Australia Ceramic Matrix Composites Market Size, Share, Trends and Forecast by Composite Type, Fiber Type, Fiber Material, Application, and Region, 2026-2034

Australia Ceramic Matrix Composites Market Summary:

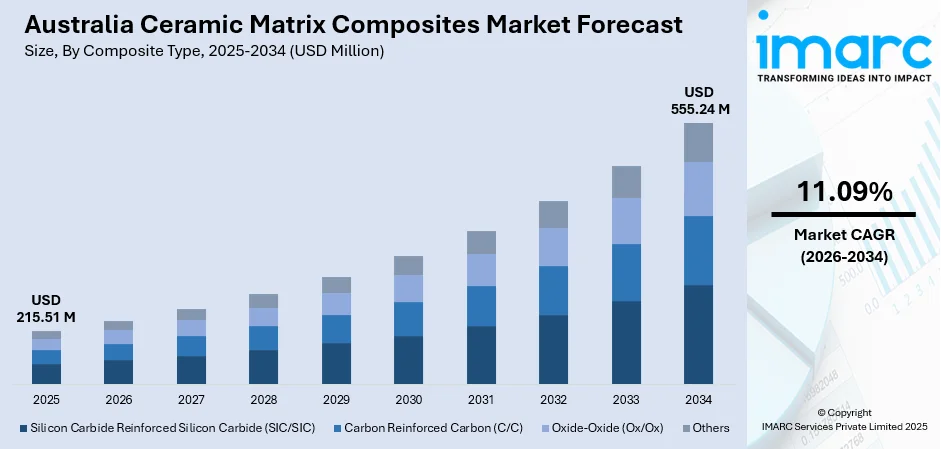

The Australia ceramic matrix composites market size was valued at USD 215.51 Million in 2025 and is projected to reach USD 555.24 Million by 2034, growing at a compound annual growth rate of 11.09% from 2026-2034.

The Australia ceramic matrix composites market is growing steadily, supported by rising demand for lightweight, high-strength materials across aerospace, defense, and industrial applications. Increasing focus on fuel efficiency, thermal performance, and durability is driving adoption in advanced engineering projects. Expanding investments in defense modernization and high-temperature manufacturing technologies further strengthen market prospects. As industries shift toward performance-driven materials, the use of ceramic matrix composites is expected to gain momentum across multiple end-use sectors.

Key Takeaways and Insights:

- By Composite Type: Silicon carbide reinforced silicon carbide (SIC/SIC) dominates the market with a share of 35.2% in 2025, driven by its superior thermal stability and oxidation resistance in aerospace engine applications.

- By Fiber Type: Continuous fiber leads the market with a share of 69.4% in 2025, reflecting preference for enhanced mechanical properties in structural aerospace components.

- By Fiber Material: SiC fiber exhibits a clear dominance with a share of 43.1% in 2025, owing to high-temperature capability requirements in defense propulsion systems.

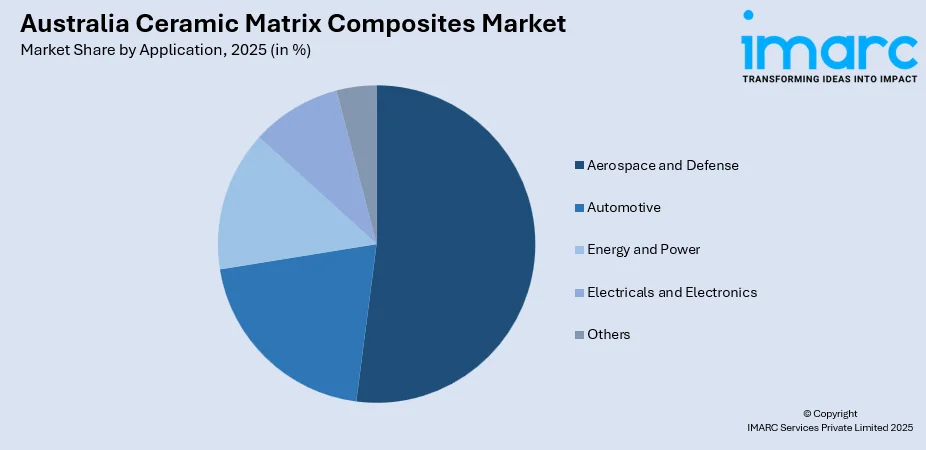

- By Application: Aerospace and defense dominated the market with a share of 51.1% in 2025, driven by extensive F-35 program participation and expanding military modernization investments.

- By Region: Australia Capital Territory & New South Wales represents the largest segment with a market share of 34% in 2025, reflecting concentration of defense aerospace infrastructure and manufacturing capabilities.

- Key Players: The Australia ceramic matrix composites market demonstrates moderate competitive intensity, with established multinational advanced materials corporations competing alongside specialized regional manufacturers across aerospace, defense, and industrial segments through strategic partnerships and localized production capabilities.

To get more information on this market Request Sample

The Australia ceramic matrix composites market is experiencing steady growth as industries shift toward materials that offer superior strength, lightweight properties, and high temperature resistance. The Australia aerospace and defense market size reached USD 12.89 Billion in 2024, and is expected to reach USD 21.04 Billion by 2033, further boosting demand for advanced materials. Expanding defense modernization programs and greater use of composites in aircraft components, turbines, and high temperature equipment are supporting wider adoption. Rising focus on fuel efficiency, operational reliability, and reduced maintenance needs continues to drive replacement of metal parts. Investments in research, material engineering, and advanced manufacturing technologies are accelerating development, positioning ceramic matrix composites as a critical material in Australia’s evolving industrial ecosystem.

Australia Ceramic Matrix Composites Market Trends:

Development of Hybrid and Multi-Phase Composites

Manufacturers are increasingly developing hybrid and multi-phase ceramic matrix composites that combine different fibres, matrices, and protective coatings. These engineered materials offer improved toughness, enhanced oxidation resistance, and greater stability under fluctuating temperatures. The approach allows precise tailoring of properties for demanding applications, ensuring better performance consistency and longer component life. This trend reflects a broader push toward advanced, application-specific CMC solutions across high-performance industries.

Integration of CMCs in Next-Generation Aircraft Engines

There is a growing shift toward replacing traditional metallic components with ceramic matrix composites in the hot sections of next-generation aircraft engines. Their exceptional thermal resistance, lower weight, and superior durability help improve overall engine performance. In October 2025, Hypersonix Launch Systems received USD 46 Million to develop its hydrogen-powered SPARTAN scramjet engine and conduct flight tests of the 11.5ft DART AE hypersonic vehicle. The project will utilize ceramic matrix composites and support the 26ft VISR hypersonic aircraft development. By enabling higher operating temperatures and reducing cooling requirements, CMCs enhance thermal efficiency and support longer engine lifespan. This transition is strengthening the material’s role in advanced aerospace propulsion systems.

Growing Adoption of Additive Manufacturing Techniques

Additive manufacturing techniques, including advanced 3D printing and ceramic deposition processes, are gaining traction for producing complex ceramic matrix composite components. These methods enable finer design flexibility, reduced production times, and improved structural precision. By minimising material waste and facilitating intricate geometries, additive manufacturing supports more efficient development of high-performance CMC parts. The trend is accelerating innovation and expanding the material’s applicability across aerospace, energy, and industrial sectors.

Market Outlook 2026-2034:

The Australia ceramic matrix composites market outlook remains strong, supported by rising demand for lightweight, high-performance materials across aerospace, defense, and advanced industrial applications. Increasing investments in next-generation engines, high-temperature systems, and energy-efficient technologies will continue to drive adoption. Growing emphasis on operational reliability, reduced emissions, and longer component life further strengthens market prospects. As domestic manufacturing capabilities expand and innovation accelerates, ceramic matrix composites are expected to play a more prominent role in Australia’s evolving advanced materials landscape. The market generated a revenue of USD 215.51 Million in 2025 and is projected to reach a revenue of USD 555.24 Million by 2034, growing at a compound annual growth rate of 11.09% from 2026-2034.

Australia Ceramic Matrix Composites Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Composite Type | Silicon Carbide Reinforced Silicon Carbide (SIC/SIC) | 35.2% |

| Fiber Type | Continuous Fiber | 69.4% |

| Fiber Material | SiC Fiber | 43.1% |

| Application | Aerospace and Defense | 51.1% |

| Region | Australia Capital Territory & New South Wales | 34% |

Composite Type Insights:

- Silicon Carbide Reinforced Silicon Carbide (SIC/SIC)

- Carbon Reinforced Carbon (C/C)

- Oxide-Oxide (Ox/Ox)

- Others

The silicon carbide reinforced silicon carbide (SIC/SIC) dominates with a market share of 35.2% of the total Australia ceramic matrix composites market in 2025.

The silicon carbide reinforced silicon carbide segment holds a leading position in the Australia ceramic matrix composites market due to its exceptional thermal stability, oxidation resistance, and mechanical strength. These properties make SIC/SIC ideal for demanding applications in aerospace, defense, and high-temperature industrial systems. As industries shift toward materials that improve durability and performance, adoption of SIC/SIC continues to expand across advanced engineering environments.

Growing interest in lightweight and high-efficiency components further supports SIC/SIC utilisation, particularly in propulsion systems, turbines, and structural parts where reliability is critical. Manufacturers increasingly prefer this composite type because it enables longer operational life and reduced maintenance intervals. Continuous research in material optimisation and processing techniques is strengthening the segment’s position across emerging applications within Australia’s evolving high-performance materials ecosystem.

Fiber Type Insights:

- Short Fiber

- Continuous Fiber

The continuous fiber leads with a share of 69.4% of the total Australia ceramic matrix composites market in 2025.

The continuous fiber segment leads the Australia ceramic matrix composites market due to its superior load bearing capability and enhanced structural consistency. Continuous fibers provide greater mechanical strength, improved fatigue resistance, and reliable performance under extreme conditions, making them well suited for aerospace engines, thermal protection components, and advanced industrial machinery.

As industries demand materials that balance strength, flexibility, and thermal resilience, continuous fiber composites are gaining wider acceptance across high value sectors. Their ability to support complex geometries and withstand operational stresses allows manufacturers to design components that meet rigorous performance requirements. Ongoing R&D in fiber architecture and processing continues to reinforce the segment’s commercial significance.

Fiber Material Insights:

- Alumina Fiber

- Refractory Ceramic Fiber (RCF)

- SiC Fiber

- Others

The SiC Fiber represents the largest segment with a market share of 43.1% of the total Australia ceramic matrix composites market in 2025.

SiC fiber dominates the Australia ceramic matrix composites market because of its excellent thermo mechanical properties, including high modulus, oxidation resistance, and stability in extreme environments. These attributes make SiC fiber a preferred reinforcement material for aerospace, defense, and energy applications where performance reliability is essential.

The growing shift toward materials that improve operational efficiency and reduce mass is driving stronger adoption of SiC fiber based composites. As engine temperatures rise and performance thresholds increase, SiC fibers enable manufacturers to design components that maintain integrity under prolonged heat exposure. Expanded use in turbines, propulsion systems, and high temperature insulation continues to strengthen this segment’s leadership.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Aerospace and Defense

- Automotive

- Energy and Power

- Electricals and Electronics

- Others

The aerospace and defense dominated with a share of 51.1% of the total Australia ceramic matrix composites market in 2025.

The aerospace and defense segment dominates the Australia ceramic matrix composites market as advanced aircraft and defense platforms require materials that deliver high strength, lightweight benefits, and thermal resilience. In July 2025, Australia's Defence partnered with Optus to develop a Low Earth Orbit satellite, investing USD 4 Million. The project aims to enhance sovereign space capabilities, featuring research equipment from the University of Southern Queensland, with a planned launch in 2028. CMCs support improved fuel efficiency, reduced maintenance needs, and enhanced system performance, making them essential for next generation aerospace programs.

Expanding investments in engine upgrades, high temperature components, and thermal protection systems continue to accelerate CMC adoption across military and commercial fleets. As operational demands intensify, aerospace and defense stakeholders are integrating CMCs to boost reliability and meet evolving performance standards. Ongoing modernisation initiatives further reinforce the segment’s dominant market position.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & South Australia

- Western Australia

The Australia Capital Territory & New South Wales exhibit a clear dominance with a 34% share of the total Australia ceramic matrix composites market in 2025.

Australia Capital Territory & New South Wales hold a strong position in the Australia ceramic matrix composites market due to the presence of key aerospace, defense, and advanced manufacturing activities. In July 2025, Sunburnt Space Co, a Brookvale-based startup, announced its plans to launch test rockets from a site in regional NSW, partnering with Endeavour Aerospace. The initiative aims to validate their Meggs Jr. program, targeting a milestone flight beyond 100km altitude by late 2026. The region benefits from concentrated R&D facilities, technical expertise, and government supported innovation ecosystems that enable steady growth in composite material adoption.

Increasing investment in high technology industries and expanding defense procurement programs are further enhancing regional demand for advanced materials such as CMCs. Manufacturers and research institutions in the area continue to develop improved composite solutions for aerospace components, energy systems, and industrial applications. This supportive environment ensures sustained leadership within the national market.

Market Dynamics:

Growth Drivers:

Why is the Australia Ceramic Matrix Composites Market Growing?

Rising Demand for Lightweight Materials

The demand for lightweight materials is increasing as aerospace, defense, and energy sectors prioritise improved efficiency, reduced fuel consumption, and enhanced payload capacity. The Australia solar power market size reached USD 9.6 Billion in 2025, and is expected to reach USD 33.9 Billion by 2034, further accelerating the need for advanced materials that can support high performance energy infrastructure. Ceramic matrix composites offer a superior strength to weight ratio, enabling components to maintain high functionality while significantly lowering structural mass. Their ability to withstand mechanical stress without compromising durability makes them an effective replacement for heavier metals. As industries adopt more sophisticated engineering and renewable technologies, lightweight CMCs are becoming integral to modern high-performance systems.

Increasing Industry Collaboration and R&D Partnerships

Universities, research institutes, and material manufacturers are strengthening collaboration to accelerate breakthroughs in ceramic matrix composites. With the Australia wind energy market size reaching USD 1,916.0 Million in 2024 and expected to reach USD 6,698.2 Million by 2033, expanding renewable energy investments are further encouraging advanced material development. These partnerships focus on improving performance, lowering production costs, and addressing scalability barriers. Joint R&D efforts also support faster testing, shared innovation, and enhanced manufacturing techniques. As cross industry cooperation grows, CMC technologies are becoming more commercially viable for next generation applications.

Need for High-Temperature Resistant Components

Industries such as aerospace, energy, and manufacturing increasingly require materials that can operate efficiently under extreme temperatures. The Australia wind turbine components market size reached USD 2.7 Billion in 2024, and is expected to reach USD 4.6 Billion by 2033, which highlights the growing need for advanced high heat materials in next generation turbine systems. Ceramic matrix composites offer exceptional thermal stability, enabling components to maintain structural integrity in demanding environments. Their oxidation resistance and ability to withstand thermal shock improve overall reliability. As operational temperatures in modern machinery continue to rise, demand for high temperature CMC solutions is expanding across critical industrial applications.

Market Restraints:

What Challenges the Australia Ceramic Matrix Composites Market is Facing?

High Production Costs

Ceramic matrix composites involve complex manufacturing processes, advanced raw materials, and specialised equipment, resulting in significantly higher production costs compared to traditional metals. These cost barriers limit widespread adoption, particularly among price-sensitive industries. The need for skilled labour and precision processing further adds to overall expenses, slowing commercial scalability across the Australian market.

Limited Domestic Manufacturing Capacity

Australia’s limited local production capability for ceramic matrix composites remains a major restraint. Dependence on imported materials, specialised machinery, and external expertise creates longer lead times and higher procurement costs. This restricts rapid deployment across large-scale projects and limits the ability of domestic industries to conduct continuous research, prototyping, and high-volume manufacturing.

Complex Design and Engineering Challenges

Ceramic matrix composites require highly specialised design, testing, and engineering expertise to ensure structural reliability under extreme conditions. Their brittle behaviour, complex fabrication requirements, and need for customised geometries create technical challenges for manufacturers. These complexities increase development time and slow integration into mainstream aerospace, defense, and industrial applications across Australia.

Competitive Landscape:

The competitive landscape of the Australia ceramic matrix composites market is shaped by a mix of global material innovators and emerging domestic players focusing on advanced engineering solutions. Competition is driven by continuous innovation in high temperature performance, lightweight design, and additive manufacturing capabilities. Companies invest heavily in research collaborations, material testing, and specialised production technologies to enhance product reliability and reduce costs. As end use industries demand stronger, more durable, and thermally efficient components, market participants compete on technical expertise, customisation capabilities, and long-term supply partnerships, strengthening overall competitiveness in the advanced materials sector.

Australia Ceramic Matrix Composites Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Composite Types Covered | Silicon Carbide Reinforced Silicon Carbide (SIC/SIC), Carbon Reinforced Carbon (C/C), Oxide-Oxide (Ox/Ox), Others |

| Fiber Types Covered | Short Fiber, Continuous Fiber |

| Fiber Materials Covered | Alumina Fiber, Refractory Ceramic Fiber (RCF), SiC Fiber, Others |

| Applications Covered | Aerospace and Defense, Automotive, Energy and Power, Electricals and Electronics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia ceramic matrix composites market size was valued at USD 215.51 Million in 2025.

The Australia ceramic matrix composites market is expected to grow at a compound annual growth rate of 11.09% from 2026-2034 to reach USD 555.24 Million by 2034.

Silicon carbide reinforced silicon carbide (SIC/SIC) held the largest share due to its high temperature stability, strong mechanical performance, and suitability for aerospace and defense applications. Its ability to deliver durability and consistent efficiency strengthens its preference across advanced engineering uses.

Key factors driving the Australia ceramic matrix composites market include rising demand for lightweight materials, expanding aerospace and defense programs, and increasing need for high temperature components. Growing focus on energy efficiency and wider adoption of advanced manufacturing methods also supports market expansion.

Major challenges include high production costs, limited large scale manufacturing capabilities, and complex material processing requirements. Long development cycles, stringent testing standards, and the need for specialised technical expertise also restrict broader commercial adoption across multiple end use industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)