Australia Bancassurance Market Size, Share, Trends and Forecast by Product Type, Model Type, and Region, 2025-2033

Australia Bancassurance Market Size and Share:

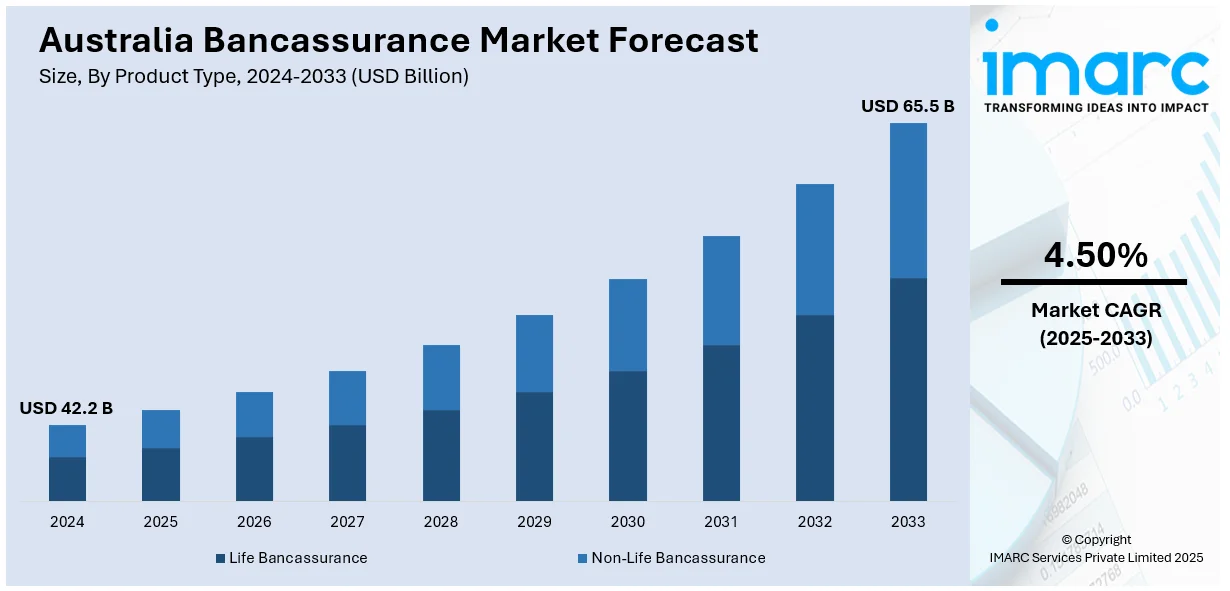

The Australia bancassurance market size reached USD 42.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 65.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The rising demand for convenient insurance distribution, expanding digital banking, strategic insurer-bank partnerships, aging population, growing awareness of financial protection, and regulatory support for integrated financial products are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 42.2 Billion |

| Market Forecast in 2033 | USD 65.5 Billion |

| Market Growth Rate 2025-2033 | 4.50% |

Australia Bancassurance Market Trends:

Wider Access to Insurance through Banking Channels

More financial institutions are integrating insurance distribution into their service offerings, making protection products easier to access for everyday consumers. In Australia, this model is gaining momentum as banks increasingly serve as a one-stop destination for both financial and insurance needs. The approach simplifies purchase pathways, particularly for life and health coverage, by embedding these options within familiar banking platforms. Consumers benefit from convenience and trust, while insurers tap into established customer bases without heavy infrastructure investment. Digital platforms further streamline the experience, allowing policy selection and purchase online with minimal friction. This shift is quietly reshaping how individuals in Australia interact with insurance, especially in regions where direct agent networks are thin. As banks deepen collaboration with insurers, the distinction between financial and insurance services continues to blur across customer touchpoints. For example, in December 2024, Blue Cross (Asia-Pacific) Insurance Limited and Public Bank (Hong Kong) Limited announced a bancassurance partnership. Customers of Public Bank can now purchase selected insurance products offered by Blue Cross through the bank's branch network and website, enhancing the accessibility of insurance services.

To get more information on this market, Request Sample

Rise of Bank-Branded Insurance

Banks in Australia are increasingly offering insurance products under their branding, leveraging partnerships with insurtech firms to simplify distribution and improve user experience. These collaborations allow banks to provide home, contents, and motor coverage directly through streamlined digital interfaces, removing friction from traditional application processes. Customers benefit from a unified experience where banking and insurance services are accessed in one place, often with faster onboarding and intuitive policy management. This model also allows banks to deepen relationships with existing clients by offering value-aligned protection products without building their insurance infrastructure. At the operational level, insurtech platforms enable scalability, data-driven customization, and more responsive support. As digital expectations rise, more banks are turning to white-labeled or co-developed insurance offerings to keep pace, embedding protection into the daily financial lives of Australian consumers with minimal disruption. For instance, in April 2024, Honey Insurance and Bank Australia announced a six-year partnership, introducing Bank Australia-branded home, contents, and motor insurance products through Honey's digital platform. This collaboration aims to enhance customer experience by simplifying the insurance application and management process.

Australia Bancassurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type and model type.

Product Type Insights:

- Life Bancassurance

- Non-Life Bancassurance

The report has provided a detailed breakup and analysis of the market based on the product type. This includes life bancassurance and non-life bancassurance.

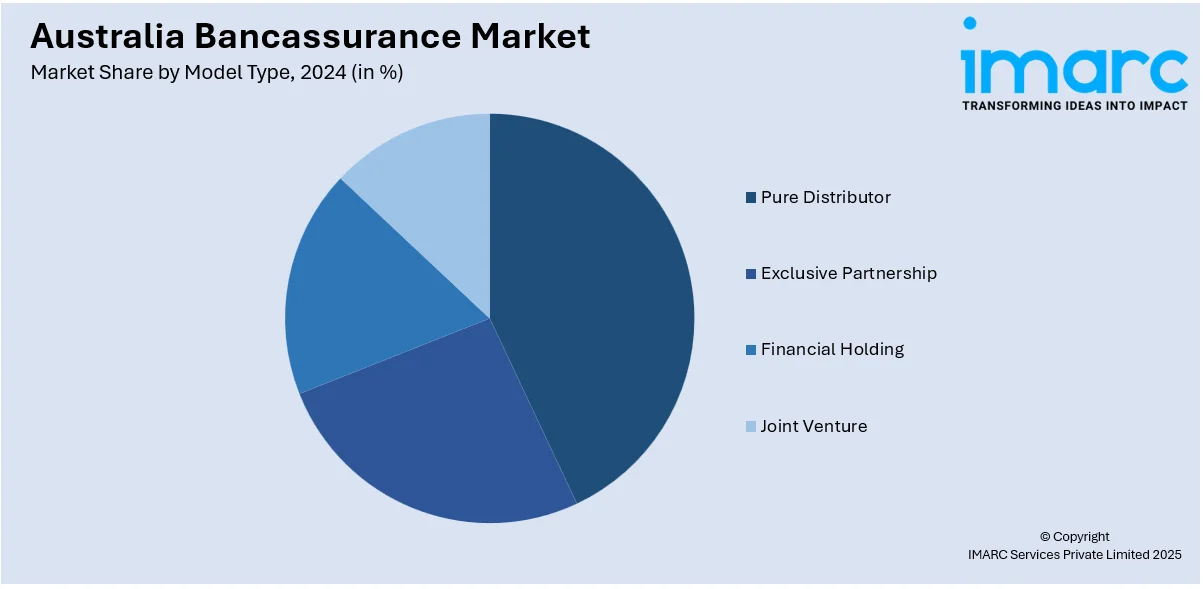

Model Type Insights:

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

A detailed breakup and analysis of the market based on the model type have also been provided in the report. This includes pure distributor, exclusive partnership, financial holding, and joint venture.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Bancassurance Market News:

- In December 2024, Nippon Life Insurance Company announced the acquisition of a controlling stake in Resolution Life for USD 8.2 Billion. This deal includes the absorption of National Australia Bank's local arm, MLC Life, for an additional USD 500 Million. The merged entity would rebrand as Acenda, aiming to enhance growth and efficiency in Australia's life insurance sector.

- In November 2024, Insurance Australia Group (IAG) agreed to acquire a 90% stake in RACQ's insurance underwriting business for USD 855 Million, with an option to purchase the remaining 10% after two years. This 25-year strategic alliance is expected to add approximately USD 1.3 Billion to IAG's gross written premiums and strengthen its presence in Queensland.

Australia Bancassurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life Bancassurance, Non-Life Bancassurance |

| Model Types Covered | Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia bancassurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia bancassurance market on the basis of product type?

- What is the breakup of the Australia bancassurance market on the basis of model type?

- What are the various stages in the value chain of the Australia bancassurance market?

- What are the key driving factors and challenges in the Australia bancassurance market?

- What is the structure of the Australia bancassurance market and who are the key players?

- What is the degree of competition in the Australia bancassurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia bancassurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia bancassurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia bancassurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)