulatory navigation.

Premium Price Points Limiting Market Accessibility

The growing emphasis on organic, natural, and premium baby care products often translates to higher retail prices that may exceed budget constraints of cost-sensitive consumers. Economic uncertainties and rising household expenses are prompting some families to prioritise essential purchases over premium alternatives. This price sensitivity can limit the penetration of high-quality formulations among broader consumer segments despite growing awareness of their benefits.

Competitive Landscape:

The Australia baby care products market exhibits a moderately consolidated competitive structure characterised by the presence of established multinational personal care corporations alongside emerging domestic organic brands. Market participants compete across multiple dimensions including product innovation, pricing strategies, distribution network expansion, and marketing investments. Leading players leverage their extensive research and development capabilities to introduce advanced formulations addressing evolving consumer preferences for natural ingredients and sustainable packaging. Domestic organic brands are carving significant niches by emphasising locally sourced ingredients and environmentally friendly practices. Strategic partnerships with retailers, both physical and online, remain crucial for market penetration. Companies are increasingly investing in digital marketing and social media engagement to build brand awareness among digitally connected millennial and Generation Z parents.

Recent Developments:

-

In December 2025, Australian baby-care brand Aiwibi unveiled a new infant formula in collaboration with ViPlus, focusing on sensitive baby needs. The launch strengthens Aiwibi’s global product offerings, combining the brand’s expertise in baby essentials with ViPlus’s century-long experience in dairy and infant nutrition.

-

In June 2024, Baby Bunting signed exclusive agreements with Nuna Baby Australia for five years and Bugaboo in New Zealand for three years, strengthening its premium baby gear portfolio. These deals expand the company’s market presence, provide competitive differentiation, and offer innovative products to families across Australia and New Zealand.

Australia Baby Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Categories Covered | Premium, Mass |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies/Drug Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia baby care products market size was valued at USD 3.4 Billion in 2025.

The Australia baby care products market is expected to grow at a compound annual growth rate of 4.90% from 2026-2034 to reach USD 5.2 Billion by 2034.

Baby toiletries held the largest share in the Australia baby care products market, driven by their essential role in daily infant hygiene, consistent repeat purchases, rising demand for gentle formulations, and strong parental preference for trusted, skin-safe care solutions.

Key factors driving the Australia baby care products market include rising parental awareness regarding infant health and safety, expanding e-commerce infrastructure enabling convenient purchasing, and growing consumer preference for organic and natural product formulations.

Major challenges include declining birth rates reducing the consumer base, stringent regulatory requirements increasing compliance costs, premium product pricing limiting accessibility, economic uncertainties affecting consumer spending, and intense competition among established and emerging brands.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)