Australia Coal Market Report by Type (Bituminous Coal, Sub-Bituminous Coal, Lignite Coal, Anthracite Coal), Mining Technology (Surface Mining, Underground Mining), End Use Industrie (Power Generation, Steel, Cement, Residential and Commercial, and Others), and Region 2025-2033

Australia Coal Market Size and Share:

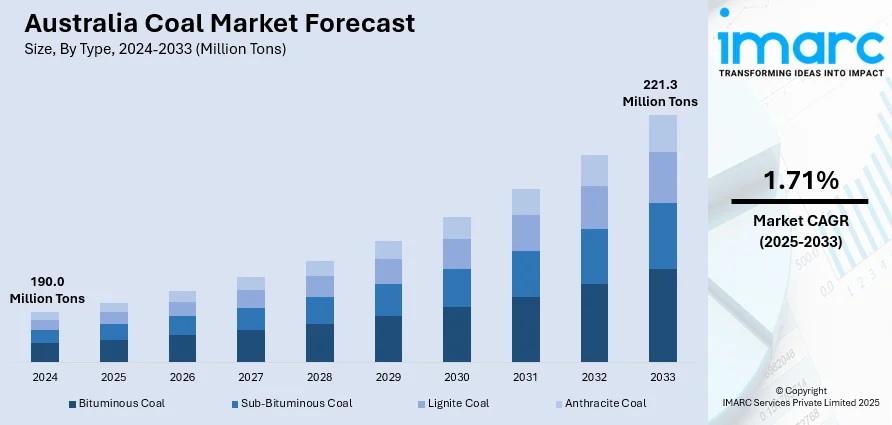

The Australia coal market size reached 190.0 Million Tons in 2024. Looking forward, the market is expected to reach 221.3 Million Tons by 2033, exhibiting a growth rate (CAGR) of 1.71% during 2025-2033. The market is driven by competitive mining labor costs, the stable domestic demand for coal-based energy, the expanding export capacity at Australian ports, continual technological advancements in coal mining, rising investment in coal mining infrastructure, and implementation of favorable government policies focused on mining.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

190.0 Million Tons |

|

Market Forecast in 2033

|

221.3 Million Tons |

| Market Growth Rate 2025-2033 | 1.71% |

Key Trends of Australia Coal Market:

Rising demand for bituminous coal

The coal market in Australia is experiencing notable expansion due to the increasing need for bituminous coal, especially from developing nations. Bituminous coal, valued for its high energy content and flexibility, has gained favor as a fuel choice for power production and industrial applications, particularly in areas experiencing quick industrial growth and urban development. New South Wales, Queensland, South Australia, Tasmania, and Western Australia have deposits of bituminous coal, with the largest amounts found in New South Wales and Queensland. Australia, as one of the leading coal producers and exporters worldwide, is well positioned to benefit from the growing demand. This trend emphasizes how crucial Australia is in the worldwide coal market, since its exports of bituminous coal help developing nations sustain their economic growth and industrial advancement. Consequently, the Australian coal industry is forecasted to experience continuous need in the near future, highlighting its significance in worldwide energy markets.

To get more information of this market, Request Sample

Increasing global demand for energy

According to the Australia coal market analysis, the increasing global demand for energy plays a significant role in driving the market. As countries around the world continue to industrialize and urbanize, the need for reliable and affordable energy sources continues to grow. Developing countries, particularly those in Asia, rely heavily on coal to power their expanding industrial sectors and urban centers. Australia's high-quality coal exports provide a critical energy source for these nations, enabling them to meet the increasing electricity demand. As energy consumption rises, these nations continue to increase their coal imports, further bolstering Australia's coal exports. Moreover, Australia's established mining infrastructure, strategic geographical location, and competitive costs make it a leading market player. The increasing global demand for energy is fueling economic growth in developing nations and driving investment in Australia’s coal mining and export infrastructure. While environmental concerns and the push for renewable energy are growing, coal remains an essential resource for many countries that rely on it to power their industries and homes.

Growth Drivers of Australia Coal Market:

Availability of Resources and Strategic Geographical Location

The Australia coal market demand is facilitated by its rich natural resource of high-grade thermal and metallurgical coal, particularly found in areas such as Queensland and New South Wales. There is a high volume of these coal basins, but their extraction costs are relatively low as open-cut mining methods are employed. The Queensland Bowen Basin, for instance, is among the world's most lucrative sources of coking coal. Besides having abundant resources, Australia's geographical positioning also has a significant logistical benefit. Located near to the industrially fast-growing economies of Asia—China, India, South Korea, and Japan—Australia enjoys shorter transportation time and distance compared to other major coal exporting countries in the world. This location, combined with an established port and rail facility, makes it easy for efficient supply chain operations that enable regular export flows. Consequently, Australia is a desired supplier in foreign markets that value both reliability and coal quality.

Export-Oriented Policy Framework and Trade Relations

The development of Australia's coal market has been complemented by a supportive policy framework that promotes mining and global trade. The federal and state authorities have long promoted resource extraction as a central driver of national economic advancement, frequently streamlining approvals for new coal mines and infrastructure. In addition, Australia has fostered strong bilateral trade ties, notably with prominent Asian economies. Despite efforts to decarbonize the world, the sustained need for metallurgical coal employed in steelmaking guarantees a robust export market. Coal exports are increased by Australia's Free Trade Agreements (FTAs) with South Korea and Japan, which also reduce tariff barriers and facilitate trade logistics. This export-oriented model is complemented by massive private investment in mining technology and logistics, raising productivity and sustaining Australia's global market competitiveness. Institutional and policy support of this nature is important in reinforcing Australia as a high-grade coal supplier, which further contributes to the increasing Australia coal market share.

Industrial Demand and Regional Economic Dependency

A further prime driver of Australia's coal market is its integrated place in serving regional economies and indigenous industrial demand. Specifically, the metallurgical coal industry supports Australia's steel manufacturing, which is still essential for infrastructure and construction. Coal power, although diminishing in urban areas, remains a main source of energy for some regional and outer communities where alternatives are less feasible. Moreover, a lot of towns and communities—particularly in New South Wales and Queensland—are economically reliant on coal mining. Public services and local business activity and employment in the region are directly linked to the performance of the coal industry. This economic embeddedness guarantees broad national energy and export policy influences as well as strong local political support for the industry. Aside from direct economic gains, coal mining in these areas tends to finance important infrastructure like schools, roads, and hospitals through royalty distributions, integrating the industry extensively into rural Australia's socio-economic life.

Australia Coal Market Outlook:

Shifting Demand Patterns in the Asia-Pacific Region

The outlook for Australia's coal market is highly correlated with events in the Asia-Pacific region, where energy consumption keeps on increasing, along with changing priorities. While other traditional importers like Japan and South Korea are slowly cutting back thermal coal imports for cleaner options, others such as India and Southeast Asia countries are increasing demand because of industrial growth and constraints on renewable facilities. Australia is well-placed to meet these changing market demands, due to its proven export channels and the adaptability of its coal producers to meet varying grades. The increasing demand for metallurgical coal in heavy infrastructure economies is especially pertinent, given that steel is still irreplaceable in urban construction. Moreover, Australia's established trade history and reliable supply record present a strategic strength against newer or politically unstable coal-exporting nations, enabling it to maintain a robust presence even as the global energy space undergoes change.

Domestic Policy Changes and Environmental Factors

Australia's domestic coal environment is under mounting pressure from climate targets and public debate regarding environmental sustainability. As most state governments, especially on the eastern seaboard, set net-zero targets, the shift from using thermal coal to produce electricity is likely to gain momentum. Yet, the policy strategy in Australia tends to weigh environmental ambitions against economic conditions, given that coal is still a pillar of regional jobs and export earnings. Plans like the growth of carbon capture and storage (CCS) and the phased adoption of cleaner technology in mines indicate adaptation over dramatic divestment. In special areas like the Hunter Valley, one can increasingly see efforts aimed at reinventing coal-associated infrastructure for coming clean energy initiatives, including hydrogen precincts or pumped hydro plants. These local adaptations mean that while domestic consumption of coal can fall, Australia is establishing the foundations for a diversified energy economy without necessarily causing its coal business to be discontinued.

Investment Trends and Future Export Opportunities

In the future, the Australian coal market will continue to be an important force around the world, but with a more specialized interest in metallurgical coal and high-grade thermal coal markets. Investors are getting more discerning, with a preference for projects that exhibit long-term export potential and environmental care. This is particularly apparent in Queensland, where more recent mining proposals are now subject to toughened environmental and Indigenous consultation criteria. However, demand for high-quality Australian coal remains robust in countries with continuing infrastructure demands and less advanced renewable industries. Australia's ability to supply coal with lower ash and sulfur levels than the other sources give it a competitive advantage in the premium segments. In addition, technology improvements and remote operations—especially in the large coalfields of the Galilee and Surat Basins—improve cost-effectiveness and operational efficiency. These local innovations, added to strong trade relationships, mean that whilst the coal industry will adapt, it will remain a key driver in the export economy of Australia for the foreseeable future.

Government Support of Australia Coal Market:

Pro-Resource Policy Framework and Infrastructure Investment

Support from government for the Australian coal market is deeply rooted in the country's economic and industrial policy. State and federal governments have long perceived coal as a mainstay of national prosperity, particularly in resource states such as Queensland and New South Wales. This assistance is seen in the provision of government financing for mining infrastructure like railways, ports, and energy corridors that directly provide for coal transport and exports. The Galilee and Bowen Basins, for example, have been the beneficiaries of public-private partnerships to improve rail access to key export terminals like Abbot Point and Gladstone. Such infrastructure spending is intended to enhance logistics while bringing in long-term funds into coal development schemes. Government agencies also offer regulatory certainty and long-term mining leases, which make an investment-friendly environment. This system allows coal companies to plan multi-decade ventures with confidence, a factor which remains to underpin Australia's presence in international coal markets.

Regional Economic Development and Job Creation Initiatives

Australian governments give significant importance to the socio-economic contribution of coal in regional communities, resulting in specific support programs focused on job creation and local economic security. In regions like Moranbah, Muswellbrook, and Blackwater, coal mining constitutes a major source of employment and business activity. Considering this, state governments have introduced region-specific development plans that strengthen coal's contribution to local economies. These involve funding for workforce development, subsidies for service businesses that benefit the mining industry, and upgrading infrastructure to keep viable communities in mining areas. Governments also intervene from time to time to arbitrate in labor disputes or mine closures, providing retraining packages and transition employment schemes. Distinct to Australia is the incorporation of royalties from mines into state budgets, which are usually spent back into regional development. This circular economic model means that coal-producing areas have a direct interest in the success of the industry, which creates a political and economic incentive for governments to keep supporting the industry.

International Trade Advocacy and Diplomatic Support

Support for coal by the Australian government also goes beyond domestic politics into international trade and diplomacy. Consecutive governments have actively marketed Australian coal into international markets, most prominently through trade missions and senior delegations to influential partner nations in Asia. Where there are trade tensions—such as in previous disruptions with China—federal officials tend to diversify the market and establish new opportunities, including in India and Southeast Asia. Australia's diplomatic service continually negotiates to promote its coal exports as high quality and reliable. The government further assists the coal industry with free trade agreements that lower tariffs and enhance foreign market access, making Australian exporters competitive. In contrast to most other resource-exporting countries, Australia leverages both its image of sound governance and an active effort to sustain favorable trade relations. This kind of international advocacy is a testament to the strategic significance coal still carries within Australia's overall economic and foreign policy agenda.

Australia Coal Market News:

- August 29, 2024: Stanmore Resources announced its partnership with the Queensland Government to fund a new gas-to-electricity power station at the South Walker Creek opencast coal mine. The project aims to capture coal seam gas from the site, helping to reduce future fugitive emissions and improve the environmental footprint of the mining operation. The captured gas will be used to generate electricity on-site, providing a sustainable and self-sufficient energy source for the mine. Pending regulatory approvals, the construction is set to be completed by 2027, with commercial-scale gas drainage and electricity generation projected to continue for at least 15 years.

- July 11, 2024: South32 Ltd announced that the sale of its Illawarra Metallurgical Coal operations to a joint venture between Golden Energy and Resources Pte Ltd and M Resources Pty Ltd has received approval from the Australian Foreign Investment Review Board. The transaction, which remains subject to further foreign merger clearances, is anticipated to be finalized in the first quarter of FY25.

Australia Coal Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, mining technology, and end use industry.

Type Insights:

- Bituminous Coal

- Sub-Bituminous Coal

- Lignite Coal

- Anthracite Coal

The report has provided a detailed breakup and analysis of the market based on the type. This includes bituminous coal, sub-bituminous coal, lignite coal and anthracite coal.

Mining Technology Insights:

- Surface Mining

- Underground Mining

A detailed breakup and analysis of the market based on the mining technology have also been provided in the report. This includes surface mining and underground mining.

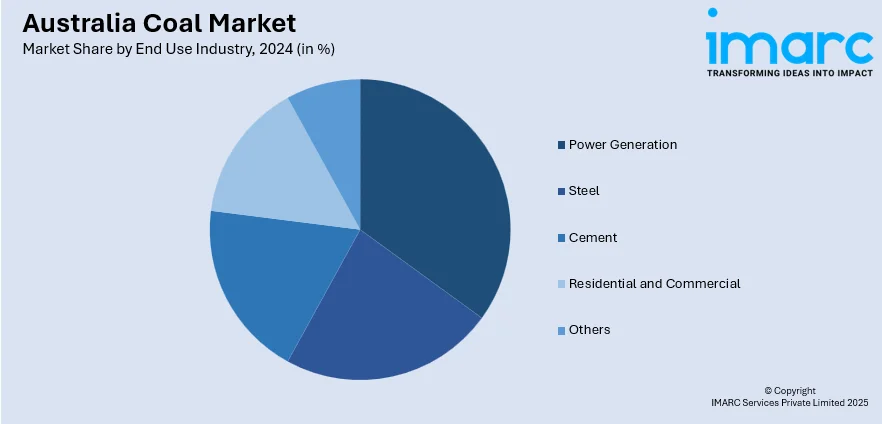

End Use Industry Insights:

- Power Generation

- Steel

- Cement

- Residential and Commercial

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes power generation, steel, cement, residential and commercial, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Coal Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bituminous Coal, Sub-Bituminous Coal, Lignite Coal, Anthracite Coal |

| Mining Technologies Covered | Surface Mining, Underground Mining |

| End Use Industries Covered | Power Generation, Steel, Cement, Residential and Commercial, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia coal market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia coal market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia coal industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia coal market was valued at 190.0 Million Tons in 2024.

The Australia coal market is projected to exhibit a CAGR of 1.71% during 2025-2033.

The Australia coal market is expected to reach a value of 221.3 Million Tons by 2033.

Australia's coal market trends are characterized by a slow transition away from thermal and toward metallurgical coal exports, rising environmental regulations, and growing demand from the emerging Asian economies. Investment is going into cleaner technology and automation, with domestic usage decreasing. Premium-grade coal production and trade diversification are driving the industry's changing strategic direction.

Australia's coal industry is fueled by vast high-quality reserves, Asia-Pacific buyer proximity, solid export infrastructure, and healthy trade relationships. Government assistance, particularly in mining areas, and continued worldwide demand for metallurgical coal also further support its expansion, keeping Australia a global energy and steel supply chain leader.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)