Australia Commercial Vehicle Market Size, Share, Trends and Forecast by Vehicle Body Type, Propulsion Type, and Region, 2025-2033

Australia Commercial Vehicle Market Size and Share:

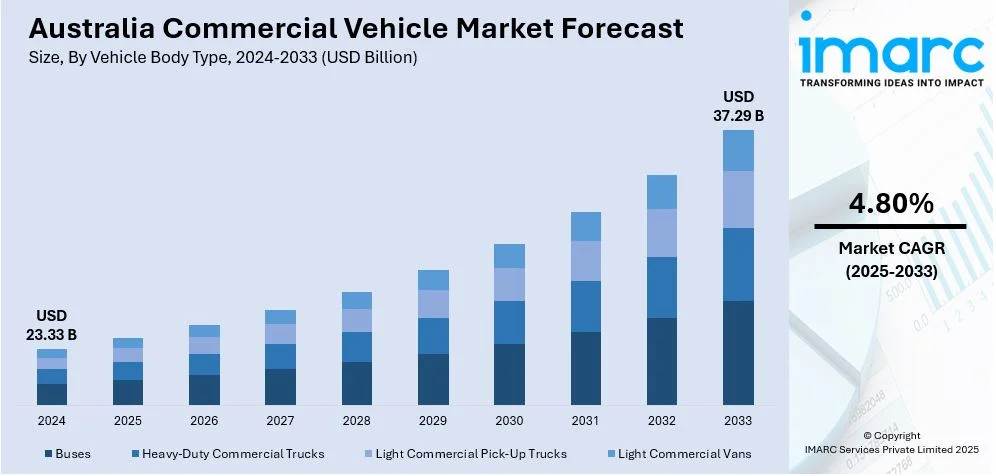

The Australia commercial vehicle market size reached USD 23.33 Billion in 2024. Looking forward, the market is projected to reach USD 37.29 Billion by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. Rising construction and mining activities, growing freight and logistics needs, and the surge in e-commerce and last-mile delivery are driving growth in the Australia commercial vehicle market share. Additional contributors include fleet replacement, expanding regional trade, and infrastructure investments. Demand is also boosted by rural transport needs, rising adoption of electric vehicles, improved telematics, favorable financing, and strong uptake from agriculture and utilities—all supporting the robust expansion of the Australia commercial vehicle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 23.33 Billion |

| Market Forecast in 2033 | USD 37.29 Billion |

| Market Growth Rate 2025-2033 | 4.80% |

Key Trends of Australia Commercial Vehicle Market:

Expansion in Mining and Construction Activities

The mining and construction industries are among the largest users of commercial vehicles in Australia, and their continued growth has led to a steady rise in demand for heavy-duty trucks and specialized utility vehicles. In 2022–23, the Australian Bureau of Statistics reported that the mining industry contributed USD 236 billion (AUD 352.4 billion) to the GDP, growing by 23.2% year-over-year, while the construction sector added USD 109 billion (AUD 163 billion), increasing by 14.8% (ABS). These sectors require extensive transport support for equipment, raw materials, and labor across remote and urban project sites. Vehicles such as dump trucks, cement mixers, and utility are essential for daily operations. With Australia continuing to invest in infrastructure and resource extraction, particularly in Western Australia and Queensland, the need for robust and specialized commercial vehicle fleets is projected to increase, which is further escalating the Australia commercial vehicle market demand.

To get more information on this market, Request Sample

Growth in E-Commerce and Last-Mile Delivery Networks

The growth of e-commerce in Australia is reshaping logistics and accelerating the adoption of commercial delivery vehicles, particularly vans and light-duty trucks. As online shopping becomes more prevalent, businesses are investing in scalable last-mile delivery networks to meet rising customer expectations. According to Statista, e-commerce revenue in Australia is expected to reach USD 32.3 billion in 2024, up from USD 28 billion in 2023, representing a 15.5% annual increase. This expansion has directly influenced courier, express, and parcel (CEP) service providers to increase fleet size and improve delivery frequency. Companies like Australia Post and Woolworths are also trialing electric vans to reduce emissions in city routes. The growing volume of small, frequent shipments places continuous demand on light commercial vehicles, especially in dense urban areas where maneuverability, fuel efficiency, and cost-effectiveness are key considerations for fleet operators.

Increasing Freight Transport Demand

Freight transport is a vital component of the Australian economy, and its growth is closely linked with rising commercial vehicle usage. Road freight in particular accounts for over 75% of all domestic freight movement. According to the Bureau of Infrastructure and Transport Research Economics (BITRE), New South Wales recorded 86 billion ton-kilometers of road freight in 2023–24, the highest in its history (BITRE). Across Australia, total road freight volumes exceeded 230 billion ton-kilometers. As manufacturing, agriculture, and retail supply chains scale up to meet domestic and export demands, logistics firms are investing in more trucks, trailers, and long-haul transport vehicles. Fleet expansions are particularly common along key interstate corridors such as the Hume, Pacific, and Bruce highways. Furthermore, Australia’s vast geography makes road transport the preferred choice in many regions, reinforcing the need for reliable, long-range commercial vehicles with advanced load capacity and fuel efficiency.

Growth Drivers of Australia Commercial Vehicle Market:

Fuel Efficiency and Environmental Awareness

With increasing environmental awareness and tightened emissions standards by governments, commercial vehicle makers are increasingly focusing on fuel efficiency. There is mounting consumer pressure for environmentally friendly alternatives that led the move towards electric and hybrid vehicles. These alternatives reduce emissions and bring long-term cost savings in the form of reduced fuel expenses. Several companies are already converting to green fleets to address corporate sustainability goals and leverage government incentives. With more electric and hybrid commercial vehicles becoming available, they stand ready to make a significant impact on decreasing the carbon footprint of the transportation sector.

Urbanization and Population Growth

Demand for commercial vehicles is also driven heavily by urbanization as well as increasing population levels, particularly in cities. With cities expanding, it becomes increasingly important that effective transport solutions for goods and services are found. Trucks and vans play a critical role in local deliveries, building works, and service businesses in congested areas. In addition, urban development involving residential and commercial properties increases the demand for vehicles such as cranes and construction trucks. With increasing population density, companies require more vehicles to match the growing need for timely deliveries and services, fuelling growth in the commercial vehicle market in cities.

Technological Advancements

Technological advancements are transforming the commercial vehicle market, enhancing safety, efficiency, and operational reliability. Technologies like sophisticated telematics systems enable organizations to monitor fleet operation in real time, streamline routes, and improve fuel efficiency. The technology of autonomous driving is also advancing in the commercial vehicle domain, promising reduced driver costs and enhanced safety. Parallel to this, improvements in automotive safety technologies like collision prevention systems, adaptive cruise control, and lane departure warning are improving the safety and reliability of commercial trucks. These technologies improve operational effectiveness and help companies meet tighter safety and environmental laws.

Opportunities of Australia Commercial Vehicle Market:

Refrigerated Vehicles

Since demand for temperature-controlled products keeps growing, especially in the pharmaceuticals and food sectors, there is an excellent potential for growth of refrigerated commercial trucks in Australia. These trucks are critical for the secure transportation of perishable products so that they are kept in desired temperatures along the supply chain. The rise of online supermarket shopping and growing demand for fresh food delivery has further increased the demand for refrigerated solutions. Moreover, the pharmaceutical industry also demands specialized vehicles for vaccine distribution and other sensitive medical products. The trend towards e-commerce and cold chain logistics creates a mounting demand for refrigerated vehicles, making this segment one of the prominent areas of growth. Australia commercial vehicle market outlook suggests that refrigerated vehicles will play an important role in meeting the evolving needs of temperature-sensitive transportation.

Improved Aftermarket Services

The growing commercial vehicle market in Australia presents a significant opportunity for businesses to offer enhanced aftermarket services. As fleets expand, the demand for maintenance, repairs, and spare parts increases, creating a thriving market for service providers. Offering high-quality aftermarket services, such as routine vehicle inspections, engine repairs, and specialized parts replacement, helps extend the lifespan of commercial vehicles, ensuring they remain in optimal working condition. Furthermore, with the growing complexity of modern commercial vehicles incorporating advanced technology and electric powertrains—there is a rising need for specialized service providers. Businesses can capitalize on this trend by offering tailored solutions that increase vehicle uptime and efficiency, thus improving fleet performance and reducing operational costs. This growing need for reliable aftermarket services is a key opportunity in the Australian commercial vehicle market.

Vehicle Customization and Specialization

In the Australian commercial vehicle market, the demand for specialized and customized vehicles is growing as industries such as construction, waste management, and logistics require tailored solutions to meet their unique operational needs. Construction companies, for instance, may need heavy-duty vehicles equipped with cranes or flatbeds, while waste management services require specialized vehicles with compactors or containers. Similarly, logistics companies require custom solutions like refrigerated trucks for temperature-sensitive goods. This trend presents a significant opportunity for manufacturers to offer vehicles with customized features, configurations, and accessories that cater to specific business requirements. As industries continue to evolve, the demand for bespoke vehicles is expected to rise, making it a key driver of the market.

Challenges of Australia Commercial Vehicle Market:

Rising Fuel Costs

Increasing fuel prices pose a considerable challenge for companies in the Australian commercial vehicle sector, particularly for those dependent on long-haul and heavy-duty vehicles. Fluctuating fuel prices directly impact operational expenses, as transportation is a key cost component in industries like logistics, freight, and delivery services. For companies with large fleets, frequent fuel price hikes can erode profit margins, forcing them to adjust pricing models or absorb additional costs. This volatility also complicates long-term budgeting and planning. To mitigate the effects, businesses are increasingly exploring alternatives such as fuel-efficient vehicles, electric commercial vehicles, or investing in fuel management systems. However, until sustainable solutions are more widely adopted, rising fuel costs remain a challenge for fleet operators in Australia.

Fleet Management Costs

Managing fleet maintenance, repair costs, and optimizing fleet operations remain significant challenges for businesses in the Australian commercial vehicle market, particularly for those with large fleets. Consistent upkeep of vehicles is essential to ensure smooth operations and minimize downtime, but it comes at a high cost. Unplanned repairs, sourcing spare parts, and labor costs can add up quickly, impacting the overall profitability of businesses. Furthermore, managing maintenance schedules for a large fleet can be complex, leading to potential inefficiencies. To address these challenges, businesses are increasingly adopting preventive maintenance practices, investing in fleet management software for better scheduling, and training staff to handle specialized repairs. According to Australia commercial vehicle market analysis, efficient fleet management is crucial for companies to maintain their competitive edge and reduce long-term operational costs.

Labor Shortages

Labor shortages, particularly in the logistics and freight sectors, are a growing challenge for fleet operators in Australia. The demand for qualified drivers has outpaced supply, making it increasingly difficult for businesses to maintain operations and meet delivery deadlines. As the workforce ages and fewer younger individuals enter the driving profession, the gap between demand and available drivers continues to widen. This shortage impacts productivity, increases costs associated with recruitment and retention, and leads to delays in shipments, affecting customer satisfaction. Fleet operators are exploring solutions such as offering higher wages, improving working conditions, and investing in training programs to attract new drivers. Additionally, advancements in autonomous vehicle technology may provide long-term relief, though this remains a future solution.

Australia Commercial Vehicle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle body type and propulsion type.

Vehicle Body Type Insights:

- Buses

- Heavy-Duty Commercial Trucks

- Light Commercial Pick-Up Trucks

- Light Commercial Vans

The report has provided a detailed breakup and analysis of the market based on the vehicle body type. This includes buses, heavy-duty commercial trucks, light commercial pick-up trucks, and light commercial vans.

Propulsion Type Insights:

.webp)

- Hybrid and Electric Vehicles

- Fuel category

- BEV

- FCEV

- HEV

- PHEV

- Fuel category

- ICE

- Fuel category

- CNG

- Diesel

- Gasoline

- LPG

- Fuel category

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes hybrid and electric vehicles [fuel category (BEV, FCEV, HEV, and PHEV)] and ICE [fuel category (CNG, Diesel, Gasoline, and LPG)].

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Commercial Vehicle Market News:

- In 2025, United H2 Limited announced the acquisition of GoZero Group, an Australian electric bus and commercial vehicle manufacturer, in a deal valued at USD 248 million. GoZero's subsidiaries include Nexport and BusTech, and the acquisition aims to bolster hydrogen and electric vehicle capabilities in Australia.

- In 2024, BHP began a 12-month trial of a battery-electric Toyota HiLux at its Port Hedland site in Western Australia. This initiative, part of a broader collaboration with Toyota, aims to electrify BHP's fleet of 5,000 vehicles and reduce operational emissions by 30% by 2030.

Australia Commercial Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Body Types Covered | Buses, Heavy-Duty Commercial Trucks, Light Commercial Pick-Up Trucks, Light Commercial Vans |

| Propulsion Types Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia commercial vehicle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia commercial vehicle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia commercial vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial vehicle market in the Australia was valued at USD 23.33 Billion in 2024.

The Australia commercial vehicle market is projected to exhibit a compound annual growth rate (CAGR) of 4.80% during 2025-2033.

The Australia commercial vehicle market is expected to reach a value of USD 37.29 Billion by 2033.

Growth drivers of the Australia commercial vehicle market are primarily fueled by ongoing infrastructure development, which creates a higher need for construction and service vehicles. The rapid growth of e-commerce is driving the demand for delivery vehicles, while stricter environmental regulations are pushing companies to adopt greener vehicles. Population growth and urbanization also contribute to increased demand for commercial transportation solutions.

Key trends in the Australia commercial vehicle market include the growing adoption of electric and hybrid vehicles, driven by sustainability concerns and cost-saving potential. The use of telematics and advanced fleet management systems is on the rise, enabling better vehicle performance and operational efficiency. Autonomous technology is also gaining attention, particularly in logistics and freight sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)