Australia Beauty and Personal Care Market Size, Share, Trends and Forecast by Type, Category, Distribution Channel, and Region, 2025-2033

Australia Beauty and Personal Care Market Size and Overview:

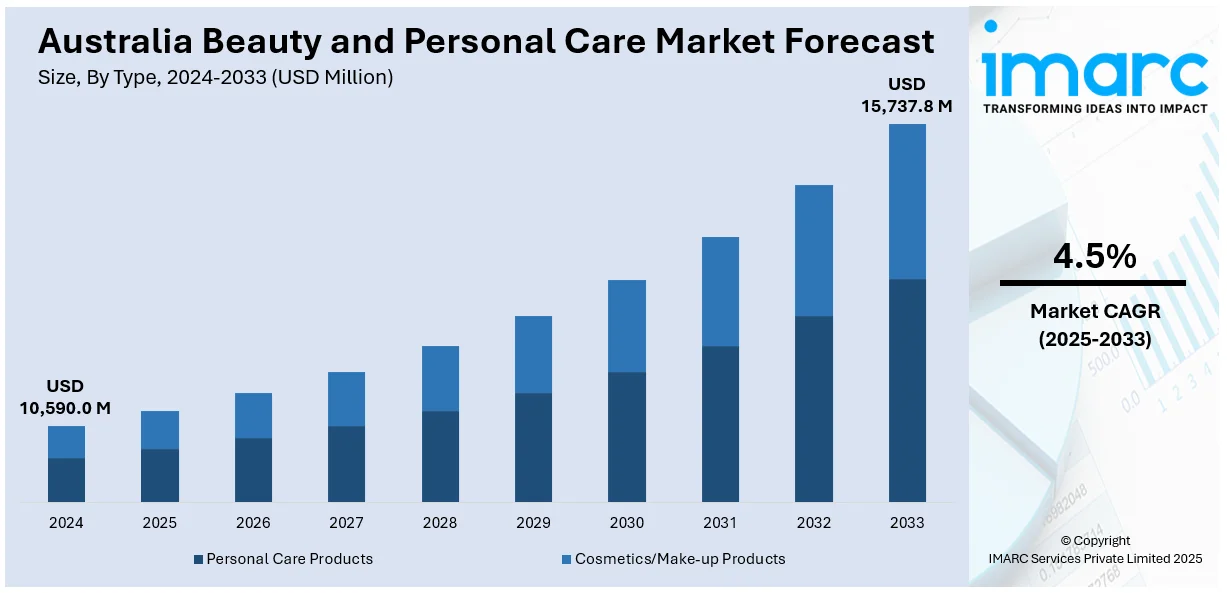

The Australia beauty and personal care market size reached USD 10,590.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 15,737.8 Million by 2033, exhibiting a growth rate (CAGR) of 4.5% during 2025-2033. The market is fueled by growing demand for organic and natural products, heightened health and sustainability consciousness, and greater demand for ethical brands. Digital innovation, e-commerce growth, and influencer marketing also drive consumer interest, particularly among younger, digitally native consumers looking for personalized and clean-label solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10,590.0 Million |

| Market Forecast in 2033 | USD 15,737.8 Million |

| Market Growth Rate 2025-2033 | 4.5% |

Key Trends of Australia Beauty and Personal Care Market:

Increasing Demand for Natural and Organic Products

The Australia beauty and personal care market share is experiencing a strong shift toward natural and organic products, fueled by growing consumer concern about ingredient safety, environmental sustainability, and ethical sourcing. Increasing numbers of Australians are turning to clean beauty solutions—products that contain no parabens, sulfates, or artificial fragrances—due to concerns over skin sensitivity and long-term health consequences. This has prompted local and international brands to invest in research and development to create safer, plant-derived alternatives. Some of the top Australian brands such as Sukin, Jurlique, and MooGoo have taken advantage of this trend and provided eco-friendly skincare and personal care ranges appealing to sustainability-oriented consumers. Apart from this, the trend is consistent with Australia's larger cultural predisposition toward wellness and a natural lifestyle. Hence, retailers are giving more shelf space to organic brands and highlighting environmental credentials on labels.

To get more information on this market, Request Sample

E-commerce and Digital Beauty Acceleration

The digital revolution of the Australia beauty and personal care market outlook is redefining the way consumers shop and find products. The ease of shopping online, and breakthroughs in digital technology such as augmented reality (AR) try-ons and bespoke skincare quizzes, have added to the shopping experience. Australia Post’s yearly eCommerce Report has shown that Australians spent a historic A$69bn (USD 43.6 billion) on online shopping in 2024, marking a 12% rise compared to the prior year. The report indicates that in the previous year, 9.8 million households engaged in online shopping, with the highest expenditures at online marketplaces (nearly A$16bn/USD 10.1 billion), followed by food and alcohol (A$13.6bn/USD 8.6 billion) and clothing and accessories (A$9.6bn/USD 6 billion). Nearly 50% of Gen Z and millennials made a weekly online purchase through social media. Hence, Australian consumers, especially Gen Z and millennials, are increasingly driven by beauty influencers, YouTube tutorials, and TikTok reviews, making for a dynamic and trend-oriented shopping experience. Digital marketplaces and online platforms like Adore Beauty and Sephora Australia are expanding with large product offerings, rapid shipping, and loyalty schemes to promote customer retention. Subscription beauty boxes are also becoming popular, with handpicked product experiences and the promotion of brand discovery. This wave is generating sales and enabling brands to collect customer information to facilitate more focused marketing and product development. With increasing trends in mobile buying and social shopping, digital moves will be at the center of market competition.

Emergence of Ethical Consumerism and Sustainable Beauty

Sustainability is emerging as an overarching priority among customers, which is also fueling the Australia beauty and personal care market growth. The ascent of ethical consumerism signifies that cruelty-free, vegan, zero-waste, and carbon-neutral beauty products are no longer a niche—as they are moving into the mainstream marketplaces. Brands are being compelled to evolve through redesigning packaging to be refillable or recyclable and pledging plastic reduction throughout their supply chains. Campaigns promoting a brand's social and environmental responsibility now play a significant role in purchasing decisions. Locally made products are also gaining popularity with several Australian consumers to cut down on carbon footprints and assist domestic businesses. This emphasis on sustainability carries over from the product itself to the entire brand philosophy—from the sourcing of ingredients to labor and community practices. The extent that ethical beauty takes hold in consumers' sensibilities, is that brands that do live up to such expectations risk becoming irrelevant within a marketplace that is increasingly conscious and values driven.

Growth Drivers of Australia Beauty and Personal Care Market:

Influence of Social Media and Influencers

Social media sites such as Instagram, TikTok, and YouTube have heavily influenced the beauty and personal care industry in Australia. Beauty influencers and content creators on social media steer consumer behavior by posting product reviews, tutorials, and beauty trends. Their potential to access a large audience and generate viral content has made them influential in driving purchasing decisions. Consequently, consumers prefer influencer recommendations and hence tend to buy more of the product. Brands are also joining forces with influencers to popularize new products, activating targeted campaigns that engage digital-native consumers. This has reshaped conventional beauty marketing, with the resulting marketing being more interactive, real, and consumer centric.

Increased Focus on Skincare

Skincare has emerged as a high-profile category in the Australian beauty and personal care market, spurred by heightened consumer knowledge of skincare regimens and the significance of the health of their skin. Products addressing individual needs like anti-aging, hydration, treatment of acne, and skin pigmentation are gaining popularity. Consumers are now looking for products with active ingredients, and there is a move toward tailored skincare solutions meeting the needs of different skin types and issues, which in turn contributes positively to the Australia beauty and personal care market demand. With increased exposure to information via the internet, individuals are better aware of the advantages of regular skincare practices and the technology involved in skincare products. This is driving both product diversity and customer investment in high-end skincare products.

Male Grooming

Male grooming market is growing at an impressive rate and fueling the growth of the Australian beauty market. Historically, beauty and personal care products have been targeted towards women, but now more and more men are adopting grooming products. Ranging from skincare, hair care, and beard care to perfumes and makeups, there is increased curiosity towards personal care among male customers. This change is motivated by evolving societal perspectives, where men are increasingly concerned about their looks and grooming regimens. Beauty companies are meeting this need with gender-neutral or men-focused products, and more grooming services are being launched to appeal to this segment. The growing influence of male influencers also contributes to mainstreaming and popularizing male grooming.

Opportunities in Australia Beauty and Personal Care Market:

Expanding Anti-Aging Market

The anti-aging market in Australia is growing rapidly as more consumers seek products that can reduce the visible signs of aging and maintain youthful skin. With an aging population and increased awareness about skin health, there’s a rising demand for anti-aging skincare solutions, including moisturizers, serums, and eye creams, as well as cosmetics that provide age-defying benefits. Brands have an opportunity to create innovative formulations targeting different age groups, from early-age preventative products to those targeting mature skin concerns. Anti-aging trends also extend to supplements and wellness products that support skin vitality from within. This expanding market allows brands to cater to diverse consumer needs and preferences, capitalizing on a trend that aligns with both beauty and overall health.

Personalized Beauty Solutions

Personalized beauty solutions have become a key opportunity in the Australian beauty and personal care market, as consumers increasingly seek products tailored to their unique needs. Advances in technology, including online skin assessments and custom formulations, allow brands to offer highly individualized skincare, haircare, and cosmetic products. Consumers are moving away from one-size-fits-all offerings in favor of products specifically designed for their skin type, concerns, and preferences. This shift has led to the growth of brands that specialize in customized beauty routines, from personalized skincare regimens to bespoke foundation shades. Offering such personalized experiences helps to build customer loyalty, while catering to the growing desire for products that provide more targeted and effective results. According to Australia beauty and personal care market analysis, the demand for personalized beauty solutions is rapidly growing as consumers prioritize customized experiences over generic offerings.

Technological Integration

The integration of technology into the beauty and personal care market is reshaping the way consumers interact with brands and products. Virtual try-ons, AI-based skin analysis, and at-home beauty devices are becoming popular tools to enhance the customer experience. Virtual try-ons, for example, allow consumers to test makeup shades and styles in real-time through their smartphones, offering convenience and reducing the need for in-store visits. Tools that utilize artificial intelligence for skin analysis can suggest customized skincare routines tailored to a person's specific skin conditions. Additionally, at-home beauty devices, such as facial massagers and LED masks, are becoming increasingly popular for personal care treatments. These technological innovations improve the consumer experience and offer new ways for brands to engage and retain customers in an increasingly digital marketplace.

Australia Beauty and Personal Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, category, and distribution channel.

Type Insights:

- Personal Care Products

- Hair Care Products

- Shampoo

- Conditioner

- Hair Oil

- Others

- Skin Care Products

- Facial Care Products

- Body Care Products

- Lip Care Products

- Bath and Shower Products

- Oral Care Products

- Toothbrushes and Replacements

- Toothpaste

- Mouthwashes and Rinses

- Others

- Men’s Grooming Products

- Fragrances and Perfumes

- Hair Care Products

- Cosmetics/Make-up Products

- Facial Cosmetics

- Eye Cosmetic Products

- Lip and Nail Products

- Hair Styling and Coloring Products

The report has provided a detailed breakup and analysis of the market based on the type. This includes personal care products, [hair care products (shampoo, conditioner, hair oil, and others), skin care products (facial care products, body care products, and lip care products), bath and shower products, oral care products (toothbrushes and replacements, toothpaste, mouthwashes and rinses, and others), men’s grooming products, and fragrances and perfume] and cosmetic/make-up products (facial cosmetics, eye cosmetic products, lip and nail products, and hair styling and coloring products).

Category Insights:

- Premium Products

- Mass Products

The report has provided a detailed breakup and analysis of the market based on the category. This includes premium products and mass products.

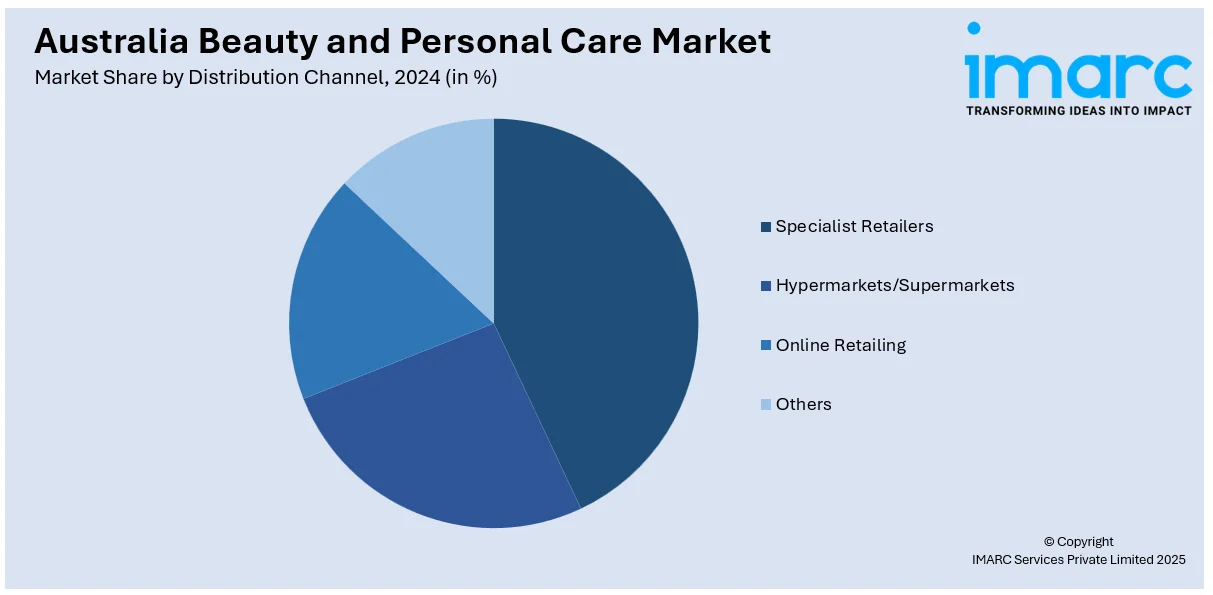

Distribution Channel Insights:

- Specialist Retailers

- Hypermarkets/Supermarkets

- Online Retailing

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes specialist retailers, hypermarkets/supermarkets, online retailing, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Beauty and Personal Care Market News:

- In February 2023, Unilever consented to invest A$2 million ($1.42 million) in the Australian scalp care brand Straand, established in 2022. Unilever Ventures' pre-seed funding has been allocated for growth in China, Southeast Asia, Europe, and the US. Straand was poised to enter the US and Southeast Asia soon and aims to debut in Europe by April 2023.

Australia Beauty and Personal Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Categories Covered | Premium Products, Mass Products |

| Distribution Channels Covered | Specialist Retailers, Hypermarkets/Supermarkets, Online Retailing, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia beauty and personal care market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia beauty and personal care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia beauty and personal care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The beauty and personal care market in the Australia was valued at USD 10,590.0 Million in 2024.

The Australia beauty and personal care market is expected to reach a value of USD 15,737.8 Million by 2033.

The Australia beauty and personal care market is projected to exhibit a compound annual growth rate (CAGR) of 4.5% during 2025-2033.

The market is driven by the growing demand for eco-friendly and organic beauty products, the rise of male grooming, and the growing focus on skincare. Social media influence, technological advancements in beauty tech, and the expanding anti-aging market are also contributing to the sector's growth.

The Australian beauty market is seeing a rise in demand for natural, sustainable, and cruelty-free products. E-commerce is growing rapidly, with online shopping becoming a key channel. Personalized beauty solutions and technological innovations like virtual try-ons and AI skin analysis are reshaping consumer experiences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)