Australia Commercial Property Market Report by Type (Office, Retail, Industrial and Logistics, Hospitality, and Others), and Region 2025-2033

Australia Commercial Property Market Size and Share:

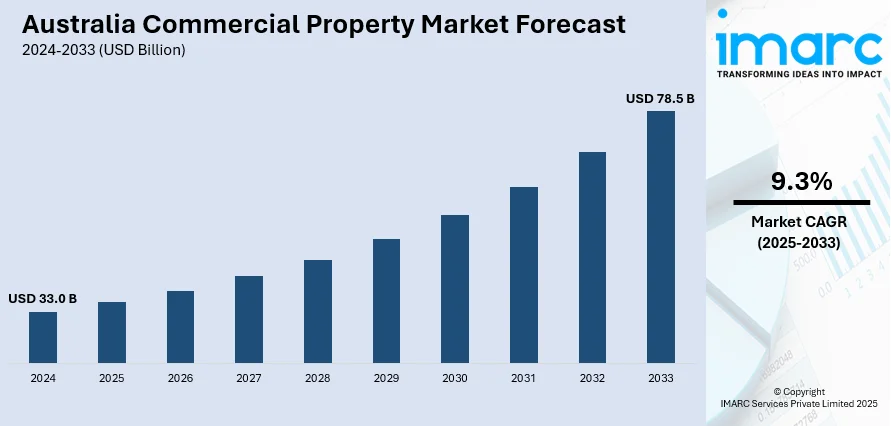

The Australia commercial property market size reached USD 33.0 Billion in 2024. Looking forward, the market is expected to reach USD 78.5 Billion by 2033, exhibiting a growth rate (CAGR) of 9.3% during 2025-2033. The market is driven by factors such as the strong economic growth, increasing population and urbanization, heightened foreign investment, rapid technological advancements, growing focus on sustainability initiatives, and burgeoning infrastructure development initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 33.0 Billion |

| Market Forecast in 2033 | USD 78.5 Billion |

| Market Growth Rate 2025-2033 | 9.3% |

Key Trends of Australia Commercial Property Market:

Heightened Economic Growth and Stability

The rising economic growth in Australia is one of the major factors driving the commercial property market. The gross domestic product (GDP) of Australia rose 0.2% and the economy grew 1.5% in 2023-24. This growth leads to increased business activity, which drives the demand for office spaces, retail stores, warehouses, and industrial facilities. Moreover, strong economic policies, such as low interest rates and government stimulus packages, are contributing to the buoyancy of the commercial property market. These factors ensure that businesses have the necessary capital to expand, thus increasing the demand for commercial spaces. Moreover, the Reserve Bank of Australia's (RBA) monetary policies play a crucial role in maintaining economic stability, which in turn facilitates the growth of the Australia commercial property market share.

To get more information of this market, Request Sample

Growing Population and Urbanization

The growing population in the country is a significant driver boosting the market growth. The country's population was 26,966,789 people in 2023, with an annual growth of 2.5% (651,200 people). Also, the increasing prevalence of urbanization, as more people migrate to urban areas for work and lifestyle reasons, is creating the demand for commercial spaces. In line with this, the urban populace reached a 23073508 mark in 2023, boosting the need for more retail outlets, office spaces, and industrial areas to support the expanding workforce and consumer base. In addition to this, the development of new business districts and the revitalization of older ones are also favoring the expansion of the commercial property market.

Increasing Foreign Investment

The increasing foreign investment is also playing a vital role in the commercial property market. The stable political environment, strong legal framework, and transparent regulatory systems which provide a level of security to investors is boosting the market growth. Moreover, the increasing foreign capital inflow into Australia's commercial real estate, particularly in office buildings, hotels, and shopping centers, is favoring the market growth. As per industry reports, the investment into Australia's office, retail, and industrial markets topped $7 billion in Q2 2024. Furthermore, the introduction of favorable exchange rates that make property investments more affordable for international buyers is enhancing the market growth.

Growth Drivers of Australia Commercial Property Market:

Infrastructure Development

The infrastructure development of Australia's major cities is one of the main factors propelling the growth of the commercial real estate sector in that country. Sydney, Melbourne, and Brisbane are still witnessing population growth and economic diversification, leading to heightened demand for office space, retail spaces, and logistics centers. Government-funded infrastructure developments like new transportation arteries, metro line extensions, and airport facilities immediately drive the commercial real estate boom by making available otherwise underdeveloped land for investment. In Western Sydney, for example, the construction of the Western Sydney Airport and the related Aerotropolis project have triggered increased demand for commercial property, especially in logistics, aviation support services, and retailing. This trend is reflected in Perth and Adelaide, where targeted revitalization efforts and regional growth programs drive commercial property development. These region-focused infrastructure strategies build a pipeline of opportunities for developers and investors who want to take advantage of Australia's changing cityscapes.

Strong Demand in Logistics and Industrial Sectors

The growth of online retail and the changing dynamics of international supply chains have greatly fueled the Australia commercial property market demand, especially around significant ports and transportation hubs. Melbourne's west suburbs, Brisbane's Trade Coast, and Sydney's outer western precinct are among the hotspots for warehouses and distribution centers. Australia's geographical position as a secure, strategically placed gateway to Asia-Pacific trade streams makes it highly appealing for multinational firms establishing regional logistics hubs. Local businesses are also looking for larger, higher-tech facilities to support growing online retail volumes. Cold storage, automated warehouses, and last-mile delivery centers are transforming industrial property needs. This change is most evident in areas that have expanding populations and advanced transport networks. Support for regional industrial parks and smart logistics hubs from government is also fueling development, making sure the industrial and logistics sector continues to be a strong driver of commercial property expansion.

Sound Economic Climate and Institutional Investment

Australia's commercial real estate market remains a magnet for large investment due to its solid economic conditions, open regulatory framework, and robust banking system. Institutional investors such as superannuation funds and international real estate trusts treat Australia as a secure, high-reward market for commercial property assets. Australia's legal system and financial system are rated among the best in the Asia-Pacific and provide robust protection for investors. This confidence is especially apparent in high-end office properties within CBD areas like Sydney, Melbourne, and Brisbane, where multinational companies look for long-term tenancies. Moreover, increasing emphasis on green certifications and sustainability in commercial properties responds to international investment patterns, making Australian real estate more attractive to eco-friendly investors. In areas such as Canberra and Hobart, public sector job growth and knowledge-intensive industries offer additional support for commercial office investment. Australia's distinctive combination of political stability, economic resilience, and institutional confidence creates a strong platform for sustained growth in its commercial property market.

Australia Commercial Property Market Outlook:

Diversification Into Regional and Secondary Markets

According to the Australia commercial property market analysis, the future could oversee a robust trend of diversification into regional and secondary cities, fueled by changing work habits, enhanced digital connectivity, and increasing affordability issues in primary metropolitan markets. Cities like Geelong, Newcastle, Wollongong, and the Gold Coast are seeing growing commercial interest as a result of deliberate infrastructure investment and population flows from capital cities. These regions are creating their own economic profiles, with education, healthcare, technology, and tourism growing industries driving demand for office and retail space. Regional councils and state governments are also providing incentives and zoning concessions to try to draw commercial development. This movement is part of a larger shift in Australia to decentralize economic activity and alleviate pressure from Sydney and Melbourne, while continuing to benefit from national productivity. As hybrid work patterns become more rooted, local commercial nodes can be expected to increase in stature, providing long-term investment prospects in a diversifying property market.

Changes in Office Space Demand and Workplace Trends

Australia's office real estate market is undergoing a transformation as companies reevaluate their space requirements in response to evolving workplace norms. The widespread use of remote and hybrid work arrangements has reduced the necessity for traditional office sizes in urban regions while simultaneously increasing demand for flexible, cooperative workspaces in the inner suburbs and surrounding areas. In Melbourne and Sydney cities, landlords are meeting this demand by upgrading buildings to provide more advanced amenities, wellness features, and energy-efficient building design, appealing to tenants who value staff retention and sustainability. Besides, managed office and co-working solutions are also becoming popular in urban and regional hubs, led by take-up from startups, small firms, and satellite offices of large groups. Office demand is stable in areas like Canberra, where government occupancy brings long-term security, providing a different setting compared to more dynamic corporate markets. Overall, the future of Australia's office market will rest on flexibility, creativity, and alignment with changing workforce expectations.

Expansion of Sustainable and Technology-Focused Assets

Environmental sustainability and technology integration are emerging as distinguishing characteristics of Australia's commercial property market direction. Developers and investors are increasingly targeting assets that are certified to green building standards, incorporate renewable energy systems, and enable digital connectivity. This change is being prompted not just by investor sentiment and tenant requirements, but also by public policy and regulatory codes to decrease emissions in the built environment. Cities like Adelaide and Brisbane are experiencing strong take-up of sustainable design, with new office projects highlighting climate resilience, energy efficiency, and smart infrastructure. Furthermore, Australia's technological leadership in industries like agritech, renewables, and data services is impacting the evolution of technology-enabled business parks and innovation precincts, especially around research institutions and universities. Regionally embedded projects are making Australia fit for a future economy, where digital readiness and environmental responsibility are critical for commercial success and long-term value creation.

Government Support of Australia Commercial Property Market:

Regional and Urban Development Incentives

Support from government is crucial in determining the commercial property market in Australia, particularly by the programs that incite the development of urban and regional locations. Federal and state governments have made various policies to decentralize business activity and entice commercial investment to urban centers like Ballarat, Toowoomba, and Launceston. These include zoning amendments, accelerated development permits, and incentives to foster private sector investment in commercial property developments. Investment in infrastructure, like road and rail improvements, also enhances the appeal of these locations by facilitating access and connectivity. For instance, the Victorian Government's emphasis on regional economic zones has driven expansion of commercial developments for logistics, retail, and professional services. Such initiatives not only provide relief to large capital cities but also facilitate more balanced economic distribution within the nation. This deliberate regional drive is essential to extend the reach and strength of the country's commercial real estate industry.

Support Through Infrastructure and Precinct Planning

One of the significant ways in which the government assists Australia's commercial property market is through long-term infrastructure planning and the establishment of economic precincts. In cities such as Sydney and Brisbane, government-initiated development of innovation districts, health precincts, and airport business precincts has provided fertile ground for commercial property growth. Developments like the Western Sydney Aerotropolis and Northshore Hamilton at Brisbane's Northshore are converting underutilized land into high-value commercial corridors. These developments usually involve a partnership of various levels of government and private investors, with governments commonly providing land, services, or financial support. They also concentrate on locating commercial buildings side by side with research centers, transport hubs, and residential developments to form dense urban environments. This type of master-planned precinct development is a conscious attempt to future-proof cities and cater to industries like technology, health, education, and logistics. The resultant commercial real estate demand is supported by government guarantee of long-term planning and strategic allocation of resources, which de-risks the investment and stimulates innovation.

Regulatory Framework and Investor Confidence

The stability and transparency of Australia's regulatory framework is a major source of government backing for the commercial property sector. Australia has a reputation for having clear property legislations, stable land title systems, and organized planning mechanisms, all of which create a stable base for domestic and overseas investors alike. State planning agencies and local councils ensure commercial developments are sustainably designed, conform to safety standards, and comply with community impact requirements, which adds to long-term asset value. In addition, foreign investment is channeled through the Foreign Investment Review Board (FIRB), which ensures supervision while still inviting large amounts of global capital into commercial property. In special jurisdictions such as the Northern Territory and Western Australia, extra incentives and accelerated approvals are provided to induce investment in new commercial regions, particularly mining, tourism, and logistics-related ones. These administrative and legislative supports render Australia a preferred place for institutional investors and are maintaining the integrity and strength of its commercial property market.

Australia Commercial Property Market News:

- In July 2023, Lendlease and Daiwa House Australia announced the creation of a new partnership in Australia to deliver a build-to-rent apartment development at Melbourne Quarter. It is a 45-storey BTR tower that offers a high-quality, tenure secure alternative to the traditional apartment rental market with 797 residences in a mix of studio, one, two and three bedroom-apartments.

- In October 2023, Costco announced that the company plans to expand its presence in Australia, with the establishment of multiple new warehouses and several hotspots. In line with this announcement, the company acquired a site in Ardeer, in Melbourne’s western suburbs, and lodged a planning application to develop a new warehouse and service station.

Australia Commercial Property Market Segmentation:

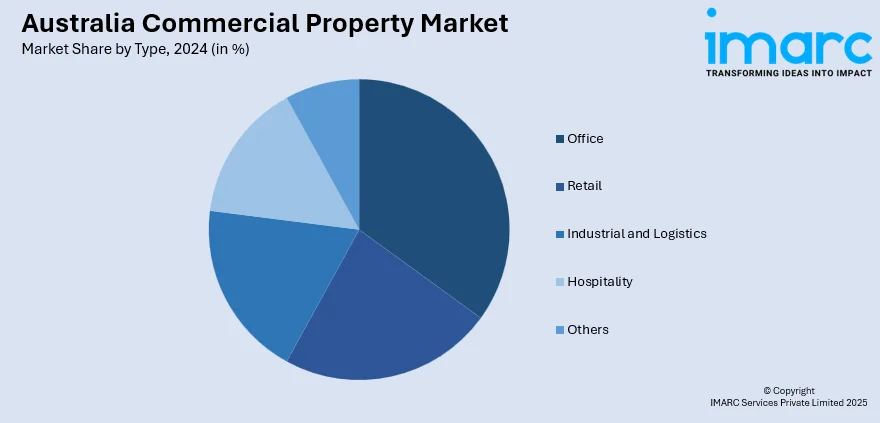

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Office

- Retail

- Industrial and Logistics

- Hospitality

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes office, retail, industrial and logistics, hospitality, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Commercial Property Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Office, Retail, Industrial and Logistics, Hospitality, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia commercial property market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia commercial property market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia commercial property industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia commercial property market was valued at USD 33.0 Billion in 2024.

The Australia commercial property market is projected to exhibit a CAGR of 9.3% during 2025-2033.

The Australia commercial property market is expected to reach a value of USD 78.5 Billion by 2033.

Trends in Australia's commercial property market involve increasing pressure for sustainable and technology-integrated buildings, expansion into regional centers, and a movement toward flexible office space. Industrial and logistics industries are flourishing as a result of e-commerce expansion, with government-supported infrastructure projects remaining at the helm in governing development trends throughout cities and emerging precincts throughout the country.

Australia's commercial property market is influenced by city growth, infrastructure construction, regional economic growth, and robust demand in logistics and office properties. Government incentives, a stable regulatory climate, and improving investor interest in sustainable and technology-enabled properties also contribute to sustained growth in metropolitan and up-and-coming regional commercial centers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)