Australia Cold Chain Pharmaceutical Logistics Market Size, Share, Trends and Forecast by Product, Service, and Region, 2025-2033

Australia Cold Chain Pharmaceutical Logistics Market Overview:

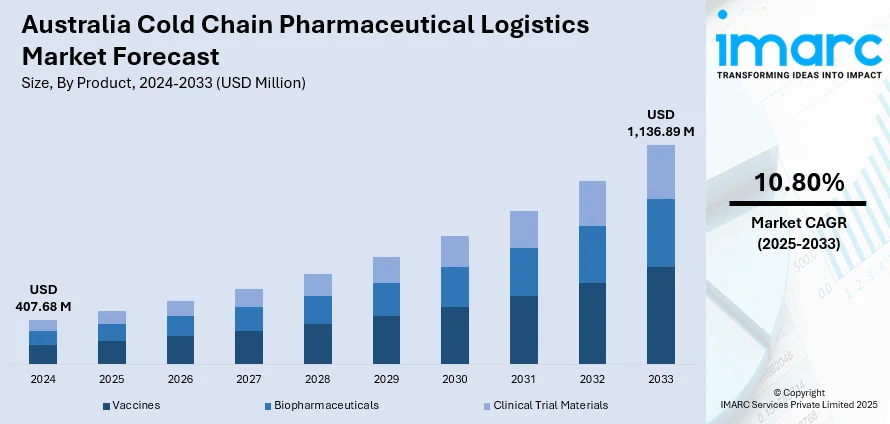

The Australia cold chain pharmaceutical logistics market size reached USD 407.68 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,136.89 Million by 2033, exhibiting a growth rate (CAGR) of 10.80% during 2025-2033. The industry is experiencing rapid growth because of the high demand for temperature-sensitive drugs like vaccines, biologics, and other medicines that are biologically derived. This trend, along with the implementation of stringent regulatory requirements and compliance standards imposed by government and health organizations, is propelling the market growth. Moreover, rapid advancements in cold chain technology are expanding the Australian cold chain pharmaceutical logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 407.68 Million |

| Market Forecast in 2033 | USD 1,136.89 Million |

| Market Growth Rate 2025-2033 | 10.80% |

Australia Cold Chain Pharmaceutical Logistics Market Trends:

Increasing Demand for Temperature-Sensitive Pharmaceuticals

The Australian pharmaceutical cold chain logistics sector is experiencing rapid growth because of the high demand for temperature-sensitive drugs like vaccines, biologics, and other medicines that are biologically-derived. Such products need stringent temperature control from the supply chain to ensure efficacy and safety. With the pharma industry developing more innovative drugs, the demand for trusted temperature-controlled transport and storage solutions is increasing. Firms are making investments in sophisticated cold chain systems, such as real-time temperature tracking, Internet of Things (IoT) sensors, and automated warehouse systems, to secure adherence to demanding regulatory requirements and preserve the integrity of pharmaceutical drugs. With the continuous global health issues and the introduction of new vaccines, there is a significant rise in the demand for strong cold chain logistics to address the needs of transporting and storing these delicate products throughout Australia. The IMARC Group predicts that the Australia pharmaceutical market size is projected to rise to USD 31.1 Billion by 2033.

To get more information on this market, Request Sample

Regulatory Compliance and Stringent Standards

The implementation of stringent regulatory requirements and compliance standards imposed by government and health organizations is propelling the Australian cold chain pharmaceutical logistics market growth. Bodies like the Therapeutic Goods Administration (TGA) and the Australian Department of Health are regularly revising their policy to ensure the secure transport and storage of pharmaceutical products, especially those that must be kept in controlled conditions. Logistics companies are increasingly emphasizing compliance with these regulations through the use of cutting-edge cold chain solutions that are compliant with Good Distribution Practice (GDP) and Good Manufacturing Practice (GMP) regulations. Increasing sophistication of these regulatory structures is encouraging logistics suppliers to embrace greater standards of temperature-controlled transportation, custom packaging, and surveillance systems to elude risks of product degradation or non-compliance, which in turn can lead to hefty penalties or damage to reputation.

Technological Advancements in Cold Chain Solutions

The rapid advancements in cold chain technology are positively influencing the market in Australia. Companies are embracing new technologies such as automated tracking systems, blockchain for transparent supply chain management, and advanced refrigeration technologies that ensure the optimal temperature conditions for pharmaceutical products. Real-time monitoring and data analytics are becoming key components of cold chain management, allowing logistics providers to track temperature fluctuations and proactively address potential issues before they compromise product quality. The adoption of energy-efficient refrigeration systems and sustainable packaging solutions is also contributing to reducing operational costs while enhancing the reliability of temperature-sensitive shipments. As technological innovations continue to shape the industry, Australian logistics companies are increasingly relying on these state-of-the-art solutions to improve service efficiency and meet the evolving needs of the pharmaceutical sector. In 2024, Merck, a global science and technology company, announced its plan to switch from conventional expanded polystyrene (EPS) insulation to wool-pack insulation for cold-chain delivery for its Life Science business in Australia starting from September 1. This switch displaced 300m3 or 3.6 tons of non-recyclable EPS annually. The wool packaging solution is proven for one-day transport of pharmaceutical products under Australian summer conditions.

Australia Cold Chain Pharmaceutical Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and service.

Product Insights:

- Vaccines

- Biopharmaceuticals

- Clinical Trial Materials

The report has provided a detailed breakup and analysis of the market based on the product. This includes vaccines, biopharmaceuticals, and clinical trial materials.

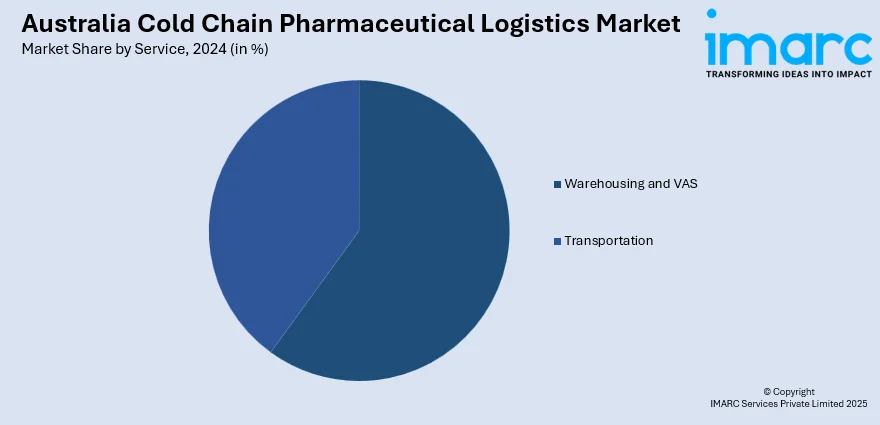

Service Insights:

- Warehousing and VAS

- Transportation

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes warehousing and VAS and transportation.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cold Chain Pharmaceutical Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Vaccines, Biopharmaceuticals, Clinical Trial Materials |

| Services Covered | Warehousing and VAS, Transportation |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia cold chain pharmaceutical logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia cold chain pharmaceutical logistics market on the basis of product?

- What is the breakup of the Australia cold chain pharmaceutical logistics market on the basis of service?

- What is the breakup of the Australia cold chain pharmaceutical logistics market on the basis of region?

- What are the various stages in the value chain of the Australia cold chain pharmaceutical logistics market?

- What are the key driving factors and challenges in the Australia cold chain pharmaceutical logistics?

- What is the structure of the Australia cold chain pharmaceutical logistics market and who are the key players?

- What is the degree of competition in the Australia cold chain pharmaceutical logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cold chain pharmaceutical logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cold chain pharmaceutical logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cold chain pharmaceutical logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)