Australia Car Subscription Market Size, Share, Trends and Forecast by Service Provider, Vehicle Type, Subscription Period, End Use, and Region, 2025-2033

Australia Car Subscription Market Size and Share:

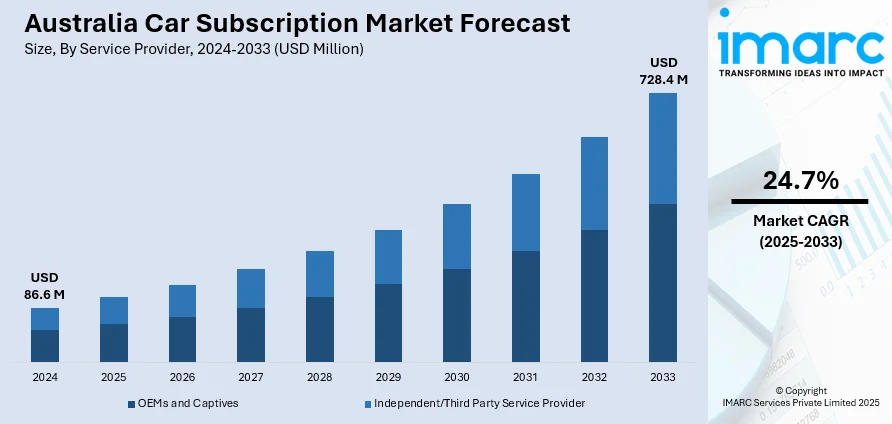

The Australia car subscription market size reached USD 86.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 728.4 Million by 2033, exhibiting a growth rate (CAGR) of 24.7% during 2025-2033. The market is experiencing significant growth, driven by consumer demand for flexible mobility solutions and the increasing adoption of electric vehicles. Innovative business models and technological advancements are reshaping traditional vehicle ownership, offering consumers greater convenience and adaptability. As automotive manufacturers and dealerships expand their subscription offerings, competition intensifies, influencing the dynamics of the Australia Car Subscription market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 86.6 Million |

| Market Forecast in 2033 | USD 728.4 Million |

| Market Growth Rate 2025-2033 | 24.7% |

Australia Car Subscription Market Trends:

Emergence of Flexible Vehicle Ownership Models

Emergence of flexible vehicle ownership models has played an important role in the growth of the Australian car subscription market. This is evidence of a general global movement from conventional car ownership to more agile and affordable mobility solutions. With increased consumer need for flexibility, car subscriptions present a convenient solution, enabling people to use a vehicle without significant long-term obligation or high capital outlays. For example, in February 2025, Karmo became Australia's largest car subscription company after buying Motopool. The consolidation strengthens Karmo's fleet by adding 5,000 cars and powers its global growth plans with significant funding backing. Furthermore, as Australians place more emphasis on flexibility in transport, the market will continue to grow. The subscription model is in tune with changing consumer tastes, especially among city residents, who want convenience and reduced expenses. Australian car subscription market prospect points towards a consistent upward slope, with car subscription services trending upwards as they appeal to lifestyles of the time, where consumers are inclined towards taking cars for short periods as opposed to holding outright ownership of a vehicle. This trend promises to fuel Australia car subscription market growth and continue boosting subscription share countrywide.

To get more information on this market, Request Sample

Technology Incorporation in Subscription Services

The incorporation of cutting-edge technologies is a major trend that's redefining the Australian car subscription industry. Subscription services are increasingly making use of digital platforms to create superior user experience, providing smooth vehicle choice, payment handling, and tracing. The utilization of mobile apps is now a common practice, enabling subscribers to comprehensively control their plans and access vehicles with ease, while artificial intelligence (AI) is being introduced to customize the service offering according to personal tastes. Also, technology allows subscription services to monitor vehicle usage habits, refine fleet management, and enhance customer service. Consequently, customers are treated to a less complicated, streamlined experience, hence a more attractive car subscription offer. This tendency follows the envisioned development of the Australian car subscription industry, expected to have more automotive presence through customers' increasing use of technology-backed services in order to become more convenient and personalized.

Sustainability and Environmentally Friendly Vehicles

There is a growing influence of sustainability on customer purchasing behavior in the Australian car subscription sector. Most subscription services are adding environmentally friendly vehicles, such as electric vehicles (EVs) and hybrid vehicles, to appeal to green-conscious consumers. For instance, in April 2024, Carly, Australia's first flexible car subscription business, introduced an EV trial program, allowing prospective buyers to try electric cars before buying, helping to overcome range, battery durability, and charging concern. Moreover, this transition to green mobility solutions is influenced by the increasing awareness of environmental issues and the need to minimize carbon footprints. With government regulations compelling stricter emissions standards, the Australian car subscription market is transforming to feature more environmentally friendly transportation solutions. Growing demand for electric vehicles is likely to further drive the trend, with subscribers looking for environmentally friendly alternatives without the long-term obligation of buying. Sustainability being the prime focus, Australian car subscription market share is also set to rise, as greater numbers of people turn to low-emission vehicles through flexible and convenient subscription models. The trend is part of wider changes in consumer behavior towards cleaner, more sustainable mobility options.

Australia Car Subscription Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service provider, vehicle type, subscription period, and end use.

Service Provider Insights:

- OEMs and Captives

- Independent/Third Party Service Provider

The report has provided a detailed breakup and analysis of the market based on the service provider. This includes OEMs and captives and independent/third party service provider.

Vehicle Type Insights:

- IC Powered Vehicle

- Electric Vehicle

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes IC powered vehicle and electric vehicle.

Subscription Period Insights:

- 1 to 6 Months

- 6 to 12 Months

- More Than 12 Months

The report has provided a detailed breakup and analysis of the market based on the subscription period. This includes 1 to 6 months, 6 to 12 months, and more than 12 months.

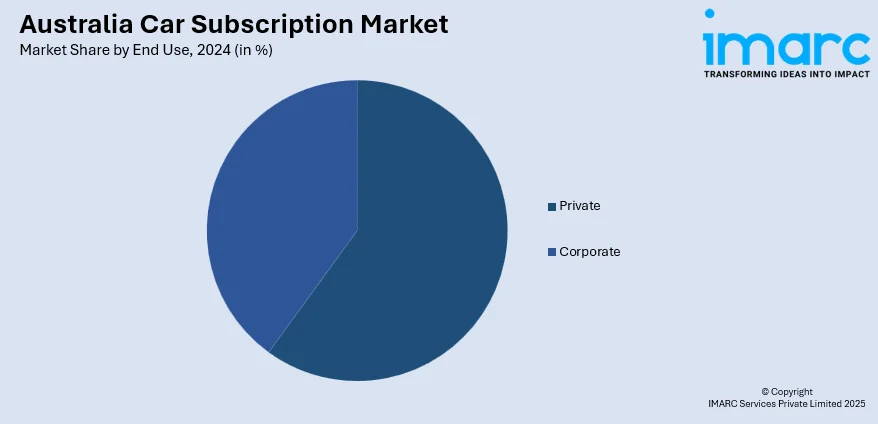

End Use Insights:

- Private

- Corporate

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes private and corporate.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Car Subscription Market News:

- In February 2025, Carly Holdings Limited (ASX: CL8) signed a non-binding agreement to combine its car subscription business with Carbar Holdings Pty Ltd. The combination brings together two top Australian platforms, with the goal of improving scale and synergies. It is subject to shareholder approval and compliance with regulatory conditions.

Australia Car Subscription Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Providers Covered | OEMs and Captives, Independent/Third Party Service Provider |

| Vehicle Types Covered | IC Powered Vehicle, Electric Vehicle |

| Subscription Periods Covered | 1 to 6 Months, 6 to 12 Months, More Than 12 Months |

| End Uses Covered | Private, Corporate |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia car subscription market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia car subscription market on the basis of service provider?

- What is the breakup of the Australia car subscription market on the basis of vehicle type?

- What is the breakup of the Australia car subscription market on the basis of subscription period?

- What is the breakup of the Australia car subscription market on the basis of end use?

- What is the breakup of the Australia car subscription market on the basis of region?

- What are the various stages in the value chain of the Australia car subscription market?

- What are the key driving factors and challenges in the Australia car subscription?

- What is the structure of the Australia car subscription market and who are the key players?

- What is the degree of competition in the Australia car subscription market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia car subscription market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia car subscription market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia car subscription industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)