Australia Construction Robots Market Size, Share, Trends and Forecast by Function, Type, End Use, and Region, 2025-2033

Australia Construction Robots Market Overview:

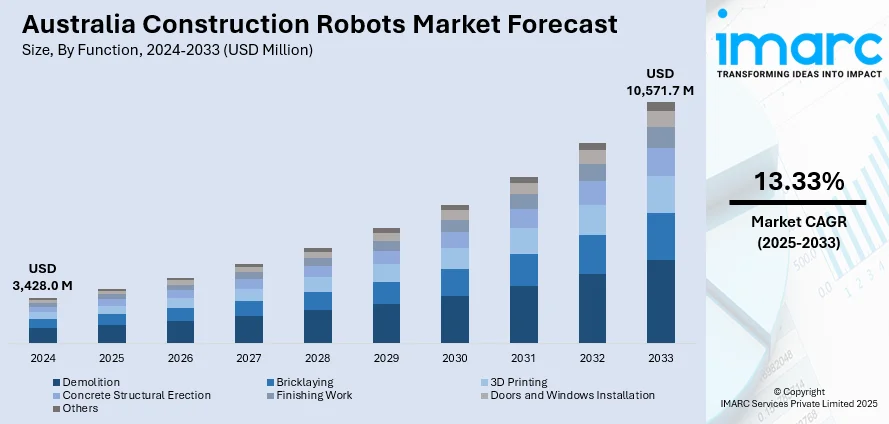

The Australia construction robots market size reached USD 3,428.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 10,571.7 Million by 2033, exhibiting a growth rate (CAGR) of 13.33% during 2025-2033. The rising labor costs, rapid urbanization, burgeoning infrastructure investment, stringent workplace safety regulations, advancements in artificial intelligence (AI) and sensor technologies, growth in prefabrication, surging adoption of drones for site monitoring, and expanding use of building information modelling (BIM) across complex construction projects are accelerating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,428.0 Million |

| Market Forecast in 2033 | USD 10,571.7 Million |

| Market Growth Rate 2025-2033 | 13.33% |

Australia Construction Robots Market Trends:

Urbanization and Infrastructure Investment

The ongoing wave of urbanization is directly influencing the demand for construction automation, including robots, which is one of the key factors stimulating the Australia construction robots market growth. As of 2025, approximately 86.5% of Australia's population resides in urban areas, equating to about 23.3 million people. This marks a slight increase from 86.62% in 2023. Major metropolitan centers such as Sydney, Melbourne, and Brisbane are experiencing strong population growth, which is putting pressure on existing urban infrastructure. This trend has resulted in large-scale investments in transport networks, residential housing, healthcare facilities, and public utilities. Construction robots are becoming essential tools to meet the speed and efficiency requirements of these projects. Automated machines, including bricklaying robots and three dimensional (3D) printers, are being integrated to accelerate project timelines while reducing reliance on manual labor. In addition, government-led initiatives such as the National Infrastructure Plan and state-level infrastructure strategies are setting the stage for long-term adoption of advanced technologies, including robotics.

To get more information on this market, Request Sample

Labor Shortages in the Construction Industry

Australia’s construction industry is facing a persistent shortage of skilled labor, which is acting as a catalyst for the adoption of robotic technologies. The aging workforce, limited influx of younger workers, and constraints on skilled migration have created operational bottlenecks for contractors and developers. Projects are frequently delayed due to lack of available tradespeople, especially in regional and remote areas. In response, companies are integrating robotic systems for tasks such as bricklaying, concrete dispensing, welding, and demolition, which is further boosting the Australia construction robotics market share. These robots offer consistency and can operate continuously without fatigue, making them valuable in bridging the labor gap. Furthermore, the labor shortage is not expected to ease significantly in the short to medium term, which reinforces the long-term relevance of robotics in construction workflows. Automation is increasingly viewed as a strategic necessity rather than an optional investment, especially for firms managing high-volume or repetitive tasks across multiple job sites.

Rising Labor Costs

Labor costs in Australia’s construction sector have been increasing steadily due to higher wage expectations, stronger union influence, and greater demand for skilled trades. This cost pressure is particularly acute in urban markets and remote infrastructure projects, where resource mobilization adds to overheads. As a result, construction firms are exploring robotics as a cost-control mechanism. Robotic equipment offers a one-time capital investment with predictable maintenance and operating expenses, contrasting with the variable and escalating costs of human labor. Machines can also deliver output with minimal downtime, improving cost-efficiency across entire project lifecycles. Additionally, as robots become more sophisticated and capable of performing multi-functional tasks, the cost-per-task advantage becomes more pronounced, which is another factor providing a positive Australia construction robots market outlook. This dynamic is prompting mid-size and large construction firms to assess the return on investment of robotics more favorably, positioning automated solutions as a long-term hedge against labor market volatility and rising employment-related costs.

Australia Construction Robots Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on function, type, and end use.

Function Insights:

- Demolition

- Bricklaying

- 3D Printing

- Concrete Structural Erection

- Finishing Work

- Doors and Windows Installation

- Others

The report has provided a detailed breakup and analysis of the market based on the function. This includes demolition, bricklaying, 3D printing, concrete structural erection, finishing work, doors and windows installation, and others.

Type Insights:

- Traditional Robot

- Robotic Arm

- Exoskeleton

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes traditional robot, robotic arm, and exoskeleton.

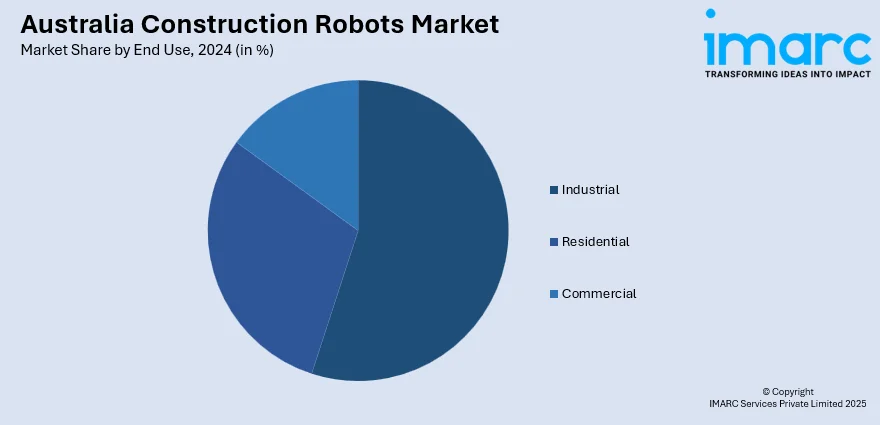

End Use Insights:

- Industrial

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes industrial, residential, and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Construction Robots Market News:

- In 2024, FBR completed its largest project to date, a 16-townhouse development, using its Hadrian X® robotic bricklaying system. This achievement set a global benchmark for robotic construction scale and precision.

- In 2024, Laing O’Rourke and John Holland partnered with Robotics Australia Group to sponsor and support the integration of robotics like MULE into the construction industry. This collaboration sought to enhance productivity, safety, and sustainability by working closely with local robotics developers and suppliers.

Australia Construction Robots Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Function Covered | Demolition, Bricklaying, 3D Printing, Concrete Structural Erection, Finishing Work, Doors and Windows Installation, Others |

| Type Covered | Traditional Robot, Robotic Arm, Exoskeleton |

| End Use Covered | Industrial, Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia construction robots market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia construction robots market on the basis of function?

- What is the breakup of the Australia construction robots market on the basis of type?

- What is the breakup of the Australia construction robots market on the basis of end use?

- What is the breakup of the Australia construction robots market on the basis of region?

- What are the various stages in the value chain of the Australia construction robots market?

- What are the key driving factors and challenges in the Australia construction robots market?

- What is the structure of the Australia construction robots market and who are the key players?

- What is the degree of competition in the Australia construction robots market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia construction robots market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia construction robots market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia construction robots industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)