Australia CCTV Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Australia CCTV Market Overview:

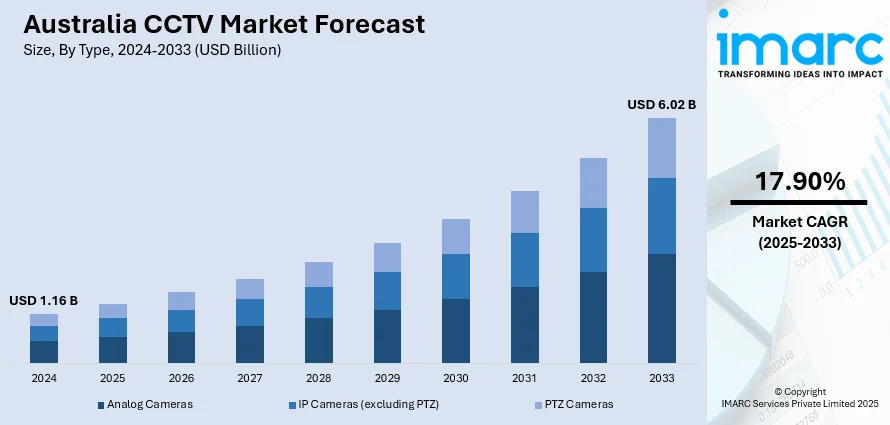

The Australia CCTV market size reached USD 1.16 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.02 Billion by 2033, exhibiting a growth rate (CAGR) of 17.90% during 2025-2033. The market is driven by growing public safety concerns, rising uptake of smart city technologies, and government spending on infrastructure, in major cities such as Sydney and Melbourne. Companies securing their operations with more sophisticated CCTV systems to prevent theft and watch activities, along with the adoption of supporting technologies, including AI-based analytics and cloud storage are some of the other factors further increasing the Australia CCTV market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.16 Billion |

| Market Forecast in 2033 | USD 6.02 Billion |

| Market Growth Rate 2025-2033 | 17.90% |

Australia CCTV Market Trends:

Convergence of AI and Smart Technologies

Australia's CCTV industry is increasingly becoming dependent on artificial intelligence (AI) and intelligent technologies to enhance surveillance. Cameras with face recognition, object recognition, and behavior analysis powered by AI are becoming standard in public and private environments. Advanced systems can spot threats in real time and give proactive security. For instance, in Melbourne and Sydney, AI-powered CCTV systems are featured in smart city initiatives, and they facilitate efficient monitoring of traffic hubs and open spaces. Utilization of AI enhances security while simplifying procedures by reducing the necessity for incessant human attention. In addition, the feature of Internet of Things (IoT) connectivity allows CCTV systems to share data with other connected smart devices and create an extensive security system. This attests to Australia's commitment to using advanced technology to enhance public safety and operational efficiency that contributes to the Australia CCTV market growth.

To get more information on this market, Request Sample

Growth in Commercial and Public Sectors

The demand for CCTV systems in Australia is increasing in the commercial and public sectors. Retailers, banks, and hospitality businesses are spending more on surveillance systems to safeguard assets, monitor customer behavior, and secure their premises. Municipal governments in cities are installing CCTV cameras in public spaces, including parks, streets, and transportation hubs, as part of broader public safety initiatives. Based on reports from the industry, Australians spent around $450,000 on security in 2023. Sales jumped to $534,000 in 2024, and the firm anticipates that number to come close to doubling in 2025. The deployments are aimed at deterring crime, supporting law enforcement, and providing beneficial evidence for investigations. The combination of cloud storage technology and high-definition cameras has made surveillance systems more accessible and efficient. In addition, the expansion of smart city projects in urban cities like Sydney and Melbourne has enhanced the application of CCTV technologies further, as they are at the core of urban infrastructure management and public safety.

Focus on Data Protection and Privacy Requirements

As the use of CCTV systems becomes more widespread in Australia, there is greater emphasis on data privacy and security regulation. With the advent of new technologies like AI and cloud storage, surveillance data security is taking center stage. Robust cybersecurity measures are being adopted by Australian government agencies and companies to protect against future attacks and misuse. In addition, compliance with privacy law, such as the Australian Privacy Principles, is critical in the operation of CCTV systems. Organizations are performing routine audits and testing to be compliant and uphold public trust. Data security and privacy are safeguarding individuals' rights as well as instilling confidence in the application of surveillance technology. This reflects Australia's commitment to connecting technological advancement with ethical issues in public security and monitoring.

Australia CCTV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, and end user.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

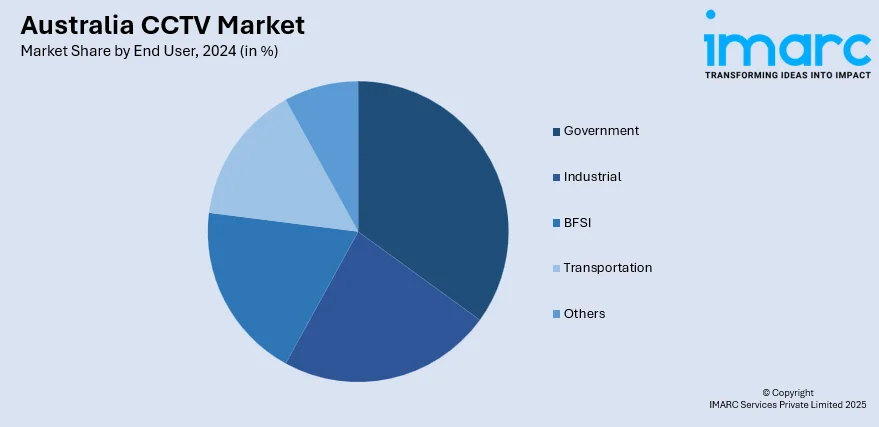

End User Insights:

- Government

- Industrial

- BFSI

- Transportation

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes government, industrial, BFSI, transportation, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia CCTV Market News:

- In April 2025, the Western Australia (WA) Police Force, via its Radio and Electronic Services (RES), requested proposals to acquire a variety of certified open-platform IP-based products from Axis Communications. The WA Police Force oversees law enforcement in the world's largest single police jurisdiction, spanning 2.5 million square kilometers, boasting over 9500 officers and 150 police facilities throughout 8 metropolitan and 7 regional areas.

Australia CCTV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (Excluding PTZ), PTZ Cameras |

| End Users Covered | Government, Industrial, BFSI, Transportation, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia CCTV market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia CCTV market on the basis of type?

- What is the breakup of the Australia CCTV market on the basis of end user?

- What is the breakup of the Australia CCTV market on the basis of region?

- What are the various stages in the value chain of the Australia CCTV market?

- What are the key driving factors and challenges in the Australia CCTV market?

- What is the structure of the Australia CCTV market and who are the key players?

- What is the degree of competition in the Australia CCTV market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia CCTV market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia CCTV market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia CCTV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)