Australia Candles Market Size, Share, Trends and Forecast by Product, Wax Type, Distribution Channel, and Region, 2026-2034

Australia Candles Market Size and Share:

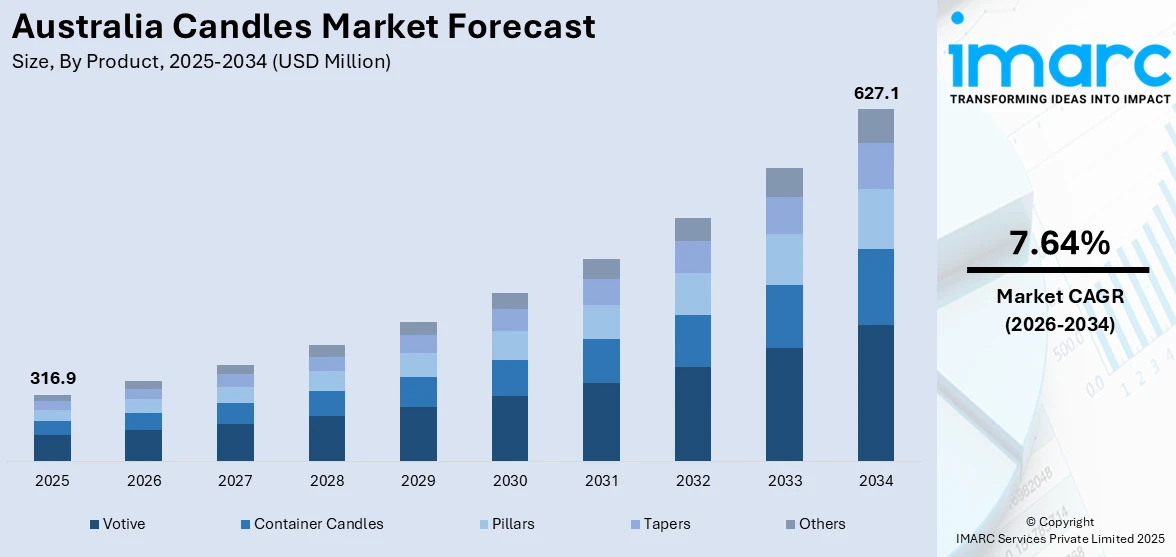

The Australia candles market size reached USD 316.9 Million in 2025. Looking forward, the market is projected to reach USD 627.1 Million by 2034, exhibiting a growth rate (CAGR) of 7.64% during 2026-2034. The market is driven by increasing consumer interest in home ambiance and decoration, rising focus on personal wellness, and sustainable living. Eco-friendly candles made from soy and beeswax are also gaining popularity, aligning with environmental consciousness. Rapid growth of online retail enabling easy accessibility of a wide variety of candles to consumers is further fueling the Australia candles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 316.9 Million |

| Market Forecast in 2034 | USD 627.1 Million |

| Market Growth Rate 2026-2034 | 7.64% |

Key Trends of Australia Candles Market:

Growing Focus on Home Ambiance and Decoration

Australians are increasingly emphasizing the creation of comfortable and aesthetically pleasing home environments. Candles, especially fragrant ones, have an important function in creating this atmosphere. They are not only used for lighting but also as ornaments that create a visual attractiveness to living spaces. Buyers prefer candles that complement their interior decor and create a sense of warmth. The presence of a broad range of colors, shapes, and designs makes it possible for people to choose candles that match their individual taste and enhance the home décor. This trend of viewing candles as integral to home styling, rather than solely functional items, is a substantial driver for the Australia candles market growth.

To get more information on this market Request Sample

Rising Interest in Wellness and Self-Care Practices

The increasing focus on personal welfare and self-care is strongly impacting the Australian candles market. Fragrant candles, particularly those with essential oils reputed to possess therapeutic qualities such as lavender and eucalyptus, are gaining popularity due to their aromatherapy properties. People are employing candles to design soothing and peaceful settings, helping in stress relief and encouraging a feeling of calmness. This is in line with larger wellness patterns in which consumers want to optimize their mind and emotional well-being through sensory experiences at home. The use of candles as part of self-care practices, for example, during bathing or meditation, is a major driver of demand for scented and natural wax candles in the Australian market.

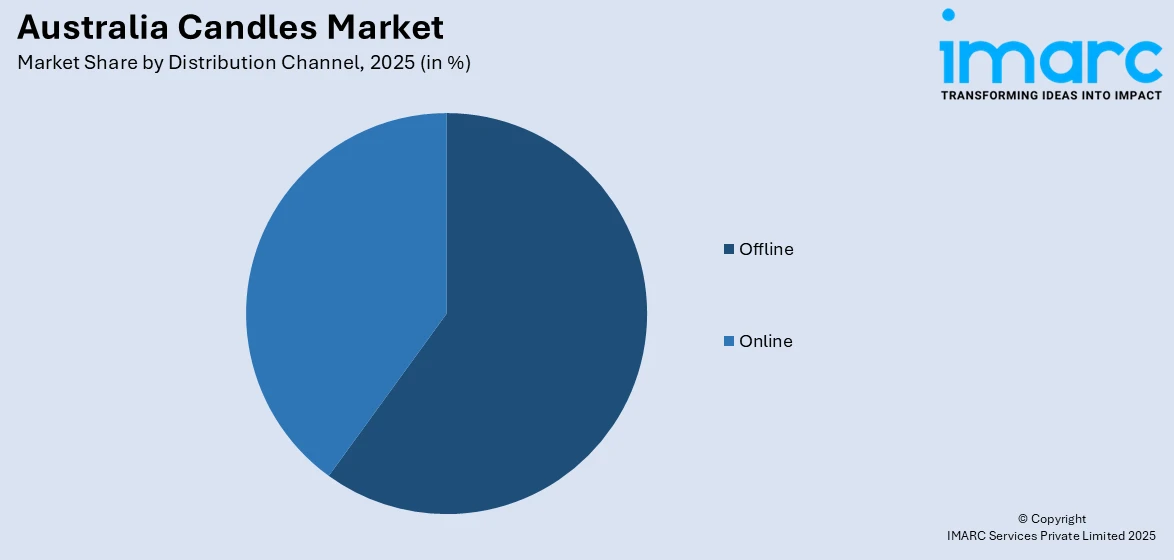

Expansion of Online Retail and Accessibility

The burgeoning e-commerce sector in Australia has significantly boosted the accessibility of a wide variety of candles to consumers across the country. Online platforms offer a convenient way to browse and purchase candles from local and international brands, providing a greater selection than traditional brick-and-mortar stores. This ease of access, coupled with effective online marketing and delivery services, has expanded the reach of candle retailers and catered to a wider consumer base, including those in regional areas. The growth of online shopping has overcome geographical limitations and made it simpler for Australians to discover and purchase their preferred types and scents of candles, thereby acting as a major driver for market expansion.

Growth Factors of Australia Candles Market:

Premium and Natural Product Demand

The movement toward sustainable and healthier lifestyles has greatly impacted consumer preferences in the Australian candle market. Shoppers are increasingly attracted to candles made from soy, beeswax, and other natural waxes as these options are viewed as cleaner, safer, and more eco-friendly than paraffin-based products. The appeal is further heightened by eco-friendly packaging and the incorporation of natural essential oils for fragrance. This trend aligns with the larger consumer push for ethical and sustainable products especially among younger consumers who prioritize wellness and environmental responsibility. Consequently, manufacturers and brands are broadening their ranges of premium eco-friendly candles which is contributing to steady growth in the Australia candles market demand.

Seasonal and Festive Demand

Candles possess substantial cultural and emotional importance particularly during seasonal festivities and celebrations within Australia. Sales typically rise during occasions such as Christmas, Easter, and Valentine’s Day with consumers purchasing candles for decorative and gifting purposes. Limited-edition collections and fragrances themed around holidays also play a vital role in enhancing seasonal demand. Retailers and online platforms take advantage of these events through promotional efforts fostering a strong purchasing inclination among consumers. Beyond traditional celebrations candles are commonly utilized across weddings, parties, and various special occasions, reaffirming their relevance throughout the year. This pattern of seasonal and event-driven purchases contributes to recurring spikes in demand, making it a key factor for growth in the Australia candles market.

Influence of Lifestyle Shifts

Changes in lifestyle have significantly expanded the range of candle usage in Australia, moving past mere décor and occasional gifts. With an increasing emphasis on self-care and wellness, consumers are opting for candles to foster calming atmospheres for meditation, yoga, or relaxation sessions. Scented candles, in particular, are cherished for their ability to enhance mood and provide a comforting ambiance at home. The transition to remote work and spending more time indoors has further boosted the role of candles in everyday life. Additionally, younger consumers link candles to personal expression and lifestyle aesthetics, which enhances their appeal across various demographic groups. According to Australia candles market analysis, this lifestyle-driven trend is anticipated to sustain long-term growth and diversify patterns of demand.

Australia Candles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, wax type, and distribution channel.

Product Insights:

- Votive

- Container Candles

- Pillars

- Tapers

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes votive, container candles, pillars, tapers, and others.

Wax Type Insights:

- Paraffin

- Soy Wax

- Beeswax

- Palm Wax

- Others

A detailed breakup and analysis of the market based on the wax type have also been provided in the report. This includes paraffin, soy wax, beeswax, palm wax, and others.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Candles Market News:

- In October 2024, IHG Hotels & Resorts' luxury and leisure brand, Hotel Indigo, launched a limited-edition candle collection that draws inspiration from the distinctive neighborhoods where its hotels are located throughout Australia and New Zealand. Five candles specifically designed to symbolize Hotel Indigo neighborhoods in Melbourne (Flinders Lane), Sydney (Potts Point), Adelaide (Central Markets), Brisbane (City Centre), and Auckland (City Centre) are included in Scents of the Neighbourhood.

Australia Candles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Votive, Container Candles, Pillars, Tapers, Others |

| Wax Types Covered | Paraffin, Soy Wax, Beeswax, Palm Wax, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia candles market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia candles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia candles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The candles market in Australia was valued at USD 316.9 Million in 2025.

The Australia candles market is projected to exhibit a CAGR of 7.64% during 2026-2034, reaching a value of USD 627.1 Million by 2034.

Key factors driving the Australia candles market include rising consumer preference for decorative and scented candles, growing demand for home décor and wellness products, and increasing adoption of eco-friendly and soy-based candles. Seasonal and festive occasions, along with gifting trends, further stimulate market growth across urban and suburban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)