Australia Commercial Telematics Market Size, Share, Trends and Forecast by Type, System Type, Provider Type, End Use Industry, and Region, 2025-2033

Australia Commercial Telematics Market Overview:

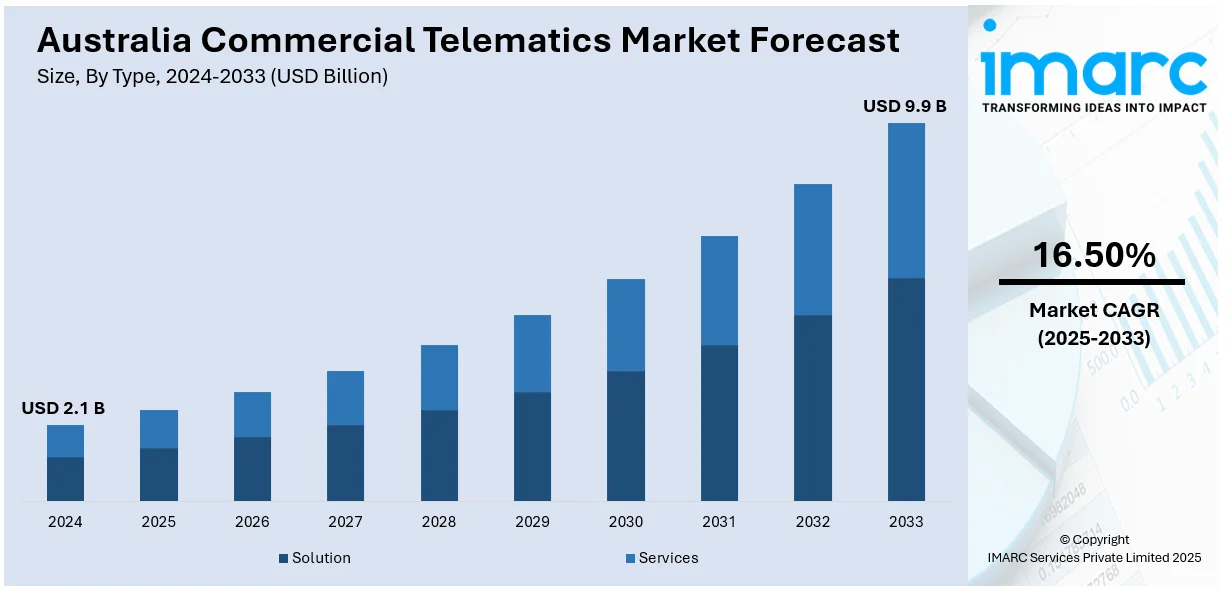

The Australia commercial telematics market size reached USD 2.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.9 Billion by 2033, exhibiting a growth rate (CAGR) of 16.50% during 2025-2033. The market share is expanding, driven by the growing execution of government initiatives aimed at promoting road safety, along with the rising adoption of artificial intelligence (AI)-based telematics solutions that aid in streamlining logistics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 9.9 Billion |

| Market Growth Rate 2025-2033 | 16.50% |

Australia Commercial Telematics Market Trends:

Rising government initiatives to promote road safety

The growing execution of government initiatives aimed at promoting road safety is offering a favorable Australia commercial telematics market outlook. The government agencies are introducing policies and frameworks that are encouraging the use of advanced technologies to reduce accidents and improve transportation safety. Telematics systems help monitor driver behavior, vehicle performance, and route planning, thereby contributing to safer road conditions. Authorities are supporting the integration of such systems into commercial fleets to ensure compliance with protection regulations. With rising concerns over traffic-related incidents and occupational hazards in the logistics and transport sectors, telematics is becoming a valuable tool for businesses. The government is also launching campaigns to raise awareness about road safety and the benefits of real-time vehicle monitoring and data analytics. In December 2024, the Government of Australia initiated the ‘Road Safety Campaign’. It aimed to strengthen safe driving practices and highlight the significance of road safety for every driver. These measures are creating a favorable environment for telematics adoption. Businesses in the transport and logistics sectors are responding positively to such initiatives, investing in fleet solutions that align with protection goals. The government’s encouragement for digital transformation in infrastructure and transportation is further fueling the market growth.

To get more information on this market, Request Sample

Increasing utilization of AI

Rising adoption of AI is impelling the Australia commercial telematics market growth. AI enables predictive analytics, allowing companies to anticipate maintenance needs, reduce vehicle downtime, and improve overall operational efficiency. It helps analyze large volumes of data collected from telematics devices, offering real-time insights into driver behavior, fuel usage, and route optimization. Fleet operators use AI to implement proactive strategies, improve safety, and reduce costs. AI-based telematics solutions also support autonomous decision-making, which streamlines logistics and improves delivery timelines. In Australia, where vast distances and complex logistics routes are common, AI adds immense value by refining navigation and scheduling. The technology enables smarter alert systems and more accurate risk assessments, assisting businesses in complying with regulations and ensuring safety. As industries are adopting digital transformation, AI is becoming a key component in achieving competitive advantage. Its integration into telematics platforms enables better data interpretation and smarter fleet control, which is encouraging more companies to wager on advanced systems. This growing reliance on AI is driving the demand for commercial telematics solutions across various sectors. As per industry reports, the AI market in Australia is set to attain a value of AUD 9.41 Billion.

Australia Commercial Telematics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, system type, provider type, and end use industry.

Type Insights:

- Solution

- Fleet Tracking and Monitoring

- Driver Management

- Insurance Telematics

- Safety and Compliance

- V2X Solutions

- Others

- Services

- Professional services

- Managed services

The report has provided a detailed breakup and analysis of the market based on the type. This includes solution (fleet tracking and monitoring, driver management, insurance telematics, safety and compliance, V2X solutions, and others) and services (professional services and managed services).

System Type Insights:

- Embedded

- Tethered

- Smartphone Integrated

A detailed breakup and analysis of the market based on the system type have also been provided in the report. This includes embedded, tethered, and smartphone integrated.

Provider Type Insights:

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes OEM and aftermarket.

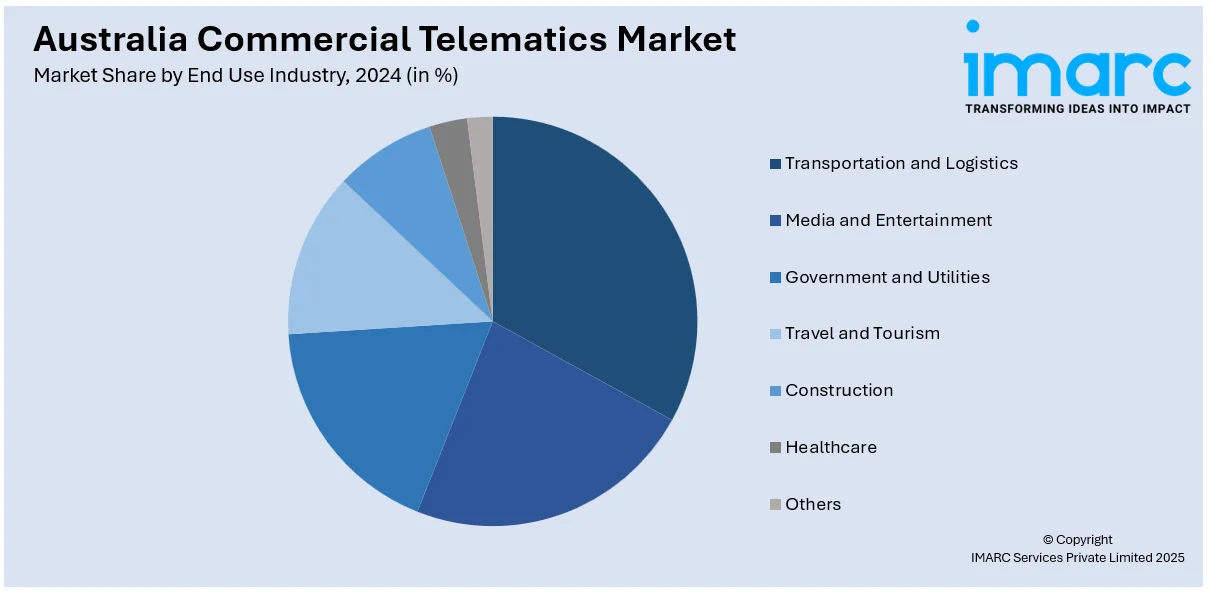

End Use Industry Insights:

- Transportation and Logistics

- Media and Entertainment

- Government and Utilities

- Travel and Tourism

- Construction

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes transportation and logistics, media and entertainment, government and utilities, travel and tourism, construction, healthcare, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Commercial Telematics Market News:

- In December 2024, Geotab Australia Pty Limited established a commercial agreement with Logmaster Trading Pty. Limited to provide the Australian trucking sector with improved telematics and compliance features. It allowed Geotab to offer Logmaster subscriptions more smoothly, enhancing the accessibility of EWDs and equipping heavy vehicle companies with the necessary tools to remain competitive and compliant.

- In March 2024, HERE Technologies, the premier location data and technology platform, and Netstar, Australia's top provider of telematics solutions, revealed the extension of their strategic partnership to equip businesses in Australia with improved asset management and navigation functionalities for commercial and heavy vehicles. This new stage of the collaboration was aimed at enhancing truck navigation through Netstar’s implementation of the ‘HERE SDK Navigate’.

Australia Commercial Telematics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| System Types Covered | Embedded, Tethered, Smartphone Integrated |

| Provider Types Covered | OEM, Aftermarket |

| End Use Industries Covered | Transportation and Logistics, Media and Entertainment, Government and Utilities, Travel and Tourism, Construction, Healthcare, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia commercial telematics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia commercial telematics market on the basis of type?

- What is the breakup of the Australia commercial telematics market on the basis of system type?

- What is the breakup of the Australia commercial telematics market on the basis of provider type?

- What is the breakup of the Australia commercial telematics market on the basis of end use industry?

- What is the breakup of the Australia commercial telematics market on the basis of region?

- What are the various stages in the value chain of the Australia commercial telematics market?

- What are the key driving factors and challenges in the Australia commercial telematics?

- What is the structure of the Australia commercial telematics market and who are the key players?

- What is the degree of competition in the Australia commercial telematics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia commercial telematics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia commercial telematics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia commercial telematics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)