Australia Big Data Security Market Size, Share, Trends and Forecast by Component, Technology, Deployment Mode, Organization Size, End Use Industry, and Region, 2025-2033

Australia Big Data Security Market Overview:

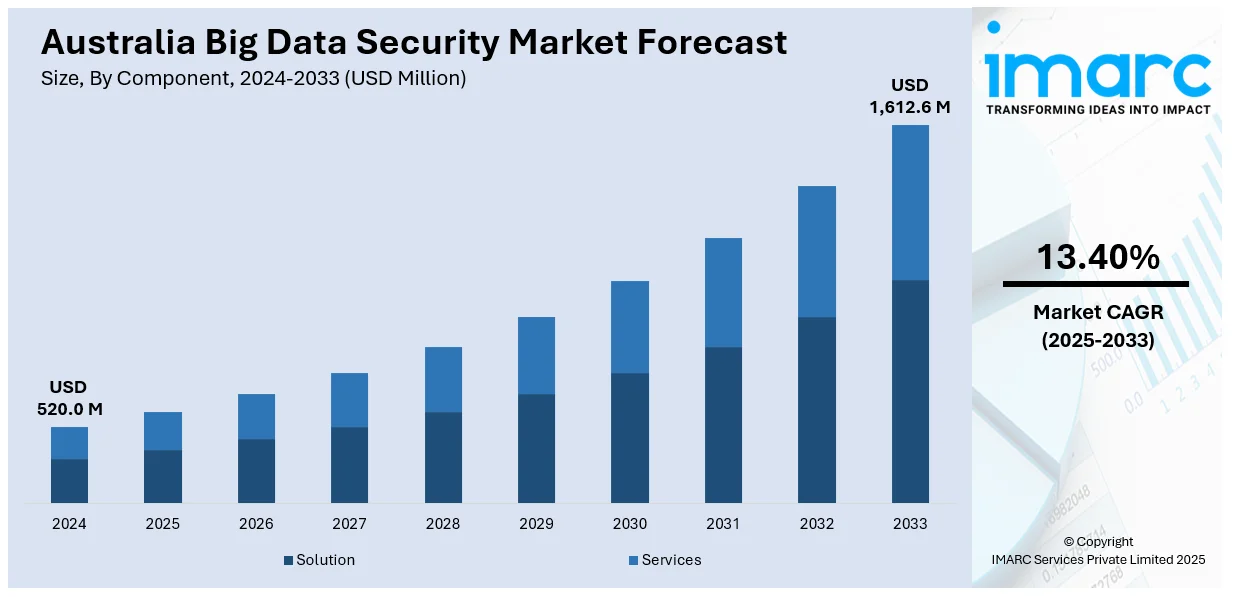

The Australia big data security market size reached USD 520.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,612.6 Million by 2033, exhibiting a growth rate (CAGR) of 13.40% during 2025-2033. Rising cyberattacks, evolving privacy regulations, widespread cloud adoption, surging ransomware threats, stricter data breach laws, hybrid infrastructure growth, increased digital transformation, sector-specific compliance pressures, and growing demand for zero-trust frameworks across industries handling sensitive and high-volume data environments are factors boosting the Australia big data security market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 520.0 Million |

| Market Forecast in 2033 | USD 1,612.6 Million |

| Market Growth Rate 2025-2033 | 13.40% |

Australia Big Data Security Market Trends:

Escalating Ransomware and Data Breach Threats

Australia has witnessed a sharp increase in ransomware incidents and large-scale data breaches, prompting organizations to re-evaluate their cybersecurity strategies. In 2024, Australia experienced 47 million data breaches, a twelvefold increase from 4.1 million in 2023, equating to nearly one compromised account every second. Threat actors are increasingly targeting sectors such as healthcare, banking, and telecommunications, often seeking financial gain or sensitive personal information. In line with this, businesses are investing in advanced threat detection systems, secure access controls, and automated incident response tools, which is accelerating the market growth. The demand for real-time monitoring and behavioral analytics has grown, as enterprises aim to detect and neutralize threats before they escalate. This trend is especially evident among mid to large-scale firms handling critical infrastructure or customer records.

To get more information on this market, Request Sample

Strengthening Regulatory Frameworks and Compliance Mandates

Regulatory changes are playing a pivotal role in shaping the demand for big data security solutions in Australia. The revision of the Australian Privacy Act, combined with enhanced enforcement of the Notifiable Data Breaches (NDB) scheme, has raised the compliance burden on enterprises managing sensitive data. Organizations are legally obligated to detect, report, and respond to data breaches promptly, failing which they risk substantial financial penalties and reputational damage. These mandates are especially stringent for sectors like finance, healthcare, and education, where personal data volumes are high. As a result, businesses are prioritizing investments in encryption, identity management, and secure storage technologies. Security audits and data classification processes are also gaining traction, particularly among firms preparing for future privacy law amendments, which is driving the Australia big data security market growth.

Cloud Migration and Hybrid Infrastructure Expansion

The shift toward cloud-based platforms and hybrid information technology (IT) environments has transformed how Australian enterprises manage and secure data. Organizations are increasingly adopting multi-cloud strategies to enhance scalability and reduce costs, but this trend introduces new vulnerabilities in data flow and access control. Traditional perimeter-based security models are no longer sufficient to protect distributed workloads and cloud-native applications. This has led to growing interest in zero-trust architectures, secure access service edge (SASE) models, and cloud-native security tools that provide real-time visibility and control. Data encryption, tokenization, and workload segmentation are becoming standard features in cloud security implementations. Businesses are also seeking unified dashboards to monitor data movement across public, private, and hybrid environments. The complexity of managing compliance, visibility, and breach response across fragmented infrastructures is pushing demand for integrated big data security solutions tailored for dynamic, cloud-centric operations.

Australia Big Data Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, technology, deployment mode, organization size, and end use industry.

Component Insights:

- Solution

- Data Discovery and Classification

- Data Authorization and Access

- Data Encryption, Tokenization and Masking

- Data Auditing and Monitoring

- Data Governance and Compliance

- Data Security Analytics

- Data Backup and Recovery

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (data discovery and classification, data authorization and access, data encryption, tokenization and masking, data auditing and monitoring, data governance and compliance, data security analytics, and data backup and recovery) and services.

Technology Insights:

- Identity and Access Management

- Security Information and Event Management

- Intrusion Detection System

- Unified Threat Management

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes identity and access management, security information and event management, intrusion detection system, unified threat management, and others.

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

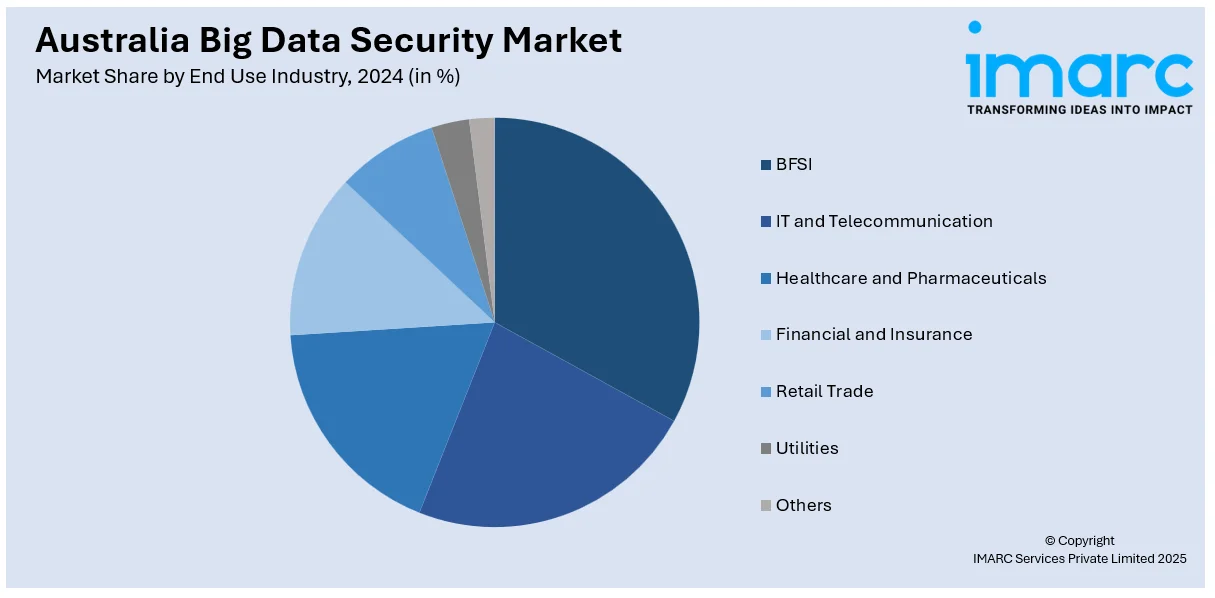

End Use Industry Insights:

- BFSI

- IT and Telecommunication

- Healthcare and Pharmaceuticals

- Financial and Insurance

- Retail Trade

- Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes BFSI, IT and telecommunication, healthcare and pharmaceuticals, financial and insurance, retail trade, utilities, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Big Data Security Market News:

- In 2025, the Australian government allocated USD 6.4 million to launch a cybersecurity information-sharing network for the healthcare sector, led by CI-ISAC. The initiative will protect sensitive patient data, enable real-time cyber threat alerts, and ensure healthcare systems remain operational during cyber incidents

- In 2024, Australian government partnered with Amazon web services (AWS) to establish three secure data centers supporting defense operations. These centers will enable intelligence-sharing within the Five Eyes alliance, boost artificial intelligence (AI) driven analysis, and reinforce national cybersecurity infrastructure for military and government agencies.

Australia Big Data Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Technologies Covered | Identity and Access Management, Security Information and Event Management, Intrusion Detection System, Unified Threat Management, Others |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Use Industries Covered | BFSI, IT and Telecommunication, Healthcare and Pharmaceuticals, Financial and Insurance, Retail Trade, Utilities, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia big data security market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia big data security market on the basis of component?

- What is the breakup of the Australia big data security market on the basis of technology?

- What is the breakup of the Australia big data security market on the basis of deployment mode?

- What is the breakup of the Australia big data security market on the basis of organization size?

- What is the breakup of the Australia big data security market on the basis of end use industry?

- What is the breakup of the Australia big data security market on the basis of region?

- What are the various stages in the value chain of the Australia big data security market?

- What are the key driving factors and challenges in the Australia big data security market?

- What is the structure of the Australia big data security market and who are the key players?

- What is the degree of competition in the Australia big data security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia big data security market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia big data security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia big data security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)