Australia Cell and Gene Therapy Market Size, Share, Trends and Forecast by Therapy Type, Indication, Delivery Mode, End User, and Region, 2025-2033

Australia Cell and Gene Therapy Market Overview:

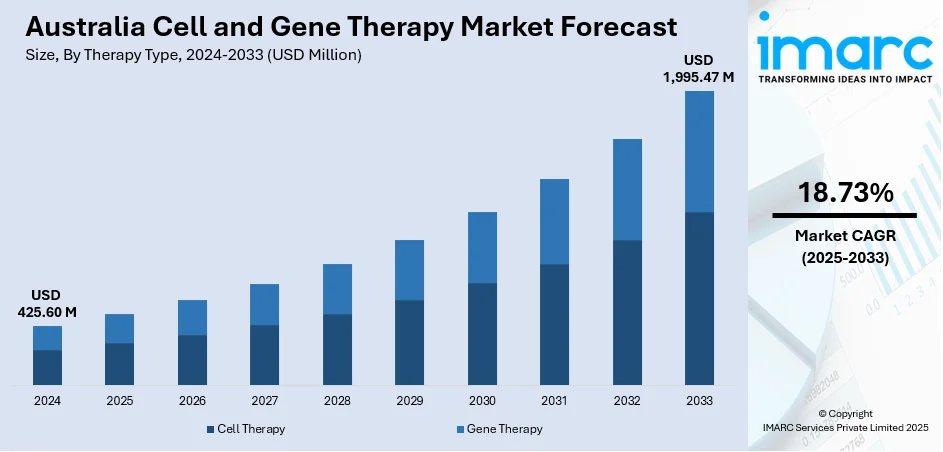

The Australia cell and gene therapy market size reached USD 425.60 Million in 2024. Looking forward, the market is projected to reach USD 1,995.47 Million by 2033, exhibiting a growth rate (CAGR) of 18.73% during 2025-2033. The market is growing due to increased government funding, cross-border collaborations, and rising clinical trial activity. Support for early-stage innovation and advanced manufacturing is driving the development of treatments targeting rare diseases and regenerative health conditions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 425.60 Million |

| Market Forecast in 2033 | USD 1,995.47 Million |

| Market Growth Rate 2025-2033 | 18.73% |

Key Trends of Australia Cell and Gene Therapy Market:

Focus on Regenerative Treatment Innovation

Australia’s cell and gene therapy market is witnessing a clear shift toward regenerative solutions, particularly in addressing conditions with limited treatment options. The country is actively supporting startups that focus on breakthrough applications capable of restoring or significantly improving bodily functions. The government’s emphasis on commercialization has created an environment where scientific research transitions into real-world impact. The emphasis on vision restoration, neurological repair, and immune modulation showcases a wider trend of targeting irreversible conditions with gene-modifying approaches. In December 2024, the Australian Government allocated USD 2 Million to Mirugen Pty Ltd under the CUREator+ program. The funding was aimed at advancing a gene therapy designed to regenerate cells in the eye and help restore vision, marking a significant step toward treating certain forms of blindness. This development reflected Australia’s commitment to strengthening its regenerative medicine capabilities and building a pipeline of therapies with long-term curative potential. Such projects are not only pushing innovation forward but also encouraging private-sector participation in early-stage development. The growing investment in targeted regenerative technologies indicates that Australia is aligning its healthcare objectives with next-generation biological tools, encouraging the growth of a competitive and forward-looking cell and gene therapy industry.

To get more information of this market, Request Sample

Expansion of Clinical Manufacturing Capacity

As clinical activity grows across global markets, Australia is increasingly being integrated into multinational therapeutic development programs, especially those requiring advanced production capabilities. Companies are now looking beyond domestic boundaries to establish scalable manufacturing systems that can support trials and prepare for commercial supply. This trend shows Australia’s strategic importance in contributing to global development chains while simultaneously benefiting from expanded access to novel therapies. In April 2025, INmune Bio partnered with the UK-based Cell and Gene Therapy Catapult to scale up the production of CORDStrom, a therapy for the rare genetic skin condition RDEB. The expanded manufacturing support also covered clinical trials across Australia, positioning the country as a key node in the broader commercialization pathway. The collaboration emphasized cross-border infrastructure sharing and highlighted Australia’s role in global therapeutic development. By enabling trial-readiness and securing stable supply chains for advanced therapies, the local market benefits from accelerated timelines and improved patient access. This trend indicates rising confidence in Australia’s clinical ecosystem and its ability to handle complex biologics manufacturing as part of multinational programs.

Advances in Personalized Medicine

One of the leading trends impacting the Australian cell and gene therapy market is the growing emphasis on personalized medicine. These treatments focus on treating the unique genetic patterns of different patients offering highly targeted and powerful solution treatments. Personalized approaches are particularly useful in areas such as oncology, rare genetic diseases, and chronic diseases where traditional treatments are ineffective. Advances in genetic sequencing, biomarker identification, and diagnostic technologies are enabling doctors to better match patients with specific therapies. Such a focus on personalized treatment improves patient outcomes and encourages the viability of long-term healthcare. Consequently, the demand for customized therapies is consistently growing bolstering Australia cell and gene therapy market share.

Growth Drivers of Australia Cell and Gene Therapy Market:

Rising Prevalence of Chronic and Genetic Disorders

The increasing burden of chronic and genetic disorders in Australia is a significant factor driving the adoption of cell and gene therapies. The growing rates of cancer, rare inherited conditions, and diseases with limited treatment options are leading to a rise in advanced therapies that target the genetic causes of these ailments. Unlike traditional treatments cell and gene therapies seek long-term solutions and, in some instances, curative outcomes. This escalating patient demand is resulting in increased investments in innovative therapeutic strategies and fostering collaborations between biotech companies and healthcare providers. As awareness grows and access to treatment improves the need for these therapies continues to rise directly impacting Australia cell and gene therapy market demand.

Supportive Government and Regulatory Frameworks

Government and regulatory support are essential in influencing the cell and gene therapy industry in Australia. Authorities are focused on refining approval processes for groundbreaking treatments, which ensures quicker access to essential therapies. Initiatives such as funding programs, research grants, and policy measures are being introduced to promote local innovation and encourage global collaborations. Regulatory agencies are also establishing clear safety and quality benchmarks to maintain patient confidence while driving industry progress. By lowering barriers to clinical trials and commercialization the government is facilitating the connection between research and patient care. This supportive policy landscape is significantly enhancing Australia cell and gene therapy market growth.

Advancements in Research and Technology

Ongoing advancements in research and technology are fueling progress in the Australian cell and gene therapy market. Breakthroughs in genetic sequencing, molecular diagnostics, and stem cell research are equipping scientists to create highly targeted and effective therapies. Enhanced technologies enable better detection of genetic abnormalities and allow for more accurate treatment delivery at the cellular level. Research institutions and biotech firms are utilizing these innovations to improve therapy effectiveness and minimize side effects. Additionally, improvements in manufacturing processes are making these therapies more scalable and commercially viable. According to Australia cell and gene therapy market analysis, technological advancements are fundamental in broadening treatment options and increasing patient accessibility.

Australia Cell and Gene Therapy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on therapy type, indication, delivery mode, and end user.

Therapy Type Insights:

- Cell Therapy

- Stem Cell

- Pluripotent Stem Cell

- Cancer Stem Cell

- Adult Stem Cell

- Non-Stem Cell

- T Cells

- Natural Killer

- Others

- Stem Cell

- Gene Therapy

The report has provided a detailed breakup and analysis of the market based on the therapy type. This includes cell therapy {stem cell (pluripotent stem cell, cancer stem cell, and adult stem cell) non-stem cell (T cells, natural killer, and others)} and gene therapy.

Indication Insights:

- Cardiovascular Disease

- Oncology Disorder

- Genetic Disorder

- Infectious Disease

- Neurological Disorder

- Others

A detailed breakup and analysis of the market based on the indication have also been provided in the report. This includes cardiovascular disease, oncology disorder, genetic disorder, infectious disease, neurological disorder, and others.

Delivery Mode Insights:

- In-Vivo

- Ex-Vivo

A detailed breakup and analysis of the market based on the delivery mode have also been provided in the report. This includes in-vivo and ex-vivo.

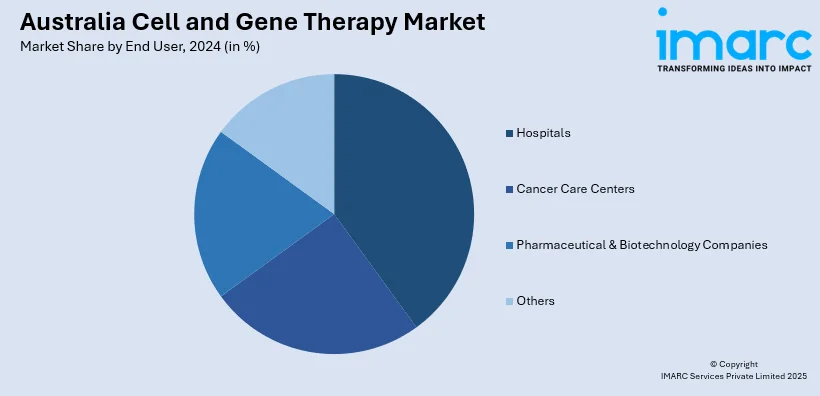

End User Insights:

- Hospitals

- Cancer Care Centers

- Pharmaceutical & Biotechnology Companies

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, cancer care centers, pharmaceutical & biotechnology companies, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cell and Gene Therapy Market News:

- April 2025: INmune Bio partnered with CGT Catapult to scale up CORDStrom manufacturing, supporting trials across Australia and other regions. This development strengthened Australia’s cell and gene therapy market by enhancing access to advanced treatments for rare genetic diseases like RDEB through global collaboration.

- March 2025: Xcellbio partnered with Planet Innovation to support rapid cell therapy manufacturing using the AVATAR Foundry platform. Its first clinical use at Royal Perth Hospital aimed to enhance TIL therapy potency, strengthening Australia's cell and gene therapy market with advanced, efficient treatment solutions.

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapy Types Covered |

|

| Indications Covered | Cardiovascular Disease, Oncology Disorder, Genetic Disorder, Infectious Disease, Neurological Disorder, Others |

| Delivery Modes Covered | In-Vivo, Ex-Vivo |

| End Users Covered | Hospitals, Cancer Care Centers, Pharmaceutical & Biotechnology Companies, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cell and gene therapy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cell and gene therapy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cell and gene therapy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cell and gene therapy market in Australia was valued at USD 425.60 Million in 2024.

The Australia cell and gene therapy market is projected to exhibit a compound annual growth rate (CAGR) of 18.73% during 2025-2033.

The Australia cell and gene therapy market is expected to reach a value of USD 1,995.47 Million by 2033.

The market is witnessing rising adoption of personalized medicine, integration of digital tools for treatment monitoring, and growing collaborations between biotech firms and academic institutions. Increasing investment in local manufacturing capacity and expanding focus on rare disease therapies are further shaping the sector’s innovation landscape.

Market growth is supported by rising patient demand for curative solutions, expanding clinical trial activity, and increasing healthcare investments in advanced treatment infrastructure. Progress in biomarker research, along with stronger partnerships between hospitals and biotech innovators, is also fueling momentum in delivering next-generation therapies to patients across Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)