Australia Brakes and Clutches Market Size, Share, Trends and Forecast by Technology, Product Type, Sales Channel, End Use Industry, and Region, 2026-2034

Australia Brakes and Clutches Market Summary:

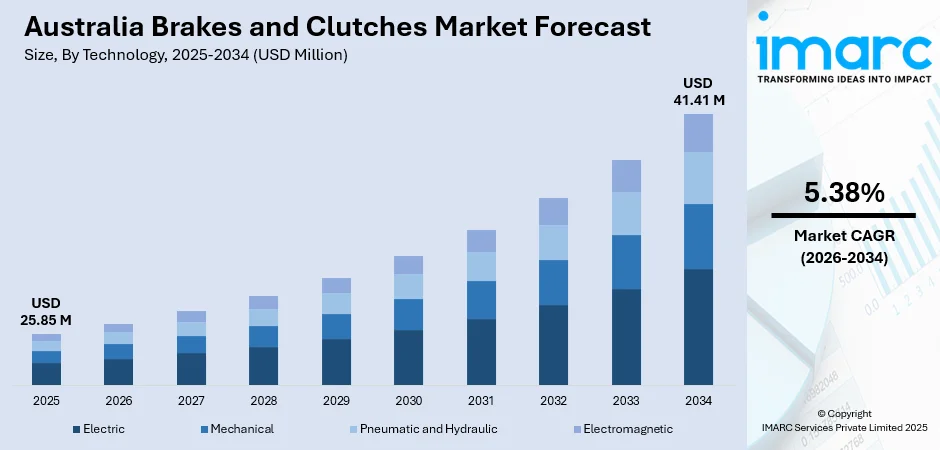

The Australia brakes and clutches market size was valued at USD 25.85 Million in 2025 and is projected to reach USD 41.41 Million by 2034, growing at a compound annual growth rate of 5.38% from 2026-2034.

Australia's brakes and clutches market is experiencing steady growth driven by the country's robust mining sector, which demands high-performance braking and transmission systems for heavy equipment operations. The increasing adoption of advanced braking technologies, including pneumatic, hydraulic, and electromagnetic systems, is supporting market expansion. Rising investment in infrastructure projects, growing vehicle fleet operations, and stringent safety regulations are further propelling demand. The transition toward electric vehicles is creating opportunities for regenerative braking systems, while the mining and metallurgy industry continues to drive significant demand for industrial-grade braking solutions, contributing to the Australia brakes and clutches market share.

Key Takeaways and Insights:

-

By Technology: Pneumatic and hydraulic hold the dominant position, accounting for 42% of the market share in 2025, driven by their widespread application in mining equipment and industrial machinery.

-

By Product Type: Dry represent 55% of the market in 2025, preferred for their reliability and lower maintenance requirements in harsh operating conditions.

-

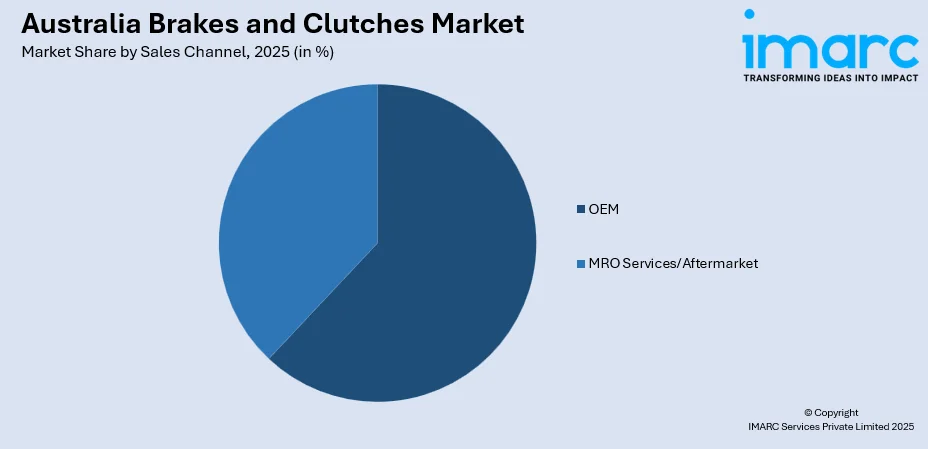

By Sales Channel: OEM dominate with 62% market share in 2025, reflecting strong demand from original equipment manufacturers supplying mining, construction, and automotive sectors.

-

By End Use Industry: Mining and metallurgy industry leads with 28% market share in 2025, supported by Australia's position as a global mining powerhouse.

-

Key Players: The market consists of a diverse mix of global brands and regional manufacturers specializing in braking and clutch technologies. These players focus on heavy-duty applications, offering advanced solutions, customized systems, and durable components tailored to the needs of mining and industrial operations.

To get more information on this market Request Sample

The Australian brakes and clutches market benefits from the country's world-leading mining industry, which operates some of the largest iron ore, coal, and gold mining operations globally. For example, the conversion to autonomous haul trucks has accelerated: at Epiroc has recently converted 78 haul trucks to fully driverless operation at Hancock Iron Ore’s Roy Hill mine in the Pilbara region. The Pilbara region operates extensive fleets of autonomous haul trucks, driving sustained demand for advanced braking systems. The market is further supported by growing vehicle electrification and increasing electric vehicle adoption. Government initiatives promoting industrial modernization, safety compliance requirements, and the expansion of maintenance, repair, and overhaul services are creating favorable conditions for market participants across both OEM and aftermarket segments.

Australia Brakes and Clutches Market Trends:

Integration of Regenerative Braking in Electric Vehicles

The rapid adoption of electric vehicles across Australia is transforming braking system requirements. Regenerative braking technology, which captures kinetic energy during deceleration to recharge batteries, is becoming standard in both passenger and commercial electric vehicles. For example, in the first half of 2025 Australians bought 72,758 battery-electric and plug-in vehicles, a 24.4% increase on the same period in 2024, pushing EVs to account for 12.1% of all new car sales. Major automotive manufacturers are integrating advanced electronic stability control and anti-lock braking systems with regenerative capabilities, creating demand for sophisticated braking components that enhance vehicle efficiency and range performance.

Autonomous Mining Equipment Driving Industrial Braking Innovation

Australia's mining sector is at the forefront of autonomous equipment adoption, with major mining companies operating extensive fleets of driverless haul trucks, trains, and drilling equipment. Recently, Scania announced that it will supply the world’s first fleet of autonomous inpit mining trucks in Australia, with first deployments planned for 2025 at Element 25’s Butcherbird mine in Western Australia’s Pilbara region, underscoring the acceleration of autonomous haulage beyond just legacy operation. These autonomous systems require highly reliable and precise braking solutions with advanced sensor integration and fail-safe mechanisms. Mining operations have deployed autonomous haulage systems that transport massive quantities of ore annually, necessitating industrial-grade braking systems capable of continuous heavy-duty operation.

Growing Aftermarket Services and MRO Demand

The maintenance, repair, and overhaul segment is experiencing significant growth as operators seek to extend equipment lifecycles and optimize operational efficiency. In 2024 the average age of vehicles in Australia reached ~11.3 years, with nearly 75% of vehicles in use more than six years, a trend that is boosting demand for independent aftermarket services. Rising demand for replacement braking and clutch components is particularly strong across passenger vehicles, commercial trucks, and industrial machinery. The aging vehicle fleet across Australia, combined with increased maintenance awareness and safety consciousness, is driving sustained aftermarket growth and creating opportunities for component suppliers and service providers.

Market Outlook 2026-2034:

The Australian brakes and clutches market is expected to grow steadily, fueled by rising demand in mining, construction, and heavy-duty industrial sectors. Equipment upgrades, stringent safety standards, and expansion of infrastructure projects will drive demand. Increasing mechanization, focus on reliability and efficiency, and rising OEM collaborations will support robust growth throughout the forecast period. The market generated a revenue of USD 25.85 Million in 2025 and is projected to reach a revenue of USD 41.41 Million by 2034, growing at a compound annual growth rate of 5.38% from 2026-2034.

Australia Brakes and Clutches Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology | Pneumatic and Hydraulic | 42% |

| Product Type | Dry | 55% |

| Sales Channel | OEM | 60% |

| End Use Industry | Mining and Metallurgy Industry | 28% |

Technology Insights:

- Electric

- Mechanical

- Pneumatic and Hydraulic

- Electromagnetic

The pneumatic and hydraulic dominates with a market share of 42% of the total Australia brakes and clutches market in 2025.

Pneumatic and hydraulic braking systems are essential for heavy-duty applications where high stopping power and reliable performance are critical. These systems are extensively deployed in mining equipment including haul trucks, excavators, and conveyors, where they must withstand extreme loads and harsh operating conditions. The technology offers superior heat dissipation and consistent performance under continuous operation, making it ideal for Australia's demanding mining environments where equipment operates around the clock transporting massive quantities of ore and materials. For example, Advanced Braking Technology (ABT) entered into an agreement with Glencore Australia to develop a “Sealed Integrated Braking System (SIBS)” for the Volvo FMX haul truck, a move signaling stronger demand for robust, maintenancefree braking technologies suitable for large mining vehicles.

This technology segment continues to evolve with integration of electronic controls and sensor systems that enhance precision and safety. Advanced hydraulic braking systems now incorporate anti-lock and stability control features that prevent equipment lockup and improve operator safety. Mining companies are increasingly specifying these advanced systems for both new equipment purchases and retrofitting existing fleets, supporting sustained demand for pneumatic and hydraulic braking solutions across the industrial sector.

Product Type Insights:

- Dry

- Oil Immersed

The dry leads with a share of 55% of the total Australia brakes and clutches market in 2025.

Dry brakes and clutches are favored across multiple applications due to their straightforward maintenance, reliable operation, and cost-effectiveness. These systems are widely used in automotive, commercial vehicle, and light industrial applications where they provide consistent stopping power without the complexity of wet systems. The absence of oil immersion simplifies maintenance procedures and reduces the risk of contamination-related failures, making dry systems particularly suitable for environments where regular servicing may be challenging.

The preference for dry systems extends to mining and construction equipment where operators value the ability to quickly inspect and service brake components. Advances in friction materials and heat management technologies have improved the durability of dry systems, enabling them to handle increasingly demanding applications. The aftermarket segment benefits significantly from dry brake components, as replacement parts are readily available and installation procedures are well-established across the service network.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM

- MRO Services/Aftermarket

The OEM dominates with a market share of 62% of the total Australia brakes and clutches market in 2025.

The original equipment manufacturer (OEM) channel dominates market share, as major mining equipment producers, automotive assemblers, and industrial machinery manufacturers specify braking and clutch systems during initial equipment design and production. Australia's position as a major mining equipment market creates substantial OEM demand, with global equipment manufacturers maintaining strong relationships with braking system suppliers. The integration of advanced safety features and electronic controls during manufacturing further reinforces OEM channel strength.

Additionally, OEM partnerships enable suppliers to innovate collaboratively, ensuring component compatibility, reliability, and regulatory compliance. Continuous technological advancements, such as predictive maintenance capabilities and energy-efficient braking solutions, further solidify the OEM channel’s pivotal role. These factors collectively drive long-term market growth, making the OEM route a preferred and strategic choice for both manufacturers and end-users.

End Use Industry Insights:

- Mining and Metallurgy Industry

- Construction Industry

- Power Generation Industry

- Industrial Production

- Commercial

- Logistics and Material Handling Industry

The mining and metallurgy industry leads with a share of 28% of the total Australia brakes and clutches market in 2025.

The mining and metallurgy industry represents the cornerstone of brakes and clutches demand in Australia, reflecting the country's position as a global mining leader. Iron ore operations in Western Australia, coal mining in Queensland and New South Wales, and gold mining across multiple states require extensive fleets of heavy equipment with sophisticated braking systems. These operations deploy haul trucks capable of carrying substantial loads, excavators, drilling equipment, and conveyor systems that all depend on reliable braking for safe and efficient operation. For instance, Rio Tinto has deployed hundreds of autonomous haul trucks across its Pilbara operations, a move that underscores how critical robust, reliable braking and control systems are for modern mining fleets.

Mining companies are investing in fleet modernization and expansion, driving ongoing demand for both new equipment with integrated braking systems and replacement components for existing machinery. The trend toward autonomous mining operations places additional emphasis on braking system reliability and precision, as these systems must operate without direct human oversight. Continued exploration and development of new mining projects across Australia ensures sustained long-term demand from this critical end-use sector.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

New South Wales and the Australian Capital Territory represent significant demand centers driven by Sydney's concentrated automotive sector, substantial coal mining operations in the Hunter Valley region, and a growing commercial vehicle fleet supporting urban logistics. The region benefits from established manufacturing capabilities, extensive service networks, and infrastructure investments that sustain demand for braking and clutch components.

Victoria and Tasmania contribute substantially to market demand through Melbourne's position as Australia's freight and logistics capital, with extensive port operations driving container trade volumes. The region's strong manufacturing heritage, commercial vehicle operations, and growing warehouse and distribution activities drive demand for reliable braking systems across trucks, logistics equipment, and material handling machinery.

Queensland emerges as a major market driven by extensive metallurgical coal mining operations in the Bowen Basin, where large-scale mining equipment requires industrial-grade braking and clutch systems. The state's mining sector operates substantial fleets of haul trucks, excavators, and support equipment, creating sustained demand for heavy-duty braking solutions capable of withstanding demanding operational conditions.

The Northern Territory and South Australia present growing opportunities driven by critical minerals development, copper mining expansion, and industrial diversification. South Australia's copper mining operations and surrounding mining province drive significant equipment demand, while the Northern Territory's manganese, gold, and emerging critical minerals projects support market growth through increased mining investment.

Western Australia dominates the national market as Australia's premier mining state, hosting major iron ore operations in the Pilbara region alongside substantial gold and critical minerals production. The state operates extensive autonomous mining equipment fleets including haul trucks and rail systems that require advanced braking technology. Continued investment in mining infrastructure and equipment modernization ensures Western Australia remains the primary demand driver.

Market Dynamics:

Growth Drivers:

Why is the Australia Brakes and Clutches Market Growing?

Expansion of Mining Operations and Equipment Modernization

Australia's mining sector continues to drive significant demand for brakes and clutches through ongoing expansion projects and fleet modernization programs. Major mining companies are investing substantially in new projects and equipment upgrades across iron ore, coal, gold, and critical minerals operations. For instance, BHP completed the conversion of 41 Komatsu 930E haul trucks to full autonomous haulage at its South Flank iron ore mine (Pilbara, Western Australia) in June 2023, a milestone that underscores how heavyduty braking and control systems remain critical even as fleets modernise and automate. The industry deploys extensive fleets of haul trucks capable of carrying substantial loads, requiring robust braking systems for continuous heavy-duty operation. The scale of operations, combined with emphasis on operational efficiency and safety, creates sustained demand for high-performance braking and clutch components across both OEM and replacement channels.

Rising Electric Vehicle Adoption and Advanced Braking Technologies

The transition toward electric and hybrid vehicles is creating new demand for advanced braking systems incorporating regenerative capabilities. Electric vehicle sales in Australia have grown substantially, with battery electric vehicles capturing an increasing share of new car registrations. The Australia electric vehicle market size was valued at USD 16.2 Billion in 2024. Looking forward, the market is expected to reach USD 171.6 Billion by 2033, exhibiting a CAGR of 30.00% from 20252033. This shift requires braking systems that integrate electronic controls, energy recovery, and sophisticated stability systems. Government policies supporting vehicle electrification are accelerating adoption rates. Manufacturers are responding by developing integrated braking solutions that combine traditional friction systems with regenerative technology.

Stringent Safety Regulations and Compliance Requirements

Increasingly strict safety regulations across automotive and industrial sectors are driving demand for advanced braking and clutch systems meeting elevated performance standards. Australian regulations require vehicles and equipment to incorporate sophisticated safety features including anti-lock braking systems and electronic stability control. Mining operations face rigorous safety compliance requirements that mandate reliable braking systems across all mobile equipment. These regulatory pressures compel equipment manufacturers and operators to specify higher-quality braking components and maintain rigorous maintenance schedules.

Market Restraints:

What Challenges the Australia Brakes and Clutches Market is Facing?

High Capital Costs and Import Dependency

The Australian market faces challenges related to high capital costs for advanced braking systems and significant dependency on imported components. Limited domestic manufacturing capacity means most sophisticated braking components must be sourced internationally, exposing buyers to currency fluctuations and supply chain vulnerabilities that can impact pricing and availability.

Commodity Price Volatility Affecting Mining Investment

Fluctuations in global commodity prices directly impact mining company investment decisions and equipment purchasing patterns. Declining prices for key commodities can lead to deferred equipment purchases, reduced maintenance spending, and project delays. The mining industry's cyclical nature creates periods of reduced demand that challenge braking component suppliers dependent on this sector.

Skilled Labor Shortages in Remote Operations

Difficulties attracting and retaining skilled technicians in remote mining and industrial locations create maintenance challenges that can impact braking system performance. Labor shortages complicate equipment servicing schedules and may result in extended equipment downtime. The competition for qualified personnel across the resources sector places additional pressure on service capabilities.

Competitive Landscape:

The Australian brakes and clutches market is characterized by a competitive mix of global industrial component manufacturers and specialized regional suppliers. International participants maintain strong positions by offering extensive product ranges, advanced technologies, and reliable distribution networks that support diverse industrial applications. Competition is driven by product performance, innovation, durability, and the ability to provide robust technical and after-sales support. Regional suppliers, meanwhile, focus on niche industry requirements, delivering tailored solutions, quick service response, and localized expertise. This combination of global scale and regional specialization fosters continuous technological development and ensures a wide range of options for end-use sectors across the country.

Recent Developments:

-

In February 2025, Disc Brakes Australia (DBA) extended its partnership with Tickford Racing for the 2025 Supercars Championship, marking five years of collaboration. DBA branding will appear on the #55 Castrol and #6 Monster Energy Mustangs, highlighting the company’s focus on precision, performance, and braking innovation for the upcoming season.

-

In January 2025, Bendix introduced new disc brake pads and brake shoes, expanding coverage for 4WDs, SUVs, EVs, and passenger cars. The updated range uses advanced friction materials designed to improve braking performance, reduce noise, and increase durability, reinforcing Bendix’s commitment to safety and innovation in automotive braking solutions.

Australia Brakes and Clutches Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Electric, Mechanical, Pneumatic and Hydraulic, Electromagnetic |

| Product Types Covered | Dry, Oil Immersed |

| Sales Channels Covered | OEM, MRO Services/Aftermarket |

| End Use Industries Covered | Mining and Metallurgy Industry, Construction Industry, Power Generation Industry, Industrial Production, Commercial, Logistics and Material Handling Industry |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia brakes and clutches market size was valued atz USD 25.85 Million in 2025.

The Australia brakes and clutches market is expected to grow at a compound annual growth rate of 5.38% from 2026-2034 to reach USD 41.41 Million by 2034.

Pneumatic and hydraulic technology holds a dominant 42% market share, supported by its widespread use in mining equipment, construction machinery, and heavy industrial systems. Its reliability, high power transmission capability, and suitability for demanding operating environments continue to drive strong adoption across key sectors.

Key growth drivers in the Australia brakes and clutches market include expansion of mining operations and equipment modernization, rising electric vehicle adoption with advanced braking technologies, and stringent safety regulations requiring enhanced braking system performance.

The Australian brakes and clutches market faces challenges including high capital costs, reliance on imported components, and exposure to supply chain risks. Demand volatility from mining commodity price fluctuations and persistent skilled labor shortages in remote operations further strain maintenance schedules and hinder consistent market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)