Australia Cold Chain Monitoring Solutions Market Size, Share, Trends and Forecast by Component, Application, and Region, 2026-2034

Australia Cold Chain Monitoring Solutions Market Overview:

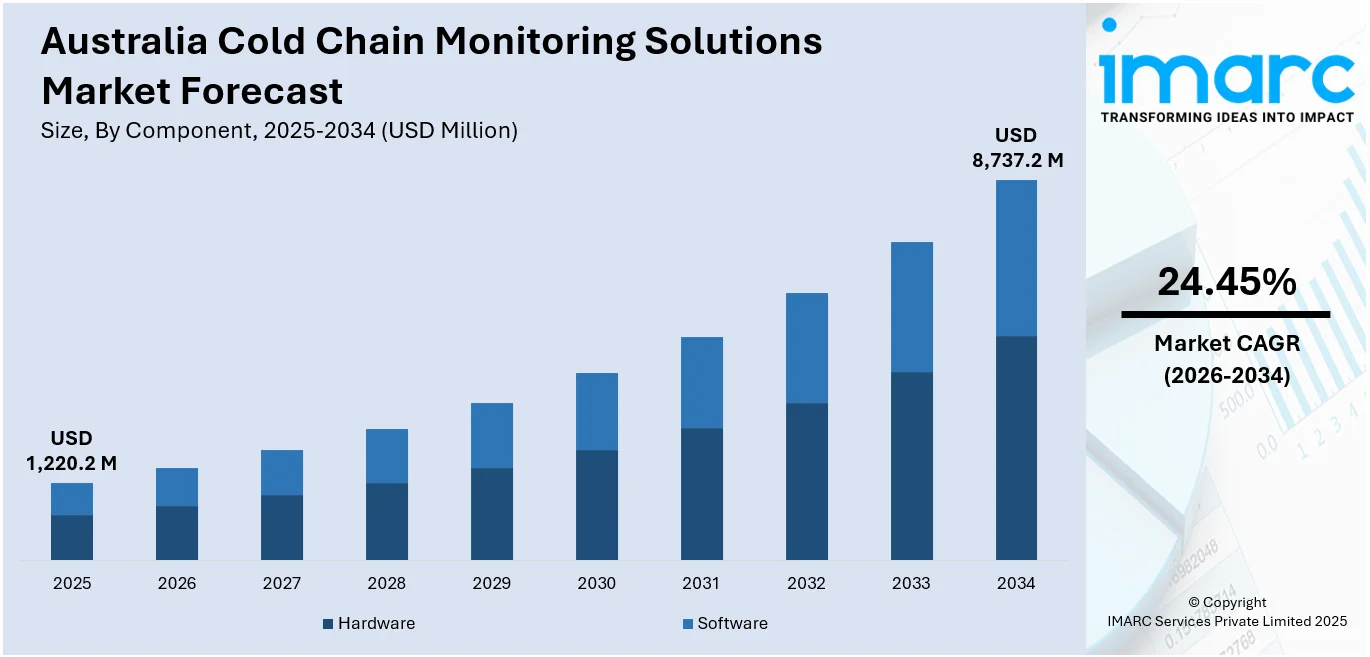

The Australia cold chain monitoring solutions market size reached USD 1,220.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 8,737.2 Million by 2034, exhibiting a growth rate (CAGR) of 24.45% during 2026-2034. The market is evolving rapidly, driven by stringent regulatory standards, technological advancements, and increasing demand for temperature-sensitive goods. The integration of IoT, AI, and real-time analytics enhances supply chain transparency and efficiency. Sectors like pharmaceuticals and perishable foods are adopting these solutions to ensure product integrity, thereby influencing the Australia cold chain monitoring solutions market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,220.2 Million |

| Market Forecast in 2034 | USD 8,737.2 Million |

| Market Growth Rate 2026-2034 | 24.45% |

Australia Cold Chain Monitoring Solutions Market Trends:

Stringent Regulations and Consumer Awareness

Stringent food safety regulations and heightened consumer awareness regarding product quality are significantly driving the adoption of cold chain monitoring solutions in Australia. Both governmental bodies and consumers are increasingly focused on ensuring the safety and quality of food and pharmaceutical products. Regulatory authorities enforce strict guidelines for the storage and transportation of these temperature-sensitive items to mitigate health risks and uphold product integrity. Consumers are also more informed and discerning about the conditions under which their food and medicines are handled. This increased scrutiny compels businesses to adopt cold chain monitoring systems that provide verifiable data, ensure regulatory compliance, build consumer confidence, and minimize the potential for costly recalls and reputational damage.

To get more information on this market Request Sample

Technological Advancements in Monitoring and Connectivity

Technological advancements in monitoring and connectivity are fundamentally reshaping the Australian cold chain landscape. Innovations such as the Internet of Things (IoT), sophisticated sensors, advanced data analytics, and cloud-based platforms are enabling more efficient and dependable temperature monitoring practices. Real-time tracking systems offer continuous visibility into the location and environmental conditions of temperature-sensitive goods, facilitating immediate alerts and corrective actions in the event of temperature deviations. Predictive analytics capabilities can even anticipate potential disruptions, enabling proactive intervention. These technological solutions enhance transparency across the supply chain, improve data-driven decision-making, reduce the likelihood of human error, and ultimately contribute to a more resilient and economically viable cold chain ecosystem.

Focus on Reducing Food Waste and Sustainability

The growing emphasis on reducing food waste and promoting sustainability is a crucial factor propelling the Australia cold chain monitoring solutions market growth. Food loss and waste represent significant challenges in Australia, with a considerable amount of perishable goods being discarded due to inadequate temperature management during storage and transit. Implementing effective cold chain monitoring systems plays a vital role in minimizing spoilage and extending the shelf life of products, thereby contributing to a more sustainable food supply chain. Furthermore, there is an increasing demand for energy-efficient and environmentally responsible cold chain technologies and practices, driving the adoption of monitoring solutions that can optimize energy consumption and reduce the overall carbon footprint associated with cold chain operations.

Australia Cold Chain Monitoring Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component and application.

Component Insights:

- Hardware

- Sensors

- RFID Devices

- Telematics

- Networking Devices

- Others

- Software

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (sensors, RFID devices, telematics, networking devices, and others) and software (on-premises and cloud-based).

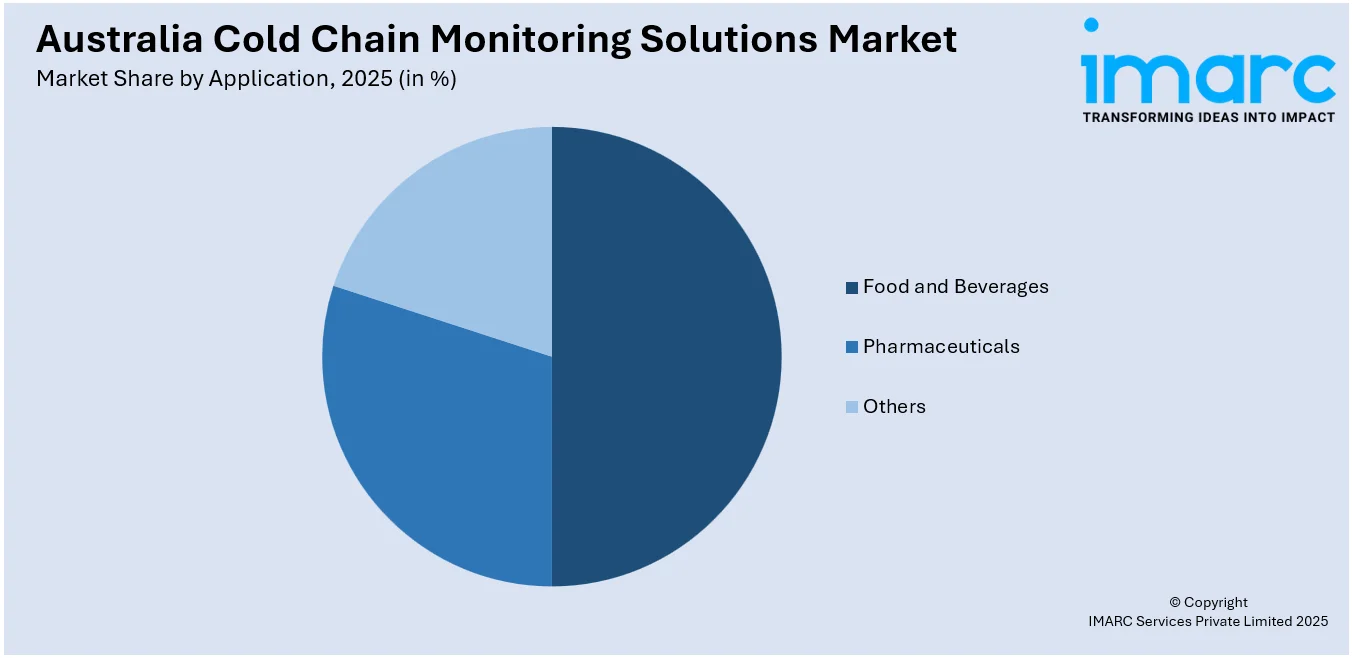

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Fruits and Vegetables

- Fruit Pulp and Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice Cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery and Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages [fruits and vegetables, fruit pulp and concentrates, dairy products (milk, butter, cheese, ice cream, and others), fish, meat, and seafood, processed food, bakery and confectionary, and others], pharmaceuticals (vaccines, blood banking, others), and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cold Chain Monitoring Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia cold chain monitoring solutions market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia cold chain monitoring solutions market on the basis of component?

- What is the breakup of the Australia cold chain monitoring solutions market on the basis of application?

- What is the breakup of the Australia cold chain monitoring solutions market on the basis of region?

- What are the various stages in the value chain of the Australia cold chain monitoring solutions market?

- What are the key driving factors and challenges in the Australia cold chain monitoring solutions market?

- What is the structure of the Australia cold chain monitoring solutions market and who are the key players?

- What is the degree of competition in the Australia cold chain monitoring solutions market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cold chain monitoring solutions market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cold chain monitoring solutions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cold chain monitoring solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)