Australia Cheese Market Size, Share, Trends and Forecast by Source, Type, Product, Format, Distribution Channel, and Region, 2025-2033

Australia Cheese Market Size and Share:

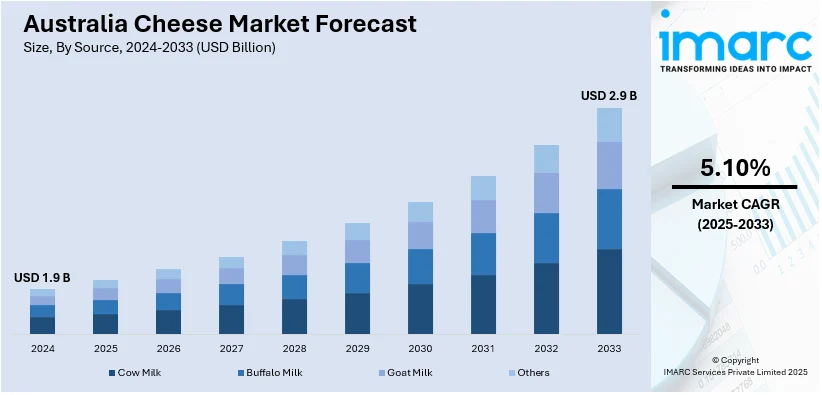

The Australia cheese market size reached USD 1.9 Billion in 2024. Looking forward, the market is expected to reach USD 2.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The market is witnessing steady growth as a result of boosting demand for premium and specialty cheese among consumers, health awareness, advances in manufacturing, and high potential for exports, particularly to Asian-Pacific markets, driven by government policies and shifting dietary lifestyles.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Market Growth Rate 2025-2033 | 5.10% |

Key Trends of Australia Cheese Market:

Growing Interest in Specialty and Artisanal Cheese

Across the nation of Australia, demand for artisanal and specialty cheeses has been increasing dramatically, with buyers strongly favoring origin, quality, and craft. For example, in November 2023, a new range of premium cheese including award-winning mature cheddar and flavored cream cheeses rolled out under the Farmer's Tribute brand in Australia with the target of achieving 200-store distribution within six months in the specialty cheese category. Furthermore, there is a clear trend away from common block or shredded cheese towards artisanal varieties featuring distinct flavor profiles. Consumers are looking for aged cheddars, bloomy rind varieties, washed-rind cheeses, and ash-covered goat logs. These produced using conventional methods and emphasize local milk origins or single-farm origin. Weekend markets, specialty delis, and independent retailers are now primary distribution channels, frequently functioning as discovery platforms for these items. Cheese is also being consumed less as an ingredient and more as a hero product, on its own or as the focus of grazing boards. Culinary curiosity plays a key role, as consumers explore different aging styles, regional varieties, and milk types. This trend is fueled by food tourism and cheese-tasting events, which further contributes to the rise in Australia cheese market demand.

To get more information on this market, Request Sample

Demand Surge for Sustainable and Ethical Cheese Production

Sustainability is playing a growing role in Australians' cheese choices, with ethical production and eco-friendly practices becoming increasingly important. Additionally, consumers are increasingly mindful of where and how their cheese is made, favoring dairies that emphasize animal welfare, regenerative farming, and sustainable production methods. Labels are being examined for evidence of ethical dedication, such as organic certification, pasture-raised labels, low-carbon operations, and waste minimization. Packaging also comes into play: recyclable materials, biodegradable wrapping, and minimalist packaging attract environmentally conscious consumers. A few manufacturers are spending money on solar-powered plants, water-efficient technology, and circular waste systems to respond to this increased demand. The concept of "climate-smart cheese" is coming into mainstream retail, with customers opting for products not just based on flavor but also their carbon impact. The move also speaks to retailers, who are growing their sustainable product offerings and advocating for supply chain transparency. Ethical cheese is no longer niche—it's becoming the norm.

Cheese Pairing Culture and Snacking Innovation

Cheese consumption in Australia is more lifestyle- and convenience-driven, with a high emphasis on pairing culture and snacking formats. Cheese is no longer just for sandwiches or recipes—it's being eaten on its own or on social, casual occasions. Grazing boards, wine pairings, and home entertaining have repositioned cheese, often served with crackers, fruits, olives, or even sweets, such as honeycomb and chocolate. This trend is driving innovation in formats: pre-cut cubes, mixed pack cheese, and wrapped wedges are increasingly popular. Shoppers are adding to their ranges of ready-to-eat cheese combinations for casual entertaining or solo enjoyment. Meanwhile, snacking culture is changing, with cheese being marketed as a protein-based, filling alternative to chips or candy. For instance, in November 2024, Woolworths launched an air fryer-compatible freezer range with cheese-based products such as cheese and bacon triangles, cheeseburger balls, and goat cheese with caramelized onion arancini, which generated high consumer interest throughout Australia. Moreover, portable, resealable packaging is now de rigueur across much of the range. This need for accessibility, visual appeal, and flavor diversity is compelling producers to treat cheese as food as well as, an experience, which further increases the Australia cheese market share.

Growth Drivers of Australia Cheese Market:

Rising Product Premiumization

The most significant trend in Australia's cheese market is that of premiumization, in which consumers demand for high-quality, artisanal products that highlight craftsmanship and provenance. Local cheesemakers—from Tasmania to South Gippsland—are answering with handcrafted varieties such as aged cheddar, brie, washed-rind, and goat cheeses. These products fit comfortably within Australia's vibrant gourmet food culture, represented in specialty delis and farmers' markets throughout cities like Adelaide, Melbourne, and Perth. Especially, makers like Berrys Creek Gourmet Cheese achieved global recognition through winning high-profile awards in the UK, boosting Australian artisan cheese's profile and promoting national pride. In addition, food festivals—such as Adelaide's CheeseFest—act as venues for small producers to access consumers, increasing brand exposure and contributing to market growth directly. This trend toward premium products also reflects consumer desires for authenticity, with considerable numbers opting for cheese as a central element of social grazing and entertainer culture over an ingredient.

Health, Wellness & Clean-Label Demand

According to the Australia cheese market analysis, the region’s changing focus on well-being and health is a prominent factor contributing to market expansion. Consumers are attracted to health-superiority snacks that complement healthy eating regimes—cheese, which is rich in protein, calcium, and quality fats, qualifies. Moreover, there is increasing demand for cleaner labels: cheeses made without artificial ingredients, reduced fat, less salt, and even probiotic-enhanced versions. Locally made probiotic and lactose-free cheeses like cultured cottage cheese or specialty quark are picking up speed as Australian consumers turn to functional foods supporting digestive wellness and active lifestyles. Moreover, plant-based cheese growth mirrors growing concern about environmental considerations and food inclusivity. Producers are trying out vegan cheese options with nut and legume bases to address rising demand among health-conscious and environmentally aware Australians.

Sustainability, Traceability & Technological Connections

Sustainability and ethical traceability strike a chord in the Australian cheese sector, fueling growth through the attraction of environmentally aware consumers. With far-reaching concern for climate change and animal welfare, manufacturers increasingly integrate eco-friendly methodologies—organic methods, pasture-grazing milk, carbon-minimizing packaging—to establish trust and distinguish products. Labels that showcase these promises resonate with consumers who want more than taste; they want nutritional value and minimal environmental footprint. Technological advancements have amplified this movement: precision agriculture on dairy farms, traceability via IoT, and blockchain for open supply chains guarantee farm-to-fridge quality monitoring. Such transparency resonates with the aspirations of consumers for responsibility and upholds the legitimacy of premium-priced cheese. Also, urban consumers increasingly value artisan cheesemakers' capacity to tell origin stories—be it Tasmania's cool-climate dairy farms or award-winning blue cheeses of South Gippsland—via digital direct-to-consumer platforms and story-driven packaging. Together, sustainability, traceability, and tech adoption are transforming cheese from an everyday grocery item to lifestyle-driven product with appealing regional identity.

Australia Cheese Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on source, type, product, format, and distribution channel.

Source Insights:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes cow milk, buffalo milk, goat milk, and others.

Type Insights:

- Natural

- Processed

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes natural and processed.

Product Insights:

- Mozzarella

- Cheddar

- Feta

- Parmesan

- Roquefort

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes mozzarella, cheddar, feta, parmesan, roquefort, and others.

Format Insights:

- Slices

- Diced/Cubes

- Shredded

- Blocks

- Spreads

- Liquid

- Others

A detailed breakup and analysis of the market based on the format have also been provided in the report. This includes slices, diced/cubes, shredded, blocks, spreads, liquid, and others.

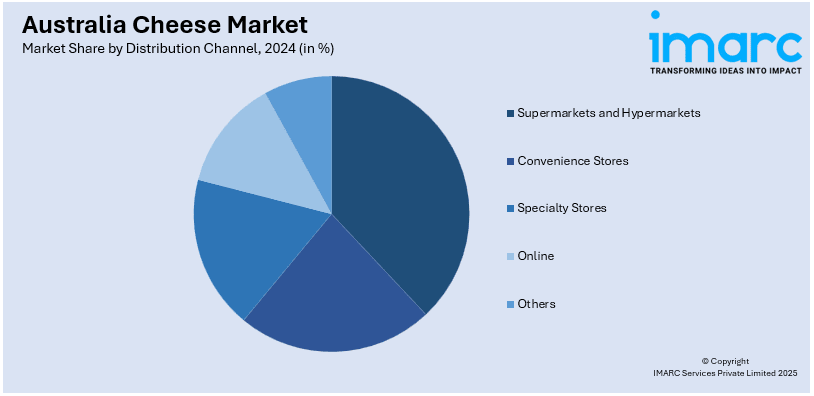

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cheese Market News:

- In November 2024, Giorgio's, a new Italian-style artisan cheese range, was introduced at select NSW, Queensland, Victorian, and Tasmanian Coles stores. Produced with Australian farm-fresh milk, the halal-certified range comprises burrata, bocconcini, mozzarella, and more.

- In November 2024, Lactalis Australia increased its cheese range in Woolworths with the addition of three new products: Galbani Pre-Sliced Fresh Mozzarella, Société Roquefort, and Président Crème de Brie, providing customers with high-quality Italian and French cheese in convenient retail packaging.

Australia Cheese Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Cow Milk, Buffalo Milk, Goat Milk, Others |

| Types Covered | Natural, Processed |

| Products Covered | Mozzarella, Cheddar, Feta, Parmesan, Roquefort, Others |

| Formats Covered | Slices, Diced/Cubes, Shredded, Blocks, Spreads, Liquid, Others |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cheese market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cheese market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cheese industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia cheese market was valued at USD 1.9 Billion in 2024.

The Australia cheese market is projected to exhibit a CAGR of 5.10% during 2025-2033.

The Australia cheese market is expected to reach a value of USD 2.9 Billion by 2033.

Australia's cheese market development is being spurred by heightened health awareness regarding clean-label and functional cheeses, and a strong emphasis on sustainability. Regional specialty production and widening export opportunities further drive market growth, backed by surging interest in locally raised, ethically manufactured dairy products.

Australia's cheese market is propelled by higher demand for specialty and artisanal cheeses, increasing emphasis on clean-label and health-conscious products, and rising consumer preference for sustainably sourced, ethically produced products. These trends demonstrate changing preferences, wellness needs, and ecological consciousness among Australian consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)