Australia Cardiovascular Devices Market Size, Share, Trends and Forecast by Device Type, Application, End User, and Region, 2025-2033

Australia Cardiovascular Devices Market Overview:

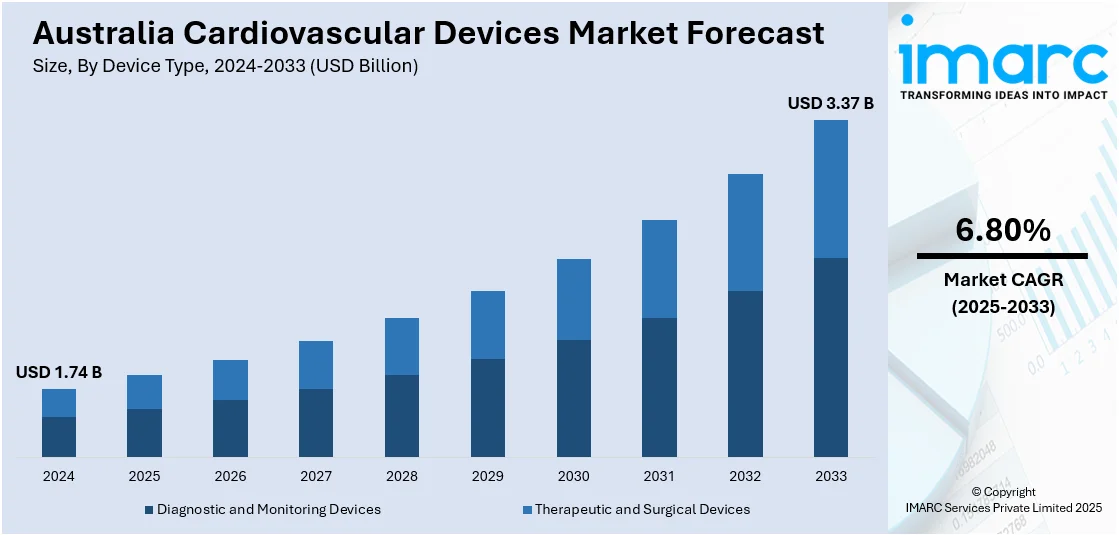

The Australia cardiovascular devices market size reached USD 1.74 Billion in 2024. Looking forward, the market is projected to reach USD 3.37 Billion by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. The market is fueled by the growing incidence rates of cardiovascular conditions, advances in medical device technologies, including advancements in bioresorbable stents and emerging pacemakers, are boosting the effectiveness of treatments and improving outcomes for patients. In addition, positive reimbursement policies and government efforts, such as funding for mobile health clinics and clinical trials, are driving more extensive use of advanced cardiovascular technology, which is further increasing the Australia cardiovascular device market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.74 Billion |

| Market Forecast in 2033 | USD 3.37 Billion |

| Market Growth Rate 2025-2033 | 6.80% |

Key Trends of Australia Cardiovascular Devices Market:

Technological Advancements and Integration of Digital Health

The Australia cardiovascular devices market is going through significant technological developments due to increased attention toward the integration of digital health technologies. Products such as wearable ECG monitors, smartwatches being one of them, enjoy growing demand as they can detect abnormal heart rhythm, and simultaneously transferring data to patients and medical practitioners. These developments enhance patient participation in the management of their cardiovascular health proactively. Moreover, the development of big data analytics and artificial intelligence (AI) help increase diagnostic accuracy and treatment planning, heralding greater personalized treatment. This technological evolution continues to receive backing from the Australian government via funding for clinical trials and research programs to keep the market in sync with the global trends.

To get more information of this market, Request Sample

Shift Toward Minimally Invasive Procedures

There is a significant shift toward minimally invasive treatment of cardiovascular disease in Australia. Improvements in catheter-based technologies, including bioresorbable stents and advanced pacemakers, are allowing medical professionals to undertake complex procedures through smaller cuts, leading to less recovery time and better patient outcomes. This is being aided by the growing uptake of robotic-assisted surgeries, which provide improved precision and stability during interventions. The fusion of these technologies is enhancing the effectiveness of cardiovascular interventions and also increasing access to treatment, especially in rural and underdeveloped regions by means of programs such as mobile health clinics. Consequently, the need for minimally invasive cardiovascular devices will continue increasing over the next few years, further fueling the Australia cardiovascular devices market growth.

Emphasis on Preventive Cardiovascular Care

Preventive cardiovascular management is gaining prominence in Australia, fueled by the increasing rate of heart diseases and the aging population. Healthcare professionals are placing more emphasis on early diagnosis and control of risk factors like hypertension, diabetes, and high cholesterol. This approach is driving the creation and utilization of diagnostic equipment that enables frequent monitoring and prompt intervention. Besides, public health campaigns and educational initiatives are creating awareness about the relevance of heart health, prompting people to adopt preventive approaches. Government expenditure on research and development as well as positive reimbursement policies are further driving preventive cardiovascular care, making Australia a pioneer in this field.

Growth Factors of Australia Cardiovascular Devices Market:

Rising Prevalence of Cardiovascular Diseases

The growing incidence of cardiovascular diseases in Australia is a major factor influencing the medical devices market. Conditions like coronary artery disease, heart failure, and arrhythmias are becoming more common due to sedentary lifestyles, poor dietary choices, and increasing obesity rates. This has led to a heightened demand for diagnostic, therapeutic, and monitoring devices aimed at enhancing patient outcomes. Hospitals and specialized clinics are investing in state-of-the-art technologies, including stents, pacemakers, and minimally invasive surgical tools, to offer effective treatment options. The increase in cases underscores the necessity for early detection and drives healthcare providers to embrace innovative solutions, thus boosting the Australia cardiovascular devices market demand.

Aging Population

Australia’s aging demographic is a significant contributor to the sustained demand for cardiovascular devices. As life expectancy increases and the segment of the population aged 65 and older grows, the prevalence of age-related heart issues is anticipated to rise. Older adults are more likely to experience conditions such as hypertension, stroke, and valvular heart disease, creating ongoing demand for interventional and monitoring devices. The expanding elderly population also promotes the need for minimally invasive techniques that lead to shorter recovery times and enhance quality of life. As healthcare providers concentrate on geriatric care, manufacturers are developing devices tailored to this demographic, ensuring steady growth for the cardiovascular devices sector in Australia.

Government Healthcare Initiatives

Government involvement is crucial in influencing the progression of Australia’s cardiovascular devices market. Policies focused on enhancing healthcare infrastructure, increasing access to advanced treatments, and funding research initiatives have bolstered the industry. Investments in public hospitals, telehealth services, and digital healthcare solutions are improving the availability of innovative cardiovascular devices. Furthermore, reimbursement policies and subsidies make these technologies more accessible for patients, encouraging broader adoption. National campaigns promoting heart health further stimulate demand for preventive and diagnostic options. Together, these efforts cultivate innovation, enhance patient access, and create a supportive environment for industry players. According to Australia cardiovascular devices market analysis, government engagement remains a key driver of industry growth.

Government Initiatives in Australia Cardiovascular Devices Market:

Healthcare Infrastructure Investments

The Australian government is actively working to enhance and modernize healthcare infrastructure to improve cardiovascular care throughout the nation. Investments in new hospital facilities, cutting-edge surgical units, and specialized cardiac centers are increasing accessibility to life-saving treatments. Improvements in diagnostic equipment, intensive care units, and catheterization labs enable public hospitals to serve a greater number of patients and undertake more complex cardiovascular procedures. These infrastructure upgrades also ensure that rural and underserved regions gain better access to advanced cardiovascular services. By addressing disparities in healthcare delivery, such initiatives are reducing waiting times and enhancing patient outcomes. This long-term emphasis on infrastructure development significantly boosts the overall demand for cardiovascular devices in Australia.

Funding for Research and Innovation

Government funding for research and innovation is crucial in propelling advancements in the Australian cardiovascular devices market. Grants, subsidies, and collaborative programs are being allocated to universities, research institutions, and startups to investigate new medical technologies and treatment solutions. These initiatives focus on creating next-generation implantable devices, minimally invasive surgical tools, and AI-driven diagnostic systems. By supporting clinical trials and pilot programs, the government is facilitating the quicker adoption of innovative technologies in hospitals and clinics. This funding also promotes collaboration between academia and the industry, ensuring that research findings translate into practical healthcare applications. Ultimately, these efforts accelerate technological advancements and help establish Australia as a center for medical device innovation.

Telehealth and Digital Health Programs

Telehealth and digital health initiatives are transforming cardiovascular care in Australia by enabling remote patient management and ongoing monitoring. The government's promotion of telemedicine platforms allows patients, particularly those in rural and regional areas, to consult with cardiologists without facing geographical obstacles. Digital health programs also encourage the use of wearable devices and AI-powered monitoring tools that track vital signs, assisting in the early detection of potential heart issues. This approach reduces the need for hospital visits, lowers treatment expenses, and ensures proactive patient management. By incorporating telehealth into the mainstream healthcare system, the government is tackling accessibility challenges and improving efficiency in cardiovascular treatment. These initiatives enhance patient outcomes and drive demand for connected cardiovascular devices.

Australia Cardiovascular Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type, application, and end user.

Device Type Insights:

- Diagnostic and Monitoring Devices

- Electrocardiogram (ECG)

- Remote Cardiac Monitoring

- Others

- Therapeutic and Surgical Devices

- Cardiac Rhythm Management (CRM) Devices

- Catheter

- Stents

- Heart Valves

- Others

The report has provided a detailed breakup and analysis of the market based on the device type. This includes diagnostic and monitoring devices (electrocardiogram (ECG), remote cardiac monitoring, and others), and therapeutic and surgical devices (cardiac rhythm management (CRM) devices, catheter, stents, heart valves, and others).

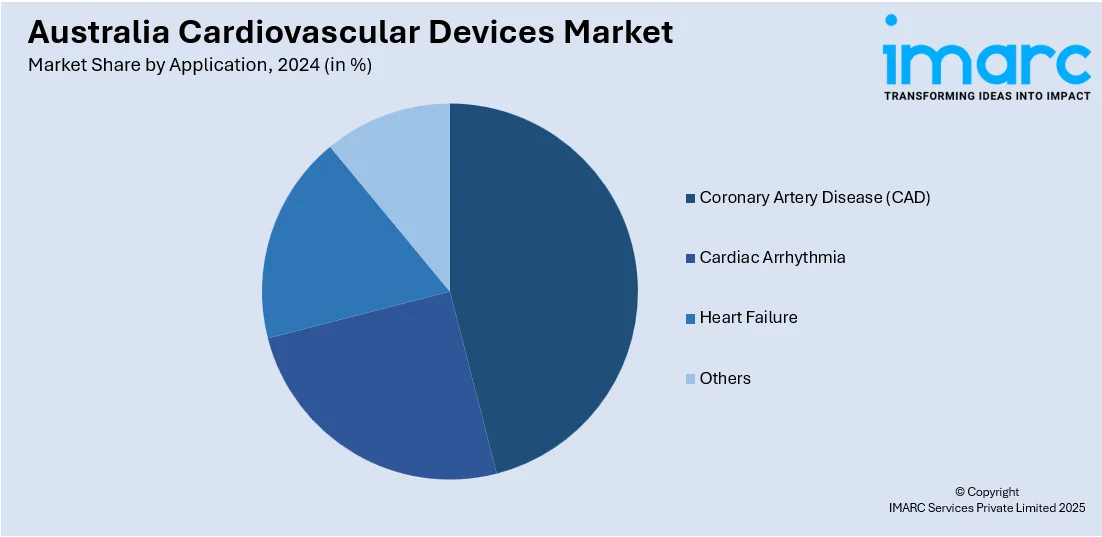

Application Insights:

- Coronary Artery Disease (CAD)

- Cardiac Arrhythmia

- Heart Failure

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes coronary artery disease (CAD), cardiac arrhythmia, heart failure, and others.

End User Insights:

- Hospitals

- Specialty Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, specialty clinics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Abbott Laboratories

- B. Braun Australia Pty Ltd

- Boston Scientific Corporation

- Cardinal Health

- LivaNova PLC

- Medtronic PLC

- Teleflex Incorporated

- Terumo Corporation

Australia Cardiovascular Devices Market News:

- In March 2025, St Vincent’s reaffirmed its position as a worldwide pioneer in cardiac treatment by successfully inserting Australia's inaugural BiVACOR Total Artificial Heart. The newest advance involved a team headed by Dr. Paul Jansz from St Vincent’s Hospital in Sydney, who implanted the groundbreaking BiVACOR Total Artificial Heart, a titanium apparatus featuring a single moving component, devoid of valves, and a no-contact suspension system aimed at preventing mechanical wear.

- In February 2024, Monash University will spearhead a transdisciplinary consortium to create and market a range of groundbreaking and transformative implantable cardiac devices that, for the first time, will provide long-term solutions for all forms of severe heart failure. The Hon Mark Butler, Minister for Health and Aged Care, revealed that the Monash-led Artificial Heart Frontiers Program, located at the Monash Alfred Baker Centre for Cardiovascular Research at The Alfred, has received a USD 50 million grant from the Medical Research Future Fund (MRFF) to advance the development and commercialization of three essential devices aimed at treating prevalent types of heart failure.

Australia Cardiovascular Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered |

|

| Applications Covered | Coronary Artery Disease (CAD), Cardiac Arrhythmia, Heart Failure, Others |

| End Users Covered | Hospitals, Specialty Clinics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Abbott Laboratories, B. Braun Australia Pty Ltd, Boston Scientific Corporation, Cardinal Health, LivaNova PLC, Medtronic PLC, Teleflex Incorporated, Terumo Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cardiovascular devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cardiovascular devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cardiovascular devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cardiovascular devices market in Australia was valued at USD 1.74 Billion in 2024.

The Australia cardiovascular devices market is projected to exhibit a compound annual growth rate (CAGR) of 6.80% during 2025-2033.

The Australia cardiovascular devices market is expected to reach a value of USD 3.37 Billion by 2033.

The Australia cardiovascular devices market is witnessing trends such as growing adoption of minimally invasive procedures, rising use of wearable monitoring devices, integration of AI and digital health solutions, and increasing patient preference for advanced, personalized treatment options supported by technological innovation and evolving healthcare practices.

Market growth is driven by factors including the rising prevalence of cardiovascular diseases, expanding aging population, supportive government healthcare initiatives, greater healthcare expenditure, and increasing investments in research and development, which together enhance access to innovative devices and strengthen the overall cardiovascular care ecosystem in Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)