Australia Business Travel Market Size, Share, Trends and Forecast by Type, Purpose Type, Expenditure, Age Group, Service Type, Travel Type, End User, and Region, 2025-2033

Australia Business Travel Market Size and Growth:

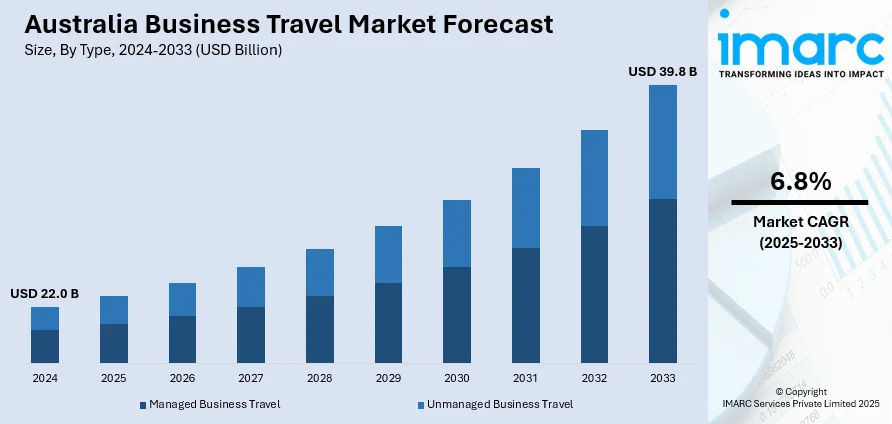

The Australia business travel market size reached USD 22.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 39.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.8% during 2025-2033. The market is propelled by the rising flexibility of work arrangements that has led to an increase in "bleisure" travel, where professionals extend business trips to include leisure activities. Additionally, enhanced regional infrastructure and investment in sectors like renewable energy and mining have spurred demand for domestic business travel, particularly to regional hubs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 22.0 Billion |

| Market Forecast in 2033 | USD 39.8 Billion |

| Market Growth Rate 2025-2033 | 6.8% |

Key Trends of Australia Business Travel Market:

Surge in Bleisure Travel

With almost 66% of business travelers now combining work and leisure travel, the rise of "bleisure" travel is impelling the Australia business travel market share. This shift reflects a growing desire for work-life balance, driven by flexible work policies and a greater focus on employee well-being. Business travelers are increasingly extending their stays to explore destinations, turning routine work trips into mini-getaways. Sectors like education, utilities, and construction are embracing this trend, while more traditional industries are slower to adapt. The seamless merging of business and leisure—often staying in the same accommodation throughout—has made travel more enjoyable and efficient. As organizations continue to support mental wellness and flexibility, bleisure travel is expected to remain a lasting and evolving feature of Australia’s corporate travel culture, enriching both employee satisfaction and travel value.

To get more information on this market, Request Sample

Integration of Advanced Technology

Technology is revolutionizing the Australia business travel market outlook, making the process more efficient and travel smoother. AI technology is making the booking process faster, easier to handle, and easier to track down the best offers. Biometric systems are accelerating security procedures at airports to make it easier to travel more quickly and easily. Additionally, virtual and augmented reality (AR) is empowering better remote teamwork and training. Such innovations not only enhance ease but also enable travelers to remain connected, productive, and entertained while on the go. With technology ongoing, it will have an immense influence in the way business individuals travel and work, making the experience more seamless and efficient.

Emphasis on Sustainability

Sustainability has become a central focus in Australia's business travel market growth, with 58% of executive stakeholders deeming sustainability and CO₂ emissions reports extremely or very important. Companies are prioritizing eco-friendly travel options, such as sustainable hotels and greener transportation like electric vehicles (EVs). Additionally, many are incorporating carbon offset programs into their travel policies to minimize their environmental impact. This growing emphasis on sustainability reflects a global shift toward more responsible travel. In response, 80% of business travelers are more likely to work for companies that integrate sustainability into their policies. With increased awareness about environmental footprints, business travelers are increasingly looking to minimize waste and emissions. The trend finds congruence with overall corporate social responsibility efforts and is anticipated to gain additional strength across sectors.

Growth Drivers of Australia Business Travel Market:

Economic Growth and Expanding Corporate Sector

Australia’s steady economic development and the expansion of its corporate sector are key drivers of business travel demand. As companies grow, so does the need for inter-state and international travel for client meetings, training, conferences, and partnerships. The rise of SMEs and startups, especially in tech and professional services, also contributes significantly to domestic travel activities. Moreover, the increasing integration of Australian businesses into global value chains has enhanced outbound business travel. Investment inflows from foreign companies encourage executives and professionals to travel frequently for business operations and stakeholder engagement. This economic vibrancy, combined with a business-friendly environment, continues to elevate the demand for structured corporate travel solutions and services.

Growth of Trade Relationships and Global Connectivity

Australia’s strategic location in the Asia-Pacific region and its growing network of free trade agreements have strengthened international trade ties, leading to increased business travel. According to the Australia business travel market analysis, as companies engage more in cross-border operations, executives frequently travel to Asia, Europe, and the Americas to negotiate deals, monitor projects, or establish partnerships. Improved air connectivity through international airports in cities like Sydney, Melbourne, and Brisbane has supported seamless global business movement. Additionally, Australia's robust diplomatic and trade relationships with countries like China, Japan, India, and the U.S. boost outbound business visits. These dynamics create a favorable climate for business mobility, positioning the country as an active participant in international commerce.

Advancements in Travel Technology and Service Personalization

The digitization of travel booking, itinerary management, and expense tracking has simplified corporate travel logistics for Australian businesses. Platforms offering real-time updates, mobile access, and AI-powered personalization have led to greater efficiency and convenience for business travelers. Companies now adopt managed travel services that streamline approvals, optimize costs, and ensure compliance with travel policies. Moreover, tailored travel experiences based on employee preferences, loyalty programs, and predictive analytics have improved overall satisfaction. These tech innovations are critical for travel management companies and corporates aiming to deliver smooth and productive travel experiences. As technology continues to evolve, it is playing a central role in shaping the growth of business travel in Australia.

Future Outlook of Australia Business Travel Market:

Shift Toward Hybrid Work and Flexible Travel Models

As hybrid and remote work models mature, business travel is evolving in purpose and frequency. Companies are prioritizing travel for in-person collaborations that deliver clear value—such as client onboarding, strategic workshops, and innovation labs—while routine tasks are handled virtually. This shift encourages demand for flexible travel solutions that accommodate last-minute changes. Travel management firms are expected to offer packaged models combining chartered flights, co-working accommodations, and meeting pods to support hybrid work needs. As leaders reassess travel policies for a post-pandemic era, business travel will focus more on efficiency, ROI, and experiential benefits rather than volume—shaping the future of travel spending and program offerings across Australia.

Sustainability and ESG Influence on Corporate Travel Policies

Environmental concerns and stakeholder scrutiny are increasingly shaping business travel decisions in Australia. Organizations are integrating sustainability benchmarks and carbon accountability into their travel programs, opting for greener transport alternatives like train routes to nearby countries, green-certified hotels, and carbon-offset programs, which are driving the Australia business travel market demand. Travel management firms are developing emissions-tracking dashboards and “green booking” portals to help companies monitor and reduce their carbon footprints. ESG-conscious investors and employees are also influencing travel policies, pushing businesses to favor eco-friendly itineraries and suppliers. As Australia aligns with global sustainability standards, including net-zero ambitions, ESG considerations will drive how and where companies choose to send employees, even reshaping travel supplier selection and service offerings.

Enhanced Digitalization and Personalized Travel Experiences

Digital innovation will fundamentally enhance the travel experience for Australian business travelers. Travel platforms are adopting AI-driven recommendations for optimal travel routes, preferred seating, and tailored accommodation based on past traveler behavior. Real-time alert systems—such as flight disruption notifications or visa reminders—help travelers proactively manage changing schedules. Personalized booking dashboards and chatbots deliver instant assistance, improving traveler satisfaction while reducing travel manager workload. Additionally, integration of travel data into corporate human capital and expense systems allows companies to track travel spend and productivity holistically. As digital tools become more intuitive and interconnected, business travel in Australia will become more seamless, intelligent, and aligned with corporate objectives.

Australia Business Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, purpose type, expenditure, age group, service type, travel type, and end user.

Type Insights:

- Managed Business Travel

- Unmanaged Business Travel

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes managed business travel, and unmanaged business travel.

Purpose Type Insights:

- Marketing

- Internal Meetings

- Trade Shows

- Product Launch

- Others

The report has provided a detailed breakup and analysis of the market based on the purpose type. This includes marketing, internal meetings, trade shows, product launch, and others.

Expenditure Insights:

- Travel Fare

- Lodging

- Dining

- Others

A detailed breakup and analysis of the market based on the expenditure have also been provided in the report. This includes travel fare, lodging, dining, and others.

Age Group Insights:

- Travelers Below 40 Years

- Travelers Above 40 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes travelers below 40 years, and travelers above 40 years.

Service Type Insights:

- Transportation

- Food and Lodging

- Recreational Activities

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes transportation, food and lodging, recreational activities, and others.

Travel Type Insights:

- Group Travel

- Solo Travel

The report has provided a detailed breakup and analysis of the market based on the travel type. This includes group travel, and solo travel.

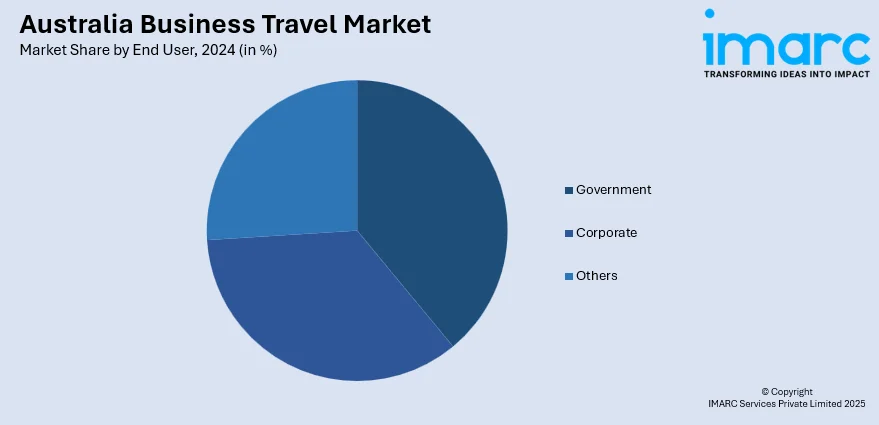

End User Insights:

- Government

- Corporate

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes government, corporate, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Business Travel Market News:

- In November 2024, Gray Dawes Group, based in the UK, extended its international presence through the acquisition of Australia's Verve Travel and Leisure, encompassing Verve Travel Management and Bay Travel and Cruise. It is the group's 16th acquisition, which increases its staff to more than 550 and turnover to more than £600 million. CEO Suzanne Horner emphasized her skill in hassle-free global service and integration. Verve, established in 2001, views the merger as a strategic opportunity that provides clients and employees with more worldwide opportunities.

- In November 2024, EaseMyTrip is making its first foray into the international study tourism market with the purchase of a 49% share in Planet Education Australia. This strategic acquisition brings together EaseMyTrip's travel and technology prowess with Planet Education's international network of universities. The alliance will streamline visa procedures and provide bundled travel and education services to students seeking higher education in countries such as Australia, the US, UK, and others, making their study-abroad experience smoother.

Australia Business Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Managed Business Travel, Unmanaged Business Travel |

| Purpose Types Covered | Marketing, Internal Meetings, Trade Shows, Product Launch, Others |

| Expenditures Covered | Travel Fare, Lodging, Dining, Others |

| Age Group Covered | Travelers Below 40 Years, Travelers Above 40 Years |

| Service Types Covered | Transportation, Food and Lodging, Recreational Activities, Others |

| Travel Types Covered | Group Travel, Solo Travel |

| End Users Covered | Government, Corporate, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia business travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia business travel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia business travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The business travel market in Australia was valued at USD 22.0 Billion in 2024.

The Australia business travel market is projected to exhibit a CAGR of 6.8% during 2025-2033.

The Australia business travel market is projected to reach a value of USD 39.8 Billion by 2033.

Key growth drivers of Australia’s business travel market include robust economic expansion, increasing international trade and corporate partnerships, rising demand for cross-border collaboration, and improved aviation connectivity. Additionally, more efficient travel technology and travel management solutions, alongside growing significance of face-to-face meetings, are supporting continued market growth.

Australia business travel market is witnessing a shift toward hybrid travel, where corporate trips merge with leisure. Emphasis on sustainable practices, digital transformation, and traveler well-being is also increasing business travel in Australia. Enhanced personalization, flexible policies, and increased demand for regional connectivity are redefining corporate mobility providing a positive impact on the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)