Australia Beverage Packaging Market Size, Share, Trends and Forecast by Material, Product, Application, and Region, 2025-2033

Australia Beverage Packaging Market Overview:

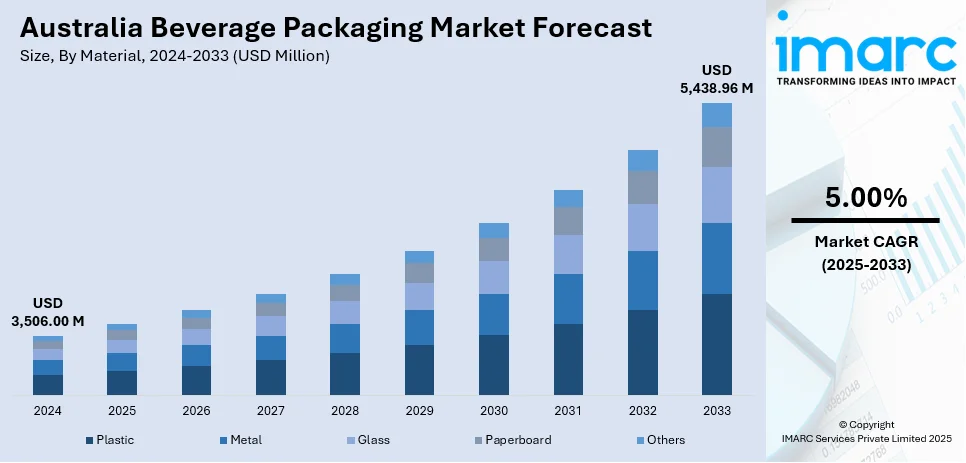

The Australia beverage packaging market size reached USD 3,506.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,438.96 Million by 2033, exhibiting a growth rate (CAGR) of 5.00% during 2025-2033. The market is propelled by mounting demand for environmentally friendly materials, new formats, and visual attractiveness. Health awareness and lifestyle changes are driving alterations in packaging types in alcoholic and non-alcoholic segments, with improved functionality and sustainability and in accordance with consumer and environmental needs in a competitive environment, contributing to the evolving dynamics of the Australia beverage packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,506.00 Million |

| Market Forecast in 2033 | USD 5,438.96 Million |

| Market Growth Rate 2025-2033 | 5.00% |

Australia Beverage Packaging Market Trends:

Emergence of Sustainable and Eco-Friendly Packaging

One of the prominent trends transforming the beverage packaging scenario in Australia is the growing preference for sustainable and eco-friendly packaging materials. The trend is significantly influenced by heightened environmental consciousness among consumers and governmental initiatives to limit plastic waste. Packaging types comprising biodegradable materials, recyclable paperboard, plant-based plastics, and reusable containers are becoming popular in different beverage categories. For instance, in March 2025, Australia released a beverage can containing 83% recycled content, made by Visy at Yatala, Queensland, as a big step in sustainable packaging through industry cooperation. Moreover, manufacturers are using lighter packs with less material consumption, reflecting circular economy practices. There is also a trend towards clean design that supports green branding. Australia beverage packaging market outlook indicates that sustained innovation in green materials will continue to be instrumental in influencing consumers' attitudes and buying behaviors. As consumers become more proactive in pursuing green products, this trend will continue to drive investments in sustainable packaging technology and infrastructure, spurring a revolution in the classic beverage packaging model and ensuring long-term market sustainability.

To get more information on this market, Request Sample

Increased Demand for Convenient Packaging Forms

Australian consumer habits are being driven by mobility, on-the-go usage, and time management, spurring the development of convenience-focused beverage packaging formats. Packaging formats like single-serve bottles, resealable pouches, light cans, and easy-pour cartons are gaining momentum, particularly in urban areas. These packages are convenient to store, easy to carry, and easy to use, fitting busy consumers' and younger generations' tastes. For example, in August 2023, Australian start-up The Boxed Beverage Company released Waterbox, sustainably packaged alkaline water in plant-based cartons with up to 8x lower climate footprint than PET bottles. Furthermore, the trend also moves into packaging with enhanced functionality, like temperature-tracking inks or smart caps that monitor freshness. Australia beverage packaging market growth is driven by the capacity of manufacturers to reformat packaging to suit contemporary habits and active lifestyles. As convenience becomes a key driver of purchasing decisions, packaging formats that maximize user experience, shelf life, and portion control will increasingly be adopted across a wide range of beverage categories, from carbonated beverages and bottled water to milk and plant-based drinks.

Premiumization and Aesthetic Attraction in Packaging Design

Australian consumers are showing a strong preference for premium and attractive beverage packaging that is both aesthetic and functional. Premium finishes, embossed labels, clear materials, and streamlined shapes are being used to communicate brand values and product quality. This trend is most apparent in areas like craft drinks, health beverages, and specialty waters, where packaging is important for product differentiation at the shelf. Additionally, packaging design is changing to communicate authenticity, wellness, and stories of origin, which are having more impact on purchase decisions. Increased shelf appeal through advanced designs not only contributes to brand identification but also drives perceived value. The Australia beverage packaging market share is experiencing significant changes as products with better visual appearance command premium shelf space and consumer demand. As design becomes a strategic marketing strategy, brands will be required to invest more in aesthetic innovation to gain market share and build consumer loyalty.

Australia Beverage Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material, product, and application.

Material Insights:

- Plastic

- Metal

- Glass

- Paperboard

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes plastic, metal, glass, paperboard, and others.

Product Insights:

- Bottles

- Cans

- Pouches

- Cartons

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes bottles, cans, pouches, cartons, and others.

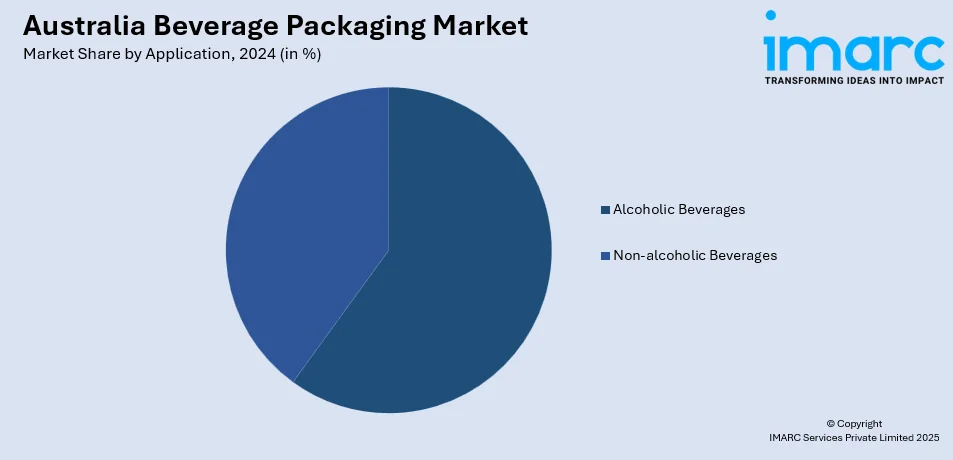

Application Insights:

- Alcoholic Beverages

- Non-alcoholic Beverages

- Carbonated drinks

- Bottled water

- Milk

- Fruit and vegetable juices

- Energy drinks

- Plant-based drinks

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes alcoholic beverages, and non-alcoholic beverages (carbonated drinks, bottled water, milk, fruit and vegetable juices, energy drinks, plant-based drinks, others).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Beverage Packaging Market News:

- In July 2024, SIG launched a recycle-ready bag-in-box water packaging in Australia, substituting aluminum parts with SIG Terra RecShield. The innovation aligns with Australia's 2025 National Packaging Targets, is more sustainable by minimizing plastic usage over PET bottles and will be available on the market from September 2024.

Australia Beverage Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Plastic, Metal, Glass, Paperboard, Others |

| Products Covered | Bottles, Cans, Pouches, Cartons, Others |

| Applications Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia beverage packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia beverage packaging market on the basis of material?

- What is the breakup of the Australia beverage packaging market on the basis of product?

- What is the breakup of the Australia beverage packaging market on the basis of application?

- What is the breakup of the Australia beverage packaging market on the basis of region?

- What are the various stages in the value chain of the Australia beverage packaging market?

- What are the key driving factors and challenges in the Australia beverage packaging?

- What is the structure of the Australia beverage packaging market and who are the key players?

- What is the degree of competition in the Australia beverage packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia beverage packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia beverage packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia beverage packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)